概述

MA MACD BB多指标交易策略回测工具是一个功能强大的量化交易策略开发和回测平台。该工具支持使用三种常用的技术指标:移动平均线(MA)、移动平均线收敛发散指标(MACD)和布林带(BB),用户可以灵活选择其中一种作为主要的交易信号指标。同时,该工具还支持多空双向交易,用户可以根据市场趋势灵活选择做多或做空方向。在风险管理方面,该工具支持灵活设置每笔交易的资金占比,以更好地控制风险。此外,该工具还提供了详细的指标分析和信号生成功能,以帮助用户更好地把握交易机会。

策略原理

该策略的核心原理是利用三种常用技术指标(MA、MACD和BB)来识别市场趋势和交易信号。具体来说: 1. 当用户选择MA作为主要指标时,策略会计算指定周期的移动平均线,当价格上穿或下穿移动平均线时分别产生买入和卖出信号。 2. 当用户选择MACD作为主要指标时,策略会计算MACD值和信号线,当MACD上穿或下穿信号线时分别产生买入和卖出信号。此外,策略还会绘制MACD柱状图以更直观地展示趋势强度。 3. 当用户选择BB作为主要指标时,策略会计算布林带的上中下轨,当价格突破下轨时产生买入信号,突破上轨时产生卖出信号,回到中轨附近时平仓。

在具体交易时,策略会根据用户选择的交易方向(多头或空头)和资金管理设置,自动计算每笔交易的头寸大小,然后根据信号执行相应的开仓和平仓操作。

策略优势

- 指标灵活:用户可以根据自己的偏好和市场特点,灵活选择MA、MACD或BB作为主要的交易指标,适应不同的交易风格和市场环境。

- 双向交易:策略支持多空双向交易,用户可以根据市场趋势灵活选择交易方向,不仅可以在上涨行情中获利,也能在下跌行情中获得收益机会。

- 风险可控:用户可以灵活设置每笔交易的资金占比,合理控制单笔交易的风险敞口,同时策略会根据账户余额自动计算每笔交易的头寸大小,避免过度冒险。

- 信号明确:策略使用常用技术指标产生客观明确的交易信号,并通过图表直观展示,用户可以清晰地识别趋势方向和交易时机。

- 回测便捷:用户可以利用该工具对历史数据进行回测,快速评估和优化策略性能,为实盘交易提供重要参考。

策略风险

- 市场风险:任何交易策略都面临市场波动和不确定性的风险,该策略也不例外。如果市场出现剧烈波动或非理性行为,可能导致策略产生错误信号和损失。

- 参数风险:该策略的表现在一定程度上取决于用户选择的指标参数,如MA的周期、MACD的快慢线周期、BB的周期和宽度等。不恰当的参数设置可能导致策略效果不佳。

- 过拟合风险:如果用户在回测中过度优化策略参数,可能导致策略过于针对特定历史数据,在实际市场中表现不佳,即出现过拟合问题。

- 黑天鹅风险:该策略主要依赖技术指标产生交易信号,如果市场出现重大的基本面变化或极端事件,策略可能无法及时应对,导致重大损失。

为了降低以上风险,用户应当合理设置策略参数,定期评估和调整策略,同时密切关注市场动向,必要时进行人工干预。此外,严格的风险管理措施如设置止损和仓位限制等也不可或缺。

策略优化方向

- 动态参数优化:目前策略的指标参数是固定的,可以考虑引入自适应机制,根据市场状态的变化动态调整参数,以求更好地适应市场。

- 组合信号优化:目前策略主要基于单一指标产生交易信号,可以考虑将多个指标的信号进行组合,如MA和MACD的组合信号,以提高信号的可靠性和稳健性。

- 仓位管理优化:目前策略采用固定比例的仓位管理,可以考虑引入更高级的方法如凯利公式或动态平衡策略,以优化头寸规模和风险收益比。

- 止损优化:目前策略缺乏明确的止损逻辑,可以考虑加入基于ATR或百分比的动态止损机制,以更好地控制下行风险。

- 多市场优化:目前策略只针对单一市场,可以考虑扩展到多个相关或互补的市场,利用市场间的联动关系提高策略稳定性和收益水平。

以上优化方向主要是从提高策略适应性、稳健性、收益性和控制风险的角度出发,通过引入更先进灵活的方法,不断改进和完善策略的性能表现。

总结

MA MACD BB多指标交易策略回测工具是一个功能丰富、灵活实用的量化交易工具。它通过三种常用技术指标捕捉交易信号,同时支持多空双向交易和灵活的风险管理,能够适应różnych rynków 和交易风格。用户可以利用该工具对历史数据进行回测和优化,也可以将其应用于实盘交易。尽管任何策略都面临市场风险和模型风险,但通过合理的参数设置、严格的风险控制以及持续的优化改进,该策略有望成为量化交易者的得力助手,为其创造长期稳定的收益。

