概述

该策略结合了成交量热图和实时价格,通过分析一定时间内的价格和成交量分布,生成买卖信号。策略首先根据当前价格和设定的价格范围百分比,计算出若干个价格水平。然后统计每个价格水平在过去一段时间内的买卖成交量,并计算出累计的买卖成交量。根据累计的买卖成交量,确定标签的颜色。同时,策略还会绘制实时价格曲线。此外,该策略还结合了EMA、VWAP等指标,根据它们与价格、成交量的关系,产生买卖信号。当满足买入条件且之前没有产生过信号时,会产生买入信号;当满足卖出条件或连续两根阴线且之前没有产生过信号时,会产生卖出信号。

策略原理

- 根据当前价格和设定的价格范围百分比,计算出若干个价格水平。

- 统计每个价格水平在过去一段时间内的买卖成交量,并计算出累计的买卖成交量。

- 根据累计的买卖成交量,确定标签的颜色,并显示标签或绘制图形。

- 绘制实时价格曲线。

- 计算EMA、VWAP等指标。

- 根据价格与EMA、VWAP等指标的关系以及成交量条件,判断是否满足买入条件。若满足且之前没有产生过信号,则产生买入信号。

- 根据价格与EMA等指标的关系以及成交量条件,判断是否满足卖出条件。若满足且之前没有产生过信号,则产生卖出信号。若连续两根阴线且之前没有产生过信号,也产生卖出信号。

- 记录当前买卖条件状态,并更新信号产生状态。

优势分析

- 结合了成交量热图和实时价格,能够直观地展示价格和成交量的分布情况,为交易决策提供参考。

- 引入了EMA、VWAP等指标,丰富了策略的条件判断,提高了策略的可靠性。

- 同时考虑了价格、指标和成交量等多方面因素,使得买卖信号更加全面和稳健。

- 设置了信号产生的限制条件,避免了连续产生重复信号的情况,减少了误导性信号。

风险分析

- 策略的表现可能受到价格范围百分比、回溯期等参数设置的影响,需要根据具体情况进行调整和优化。

- EMA、VWAP等指标本身也有一定的滞后性和局限性,在某些市场环境下可能失效。

- 该策略主要适用于趋势性较强的市场,在震荡市可能产生较多的虚假信号。

- 策略的风险控制措施相对简单,缺乏止损和仓位管理等风险管理手段。

优化方向

- 引入更多的技术指标和市场情绪指标,如RSI、MACD、布林带等,丰富策略的判断依据。

- 优化买卖信号的产生条件,提高信号的准确性和可靠性。可以考虑引入多个时间框架的分析,确认趋势方向。

- 加入止损和仓位管理等风险控制措施,设置合理的止损位和仓位规模,控制单笔交易的风险敞口。

- 对策略进行参数优化和回测,找出最优的参数组合和市场适用范围。

- 考虑将该策略与其他策略进行组合,发挥不同策略的优势,提高整体的稳定性和收益性。

总结

该策略通过结合成交量热图、实时价格和多个技术指标,生成买卖信号,具有一定的参考价值。策略的优势在于能够直观展示价格和成交量的分布,并综合考虑多方面因素产生信号。但策略也存在一些局限性和风险,如参数设置的影响、指标的滞后性、趋势性市场的依赖等。因此,在实际应用中,需要进一步优化和完善策略,如引入更多指标、优化信号条件、加强风险控制等,以提升策略的稳健性和盈利能力。

