概述

该策略基于两条不同周期的VWAP线的交叉,并结合RSI指标来确认交易信号。当价格向上突破VWAP线且RSI高于超卖水平时产生做多信号;当价格向下突破VWAP线且RSI低于超买水平时产生做空信号。该策略旨在捕捉价格相对于VWAP的突破行情,同时利用RSI指标来过滤可能的假突破信号。

策略原理

- 计算给定周期内的VWAP值。VWAP是成交量加权平均价,反映了一段时间内市场参与者的平均持仓成本。

- 计算RSI指标。RSI衡量一段时间内价格的相对强弱,用于判断市场是否超买或超卖。

- 当收盘价向上突破VWAP线且RSI高于超卖水平(默认为30)时,产生做多信号。

- 当收盘价向下突破VWAP线且RSI低于超买水平(默认为70)时,产生做空信号。

- 当持有多头仓位时,如果收盘价向下突破VWAP线或RSI高于超买水平,则平仓。

- 当持有空头仓位时,如果收盘价向上突破VWAP线或RSI低于超卖水平,则平仓。

策略优势

- 结合了价格与成交量的信息。VWAP综合考虑了价格和成交量,能更全面地反映市场走势。

- 利用RSI指标来确认趋势和过滤假信号。RSI有助于判断突破的可靠性,减少误判。

- 突破策略易于理解和实现。该策略逻辑清晰,适合初学者学习和使用。

- 适用于多个时间周期。通过调整VWAP和RSI的计算周期,该策略可以适用于不同的交易风格和市场。

策略风险

- VWAP和RSI的参数选择影响策略表现。不恰当的参数设置可能导致频繁交易或错失良机。

- 在趋势不明朗或波动率较低的市场中,该策略可能产生较多的虚假信号。

- 该策略未考虑风险管理,如止损和仓位控制。在实际应用中需要结合风险管理措施。

- 突破策略在震荡市容易产生亏损。当价格在VWAP附近振荡时,该策略可能频繁交易而导致损失。

策略优化方向

- 引入多时间周期的VWAP和RSI。通过结合不同周期的指标来提高信号的可靠性和稳健性。

- 加入趋势确认指标,如移动平均线或ADX。只有在趋势明确的方向交易,可以提高策略的胜率和盈亏比。

- 优化入场和出场规则。如在突破时要求价格超过VWAP一定比例,或者使用ATR作为过滤条件。

- 结合其他技术指标,如布林带或者动量指标。通过多个指标的共同确认来提高信号质量。

- 加入风险管理,如止损和动态仓位控制。合理设置止损位可以降低单次交易的风险,动态调整仓位可以提高资金利用效率。

总结

成交量加权平均价与相对强弱指数交叉策略是一个简单易用的交易方法,通过捕捉价格相对VWAP的突破行情来获取潜在利润。但该策略也存在参数优化、振荡市表现不佳、缺乏风险管理等问题。通过引入多时间周期分析、结合其他技术指标、优化出入场规则以及加入风险控制等方法,可以进一步提升该策略的稳健性和实用性。交易者在应用该策略时需要结合自身的交易风格和市场特点进行适当调整和优化。

