概述

这是一个基于Supertrend指标的趋势追踪策略,结合了自适应的跟踪止损机制。该策略主要通过Supertrend指标识别市场趋势方向,并利用动态调整的跟踪止损来管理风险和优化出场时机。策略支持多种止损方式,包括百分比止损、ATR止损和固定点数止损,能够根据不同市场环境灵活调整。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用Supertrend指标作为趋势判断的主要依据,该指标结合了ATR(平均真实波幅)来衡量市场波动性 2. 入场信号由Supertrend方向变化触发,支持做多、做空或双向交易 3. 止损机制采用自适应的跟踪止损,可以根据市场波动自动调整止损位置 4. 交易管理系统包含仓位管理(默认为账户15%仓位)和时间过滤机制

策略优势

- 趋势捕捉能力强: 通过Supertrend指标能够有效识别主要趋势,减少误判

- 风险控制完善: 采用多样化的止损机制,能够适应不同市场环境

- 灵活性高: 支持多种交易方向和止损方式的配置

- 自适应性强: 跟踪止损会根据市场波动自动调整,提高策略的适应能力

- 完整的回测系统: 内置时间过滤功能,便于历史表现分析

策略风险

- 趋势反转风险: 在剧烈波动市场中可能出现虚假信号

- 滑点风险: 跟踪止损的执行可能受到市场流动性影响

- 参数敏感性: Supertrend的因子和ATR周期设置对策略表现影响较大

- 市场环境依赖: 在震荡市场中可能频繁交易导致成本增加

策略优化方向

- 信号过滤优化: 可以添加额外的技术指标来过滤虚假信号

- 仓位管理优化: 可以根据市场波动性动态调整持仓比例

- 止损机制增强: 可以结合成本均价设计更复杂的止损逻辑

- 入场时机优化: 可以增加价格结构分析来提高入场准确性

- 回测系统完善: 可以添加更多的统计指标来评估策略表现

总结

这是一个设计合理、风险可控的趋势追踪策略。通过结合Supertrend指标和灵活的止损机制,策略能够在保持较高盈利能力的同时有效控制风险。策略的可配置性强,适合在不同市场环境下使用,但需要经过充分的参数优化和回测验证。未来可以通过添加更多的技术分析工具和风险控制手段来进一步提升策略的稳定性和盈利能力。

