概述

这个策略是一个基于RSI指标和价格波动性的多层级均值回归交易系统。它利用RSI的极端值和异常大的价格波动作为入场信号,同时采用金字塔式加仓和动态止盈来管理风险和优化收益。该策略的核心思想是在市场出现极端波动时入场,并在价格回归正常水平时获利了结。

策略原理

入场条件:

- 使用20周期RSI(RSI20)作为主要指标

- 设置多个RSI阈值(35⁄65, 30⁄70, 25⁄75, 20⁄80)和相应的波动率阈值

- 当RSI达到某个阈值,且当前K线实体大小超过对应的波动率阈值时,触发入场信号

- 额外条件:价格需要突破最近的高点/低点支撑位一定百分比

加仓机制:

- 最多允许5次入场(初始入场+4次加仓)

- 每次加仓需满足更严格的RSI和波动率条件

出场机制:

- 设置5个不同级别的止盈点

- 止盈点基于入场时的支撑/阻力位动态计算

- 随着持仓数量增加,止盈目标逐渐降低

风险控制:

- 使用百分比风险模型,每次交易风险固定为账户总值的20%

- 设置最大允许同时持仓数为5,限制总体风险敞口

策略优势

多层级入场:通过设置多个RSI和波动率阈值,策略可以捕捉不同程度的市场极端情况,提高交易机会。

动态止盈:基于支撑/阻力位计算的止盈点,能够根据市场结构自适应调整,既保护利润又不过早离场。

金字塔式加仓:在趋势延续时增加持仓,可以显著提高盈利潜力。

风险管理:固定百分比风险和最大持仓限制,有效控制每笔交易和总体风险。

灵活性:大量可调参数使策略能够适应不同市场环境和交易品种。

均值回归+趋势跟踪:结合了均值回归和趋势跟踪的优点,既能捕捉短期反转又不错过大趋势。

策略风险

过度交易:在高波动市场中可能频繁触发交易信号,导致手续费过高。

假突破:市场可能出现短暂的极端波动后快速回调,造成错误信号。

连续亏损:如果市场持续单向运动,可能导致多次加仓后大幅亏损。

参数敏感性:策略表现可能对参数设置高度敏感,存在过拟合风险。

滑点影响:在剧烈波动时期,可能面临严重滑点,影响策略表现。

市场环境依赖:策略在某些市场环境下可能表现欠佳,如低波动或强势趋势市场。

策略优化方向

动态参数调整:引入自适应机制,根据市场状态动态调整RSI和波动率阈值。

多时间周期分析:结合更长期的市场趋势判断,提高入场质量。

止损优化:增加追踪止损或基于ATR的动态止损,进一步控制风险。

市场状态过滤:加入趋势强度、波动率周期等过滤条件,避免在不适合的市场环境交易。

资金管理优化:实现更细致的仓位管理,如根据不同级别的信号调整交易规模。

机器学习集成:利用机器学习算法优化参数选择和信号生成过程。

相关性分析:加入与其他资产的相关性分析,提高策略的稳定性和多样性。

总结

该多层级RSI回归交易策略是一个精心设计的量化交易系统,它巧妙地结合了技术分析、动态风险管理和金字塔式加仓技术。通过捕捉市场的极端波动并在价格回归时获利,策略展现了较强的盈利潜力。然而,它也面临过度交易和市场环境依赖等挑战。未来的优化方向应focus于提高策略的自适应能力和风险控制能力,以适应不同的市场环境。总的来说,这是一个具有良好基础的策略框架,通过进一步优化和回测,有望发展成为一个稳健的交易系统。

