概述

该策略是一个基于Fibonacci回撤原理的高级趋势跟踪系统。它通过动态计算重要的Fibonacci回撤水平(23.6%, 38.2%, 50%, 61.8%, 78.6%)来识别潜在的支撑和阻力区域。系统采用了100个周期的回溯窗口来确定最高点和最低点,并以此为基础计算各个回撤水平。策略集成了精确的入场信号和风险管理机制,通过在关键Fibonacci水平的突破来触发交易信号。

策略原理

策略的核心逻辑建立在价格在主要趋势中会在关键的Fibonacci回撤水平附近发生反转的理论基础上。具体来说: 1. 系统通过滚动窗口持续计算最高点和最低点,确保回撤水平的动态更新 2. 当价格向上突破61.8%回撤水平时,触发做多信号,表明上升趋势的延续 3. 当价格跌破38.2%回撤水平时,系统识别为看跌信号 4. 止盈设置在100%回撤水平(最高点),止损设置在0%回撤水平(最低点) 5. 策略通过plot函数在图表上标示各个关键水平,便于可视化分析

策略优势

- 动态适应性强 - 策略能够根据市场条件自动调整回撤水平

- 风险管理完善 - 通过预设的止盈止损位置严格控制风险

- 信号明确客观 - 入场和出场信号基于客观的价格突破,减少主观判断

- 可视化程度高 - 在图表上清晰展示各个关键价位,便于分析和验证

- 参数可调整性 - 回溯周期和Fibonacci水平均可根据需要灵活调整

风险分析

- 震荡市场风险 - 在横盘整理阶段可能产生虚假信号

- 滞后性风险 - 基于历史数据计算可能导致信号滞后

- 跳空风险 - 价格跳空可能导致止损失效

- 参数敏感性 - 不同的回溯周期设置会影响策略表现 建议通过以下方式控制风险:

- 结合趋势指标确认市场环境

- 适当调整止损位置

- 采用移动止损方式

- 定期优化策略参数

策略优化方向

- 增加趋势过滤器,仅在明确趋势中交易

- 引入成交量确认信号

- 优化止盈止损机制,如采用移动止损

- 增加市场波动率过滤条件

- 开发自适应的回溯周期调整机制

总结

这是一个建立在经典技术分析理论基础上的系统化交易策略。通过程序化实现使其具备了客观性和可重复性。策略的核心优势在于将Fibonacci理论与严格的风险控制相结合,适合在trending市场中应用。通过持续优化和完善,该策略有望在各类市场环境中保持稳定的表现。

