策略概述

本文介绍了一个名为”Kyrie Crossover @zaytrade”的量化交易策略。该策略结合了双均线交叉和多时间周期DMI指标,通过捕捉市场趋势来进行交易决策。策略的核心是利用短期均线(10周期EMA)和长期均线(323周期EMA)的交叉信号,同时结合5分钟、15分钟、30分钟和1小时等多个时间周期的DMI指标来确认趋势的方向和强度。

策略原理

该策略的原理可以分为以下几个部分:

双均线交叉: 策略使用短期EMA(10周期)和长期EMA(323周期)来捕捉市场趋势。当短期EMA上穿长期EMA时,表示潜在的做多机会;当短期EMA下穿长期EMA时,表示潜在的做空机会。这种均线交叉的方法可以有效地识别市场的转折点和趋势方向。

多时间周期DMI指标: 为了进一步确认趋势的方向和强度,策略采用了多时间周期的DMI指标。DMI指标由ADX(平均方向性指数)、+DI(上升方向指标)和-DI(下降方向指标)组成。通过比较+DI和-DI的相对强度,可以判断当前趋势是看涨还是看跌。策略在5分钟、15分钟、30分钟和1小时等多个时间周期上计算DMI指标,以获得更全面的趋势信息。

趋势确认: 策略通过综合考虑均线交叉信号和多时间周期DMI指标来确认趋势。当均线交叉信号与DMI指标的趋势方向一致时,策略会产生相应的交易信号。例如,当短期EMA上穿长期EMA,并且多个时间周期的DMI指标都显示看涨趋势时,策略会产生做多信号。

风险管理: 策略采用了基于风险百分比的头寸管理方法。用户可以通过设置

riskPercentageEMA参数来控制每笔交易的风险敞口。此外,策略还利用止损单来限制潜在损失。

策略优势

捕捉市场趋势: 通过结合双均线交叉和多时间周期DMI指标,策略能够有效地捕捉市场的主要趋势。这种方法可以帮助交易者顺应市场的大方向,提高交易成功的概率。

多时间周期确认: 策略在多个时间周期上计算DMI指标,包括5分钟、15分钟、30分钟和1小时。这种多时间周期的分析方法可以提供更全面和可靠的趋势确认信号,减少假信号的出现。

灵活的参数设置: 策略提供了多个可调整的参数,如短期EMA周期、长期EMA周期、ADX平滑周期和DI长度等。用户可以根据自己的交易风格和市场特点来优化这些参数,以获得更好的交易表现。

风险管理: 策略内置了基于风险百分比的头寸管理方法,用户可以通过设置

riskPercentageEMA参数来控制每笔交易的风险敞口。此外,策略还利用止损单来限制潜在损失,提高了风险管理的效果。

策略风险

参数优化: 策略的性能在很大程度上取决于参数的选择。不当的参数设置可能导致策略表现不佳,甚至产生较大的回撤。因此,在实际应用中,需要对参数进行优化和测试,以找到适合当前市场条件的最佳参数组合。

趋势延迟: 由于策略依赖于均线交叉和DMI指标来确认趋势,在市场快速变化的情况下,信号的产生可能会有一定的延迟。这意味着策略可能错过一些早期的趋势机会,或者在趋势已经反转时才产生信号。

震荡市场: 在震荡市场中,价格的波动可能导致频繁的均线交叉和DMI指标的变化。这可能导致策略产生较多的交易信号,增加交易成本和回撤风险。因此,在震荡市场中,策略的表现可能会受到影响。

黑天鹅事件: 策略基于历史数据和统计模型,对于一些极端的市场事件,如黑天鹅事件,策略可能无法及时作出正确的反应。这可能导致策略在这些特殊情况下遭受较大损失。

优化方向

动态参数调整: 可以考虑引入动态参数调整机制,根据市场的波动性和趋势强度来自适应地调整策略参数。这可以帮助策略更好地适应不同的市场环境,提高策略的稳健性。

多因子确认: 除了均线交叉和DMI指标,可以引入其他技术指标或基本面因子来进一步确认趋势。例如,可以结合成交量、波动率、市场情绪等指标,以获得更可靠的交易信号。

止盈止损优化: 可以对止盈止损的位置进行优化,例如采用移动止损、动态止损等方法。这可以帮助策略更好地保护利润,同时限制潜在损失。

仓位管理: 可以引入更高级的仓位管理方法,如凯利公式、固定比例投资等。这可以帮助策略在不同的市场环境中动态调整仓位,提高资金利用效率和风险控制能力。

机器学习优化: 可以尝试将机器学习算法与该策略相结合,通过对历史数据的学习和模式识别,优化策略的参数选择和信号生成。这可以帮助策略自动适应市场的变化,提高策略的适应性和稳健性。

