概述

RSI双重差分策略是一种利用两个不同周期的相对强弱指数(RSI)之间的差值来进行交易决策的策略。与传统的单一RSI策略不同,该策略通过分析短期RSI和长期RSI的差值,提供了一种更加细致入微的市场动态分析方法。这种方法能够帮助交易者更准确地把握超买和超卖的市场条件,从而做出更加精准的交易决策。

策略原理

该策略的核心是计算两个不同周期的RSI指标,并分析它们之间的差值。具体来说,该策略使用了一个短期RSI(默认为21天)和一个长期RSI(默认为42天)。通过计算长期RSI与短期RSI的差值,我们可以得到一个RSI差分指标。当RSI差分指标低于-5时,表明短期动量正在增强,此时可以考虑做多;当RSI差分指标高于+5时,表明短期动量正在减弱,此时可以考虑做空。

策略优势

RSI双重差分策略的优势在于它提供了一种更加细致入微的市场分析方法。通过分析不同周期RSI之间的差值,该策略能够更加准确地捕捉市场的动量变化,从而为交易者提供更加可靠的交易信号。此外,该策略还引入了持仓天数和止盈止损的设置,使得交易者能够更加灵活地控制自己的风险敞口。

策略风险

尽管RSI双重差分策略具有很多优势,但它仍然存在一些潜在的风险。首先,该策略依赖于对RSI差分指标的正确解读,如果交易者对指标的理解存在偏差,可能会导致错误的交易决策。其次,该策略在波动较大的市场环境中可能会产生较多的假信号,导致频繁的交易和高昂的交易成本。为了降低这些风险,交易者可以考虑结合其他技术指标或基本面分析来验证RSI双重差分策略的交易信号。

策略优化方向

为了进一步提升RSI双重差分策略的性能,我们可以考虑从以下几个方面对策略进行优化:

参数优化:通过对RSI周期、RSI差分阈值、持仓天数等参数进行优化,我们可以找到最适合当前市场环境的参数组合,从而提高策略的盈利能力和稳定性。

信号过滤:引入其他技术指标或市场情绪指标,对RSI双重差分策略的交易信号进行二次确认,以减少假信号的出现。

风险控制:优化止盈止损的设置,或者引入动态风险控制机制,根据市场波动性的变化动态调整持仓规模,以更好地控制策略的风险敞口。

多市场适应:将RSI双重差分策略扩展到其他金融市场,如外汇、商品、债券等,以验证策略的普适性和稳健性。

总结

RSI双重差分策略是一种基于相对强弱指数的动量交易策略,通过分析不同周期RSI之间的差值,为交易者提供了一种更加细致入微的市场分析方法。尽管该策略存在一些潜在的风险,但通过适当的优化和改进,我们可以进一步提升该策略的性能,使其成为一个更加可靠和有效的交易工具。