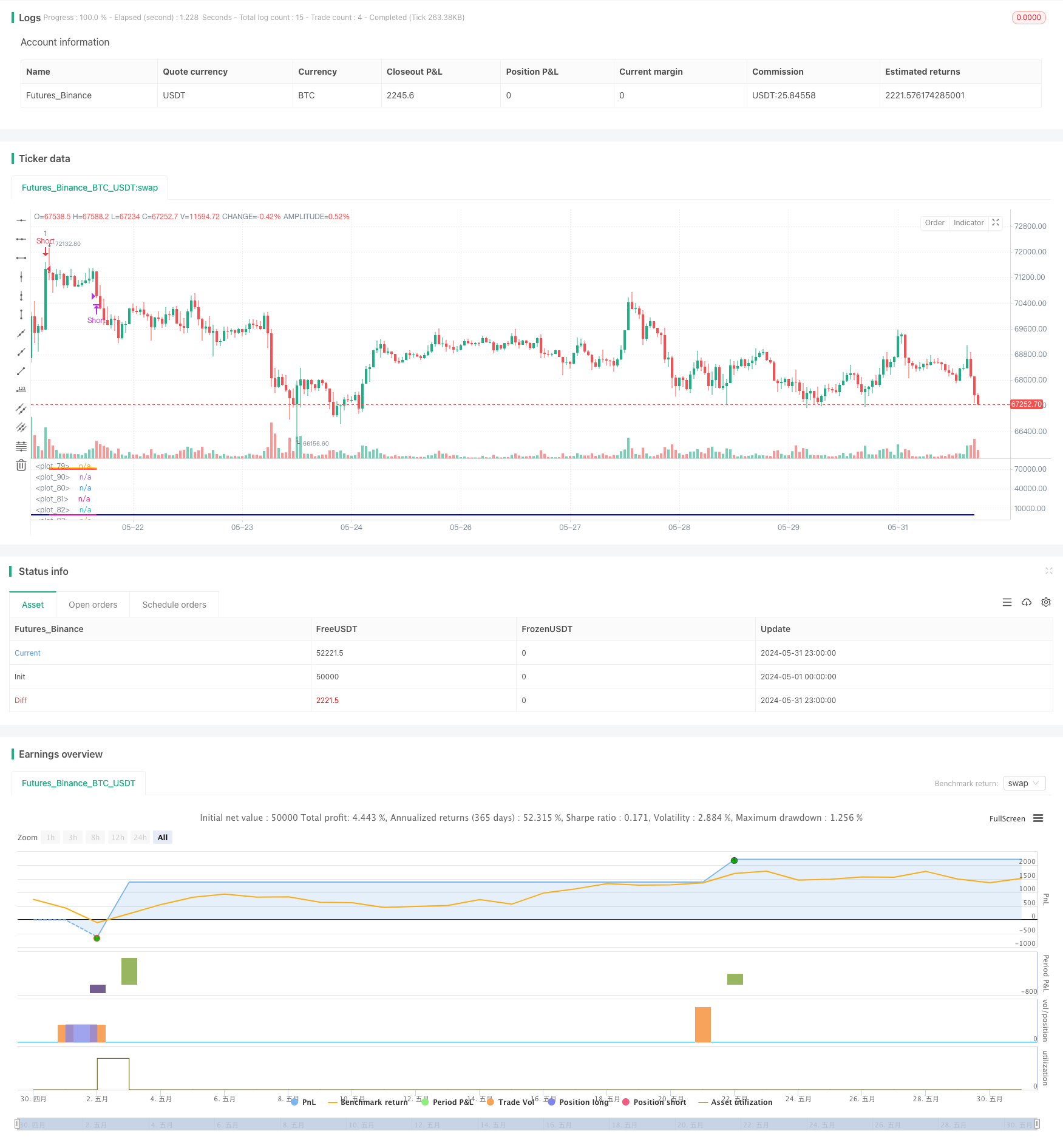

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Retorno_Pivots_5min_Novo_v3.3')

// Input variables

bars_left1 = input(1, title = "Entry - Pivot Left Bars")

bars_right1 = input(1, title = "Entry - Pivot Right Bars")

rsi20_longentry0 = input(35, title = "Entry 1 - RSI20 Long")

rsi20_shortentry0 = input(65, title = "Entry 1 - RSI20 Short")

bar_size_entry0 = input.float(1, title="Entry 1 - Bar Size")

rsi20_longentry1 = input(30, title = "Entry 2 - RSI20 Long")

rsi20_shortentry1 = input(70, title = "Entry 2 - RSI20 Short")

bar_size_entry1 = input.float(0.8, title="Entry 2 - Bar Size")

rsi20_longentry2 = input(25, title = "Entry 3 - RSI20 Long")

rsi20_shortentry2 = input(75, title = "Entry 3 - RSI20 Short")

bar_size_entry2 = input.float(0.7, title="Entry 3 - Bar Size")