策略源码

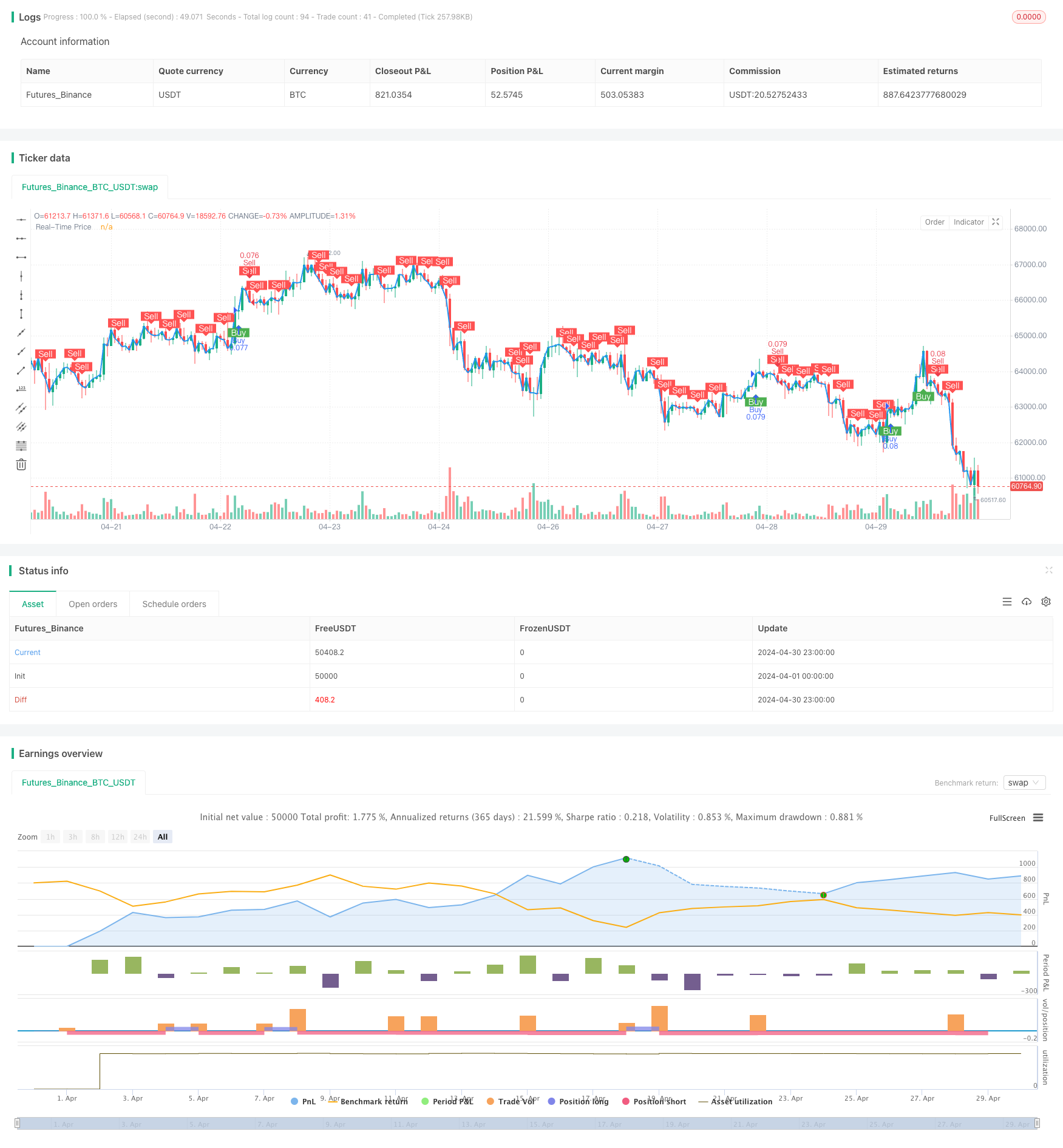

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy and Sell Volume Heatmap with Real-Time Price Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Settings for Volume Heatmap

lookbackPeriod = input.int(100, title="Lookback Period")

baseGreenColor = input.color(color.green, title="Buy Volume Color")

baseRedColor = input.color(color.red, title="Sell Volume Color")

priceLevels = input.int(10, title="Number of Price Levels")

priceRangePct = input.float(0.01, title="Price Range Percentage")

labelSize = input.string("small", title="Label Size", options=["tiny", "small", "normal", "large"])

showLabels = input.bool(true, title="Show Volume Labels")

// Initialize arrays to store price levels, buy volumes, and sell volumes

var float[] priceLevelsArr = array.new_float(priceLevels)

var float[] buyVolumes = array.new_float(priceLevels)

var float[] sellVolumes = array.new_float(priceLevels)

