概述

该交易策略基于相对强弱指标(RSI)与价格走势之间的背离现象,旨在捕捉潜在的趋势反转机会。策略通过检测多头背离和空头背离,分别产生买入和卖出信号。当RSI与价格出现背离时,表明当前趋势可能即将反转,为交易者提供了潜在的交易机会。

策略原理

- 计算指定周期内的RSI指标。

- 通过比较过去一定周期内的价格和RSI走势,判断是否存在多头背离或空头背离。

- 多头背离:价格创新低,但RSI并未创新低,表明上涨动能正在积聚。

- 空头背离:价格创新高,但RSI并未创新高,表明下跌动能正在积聚。

- 当检测到多头背离且RSI从超卖区crossed上穿回归时,产生买入信号。

- 当检测到空头背离且RSI从超买区crossed下穿回归时,产生卖出信号。

策略优势

- 捕捉趋势反转:通过识别RSI与价格的背离现象,策略能够在趋势反转初期产生交易信号,为交易者提供提前布局的机会。

- 简单易用:策略基于经典的RSI指标,计算简单,参数易于理解和调整,适合各类交易者使用。

- 适用多个市场:RSI背离策略可以应用于各类金融市场,如股票、期货、外汇等,具有广泛的适用性。

策略风险

- 假信号:并非所有的RSI背离都能导致实际的趋势反转,有时会出现假信号,导致交易亏损。

- 滞后性:RSI背离通常发生在趋势反转的早期阶段,但并非所有的背离信号都能立即引发趋势反转,可能存在一定的滞后性。

- 参数敏感:策略的表现可能对RSI计算周期、超买超卖阈值等参数较为敏感,不同参数设置可能导致不同的交易结果。

策略优化方向

- 结合其他指标:将RSI背离策略与其他技术指标(如移动平均线、MACD等)结合使用,提高信号确认的可靠性。

- 动态调整参数:根据市场状况和资产特点,动态调整RSI计算周期、超买超卖阈值等参数,以适应不同的市场环境。

- 加入风险管理:在策略中引入止损和止盈机制,控制单笔交易风险,提高策略的风险调整后收益。

- 多时间尺度分析:在不同时间尺度(如日线、4小时线等)上分析RSI背离现象,捕捉不同级别的趋势反转机会。

总结

基于RSI背离的趋势反转交易策略通过捕捉RSI指标与价格走势之间的背离现象,识别潜在的趋势反转机会。策略简单易用,适用于多个金融市场。然而,交易者需要注意假信号、滞后性和参数敏感等风险因素。通过结合其他指标、动态调整参数、加入风险管理等优化措施,可以进一步提高策略的稳健性和盈利潜力。