总结

本文介绍了一个基于双均线交叉和多时间周期DMI指标的量化交易策略。该策略通过捕捉市场趋势来进行交易决策,同时采用了风险管理措施来控制潜在损失。策略的优势在于能够有效地识别市场的主要趋势,并通过多时间周期的确认来提高信号的可靠性。然而,策略也存在一些风险,如参数优化、趋势延迟、震荡市场和黑天鹅事件等。为了进一步优化策略,可以考虑引入动态参数调整、多因子确认、止盈止损优化、仓位管理和机器学习等方法。总的来说,该策略为量化交易者提供了一种基于趋势跟踪的交易思路,通过合理的优化和改进,有望在实际交易中取得良好的表现。

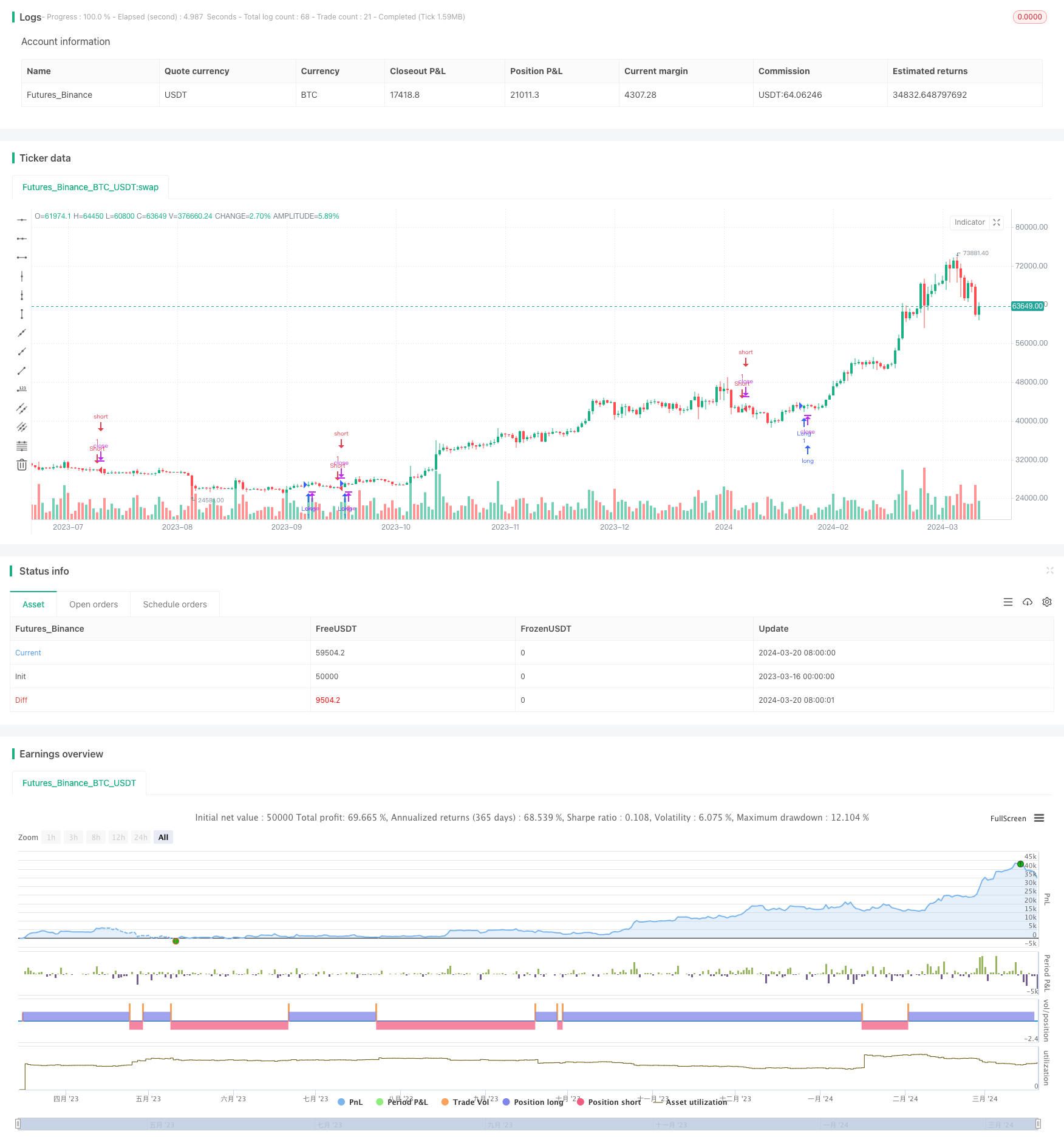

/*backtest

start: 2023-03-16 00:00:00

end: 2024-03-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Kyrie Crossover @zaytrade ", overlay=true, calc_on_every_tick=true)

