概述

该策略是一种短线外汇交易策略,主要思路是通过动态调整头寸规模来增强风险管理。策略根据当前账户权益和每笔交易的风险比例,计算出动态的头寸规模。同时,策略设置了严格的止损和止盈条件,在价格出现不利变动时快速平仓,控制风险;在价格朝有利方向变动时,及时锁定利润。

策略原理

- 根据用户输入的参数,如短线持仓天数、价格下跌百分比、每笔交易风险比例、止损百分比和止盈百分比,初始化相关变量。

- 在没有持仓的情况下,根据当前账户权益和每笔交易风险比例,计算出动态的头寸规模,然后以市价开空头。

- 记录开仓价格和预期平仓的时间。

- 在持仓过程中,实时监测价格变动。如果达到止损价格、止盈价格或预设的持仓时间,则平掉空头头寸。

- 在图表上标记开仓和平仓点位,直观显示交易情况。

优势分析

- 动态头寸规模:根据账户权益和风险比例动态调整每笔交易的头寸规模,在控制风险的同时提高资金使用效率。

- 严格的止损止盈:设置紧密的止损位和止盈位,有效控制单笔交易的风险敞口,同时及时锁定利润。

- 短线交易:策略专注于短线交易机会,持仓时间较短,可以快速适应市场变化,抓住短期内的价格波动。

- 简单易用:策略逻辑清晰,参数设置简单,适合初学者学习和使用。

风险分析

- 市场风险:外汇市场瞬息万变,短期内价格波动剧烈,可能导致策略频繁触发止损。

- 参数设置风险:不恰当的参数设置,如过高的风险比例、过窄的止损止盈空间等,可能导致账户快速爆仓。

- 头寸规模风险:虽然策略采用了动态头寸规模,但仍需谨慎设置每笔交易的风险比例,以避免单笔交易占用过多资金。

优化方向

- 引入更多技术指标,如移动平均线、MACD等,辅助判断趋势和开平仓时机。

- 优化止损止盈逻辑,如采用追踪止损、部分止盈等方法,提高策略收益风险比。

- 针对不同货币对和市场状况,设置不同的参数组合,提高策略的适应性和稳定性。

- 加入仓位管理逻辑,如采用Kelly公式等方法,动态调整每笔交易的风险比例。

总结

该策略通过动态头寸规模和严格的止损止盈,在短线交易中实现了风险控制和利润追求的平衡。策略逻辑简单清晰,适合初学者学习掌握。但是,在实际应用中仍需谨慎,注意控制风险,并根据市场变化不断优化和改进策略。通过引入更多技术指标、优化止损止盈逻辑、针对不同市场状况设置参数、加入仓位管理等方法,可以进一步提升策略的稳健性和盈利能力。