rsi20_longentry3 = input(20, title = "Entry 4 - RSI20 Long")

rsi20_shortentry3 = input(80, title = "Entry 4 - RSI20 Short")

bar_size_entry3 = input.float(0.5, title="Entry 4 - Bar Size")

limit_perc1 = input.float(0.60, title="Profit Range 1")

limit_perc2 = input.float(0.40, title="Profit Range 2")

limit_perc3 = input.float(0.20, title="Profit Range 3")

limit_perc4 = input.float(0.00, title="Profit Range 4")

limit_perc5 = input.float(0.00, title="Profit Range 5")

minimum_pivot_distance = input.float(0, title="Minimum Pivot Distance %")

barsize_1h_input = input(288, title="Highest Bar Lookback")

rsi20 = ta.rsi(close, 20)

rsi200 = ta.rsi(close, 200)

Pivot_High_Last1 = ta.valuewhen(ta.pivothigh(high, bars_left1, bars_right1), ta.pivothigh(high, bars_left1, bars_right1), 0)

Pivot_Low_Last1 = ta.valuewhen(ta.pivotlow(low, bars_left1, bars_right1), ta.pivotlow(low, bars_left1, bars_right1), 0)

barsize = math.abs(close - open)

barsize_1h = ta.highest(barsize, barsize_1h_input)

Bar0Long = rsi20 < rsi20_longentry0 and barsize >= (barsize_1h * bar_size_entry0)

Bar1Long = rsi20 < rsi20_longentry1 and barsize >= (barsize_1h * bar_size_entry1)

Bar2Long = rsi20 < rsi20_longentry2 and barsize >= (barsize_1h * bar_size_entry2)

Bar3Long = rsi20 < rsi20_longentry3 and barsize >= (barsize_1h * bar_size_entry3)

// Long Entries

Long_Entry1 = strategy.opentrades == 0 and rsi20 < rsi20[1] and ((rsi20 < rsi20_longentry0 and barsize >= (barsize_1h * bar_size_entry0)) or (rsi20 < rsi20_longentry1 and barsize >= (barsize_1h * bar_size_entry1)) or (rsi20 < rsi20_longentry2 and barsize >= (barsize_1h * bar_size_entry2)) or (rsi20 < rsi20_longentry3 and barsize >= (barsize_1h * bar_size_entry3))) and close < (Pivot_Low_Last1 * (1 - (minimum_pivot_distance / 100)))

Long_Entry2 = strategy.opentrades == 1 and strategy.position_size > 0 and rsi20 < rsi20[1] and (Bar0Long or Bar1Long or Bar2Long or Bar3Long)

Long_Entry3 = strategy.opentrades == 2 and strategy.position_size > 0 and rsi20 < rsi20[1] and (Bar0Long or Bar1Long or Bar2Long or Bar3Long)

Long_Entry4 = strategy.opentrades == 3 and strategy.position_size > 0 and rsi20 < rsi20[1] and (Bar0Long or Bar1Long or Bar2Long or Bar3Long)

Long_Entry5 = strategy.opentrades == 4 and strategy.position_size > 0 and rsi20 < rsi20[1] and (Bar0Long or Bar1Long or Bar2Long or Bar3Long)

if Long_Entry1 or Long_Entry2 or Long_Entry3 or Long_Entry4 or Long_Entry5

strategy.entry("Long", strategy.long, comment = "ENTER-LONG_BINANCE-FUTURES_BTCBUSD_Bot-BTC-1min_1M_970d2ee265390c27")

// Longs Exits

Long_Exit1 = strategy.opentrades == 1 and close > (strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc1))

Long_Exit2 = strategy.opentrades == 2 and close > (strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc2))

Long_Exit3 = strategy.opentrades == 3 and close > (strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc3))

Long_Exit4 = strategy.opentrades == 4 and close > (strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc4))

Long_Exit5 = strategy.opentrades == 5 and close > (strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc5))

if Long_Exit1 or Long_Exit2 or Long_Exit3 or Long_Exit4 or Long_Exit5

strategy.close("Long", comment = "EXIT-LONG_BINANCE-FUTURES_BTCBUSD_Bot-BTC-1min_1M_970d2ee265390c27")

Bar0Short = rsi20 > rsi20_shortentry0 and barsize >= (barsize_1h * bar_size_entry0)