// Calculate price levels around the current price

for i = 0 to priceLevels - 1

priceLevel = close * (1 + (i - priceLevels / 2) * priceRangePct) // Adjust multiplier for desired spacing

array.set(priceLevelsArr, i, priceLevel)

// Calculate buy and sell volumes for each price level

for i = 0 to priceLevels - 1

level = array.get(priceLevelsArr, i)

buyVol = 0.0

sellVol = 0.0

for j = 1 to lookbackPeriod

if close[j] > open[j]

if close[j] >= level and low[j] <= level

buyVol := buyVol + volume[j]

else

if close[j] <= level and high[j] >= level

sellVol := sellVol + volume[j]

array.set(buyVolumes, i, buyVol)

array.set(sellVolumes, i, sellVol)

// Determine the maximum volumes for normalization

maxBuyVolume = array.max(buyVolumes)

maxSellVolume = array.max(sellVolumes)

// Initialize cumulative buy and sell volumes for the current bar

cumulativeBuyVol = 0.0

cumulativeSellVol = 0.0

// Calculate colors based on the volumes and accumulate volumes for the current bar

for i = 0 to priceLevels - 1

buyVol = array.get(buyVolumes, i)

sellVol = array.get(sellVolumes, i)

cumulativeBuyVol := cumulativeBuyVol + buyVol

cumulativeSellVol := cumulativeSellVol + sellVol

// Determine the label color based on which volume is higher

labelColor = cumulativeBuyVol > cumulativeSellVol ? baseGreenColor : baseRedColor

// Initialize variables for plotshape

var float shapePosition = na

var color shapeColor = na

if cumulativeBuyVol > 0 or cumulativeSellVol > 0

if showLabels

labelText = "Buy: " + str.tostring(cumulativeBuyVol) + "\nSell: " + str.tostring(cumulativeSellVol)

label.new(x=bar_index, y=high + (high - low) * 0.02, text=labelText, color=color.new(labelColor, 0), textcolor=color.white, style=label.style_label_down, size=labelSize)

else

shapePosition := high + (high - low) * 0.02

shapeColor := labelColor

// Plot the shape outside the local scope

plotshape(series=showLabels ? na : shapePosition, location=location.absolute, style=shape.circle, size=size.tiny, color=shapeColor)

// Plot the real-time price on the chart

plot(close, title="Real-Time Price", color=color.blue, linewidth=2, style=plot.style_line)

// Mpullback Indicator Settings

a = ta.ema(close, 9)

b = ta.ema(close, 20)

e = ta.vwap(close)

volume_ma = ta.sma(volume, 20)

// Calculate conditions for buy and sell signals

buy_condition = close > a and close > e and volume > volume_ma and close > open and low > a and low > e // Ensure close, low are higher than open, EMA, and VWAP

sell_condition = close < a and close < b and close < e and volume > volume_ma

// Store the previous buy and sell conditions

var bool prev_buy_condition = na

var bool prev_sell_condition = na

// Track if a buy or sell signal has occurred

var bool signal_occurred = false

// Generate buy and sell signals based on conditions

buy_signal = buy_condition and not prev_buy_condition and not signal_occurred

sell_signal = sell_condition and not prev_sell_condition and not signal_occurred

// Determine bearish condition (close lower than the bottom 30% of the candle's range)

bearish = close < low + (high - low) * 0.3

// Add sell signal when there are two consecutive red candles and no signal has occurred

two_consecutive_red_candles = close[1] < open[1] and close < open

sell_signal := sell_signal or (two_consecutive_red_candles and not signal_occurred)

// Remember the current conditions for the next bar

prev_buy_condition := buy_condition

prev_sell_condition := sell_condition

// Update signal occurred status

signal_occurred := buy_signal or sell_signal

// Plot buy and sell signals

plotshape(buy_signal, title="Buy", style=shape.labelup, location=location.belowbar, color=color.green, text="Buy", textcolor=color.white)

plotshape(sell_signal, title="Sell", style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell", textcolor=color.white)

// Strategy entry and exit

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.entry("Sell", strategy.short)

相关推荐