策略源码

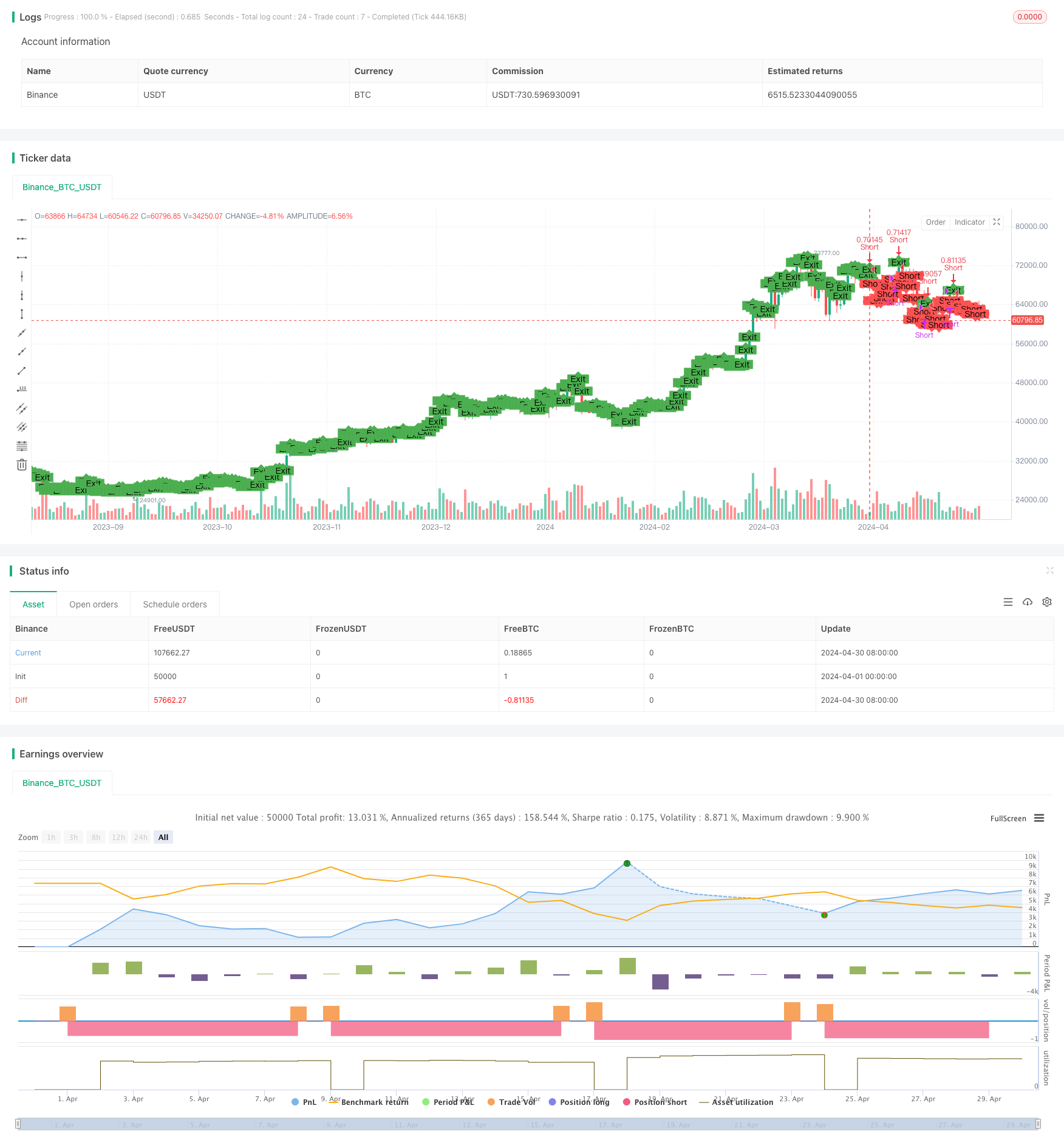

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Short High-Grossing Forex Pair - Enhanced Risk Management", overlay=true)

// Parameters

shortDuration = input.int(7, title="Short Duration (days)")

priceDropPercentage = input.float(30, title="Price Drop Percentage", minval=0, maxval=100)

riskPerTrade = input.float(2, title="Risk per Trade (%)", minval=0.1, maxval=100) / 100 // Increased risk for short trades

stopLossPercent = input.float(2, title="Stop Loss Percentage", minval=0) // Tighter stop-loss for short trades

takeProfitPercent = input.float(30, title="Take Profit Percentage", minval=0) // Take Profit Percentage

// Initialize variables

var int shortEnd = na

var float entryPrice = na

// Calculate dynamic position size

equity = strategy.equity

riskAmount = equity * riskPerTrade

pipValue = syminfo.pointvalue

stopLossPips = close * (stopLossPercent / 100)

positionSize = riskAmount / (stopLossPips * pipValue)

// Entry condition: Enter short position at the first bar with calculated position size

if (strategy.opentrades == 0)

strategy.entry("Short", strategy.short, qty=positionSize)

shortEnd := bar_index + shortDuration

entryPrice := close

alert("Entering short position", alert.freq_once_per_bar_close)

// Exit conditions

exitCondition = (bar_index >= shortEnd) or (close <= entryPrice * (1 - priceDropPercentage / 100))

// Stop-loss and take-profit conditions

stopLossCondition = (close >= entryPrice * (1 + stopLossPercent / 100))

takeProfitCondition = (close <= entryPrice * (1 - takeProfitPercent / 100))

// Exit the short position based on the conditions

if (strategy.opentrades > 0 and (exitCondition or stopLossCondition or takeProfitCondition))

strategy.close("Short")

alert("Exiting short position", alert.freq_once_per_bar_close)

// Plot entry and exit points for visualization

plotshape(series=strategy.opentrades > 0, location=location.belowbar, color=color.red, style=shape.labeldown, text="Short")

plotshape(series=strategy.opentrades == 0, location=location.abovebar, color=color.green, style=shape.labelup, text="Exit")

// Add alert conditions

alertcondition(strategy.opentrades > 0, title="Short Entry Alert", message="Entering short position")

alertcondition(strategy.opentrades == 0, title="Short Exit Alert", message="Exiting short position")

相关推荐