概述

动态Keltner通道动量反转策略是一种结合了多个技术指标的复杂交易系统。该策略主要利用Keltner通道、指数移动平均线(EMA)和平均真实波幅(ATR)来识别市场中的潜在入场和出场点。其核心思想是在市场出现回调后捕捉动量行情,同时融合了趋势跟踪的元素。

该策略的主要组成部分包括: 1. Keltner通道:用于识别市场的超买和超卖状态。 2. 指数移动平均线(EMA):作为趋势过滤器。 3. 平均真实波幅(ATR):用于动态止损设置。

策略的入场条件精心设计,要求价格触及Keltner通道的外轨,随后回落至中轨,并且收盘价位于EMA的上方或下方。这种设计旨在捕捉市场在大幅波动后的潜在反转或趋势延续。

出场条件同样基于Keltner通道,当价格达到或超过相应的通道边界时,策略会自动平仓。此外,策略还采用了基于ATR的动态止损机制,为风险管理提供了灵活性和适应性。

策略原理

动态Keltner通道动量反转策略的核心原理可以分为以下几个关键部分:

Keltner通道设置: 策略使用20周期的简单移动平均线(SMA)作为Keltner通道的基准线,通道宽度设置为6倍ATR。这种设置使得通道能够动态适应市场波动性的变化。

趋势过滤: 采用280周期的EMA作为长期趋势指标。这有助于确保交易方向与整体市场趋势保持一致。

入场条件:

- 多头入场:要求在过去120个周期内上轨被触及,当前蜡烛线的影线触及中轨,且收盘价在EMA之上。

- 空头入场:要求在过去120个周期内下轨被触及,当前蜡烛线的影线触及中轨,且收盘价在EMA之下。

出场条件:

- 多头出场:当高点达到或超过上轨时。

- 空头出场:当低点达到或跌破下轨时。

风险管理: 使用35周期的ATR计算动态止损,止损距离设为5.5倍ATR。这种方法可以根据市场波动性自动调整止损水平。

策略的设计理念是在市场出现显著波动后(触及Keltner通道外轨)寻找潜在的反转或趋势延续机会。中轨触及要求有助于确认价格回调,而EMA则用于确保交易方向与整体趋势一致。

策略优势

多指标协同:结合Keltner通道、EMA和ATR,提供了全面的市场分析视角,有助于减少假信号。

动态适应性:通过使用ATR来设置Keltner通道宽度和止损距离,策略能够自动适应不同市场条件下的波动性变化。

趋势确认:利用EMA作为额外的趋势过滤器,有助于提高交易的成功率,避免逆势交易。

灵活的入场机制:通过要求价格在触及外轨后回落至中轨,策略能够捕捉到潜在的反转或趋势延续机会,既不会过早入场,也不会错过重要的交易机会。

清晰的出场策略:基于Keltner通道的出场条件为交易提供了明确的获利目标,有助于锁定利润。

风险管理:采用基于ATR的动态止损机制,能够根据市场波动性自动调整止损水平,提供了更好的风险控制。

参数可调:策略提供了多个可调参数,如ATR长度、Keltner通道乘数、EMA长度等,使得交易者可以根据不同的市场和时间框架进行优化。

代码实现简洁:尽管策略逻辑相对复杂,但代码实现简洁明了,便于理解和维护。

策略风险

参数敏感性:策略的性能可能对参数设置非常敏感。不同的市场条件可能需要不同的参数设置,这增加了策略优化和维护的难度。

滞后性:使用移动平均线和ATR等指标可能导致信号产生滞后,在快速变化的市场中可能错过重要的入场或出场机会。

假突破风险:在横盘市场中,价格可能频繁触及Keltner通道的边界,导致过多的假信号。

趋势依赖:策略在强趋势市场中表现可能更好,但在震荡市场中可能面临频繁的止损出场。

过度优化风险:由于策略提供了多个可调参数,交易者可能陷入过度优化的陷阱,导致策略在实盘交易中的表现不如回测结果。

市场条件变化:策略可能在特定的市场条件下表现良好,但当市场特征发生变化时,性能可能会显著下降。

执行风险:在实际交易中,由于滑点和流动性问题,可能无法准确地在指定价格执行交易,这可能影响策略的整体表现。

为了缓解这些风险,建议采取以下措施: - 在不同的市场和时间框架上进行充分的回测和前向测试。 - 使用稳健的参数优化方法,避免过度拟合。 - 考虑增加额外的过滤条件,如成交量指标,以减少假信号。 - 实施严格的资金管理规则,限制每笔交易的风险敞口。 - 定期监控和评估策略性能,及时调整参数或暂停交易。