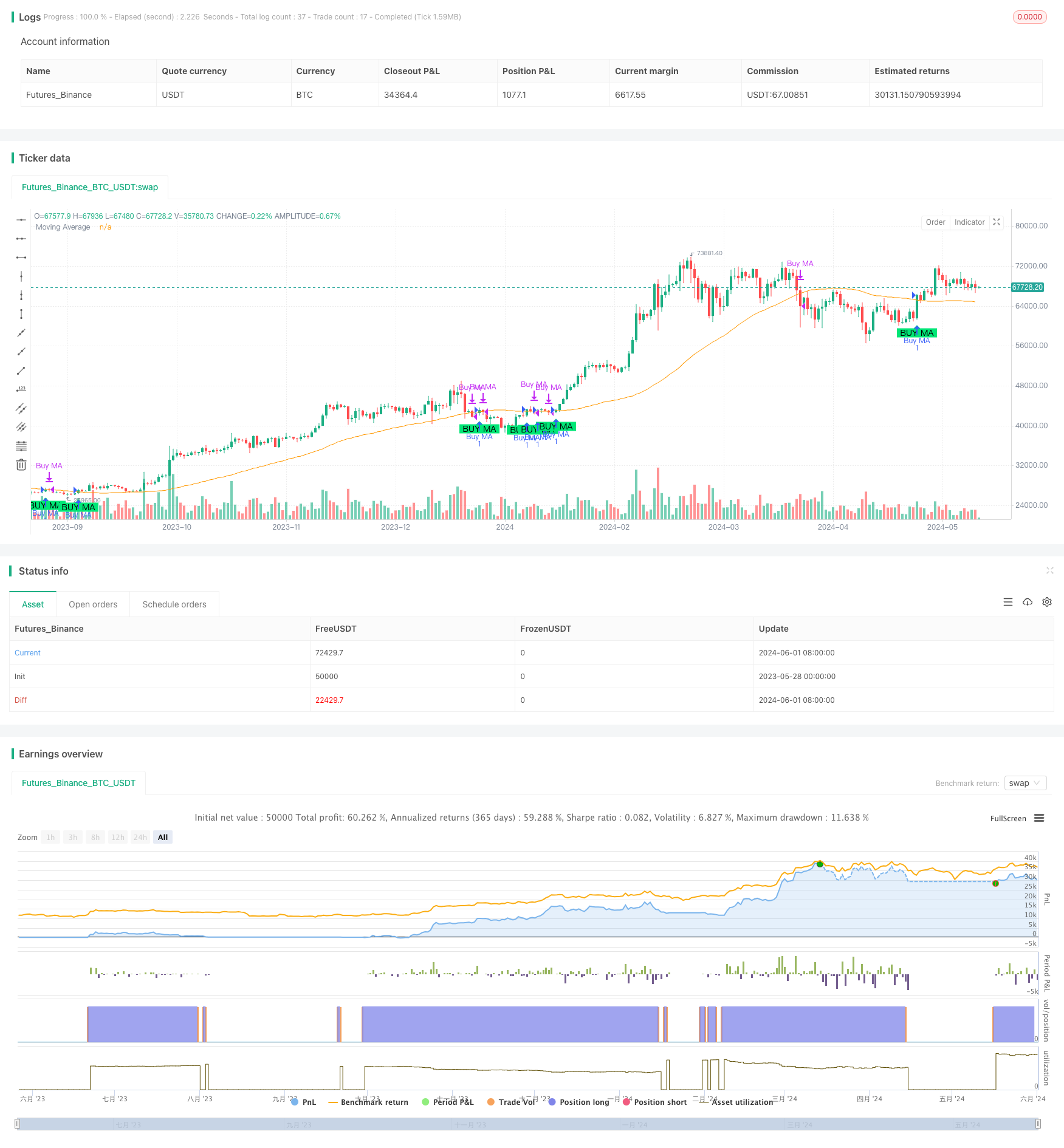

/*backtest

start: 2023-05-28 00:00:00

end: 2024-06-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Future_Billi0naire_

//@version=5

strategy("MA MACD BB Backtester", overlay=true)

//@variable Input for Strategy

which_ta = input.string("MA", title="Select Indicator", options=["MACD", "BB", "MA"])

which_camp = input.string("Long", title="Select Long / Short", options=["Short", "Long"])

//@variable Input parameters for Risk Management

positionSize = input.float(100.0, title="Each position's capital allocation %", minval=0.0, maxval = 100.0) / 100

//@variable Input parameters for MACD

fast_length = input.int(12, title="MACD Fast Length")

slow_length = input.int(26, title="MACD Slow Length")

signal_smoothing = input.int(9, title="MACD Signal Smoothing")

macd_source = input.source(close, title="MACD Source")

//@variable Input parameters for Moving Average

ma_length = input.int(50, title="Moving Average Length")

//@variable Input parameters for Bollinger Bands

bb_length = input.int(20, title="Bollinger Bands Length")

bb_mult = input.float(2.0, title="Bollinger Bands Multiplier")

