概述

这是一个基于1分钟K线收盘方向进行高频交易的策略。策略通过判断K线的收盘价与开盘价的关系来确定市场走势,并在看涨K线形成后做多,看跌K线形成后做空。策略采用固定持仓时间,在下一根K线收盘时平仓,并对每日最大交易次数进行限制,以控制风险。

策略原理

策略的核心逻辑是通过K线收盘方向来判断短期市场趋势: 1. 当收盘价高于开盘价时,形成阳线,表明当前周期内买方力量占优,策略选择做多。 2. 当收盘价低于开盘价时,形成阴线,表明当前周期内卖方力量占优,策略选择做空。 3. 策略在开仓后的下一根K线收盘时平仓,实现快速获利或止损。 4. 每日交易次数限制在200次以内,防止过度交易。 5. 每次交易使用账户1%的资金量,实现风险控制。

策略优势

- 交易逻辑简单清晰,易于理解和实现

- 持仓时间短,减少了市场波动带来的风险

- 采用固定的持仓时间,避免了主观判断带来的偏差

- 设置了每日最大交易次数限制,有效控制风险

- 使用百分比风险管理,保护账户资金安全

- 通过可视化显示交易信号,便于策略监控和优化

策略风险

- 高频交易可能带来较高的交易成本 解决方案:选择点差较小的交易品种,优化交易时间段

- 在剧烈波动市场中可能遭受连续损失 解决方案:增加市场波动率过滤条件

- 策略可能受到假突破的影响 解决方案:增加成交量等辅助指标进行确认

- 固定持仓时间可能错过更大的盈利机会 解决方案:根据市场情况动态调整持仓时间

- 没有考虑更多的市场信息和技术指标 解决方案:结合其他技术指标优化入场条件

策略优化方向

- 引入成交量指标:通过成交量确认K线的有效性,提高交易信号的可靠性

- 添加趋势过滤:结合均线等趋势指标,在主趋势方向上进行交易

- 动态持仓时间:根据市场波动率动态调整持仓时间,提高策略适应性

- 优化资金管理:根据历史盈亏情况动态调整position size

- 增加市场波动率过滤:在波动率过大或过小的市场环境下暂停交易

- 添加时间过滤:避开高波动的市场开盘和收盘时段

总结

该策略是一个基于K线收盘方向的高频交易系统,通过简单的价格行为分析来捕捉短期市场机会。策略的优势在于逻辑简单、持仓时间短、风险可控,但同时也面临着交易成本高、假突破等挑战。通过引入更多的技术指标和优化方案,策略的稳定性和盈利能力有望得到进一步提升。对于追求短期交易机会的投资者来说,这是一个值得尝试和改进的交易策略。