策略源码

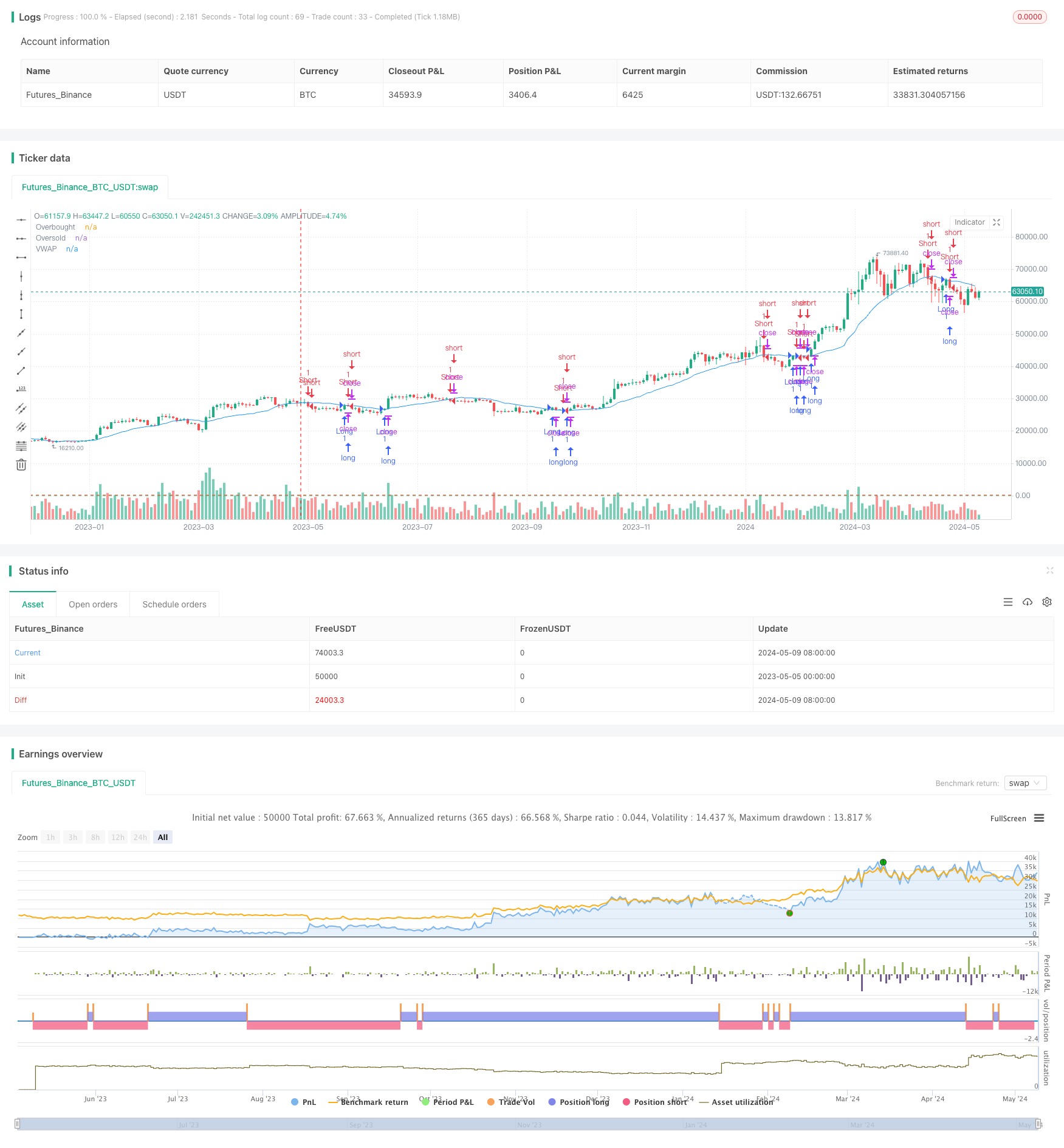

/*backtest

start: 2023-05-05 00:00:00

end: 2024-05-10 00:00:00

period: 2d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("VWAP and RSI Strategy with Alerts", overlay=true)

// Inputs

cumulativePeriod = input(20, "Rolling Period for VWAP", minval=1)

rsiPeriod = input(20, "RSI Period", minval=1)

rsiOverbought = input(70, "RSI Overbought Level")

rsiOversold = input(30, "RSI Oversold Level")

tradeQty = input(1, "Trade Quantity", minval=0.01) // Cantidad de la operación

// VWAP Calculation

typicalPrice = (high + low + close) / 3

typicalPriceVolume = typicalPrice * volume

cumulativeTypicalPriceVolume = sum(typicalPriceVolume, cumulativePeriod)

cumulativeVolume = sum(volume, cumulativePeriod)

vwapValue = cumulativeTypicalPriceVolume / cumulativeVolume

plot(vwapValue, color=color.blue, title="VWAP")

// RSI Calculation

rsiValue = rsi(close, rsiPeriod)

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

// Entry Conditions

longCondition = crossover(close, vwapValue) and rsiValue > rsiOversold

shortCondition = crossunder(close, vwapValue) and rsiValue < rsiOverbought

// Strategy Execution for Entries

if (longCondition)

strategy.entry("Long", strategy.long, qty=tradeQty)

if (shortCondition)

strategy.entry("Short", strategy.short, qty=tradeQty)

// Conditions for Exiting

exitLongCondition = crossunder(close, vwapValue) or rsiValue > rsiOverbought // Salir de long cuando el precio cruce debajo del VWAP o el RSI sea alto

exitShortCondition = crossover(close, vwapValue) or rsiValue < rsiOversold // Salir de short cuando el precio cruce por encima del VWAP o el RSI sea bajo

// Strategy Execution for Exits

strategy.exit("Exit Long", "Long", when=exitLongCondition)

strategy.exit("Exit Short", "Short", when=exitShortCondition)

// Alert Conditions

alertcondition(longCondition, title="Enter Long", message="ENTER-LONG_BINANCE-FUTURES_BTCUSDT_WunderTrading-1_1M_1354a524d74bc295")

alertcondition(exitLongCondition, title="Exit Long", message="EXIT-LONG_BINANCE-FUTURES_BTCUSDT_WunderTrading-1_1M_1354a524d74bc295")

alertcondition(shortCondition, title="Enter Short", message="ENTER-SHORT_BINANCE-FUTURES_BTCUSDT_WunderTrading-1_1M_1354a524d74bc295")

alertcondition(exitShortCondition, title="Exit Short", message="EXIT-SHORT_BINANCE-FUTURES_BTCUSDT_WunderTrading-1_1M_1354a524d74bc295")

相关推荐