概述

这是一个基于双均线系统的趋势跟踪策略,结合了动态止损和均线过滤器。该策略使用两条不同周期的移动平均线来捕捉市场趋势,同时通过过滤均线来限制交易方向,并提供灵活的止损设置选项。这种方法旨在捕捉中长期趋势,同时通过动态风险管理来保护资金。

策略原理

该策略的核心原理包括以下几个方面:

双均线系统:使用两条移动平均线,一条作为主要信号线(较短周期),另一条作为过滤器(较长周期)。

趋势确认:只有当价格和主均线都位于过滤均线的同一侧时,才考虑开仓。这有助于确保交易方向与整体趋势一致。

入场信号:当价格突破主均线,并且满足过滤条件时,触发入场信号。

动态止损:提供两种止损选项 - 基于百分比的动态止损或基于前一根蜡烛高低点的固定止损。

固定止盈:使用基于入场价格百分比的固定止盈水平。

可视化:在图表上绘制均线、入场价格、止损和止盈水平,以便直观地分析交易。

策略优势

趋势跟踪:通过使用双均线系统,该策略能够有效地捕捉中长期趋势,提高盈利机会。

风险管理:动态止损选项使得策略能够根据市场波动性自动调整风险敞口,提高资金保护能力。

灵活性:策略允许用户选择不同类型的移动平均线(SMA、EMA、WMA),以及自定义各项参数,适应不同的交易风格和市场环境。

过滤机制:使用长周期均线作为过滤器,有助于减少假突破和逆势交易,提高策略的稳定性。

可视化效果:通过在图表上绘制关键价格水平和均线,交易者可以直观地理解策略逻辑和当前市场状况。

自动化执行:策略可以在交易平台上自动执行,减少人为干预和情绪影响。

策略风险

滞后性:移动平均线本质上是滞后指标,可能导致在趋势反转时入场或出场较晚。

震荡市场表现:在横盘或震荡市场中,策略可能产生频繁的假信号,导致连续亏损。

参数敏感性:策略性能高度依赖于选择的参数,不当的参数设置可能导致过度交易或错过重要机会。

固定止盈限制:使用固定百分比的止盈可能在强劲趋势中过早结束盈利交易。

市场条件变化:策略在不同的市场环境下表现可能存在显著差异,需要定期评估和调整。

滑点和交易成本:在实际交易中,滑点和交易成本可能显著影响策略的盈利能力,特别是在高频交易的情况下。

策略优化方向

动态参数调整:实现自适应的均线周期和止损百分比,以适应不同的市场波动性和趋势强度。

多时间框架分析:整合更长时间周期的趋势信息,以提高入场决策的准确性和降低假信号。

波动性过滤:引入波动性指标(如ATR),在低波动性期间暂停交易,减少震荡市场中的损失。

趋势强度确认:结合其他技术指标(如ADX)来评估趋势强度,仅在强趋势中开仓。

动态止盈:实现基于市场波动性或趋势强度的动态止盈机制,以最大化盈利潜力。

资金管理优化:根据账户规模和市场波动性动态调整头寸大小,以优化风险收益比。

机器学习集成:利用机器学习算法优化参数选择和入场时机,提高策略的适应性和性能。

情绪分析:整合市场情绪指标,在极端情绪时期调整策略行为,避免过度拥挤的交易。

总结

双均线趋势捕捉策略结合动态止损和过滤器是一个全面的趋势跟踪系统,旨在捕捉中长期市场趋势。通过结合主要信号均线和过滤均线,该策略能够有效地识别趋势方向并生成交易信号。动态止损选项提供了灵活的风险管理,而可视化功能则增强了策略的可解释性。

尽管该策略具有很强的潜力,但仍然存在固有的风险,如滞后性和对市场条件变化的敏感性。为了提高策略的稳健性和适应性,建议进行进一步的优化,如实现动态参数调整、整合多时间框架分析和引入额外的过滤机制。