Bar1Short = rsi20 > rsi20_shortentry1 and barsize >= (barsize_1h * bar_size_entry1)

Bar2Short = rsi20 > rsi20_shortentry2 and barsize >= (barsize_1h * bar_size_entry2)

Bar3Short = rsi20 > rsi20_shortentry3 and barsize >= (barsize_1h * bar_size_entry3)

// Short Entries

Short_Entry1 = strategy.opentrades == 0 and rsi20 > rsi20[1] and ((rsi20 > rsi20_shortentry0 and barsize >= (barsize_1h * bar_size_entry0)) or (rsi20 > rsi20_shortentry1 and barsize >= (barsize_1h * bar_size_entry1)) or (rsi20 > rsi20_shortentry2 and barsize >= (barsize_1h * bar_size_entry2)) or (rsi20 > rsi20_shortentry2 and barsize >= (barsize_1h * bar_size_entry2))) and close > (Pivot_High_Last1 * (1 + (minimum_pivot_distance / 100)))

Short_Entry2 = strategy.opentrades == 1 and strategy.position_size < 0 and rsi20 > rsi20[1] and (Bar0Short or Bar1Short or Bar2Short or Bar3Short)

Short_Entry3 = strategy.opentrades == 2 and strategy.position_size < 0 and rsi20 > rsi20[1] and (Bar0Short or Bar1Short or Bar2Short or Bar3Short)

Short_Entry4 = strategy.opentrades == 3 and strategy.position_size < 0 and rsi20 > rsi20[1] and (Bar0Short or Bar1Short or Bar2Short or Bar3Short)

Short_Entry5 = strategy.opentrades == 4 and strategy.position_size < 0 and rsi20 > rsi20[1] and (Bar0Short or Bar1Short or Bar2Short or Bar3Short)

if Short_Entry1 or Short_Entry2 or Short_Entry3 or Short_Entry4 or Short_Entry5

strategy.entry("Short", strategy.short, comment = "ENTER-SHORT_BINANCE-FUTURES_BTCBUSD_Bot-BTC-1min_1M_970d2ee265390c27")

// Short Exits

Short_Exit1 = strategy.opentrades == 1 and close < (strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc1))

Short_Exit2 = strategy.opentrades == 2 and close < (strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc2))

Short_Exit3 = strategy.opentrades == 3 and close < (strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc3))

Short_Exit4 = strategy.opentrades == 4 and close < (strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc4))

Short_Exit5 = strategy.opentrades == 5 and close < (strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc5))

if Short_Exit1 or Short_Exit2 or Short_Exit3 or Short_Exit4 or Short_Exit5

strategy.close("Short", comment = "EXIT-SHORT_BINANCE-FUTURES_BTCBUSD_Bot-BTC-1min_1M_970d2ee265390c27")

// Plots

plot(rsi20, color=color.new(#fbff00, 0), linewidth=2)

plot(((strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc1))), color=color.new(#00ff2a, 0), linewidth=2)

plot(((strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc2))), color=color.new(#00ff2a, 50), linewidth=2)

plot(((strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc3))), color=color.new(#00ff2a, 80), linewidth=2)

plot(((strategy.position_avg_price + ((ta.valuewhen(strategy.opentrades == 0, Pivot_Low_Last1, 0) - (strategy.position_avg_price)) * limit_perc4))), color=color.new(#00ff2a, 100), linewidth=2)

plot((strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc1)), color=color.new(#ff0000, 0), linewidth=2)

plot((strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc2)), color=color.new(#ff0000, 50), linewidth=2)

plot((strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc3)), color=color.new(#ff0000, 80), linewidth=2)

plot((strategy.position_avg_price - ((strategy.position_avg_price - ta.valuewhen(strategy.opentrades == 0, Pivot_High_Last1, 0)) * limit_perc4)), color=color.new(#ff0000, 100), linewidth=2)

plot(strategy.position_avg_price, color=color.new(#ffc400, 0), linewidth=2)

plot(strategy.opentrades * (strategy.position_size / math.abs(strategy.position_size)), color=color.new(#ff00bb, 0), linewidth=2)

plot(((barsize / barsize_1h) * 100), color=color.new(#0000ff, 0), linewidth=2)