策略源码

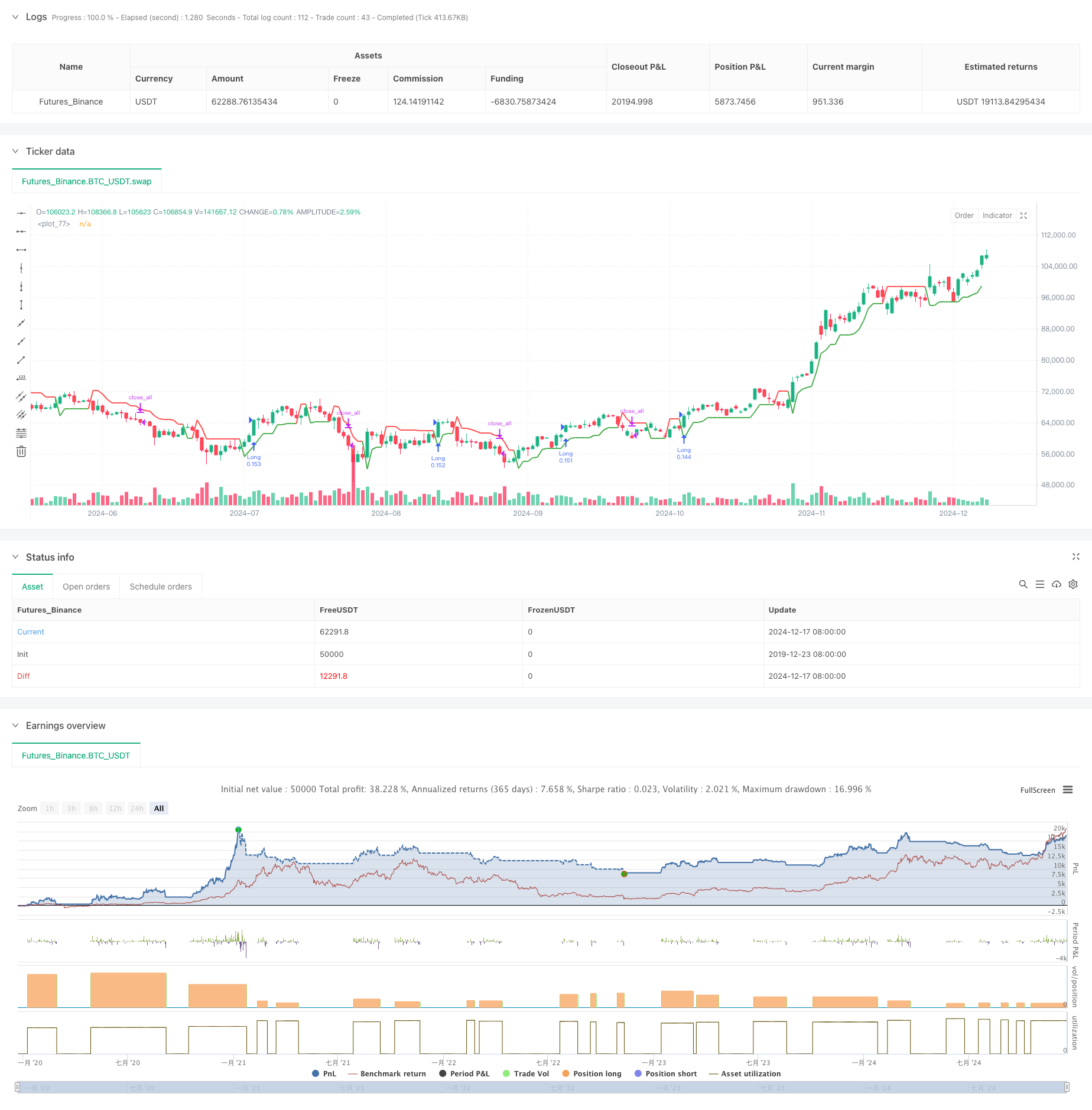

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Supertrend Strategy with Adjustable Trailing Stop [Bips]", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=15)

// Inputs

atrPeriod = input(10, "ATR Länge", "Average True Range „wahre durchschnittliche Schwankungsbreite“ und stammt aus der technischen Analyse. Die ATR misst die Volatilität eines Instruments oder eines Marktes. Mit ihr kann die Wahrscheinlichkeit für einen Trendwechsel bestimmt werden.", group="Supertrend Settings")

factor = input.float(3.0, "Faktor", step=0.1, group="Supertrend Settings")

tradeDirection = input.string("Long", "Trade Direction", options=["Both", "Long", "Short"], group="Supertrend Settings")

sl_type = input.string("%", "SL Type", options=["%", "ATR", "Absolute"])

// Parameter für ST nur für einstieg -> Beim Ausstieg fragen ob der bool WWert true ist -> Für weniger und längere Trädes

sl_perc = input.float(4.0, "% SL", group="Stop Loss Einstellung")

atr_length = input.int(10, "ATR Length", group="Stop Loss Einstellung")

atr_mult = input.float(2.0, "ATR Mult", group="Stop Loss Einstellung")

sl_absol = input.float(10.0, "Absolute SL", group="Stop Loss Einstellung")

//-------------------------//

// BACKTESTING RANGE

fromDay = input.int(defval=1, title="From Day", minval=1, maxval=31, group="Backtesting Einstellung")

fromMonth = input.int(defval=1, title="From Month", minval=1, maxval=12, group="Backtesting Einstellung")

fromYear = input.int(defval=2016, title="From Year", minval=1970, group="Backtesting Einstellung")

toDay = input.int(defval=1, title="To Day", minval=1, maxval=31, group="Backtesting Einstellung")

toMonth = input.int(defval=1, title="To Month", minval=1, maxval=12, group="Backtesting Einstellung")

toYear = input.int(defval=2100, title="To Year", minval=1970, group="Backtesting Einstellung")

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = time >= startDate and time <= finishDate

//-------------------------//

// Supertrend calculation

[_, direction] = ta.supertrend(factor, atrPeriod)

// SL values

sl_val = sl_type == "ATR" ? atr_mult * ta.atr(atr_length) :

sl_type == "Absolute" ? sl_absol :

close * sl_perc / 100

// Init Variables

var pos = 0

var float trailing_sl = 0.0

// Signals

long_signal = nz(pos[1]) != 1 and high > nz(trailing_sl[1])

short_signal = nz(pos[1]) != -1 and low < nz(trailing_sl[1])

// Calculate SL

trailing_sl := short_signal ? high + sl_val :

long_signal ? low - sl_val :

nz(pos[1]) == 1 ? math.max(low - sl_val, nz(trailing_sl[1])) :

nz(pos[1]) == -1 ? math.min(high + sl_val, nz(trailing_sl[1])) :

nz(trailing_sl[1])

// Position var

pos := long_signal ? 1 : short_signal ? -1 : nz(pos[1])

// Entry logic

if ta.change(direction) < 0 and time_cond

if tradeDirection == "Both" or tradeDirection == "Long"

strategy.entry("Long", strategy.long, stop=trailing_sl)

else

strategy.close_all("Stop Short")

if ta.change(direction) > 0 and time_cond

if tradeDirection == "Both" or tradeDirection == "Short"

strategy.entry("Short", strategy.short, stop=trailing_sl)

else

strategy.close_all("Stop Long")

// Exit logic: Trailing Stop and Supertrend

//if strategy.position_size > 0 and not na(trailing_sl)

//strategy.exit("SL-Exit Long", from_entry="Long", stop=trailing_sl)

//if strategy.position_size < 0 and not na(trailing_sl)

//strategy.exit("SL-Exit Short", from_entry="Short", stop=trailing_sl)

// Trailing Stop visualization

plot(trailing_sl, linewidth = 2, color = pos == 1 ? color.green : color.red)

//plot(not na(trailing_sl) ? trailing_sl : na, color=pos == 1 ? color.green : color.red, linewidth=2, title="Trailing Stop")

相关推荐