策略概述(Strategy Overview)

动态RSI双均线买卖策略是一种结合相对强弱指标(RSI)、简单移动平均线(SMA)和指数移动平均线(EMA)的量化交易策略。该策略旨在捕捉潜在的买入和卖出信号,以实现在市场中获利。策略通过分析RSI、SMA和EMA之间的关系,根据预定义的条件触发买入和卖出操作。同时,该策略还引入了止盈、止损和移动止损等风险管理措施,以控制潜在的损失和保护已获得的利润。

策略原理(Strategy Principles)

该策略的核心原理是利用RSI、SMA和EMA三个技术指标之间的关系来判断市场趋势和买卖时机。具体来说:

当2周期的RSI小于等于20,且当前收盘价大于等于200周期的SMA,同时当前收盘价大于等于20周期的EMA时,触发买入信号。这表明市场可能处于超卖状态,且当前价格高于长期和中期均线,因此可能是买入的好时机。

当80周期的EMA出现,且2周期的RSI大于等于80时,触发卖出信号。这表明市场可能处于超买状态,且当前价格低于长期均线,因此可能是卖出的好时机。

当2周期的RSI大于等于80,且当前收盘价小于等于200周期的SMA,同时当前收盘价小于等于80周期的EMA时,触发做空信号。这表明市场可能处于超买状态,且当前价格低于长期和中期均线,因此可能是做空的好时机。

当最低价小于等于20周期的EMA,且2周期的RSI小于等于10时,触发平仓做空头寸的信号。这表明市场可能即将反转向上,因此应该平仓空头头寸以规避风险。

除了买卖信号外,该策略还引入了止盈、止损和移动止损等风险管理措施。用户可以根据自己的风险偏好,设置相应的止盈、止损和移动止损水平。这有助于控制潜在损失并保护已获得的利润。

策略优势(Strategy Advantages)

结合多个技术指标:该策略综合考虑了RSI、SMA和EMA三个常用的技术指标,从多个角度分析市场趋势和买卖时机,提高了策略的可靠性。

引入风险管理措施:通过设置止盈、止损和移动止损水平,策略可以有效控制潜在损失并保护已获得的利润,增强了策略的风险管理能力。

参数可调:用户可以根据自己的偏好和市场特点,调整策略中的各项参数,如RSI周期、SMA和EMA周期、止盈止损水平等,以适应不同的交易风格和市场环境。

适用性广:该策略可以应用于各类金融市场,如股票、期货、外汇等,具有较强的通用性和适用性。

策略风险(Strategy Risks)

参数设置风险:不恰当的参数设置可能导致策略性能下降,甚至产生较大损失。因此,在使用该策略时,需要仔细评估和优化参数,以确保策略的稳健性。

市场风险:该策略基于历史数据和特定的技术指标,在市场发生重大变化或出现黑天鹅事件时,策略可能无法及时适应,从而导致损失。因此,需要密切关注市场动态,必要时对策略进行调整。

过拟合风险:如果策略参数过于复杂或针对特定历史数据进行优化,可能导致策略过拟合,在实际应用中表现不佳。因此,在开发和优化策略时,需要注意控制过拟合风险。

策略优化(Strategy Optimization)

动态调整参数:根据市场变化和策略表现,动态调整策略参数,如RSI周期、SMA和EMA周期、止盈止损水平等,以适应不同的市场环境和提高策略的稳健性。

引入其他技术指标:考虑引入其他有效的技术指标,如布林带、MACD等,以丰富策略的分析维度,提高买卖信号的可靠性。

结合基本面分析:将基本面分析与技术分析相结合,在判断买卖时机时,考虑宏观经济、行业趋势、公司业绩等基本面因素,以提高策略的全面性和准确性。

加强风险管理:优化风险管理措施,如引入多级止损、动态止损、风险平价等方法,以更好地控制风险并保护资金安全。

回测和实盘优化:定期进行策略回测和实盘交易,分析策略在不同市场条件下的表现,及时发现和解决潜在问题,不断优化和完善策略。

总结(Summary)

动态RSI双均线买卖策略是一种结合RSI、SMA和EMA等技术指标的量化交易策略。该策略通过分析指标之间的关系,根据预定义的条件触发买入和卖出操作,同时引入止盈、止损和移动止损等风险管理措施。策略的优势在于综合考虑多个技术指标、引入风险管理措施、参数可调、适用性广等。但在实际应用中,需要注意参数设置风险、市场风险和过拟合风险等潜在问题。为了进一步提升策略的性能和稳健性,可以考虑动态调整参数、引入其他技术指标、结合基本面分析、加强风险管理等优化措施。此外,定期进行回测和实盘交易分析,不断优化和完善策略,也是确保策略长期有效的重要方法。