// Choosing the Strategy

int x = na

if which_ta == "MA"

x := 1

else if which_ta == "MACD"

x := 2

else if which_ta == "BB"

x := 3

// Calculate MACD and Signal line

[macdLine, signalLine, _] = ta.macd(macd_source, fast_length, slow_length, signal_smoothing)

// Calculate Moving Average

ma = ta.sma(close, ma_length)

// Calculate Bollinger Bands

basis = ta.sma(close, bb_length)

dev = bb_mult * ta.stdev(close, bb_length)

upper = basis + dev

lower = basis - dev

// Plotting MACD and Signal lines

plot(x == 2 ? macdLine : na, color=color.blue, title="MACD Line")

plot(x == 2 ? signalLine : na, color=color.red, title="Signal Line")

// Plotting histogram

histogram = macdLine - signalLine

plot(x == 2 ? histogram : na, color=color.gray, style=plot.style_histogram, title="MACD Histogram")

// Plotting Moving Average

plot(x == 1 ? ma : na, color=color.orange, title="Moving Average")

// Plotting Bollinger Bands

plot(x == 3 ? upper : na, color=color.green, title="Upper Bollinger Band")

plot(x == 3 ? lower : na, color=color.red, title="Lower Bollinger Band")

plot(x == 3 ? basis : na, color=color.blue, title="Basis Bollinger Band")

// Generate buy signals

buySignalMACD = ta.crossover(macdLine, signalLine)

buySignalMA = ta.crossover(close, ma)

buySignalBB = close < lower

sellSignalBBExit = close > basis

// Generate sell signals

sellSignalMACD = ta.crossunder(macdLine, signalLine)

sellSignalMA = ta.crossunder(close, ma)

sellSignalBB = close > upper

buySignalBBExit = close < basis

// Plot buy signals on the chart

plotshape(series=buySignalMACD and x == 2 and which_camp=="Long" and strategy.opentrades == 0 ? buySignalMACD : na, title="Buy Signal MACD", location=location.belowbar, color=color.lime, style=shape.labelup, text="BUY MACD")

plotshape(series=buySignalMA and x == 1 and which_camp=="Long" and strategy.opentrades == 0 ? buySignalMA : na, title="Buy Signal MA", location=location.belowbar, color=color.lime, style=shape.labelup, text="BUY MA")

plotshape(series=buySignalBB and x == 3 and which_camp=="Long" and strategy.opentrades == 0 ? buySignalBB : na, title="Buy Signal BB", location=location.belowbar, color=color.lime, style=shape.labelup, text="BUY BB")

// Plot sell signals on the chart

plotshape(series=sellSignalMACD and x == 2 and which_camp=="Short" and strategy.opentrades == 0 ? sellSignalMACD : na, title="Sell Signal MACD", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL MACD")

plotshape(series=sellSignalMA and x == 1 and which_camp=="Short" and strategy.opentrades == 0 ? sellSignalMA : na, title="Sell Signal MA", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL MA")

plotshape(series=sellSignalBB and x == 3 and which_camp=="Short" and strategy.opentrades == 0 ? sellSignalBB : na, title="Sell Signal BB", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL BB")

// Calculate stop loss and take profit levels

accountSize = strategy.equity

positionSizeAmount = accountSize * positionSize

// Calculate order size based on stop loss amount

orderSize = math.floor(positionSizeAmount / close)

// Enter long positions based on buy signals

if strategy.opentrades == 0

if (buySignalMACD) and x == 2 and which_camp == "Long"

strategy.entry("Buy MACD", strategy.long, qty=orderSize)

if (buySignalMA) and x == 1 and which_camp == "Long"

strategy.entry("Buy MA", strategy.long, qty=orderSize)

if (buySignalBB) and x == 3 and which_camp == "Long"

strategy.entry("Buy BB", strategy.long, qty=orderSize)

// Enter short positions based on sell signals

if strategy.opentrades == 0

if (sellSignalMACD) and x == 2 and which_camp == "Short"

strategy.entry("Sell MACD", strategy.short, qty=orderSize)

if (sellSignalMA) and x == 1 and which_camp == "Short"

strategy.entry("Sell MA", strategy.short, qty=orderSize)

if (sellSignalBB) and x == 3 and which_camp == "Short"

strategy.entry("Sell BB", strategy.short, qty=orderSize)

// Close positions based on exit signals

if (sellSignalMACD) and which_camp == "Long"

strategy.close("Buy MACD")

if (sellSignalMA) and which_camp == "Long"

strategy.close("Buy MA")

if (sellSignalBBExit) and which_camp == "Long"

strategy.close("Buy BB")

if (buySignalMACD) and which_camp == "Short"

strategy.close("Sell MACD")

if (buySignalMA) and which_camp == "Short"

strategy.close("Sell MA")

if (buySignalBBExit) and which_camp == "Short"

strategy.close("Sell BB")