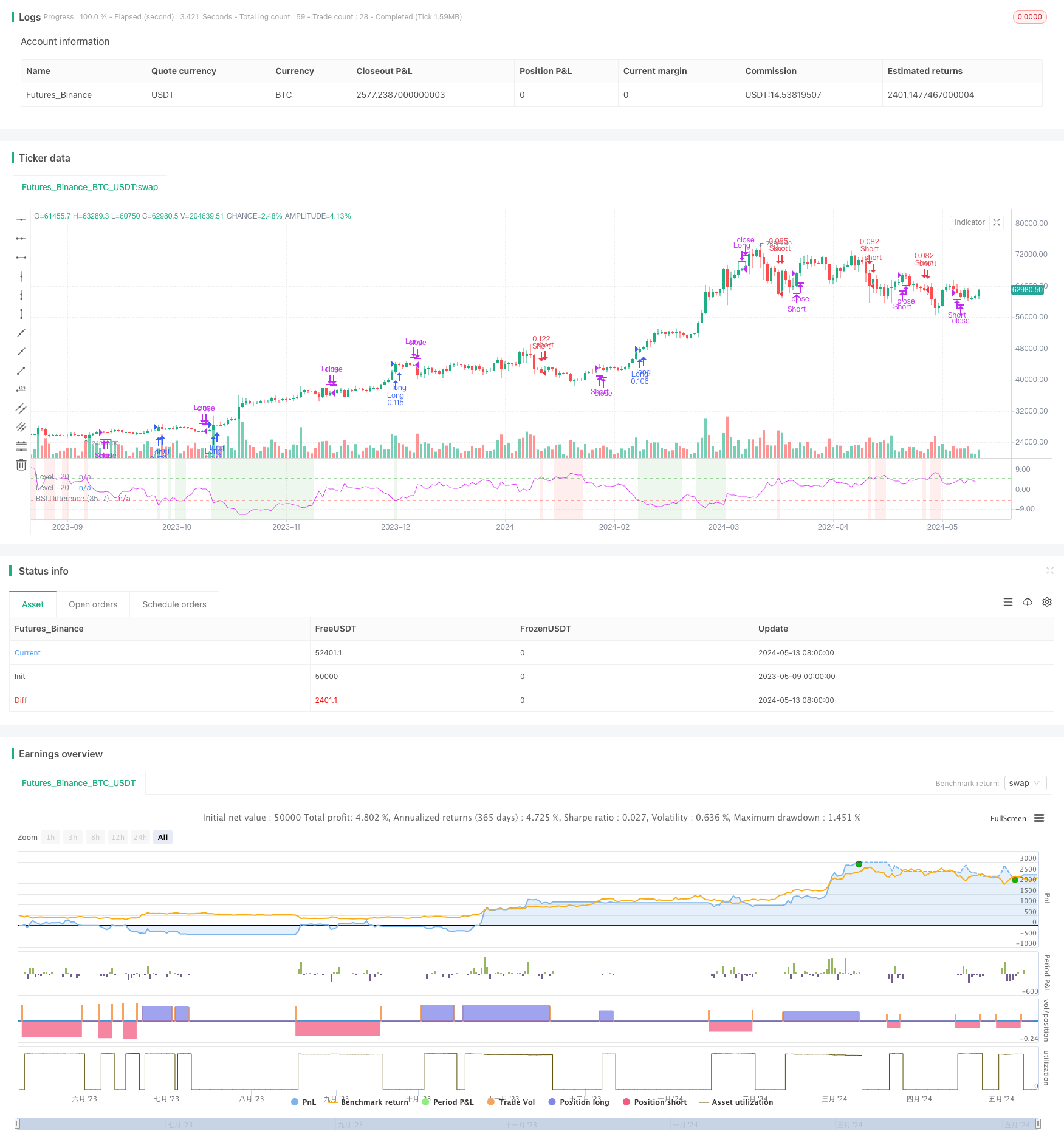

/*backtest

start: 2023-05-09 00:00:00

end: 2024-05-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// This strategy stands out by using two distinct RSI lengths, analyzing the differential between these to make precise trading decisions.

// Unlike conventional single RSI strategies, this method provides a more nuanced view of market dynamics, allowing traders to exploit

// both overbought and oversold conditions with greater accuracy.

//@version=5

strategy("Dual RSI Differential - Strategy [presentTrading]", overlay=false, precision=3,

commission_value=0.1, commission_type=strategy.commission.percent, slippage=1,

currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=10, initial_capital=10000)

// Input parameters for user customization

tradeDirection = input.string("Both", "Trading Direction", options=["Long", "Short", "Both"])

lengthShort = input(21, title="Short RSI Period")

lengthLong = input(42, title="Long RSI Period")

rsiDiffLevel = input(5, title="RSI Difference Level")

useHoldDays = input.bool(true, title="Use Hold Days")

holdDays = input.int(5, title="Hold Days", minval=1, maxval=20, step=1)

TPSLCondition = input.string("None", "TPSL Condition", options=["TP", "SL", "Both", "None"])

takeProfitPerc = input(15.0, title="Take Profit (%)")

stopLossPerc = input(10.0, title="Stop Loss (%)")

// Calculate RSIs

rsiShort = ta.rsi(close, lengthShort)

rsiLong = ta.rsi(close, lengthLong)

// Calculate RSI Difference

rsiDifference = rsiLong - rsiShort

// Plotting

hline(rsiDiffLevel, "Level +20", color=color.green, linestyle=hline.style_dashed)

hline(-rsiDiffLevel, "Level -20", color=color.red, linestyle=hline.style_dashed)

// Variables to track entry times

var float longEntryTime = na

var float shortEntryTime = na

// Condition for significant RSI difference

combinedLongCondition = rsiDifference < -rsiDiffLevel

combinedExitLongCondition = rsiDifference > rsiDiffLevel

combinedShortCondition = rsiDifference > rsiDiffLevel

combinedExitShortCondition = rsiDifference < -rsiDiffLevel

// Strategy logic using conditions and direction selection

if (tradeDirection == "Long" or tradeDirection == "Both")

if (combinedLongCondition)

strategy.entry("Long", strategy.long)

longEntryTime := time

if (useHoldDays and (time - longEntryTime >= holdDays * 86400000 or combinedExitLongCondition))

strategy.close("Long")

else if (useHoldDays == false and combinedExitLongCondition)

strategy.close("Long")

if (tradeDirection == "Short" or tradeDirection == "Both")

if (combinedShortCondition)

strategy.entry("Short", strategy.short)

shortEntryTime := time

if (useHoldDays and (time - shortEntryTime >= holdDays * 86400000 or combinedExitShortCondition))

strategy.close("Short")

else if (useHoldDays == false and combinedExitShortCondition)

strategy.close("Short")

// Conditional Profit and Loss Management

if (TPSLCondition == "TP" or TPSLCondition == "Both")

// Apply take profit conditions

strategy.exit("TakeProfit_Long", "Long", profit=close * (1 + takeProfitPerc / 100), limit=close * (1 + takeProfitPerc / 100))

strategy.exit("TakeProfit_Short", "Short", profit=close * (1 - takeProfitPerc / 100), limit=close * (1 - takeProfitPerc / 100))

if (TPSLCondition == "SL" or TPSLCondition == "Both")

// Apply stop loss conditions

strategy.exit("StopLoss_Long", "Long", loss=close * (1 - stopLossPerc / 100), stop=close * (1 - stopLossPerc / 100))

strategy.exit("StopLoss_Short", "Short", loss=close * (1 + stopLossPerc / 100), stop=close * (1 + stopLossPerc / 100))

bgcolor(combinedLongCondition ? color.new(color.green, 90) : na, title="Background Color for Significant Long RSI Diff")

bgcolor(combinedShortCondition ? color.new(color.red, 90) : na, title="Background Color for Significant Short RSI Diff")

// Plot RSIs and their difference

plot(rsiDifference, title="RSI Difference (35-7)", color=color.fuchsia)

// Alerts

alertcondition(combinedLongCondition, title="Significant Long RSI Difference Alert", message="RSI Difference is significant Long at {{close}} with RSI7 at {{rsiShort}} and RSI35 at {{rsiLong}}.")

alertcondition(combinedShortCondition, title="Significant Short RSI Difference Alert", message="RSI Difference is significant Short at {{close}} with RSI7 at {{rsiShort}} and RSI35 at {{rsiLong}}.")