// Input parameters for EMA

shortTermEMA = input.int(9, title="Short-Term EMA Period")

longTermEMA = input.int(21, title="Long-Term EMA Period")

riskPercentageEMA = input.float(1, title="Risk Percentage EMA", minval=0.1, maxval=5, step=0.1)

// Calculate EMAs

emaShort = ta.ema(close, shortTermEMA)

emaLong = ta.ema(close, longTermEMA)

// EMA Crossover Strategy

longConditionEMA = ta.crossover(emaShort, emaLong)

shortConditionEMA = ta.crossunder(emaShort, emaLong)

// Input parameters for DMI

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

// DMI Logic

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

truerange = ta.tr

plus = fixnan(100 * ta.rma((up > down ? up : 0), len) / truerange)

minus = fixnan(100 * ta.rma((down > up ? down : 0), len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adxValue = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

[adxValue, plus, minus]

// Function to get trend and strength for a given timeframe

getTrendAndStrength(_source, _dilen, _adxlen) =>

[adxValue, up, down] = adx(_dilen, _adxlen)

var string trendIndication = ""

var string trendStrength = ""

if (up > down) or ((up > down) and (up > down) and (up > adxValue)) // Bullish condition

trendIndication := "Bullish"

trendStrength := "Strengthening"

else if (down > up) or ((down > up) and (down > up) and (down > adxValue)) // Bearish condition

trendIndication := "Bearish"

trendStrength := "Weakening"

else

trendIndication := "No Clear Trend"

trendStrength := "Sideways"

[trendIndication, trendStrength]

// Get trend and strength for selected timeframes

[tf1_trend, tf1_strength] = request.security(syminfo.tickerid, "5", getTrendAndStrength(close, dilen, adxlen))

[tf2_trend, tf2_strength] = request.security(syminfo.tickerid, "15", getTrendAndStrength(close, dilen, adxlen))

[tf3_trend, tf3_strength] = request.security(syminfo.tickerid, "30", getTrendAndStrength(close, dilen, adxlen))

[tf4_trend, tf4_strength] = request.security(syminfo.tickerid, "60", getTrendAndStrength(close, dilen, adxlen))

[current_trend, _] = getTrendAndStrength(close, dilen, adxlen)

// Define colors based on trend indication

tf1_color = tf1_trend == "Bullish" ? color.green : (tf1_trend == "Bearish" ? color.red : color.white)

tf2_color = tf2_trend == "Bullish" ? color.green : (tf2_trend == "Bearish" ? color.red : color.white)

tf3_color = tf3_trend == "Bullish" ? color.green : (tf3_trend == "Bearish" ? color.red : color.white)

tf4_color = tf4_trend == "Bullish" ? color.green : (tf4_trend == "Bearish" ? color.red : color.white)

current_color = current_trend == "Bullish" ? color.green : (current_trend == "Bearish" ? color.red : color.white)

// Create and fill the enhanced table for DMI

var table dmiTable = na

if (barstate.islast)

dmiTable := table.new(position.top_right, 6, 1)

table.cell(dmiTable, 0, 0, "DMI Metrics", bgcolor=color.new(color.black, 90), width=15, height=4, text_color=color.white)

table.cell(dmiTable, 1, 0, "5m Trend: " + tf1_trend, bgcolor=tf1_color, width=15, height=4, text_color=color.white)

table.cell(dmiTable, 2, 0, "15m Trend: " + tf2_trend, bgcolor=tf2_color, width=15, height=4, text_color=color.white)

table.cell(dmiTable, 3, 0, "30m Trend: " + tf3_trend, bgcolor=tf3_color, width=15, height=4, text_color=color.white)

table.cell(dmiTable, 4, 0, "1h Trend: " + tf4_trend, bgcolor=tf4_color, width=15, height=4, text_color=color.white)

table.cell(dmiTable, 5, 0, "Current Trend: " + current_trend, bgcolor=current_color, width=15, height=4, text_color=color.white)

// Strategy logic

if (longConditionEMA)

strategy.entry("Long", strategy.long)

if (shortConditionEMA)

strategy.entry("Short", strategy.short)