概述

这是一个基于突破结构(BOS)和成交量确认的智能交易策略。该策略通过监测价格突破前期高点或低点,并结合成交量放大确认,形成交易信号。策略采用了多重条件验证机制,包括连续确认次数要求和动态止盈止损设置,以提高交易的可靠性和风险控制能力。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 通过计算指定周期内的最高价和最低价来识别结构性高点和低点 2. 使用移动平均线计算成交量基准,判断当前成交量是否显著放大 3. 当价格突破前期高点且成交量放大时,累计多头确认次数 4. 当价格跌破前期低点且成交量放大时,累计空头确认次数 5. 只有在达到指定的确认次数后才会触发交易信号 6. 建仓后设置基于百分比的止盈止损价位

策略优势

- 多重条件验证机制提高了交易信号的可靠性

- 结合成交量指标,避免假突破带来的误判

- 使用连续确认机制,降低操作频率,提高胜率

- 采用动态止盈止损设置,根据入场价格自动调整退场位置

- 策略逻辑清晰,参数可调整性强,适应性好

策略风险

- 震荡市场可能频繁出现假突破,导致连续止损

- 剧烈波动行情下止损位可能不够及时

- 确认机制可能导致入场延迟,错过最佳价位

- 成交量判断标准固定,不能很好适应市场状态变化 解决方案:

- 引入市场波动率指标,动态调整参数

- 增加趋势过滤器,减少震荡市假信号

- 优化止损逻辑,提高止损的灵活性

- 设计自适应的成交量阈值计算方法

策略优化方向

- 增加趋势判断指标,如移动平均线系统,只在趋势方向交易

- 引入ATR指标动态调整止损距离,提高风控灵活性

- 设计波动率自适应的成交量阈值判断机制

- 加入时间过滤器,避开高风险时段

- 优化确认机制,在保证可靠性的同时提高入场时效性

总结

这是一个结合了技术分析经典理论和现代量化交易方法的策略系统。通过多重条件验证和严格的风险控制,策略具有较好的稳定性和可靠性。虽然存在一些需要优化的方面,但整体框架设计合理,具有良好的实战应用价值。通过建议的优化方向,策略的表现还可以进一步提升。