策略优化方向

动态参数调整: 考虑引入自适应机制,根据市场波动性或趋势强度动态调整Keltner通道乘数和EMA长度。这可以提高策略对不同市场条件的适应性。

多时间框架分析: 整合更高时间框架的趋势信息,例如在日线策略中考虑周线趋势。这有助于提高交易方向的准确性。

成交量确认: 引入成交量指标作为额外的确认信号。例如,要求入场时成交量高于平均水平,以增加交易的可信度。

市场状态分类: 开发一个市场状态分类系统,区分趋势市场和震荡市场。在不同的市场状态下使用不同的参数设置或交易规则。

止盈优化: 考虑实施更复杂的止盈策略,如移动止盈或部分止盈,以更好地平衡风险和回报。

入场优化: 细化入场条件,例如要求价格在触及中轨后有一定的反弹确认,或者增加动量指标的确认。

机器学习集成: 探索使用机器学习算法来优化参数选择或预测最佳入场时机。

相关性分析: 如果在多个市场上使用该策略,考虑加入相关性分析,以避免过度集中风险。

事件驱动因素: 整合基本面或事件驱动的过滤器,例如避免在重要经济数据发布前后交易。

回撤控制: 加入总体回撤控制机制,在策略达到预设最大回撤时自动停止交易。

这些优化方向旨在提高策略的稳健性、适应性和整体性能。然而,在实施任何优化之前,务必进行彻底的测试和验证,以确保这些改进确实能够带来实质性的性能提升。

总结

动态Keltner通道动量反转策略是一个精心设计的交易系统,它巧妙地结合了多个技术指标来捕捉市场中的潜在反转和趋势延续机会。通过利用Keltner通道、EMA和ATR,该策略不仅能够识别潜在的入场点,还提供了动态的风险管理机制。

策略的核心优势在于其动态适应性和多层面的市场分析方法。通过要求价格触及外轨后回落至中轨,并结合EMA趋势确认,策略能够在保持较高成功率的同时,捕捉重要的市场动向。此外,基于ATR的动态止损机制为风险控制提供了灵活性。

然而,该策略也面临一些潜在的风险,如参数敏感性和市场条件变化带来的挑战。为了应对这些风险,我们提出了多个优化方向,包括动态参数调整、多时间框架分析、成交量确认等。这些优化建议旨在进一步提高策略的稳健性和适应性。

总的来说,动态Keltner通道动量反转策略为交易者提供了一个结构化的方法来分析和参与市场。通过持续的监控、测试和优化,该策略有潜力成为一个可靠的交易工具。然而,像所有交易策略一样,它并非万能的解决方案。交易者应当结合自身的风险承受能力和交易目标,审慎地实施和管理这一策略。