总的来说,这个策略为交易者提供了一个坚实的基础,可以根据个人需求和市场特征进行定制和改进。通过持续的监控、回测和优化,该策略有潜力成为一个可靠的交易工具,适用于各种市场环境。

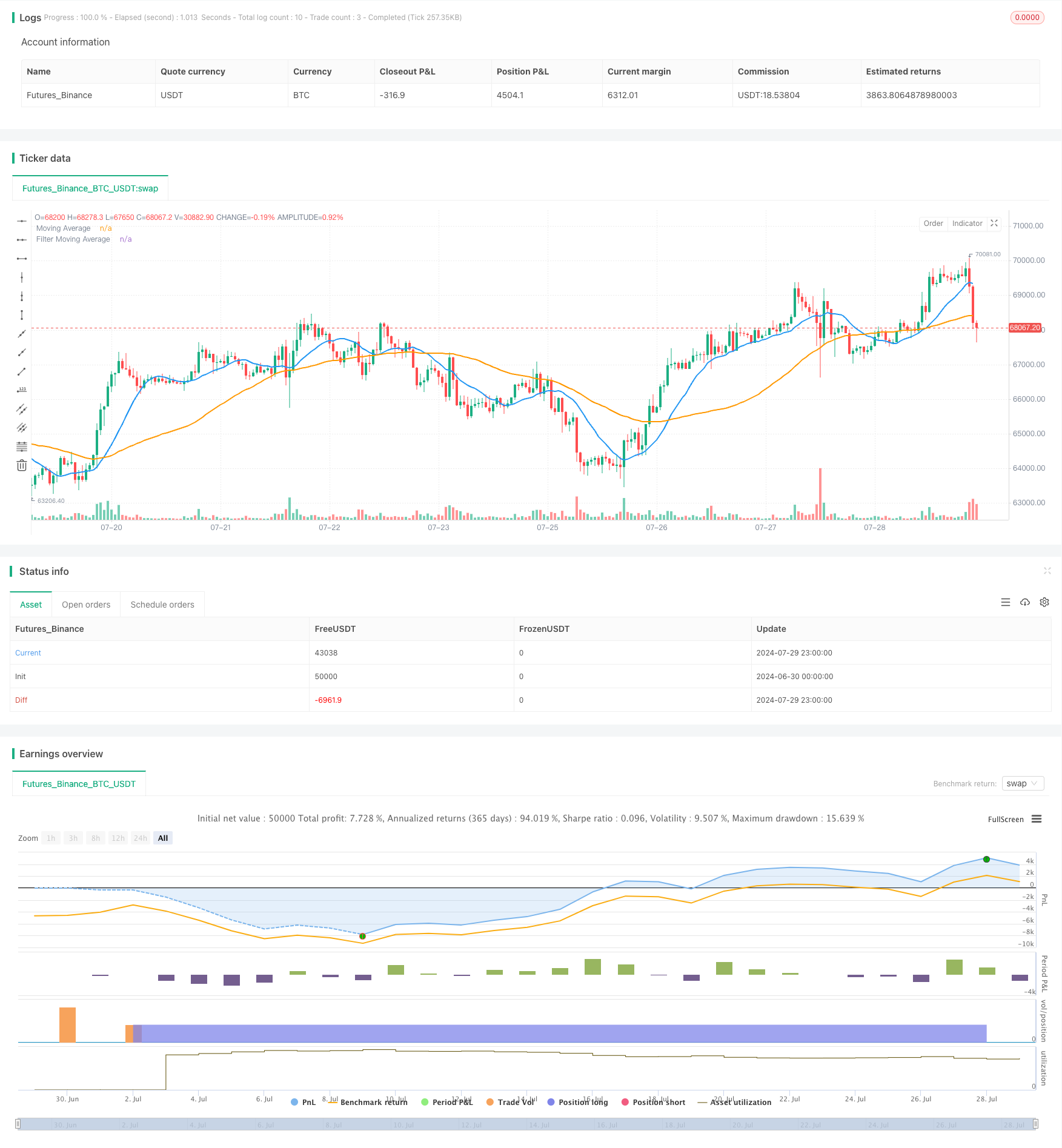

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Breakout with Filter and Dynamic Stop Loss", overlay=true)