策略源码

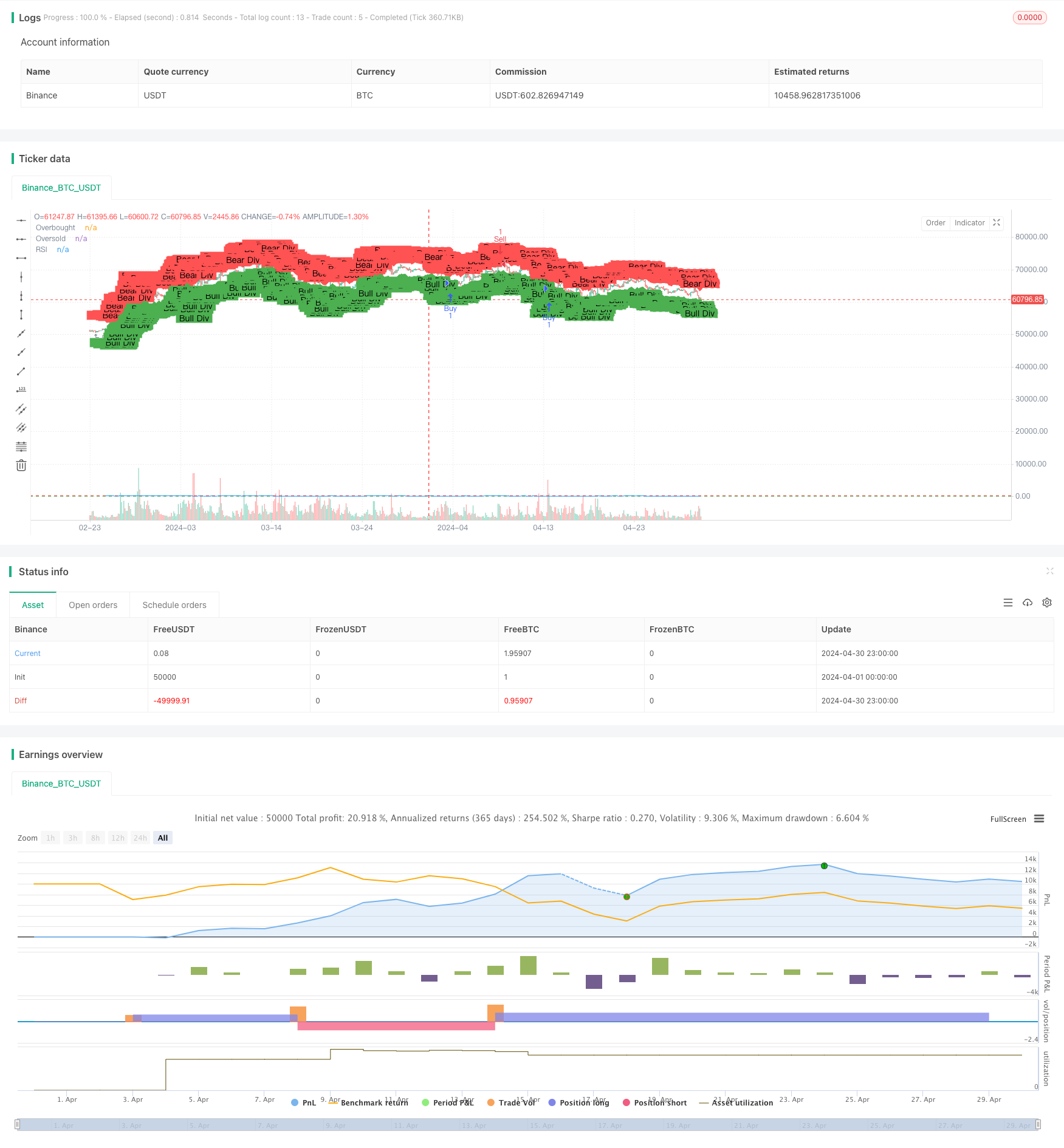

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI Divergence Strategy", overlay=true)

// Input parameters

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

lookback = input.int(5, title="Lookback Period for Divergence")

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Function to detect bullish divergence

bullishDivergence(price, rsi, lookback) =>

var bool bullDiv = false

for i = 1 to lookback

if (low[i] < low and rsi[i] > rsi)

bullDiv := true

bullDiv

// Function to detect bearish divergence

bearishDivergence(price, rsi, lookback) =>

var bool bearDiv = false

for i = 1 to lookback

if (high[i] > high and rsi[i] < rsi)

bearDiv := true

bearDiv

// Detect bullish and bearish divergence

bullDiv = bullishDivergence(close, rsi, lookback)

bearDiv = bearishDivergence(close, rsi, lookback)

// Plot RSI

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.blue)

// Generate buy signal on bullish divergence

if (bullDiv and ta.crossover(rsi, rsiOversold))

strategy.entry("Buy", strategy.long)

// Generate sell signal on bearish divergence

if (bearDiv and ta.crossunder(rsi, rsiOverbought))

strategy.entry("Sell", strategy.short)

// Plot buy/sell signals on chart

plotshape(series=bullDiv, location=location.belowbar, color=color.green, style=shape.labelup, text="Bull Div")

plotshape(series=bearDiv, location=location.abovebar, color=color.red, style=shape.labeldown, text="Bear Div")

相关推荐