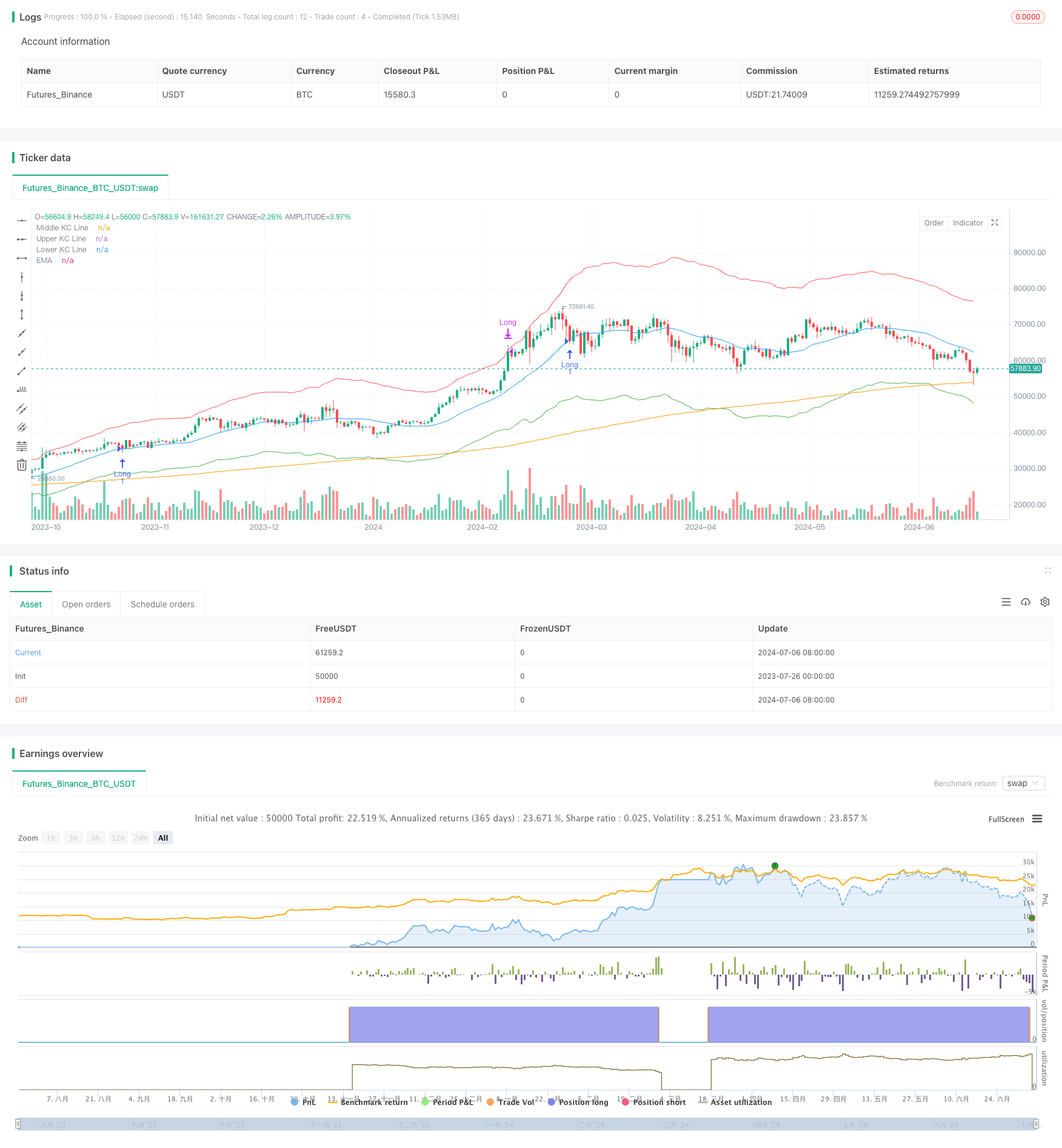

/*backtest

start: 2023-07-26 00:00:00

end: 2024-07-07 05:20:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Keltner Channel Pullback and Entry Strategy", overlay=true)

// Input settings

atrLength = input(35, "ATR Length")

atrMultiplier = input(5.5, "ATR Multiplier for Stop Loss")

kcLength = input(20, "Keltner Channel Length")

kcMultiplier = input(6.0, "Keltner Channel Multiplier")

emaLength = input(280, "EMA Length")

candleLookback = input(120, "Candle Lookback for Keltner Channel Touch")

// ATR for stop loss calculation

atr = ta.atr(atrLength)

// Keltner Channel

basis = ta.sma(close, kcLength)

kcRange = kcMultiplier * atr

upperKC = basis + kcRange

lowerKC = basis - kcRange

// EMA Trend Filter

ema = ta.ema(close, emaLength)

// Function to check if Keltner Channel was touched within the lookback period

wasKCTouched(direction) =>

touched = false

for i = 1 to candleLookback

if direction == "long" and high[i] >= upperKC[i]

touched := true

if direction == "short" and low[i] <= lowerKC[i]

touched := true

touched

// Check for middle line touch by wick

middleLineTouchedByWick = high >= basis and low <= basis

// Entry Conditions

longCondition = wasKCTouched("long") and middleLineTouchedByWick and close > ema

shortCondition = wasKCTouched("short") and middleLineTouchedByWick and close < ema

// Exit Conditions

longExit = high >= upperKC

shortExit = low <= lowerKC

// Tracking the previous ATR value for stop loss calculation

var float prevAtr = na

if longCondition or shortCondition

prevAtr := atr[1]

// Entry Execution

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - atrMultiplier * prevAtr)

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + atrMultiplier * prevAtr)

// Exit Execution

if longExit and strategy.position_size > 0

strategy.close("Long", when=barstate.isnew)

if shortExit and strategy.position_size < 0

strategy.close("Short", when=barstate.isnew)

// Plotting

plot(basis, color=color.blue, title="Middle KC Line")

plot(upperKC, color=color.red, title="Upper KC Line")

plot(lowerKC, color=color.green, title="Lower KC Line")

plot(ema, color=color.orange, title="EMA")