// Параметры

maLength = input.int(14, "MA Length")

maType = input.string("SMA", "MA Type", options=["SMA", "EMA", "WMA"])

takeProfitPercent = input.float(1.0, "Take Profit (%)", step=0.1)

filterMaLength = input.int(50, "Filter MA Length")

filterMaType = input.string("SMA", "Filter MA Type", options=["SMA", "EMA", "WMA"])

useDynamicStopLoss = input.bool(false, "Use Dynamic Stop Loss")

dynamicStopLossPercent = input.float(1.0, "Dynamic Stop Loss (%)", step=0.1)

// Выбор типа основной скользящей средней

float ma = na

switch maType

"SMA" => ma := ta.sma(close, maLength)

"EMA" => ma := ta.ema(close, maLength)

"WMA" => ma := ta.wma(close, maLength)

// Выбор типа скользящей средней фильтра

float filterMa = na

switch filterMaType

"SMA" => filterMa := ta.sma(close, filterMaLength)

"EMA" => filterMa := ta.ema(close, filterMaLength)

"WMA" => filterMa := ta.wma(close, filterMaLength)

// Построение скользящих средних

plot(ma, color=color.blue, linewidth=2, title="Moving Average")

plot(filterMa, color=color.orange, linewidth=2, title="Filter Moving Average")

// Логика открытия позиций

longCondition = ta.crossover(close, ma) and close > filterMa

shortCondition = ta.crossunder(close, ma) and close < filterMa

var bool inPosition = false

var float entryPrice = na

var float takeProfitLevel = na

var float stopLossLevel = na

if (longCondition and not inPosition and strategy.position_size == 0)

entryPrice := close

takeProfitLevel := close * (1 + takeProfitPercent / 100)

if (useDynamicStopLoss)

stopLossLevel := close * (1 - dynamicStopLossPercent / 100)

else

stopLossLevel := low[1]

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", limit=takeProfitLevel, stop=stopLossLevel)

// line.new(bar_index, entryPrice, bar_index + 1, entryPrice, color=color.blue, width=2)

// line.new(bar_index, takeProfitLevel, bar_index + 1, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index, stopLossLevel, bar_index + 1, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

inPosition := true

if (shortCondition and not inPosition and strategy.position_size == 0)

entryPrice := close

takeProfitLevel := close * (1 - takeProfitPercent / 100)

if (useDynamicStopLoss)

stopLossLevel := close * (1 + dynamicStopLossPercent / 100)

else

stopLossLevel := high[1]

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", from_entry="Short", limit=takeProfitLevel, stop=stopLossLevel)

// line.new(bar_index, entryPrice, bar_index + 1, entryPrice, color=color.blue, width=2)

// line.new(bar_index, takeProfitLevel, bar_index + 1, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index, stopLossLevel, bar_index + 1, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

inPosition := true

// Проверка закрытия позиции по тейк-профиту или стоп-лоссу

if (strategy.position_size == 0)

inPosition := false

// Отображение текущих линий стоп-лосса и тейк-профита

// if (strategy.position_size > 0)

// line.new(bar_index[1], takeProfitLevel, bar_index, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index[1], stopLossLevel, bar_index, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

// line.new(bar_index[1], entryPrice, bar_index, entryPrice, color=color.blue, width=2)

// if (strategy.position_size < 0)

// line.new(bar_index[1], takeProfitLevel, bar_index, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index[1], stopLossLevel, bar_index, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

// line.new(bar_index[1], entryPrice, bar_index, entryPrice, color=color.blue, width=2)