策略源码

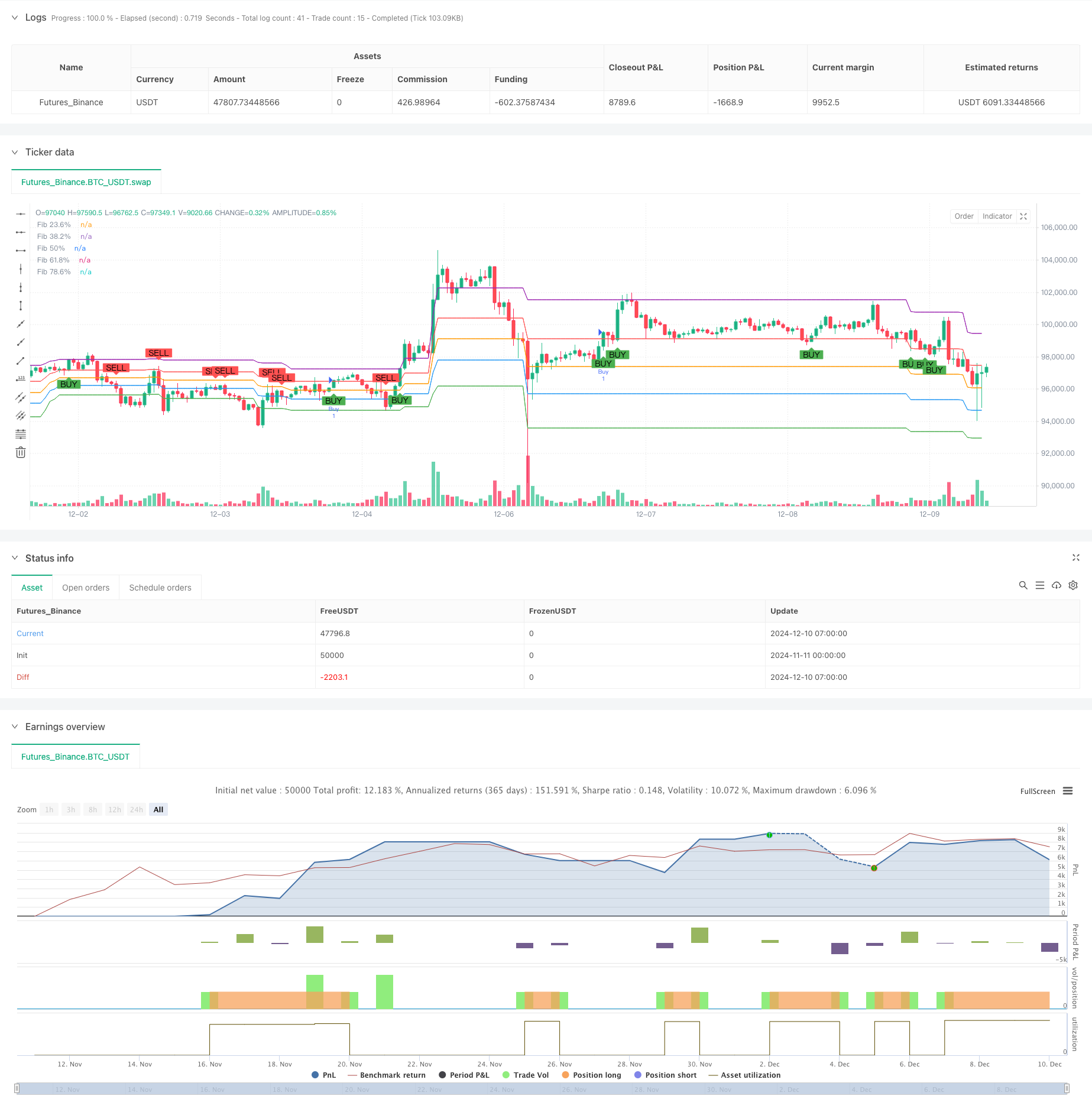

/*backtest

start: 2024-11-11 00:00:00

end: 2024-12-10 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fibonacci Retracement Strategy", overlay=true)

// Inputs

lookback_period = input.int(100, title="Lookback Period")

level_1 = input.float(0.236, title="Fibonacci Level 1")

level_2 = input.float(0.382, title="Fibonacci Level 2")

level_3 = input.float(0.5, title="Fibonacci Level 3")

level_4 = input.float(0.618, title="Fibonacci Level 4")

level_5 = input.float(0.786, title="Fibonacci Level 5")

// Calculate highest high and lowest low over the lookback period

high_level = ta.highest(high, lookback_period)

low_level = ta.lowest(low, lookback_period)

// Calculate Fibonacci retracement levels

fib_236 = low_level + (high_level - low_level) * level_1

fib_382 = low_level + (high_level - low_level) * level_2

fib_50 = low_level + (high_level - low_level) * level_3

fib_618 = low_level + (high_level - low_level) * level_4

fib_786 = low_level + (high_level - low_level) * level_5

// Plot Fibonacci levels on the chart

plot(fib_236, color=color.green, title="Fib 23.6%")

plot(fib_382, color=color.blue, title="Fib 38.2%")

plot(fib_50, color=color.orange, title="Fib 50%")

plot(fib_618, color=color.red, title="Fib 61.8%")

plot(fib_786, color=color.purple, title="Fib 78.6%")

// Entry and Exit Conditions

buy_signal = ta.crossover(close, fib_618)

sell_signal = ta.crossunder(close, fib_382)

// Strategy Orders

if buy_signal

strategy.entry("Buy", strategy.long)

// Exit based on stop-loss and take-profit conditions

take_profit = high_level // Exit at the highest Fibonacci level (100%)

stop_loss = low_level // Exit at the lowest Fibonacci level (0%)

strategy.exit("Sell", from_entry="Buy", limit=take_profit, stop=stop_loss)

// Visualization of Signals

plotshape(series=buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

相关推荐