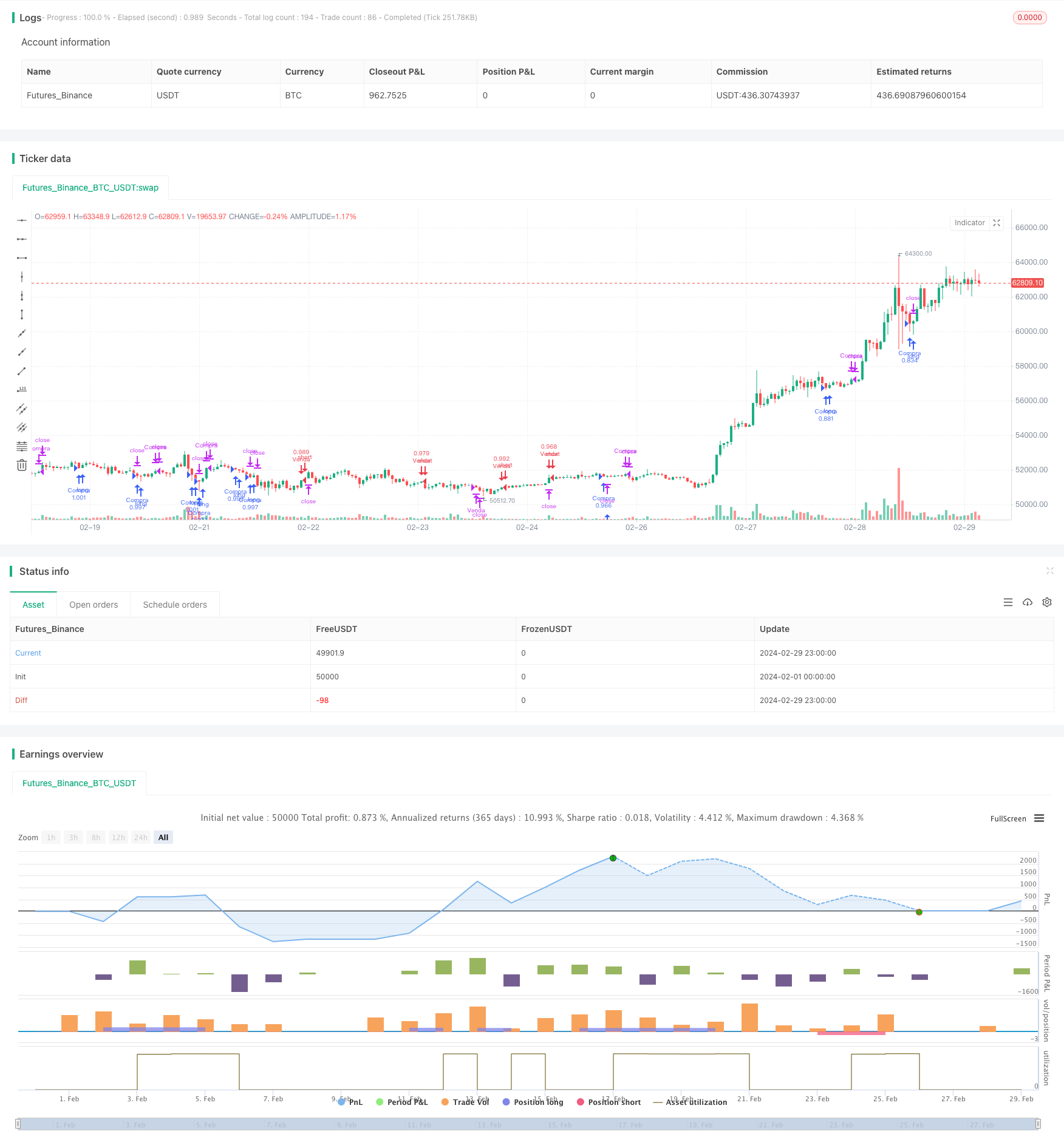

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ag7 buy sell", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

inpTakeProfit = input.int(defval = 100000000, title = "Take Profit", minval = 0)

inpStopLoss = input.int(defval = 5000, title = "Stop Loss", minval = 0)

inpTrailStop = input.int(defval = 1000, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input.int(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

longEntry() =>

ta.rsi(close, 2) <= 20 and close >= ta.sma(close, 200) and ta.ema(close, 20)

longExit() =>

ta.ema(close, 80) and ta.rsi(close, 2) >= 80

strategy.entry("Compra", strategy.long, when = longEntry())

strategy.close("Compra", when = longExit())

strategy.exit("Feche a ordem", from_entry = "Venda", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

shortEntry() =>

ta.rsi(close, 2) >= 80 and close <= ta.sma(close, 200) and ta.ema(close, 80)

shortExit() =>

low <= ta.ema(close, 20) and ta.rsi(close, 2) <= 10

strategy.entry("Venda", strategy.short, when = shortEntry())

strategy.close("Venda", when = shortExit())

strategy.exit("feche a ordem", from_entry = "Compra", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)