策略源码

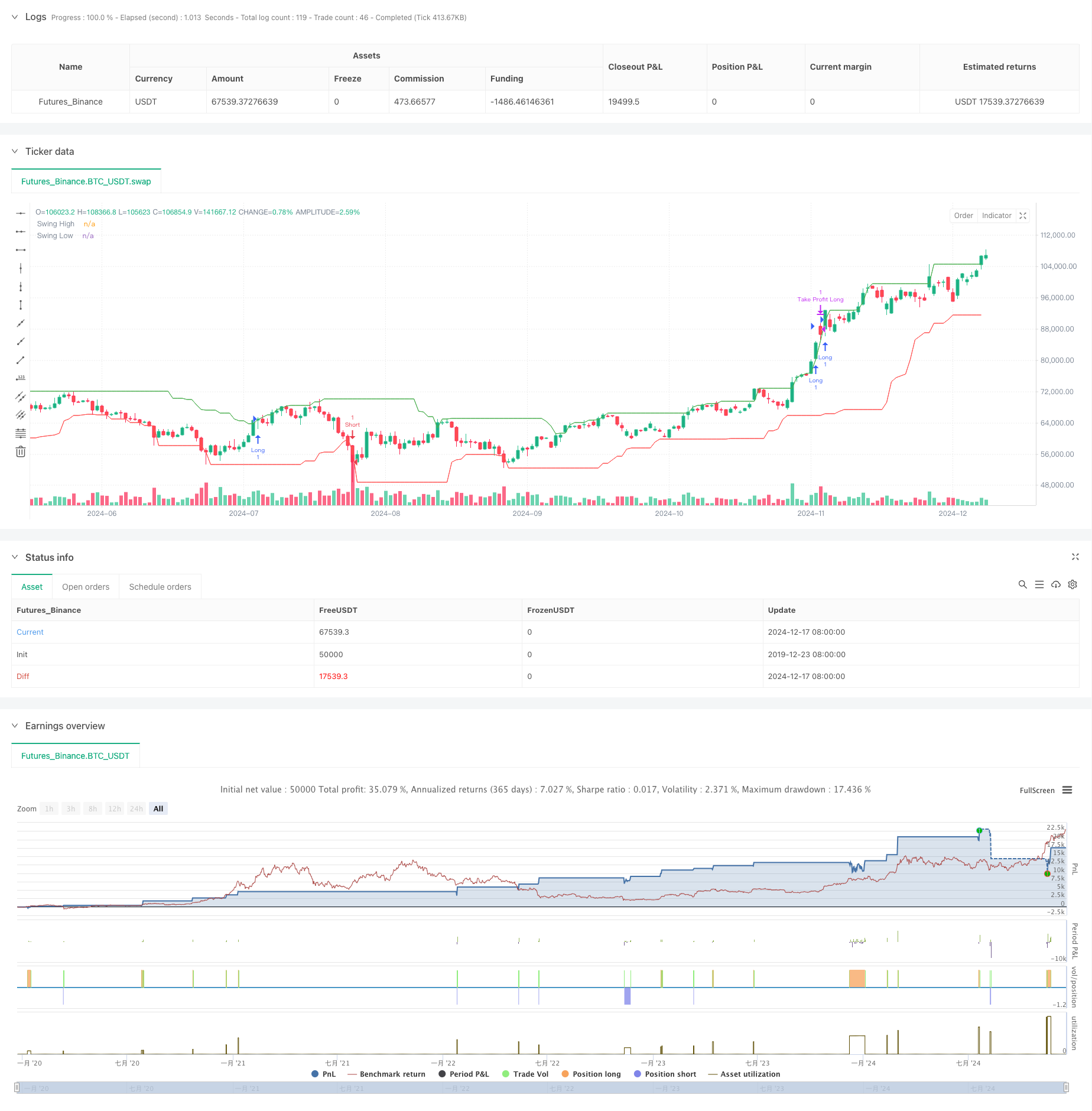

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BOS and Volume Strategy with Confirmation", overlay=true)

// Parameters

swingLength = input.int(20, title="Swing Length", minval=1)

volumeMultiplier = input.float(1.1, title="Volume Multiplier", step=0.1)

volumeSMA_length = input.int(10, title="Volume SMA Length", minval=1)

takeProfitPercentage = input.float(0.02, title="Take Profit Percentage", step=0.01)

stopLossPercentage = input.float(0.15, title="Stop Loss Percentage", step=0.01) // New parameter for stop loss

atrLength = input.int(14, title="ATR Length")

confirmationBars = input.int(2, title="Confirmation Bars", minval=1)

// Calculate Swing Highs and Lows

swingHigh = ta.highest(high, swingLength)[1]

swingLow = ta.lowest(low, swingLength)[1]

// Calculate Volume Moving Average

volumeSMA = ta.sma(volume, volumeSMA_length)

highVolume = volume > (volumeSMA * volumeMultiplier)

// Break of Structure Detection with Confirmation

var int bullishCount = 0

var int bearishCount = 0

if (close > swingHigh and highVolume)

bullishCount := bullishCount + 1

bearishCount := 0

else if (close < swingLow and highVolume)

bearishCount := bearishCount + 1

bullishCount := 0

else

bullishCount := 0

bearishCount := 0

bullishBOSConfirmed = (bullishCount >= confirmationBars)

bearishBOSConfirmed = (bearishCount >= confirmationBars)

// Entry and Exit Conditions

var float entryPrice = na // Declare entryPrice as a variable

if (bullishBOSConfirmed and strategy.position_size <= 0)

entryPrice := close // Use ':=' for assignment

strategy.entry("Long", strategy.long)

if (strategy.position_size > 0)

// Calculate stop loss price

stopLossPrice = entryPrice * (1 - stopLossPercentage)

strategy.exit("Take Profit Long", from_entry="Long", limit=entryPrice * (1 + takeProfitPercentage), stop=stopLossPrice)

if (bearishBOSConfirmed and strategy.position_size >= 0)

entryPrice := close // Use ':=' for assignment

strategy.entry("Short", strategy.short)

if (strategy.position_size < 0)

// Calculate stop loss price

stopLossPrice = entryPrice * (1 + stopLossPercentage)

strategy.exit("Take Profit Short", from_entry="Short", limit=entryPrice * (1 - takeProfitPercentage), stop=stopLossPrice)

// Plot Swing Highs and Lows for Visualization

plot(swingHigh, title="Swing High", color=color.green, linewidth=1)

plot(swingLow, title="Swing Low", color=color.red, linewidth=1)

相关推荐