策略源码

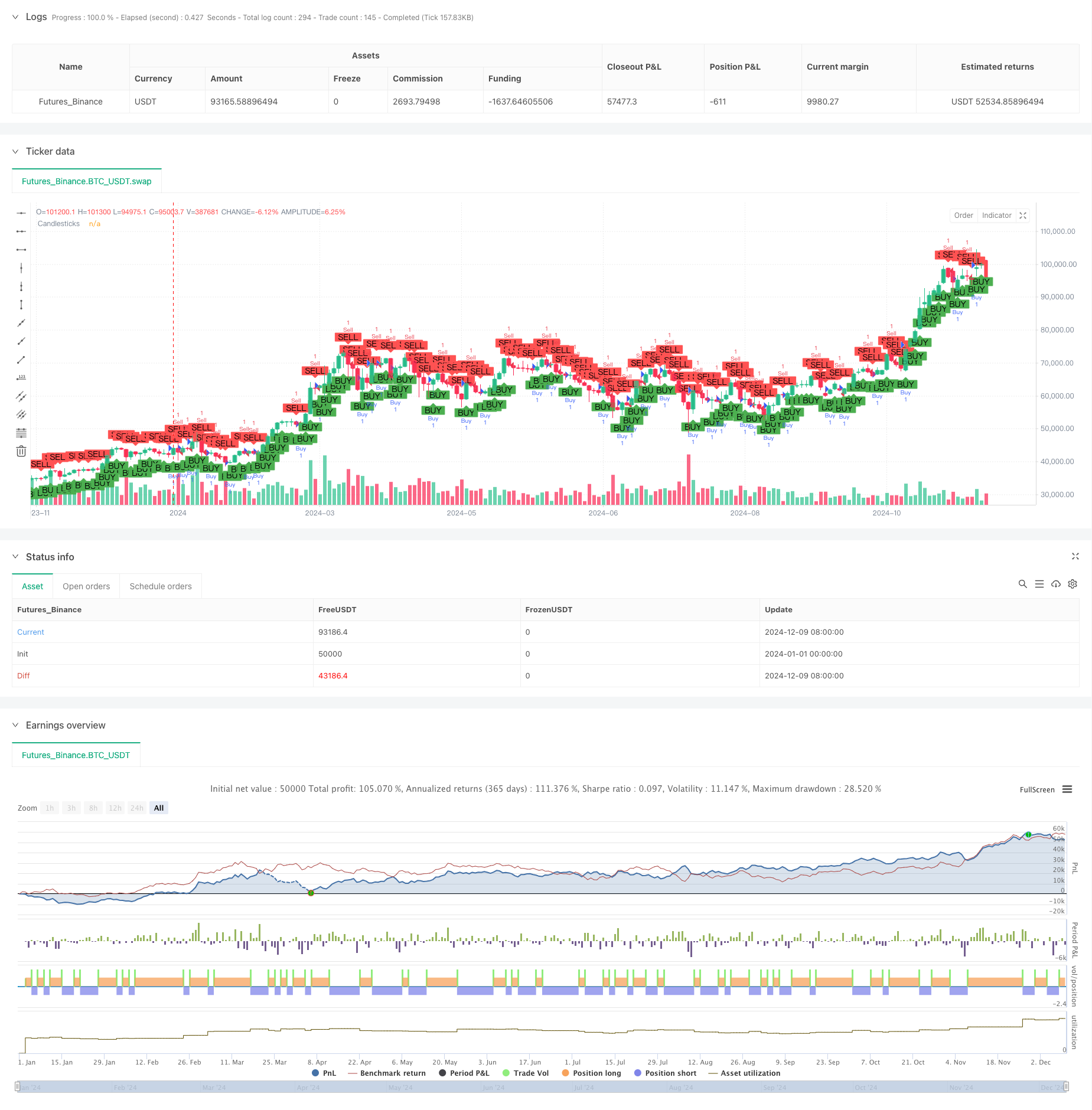

/*backtest

start: 2024-01-01 00:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Candle Close Strategy", overlay=true)

// Define conditions for bullish and bearish candlesticks

isBullish = close > open

isBearish = close < open

// Track the number of bars since the trade was opened and the number of trades per day

var int barsSinceTrade = na

var int tradesToday = 0

// Define a fixed position size for testing

fixedPositionSize = 1

// Entry condition: buy after the close of a bullish candlestick

if (isBullish and tradesToday < 200) // Limit to 200 trades per day

strategy.entry("Buy", strategy.long, qty=fixedPositionSize)

barsSinceTrade := 0

tradesToday := tradesToday + 1

// Entry condition: sell after the close of a bearish candlestick

if (isBearish and tradesToday < 200) // Limit to 200 trades per day

strategy.entry("Sell", strategy.short, qty=fixedPositionSize)

barsSinceTrade := 0

tradesToday := tradesToday + 1

// Update barsSinceTrade if a trade is open

if (strategy.opentrades > 0)

barsSinceTrade := nz(barsSinceTrade) + 1

// Reset tradesToday at the start of a new day

if (dayofmonth != dayofmonth[1])

tradesToday := 0

// Exit condition: close the trade after the next candlestick closes

if (barsSinceTrade == 2)

strategy.close("Buy")

strategy.close("Sell")

// Plot bullish and bearish conditions

plotshape(series=isBullish, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=isBearish, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot the candlesticks

plotcandle(open, high, low, close, title="Candlesticks")

相关推荐