概述

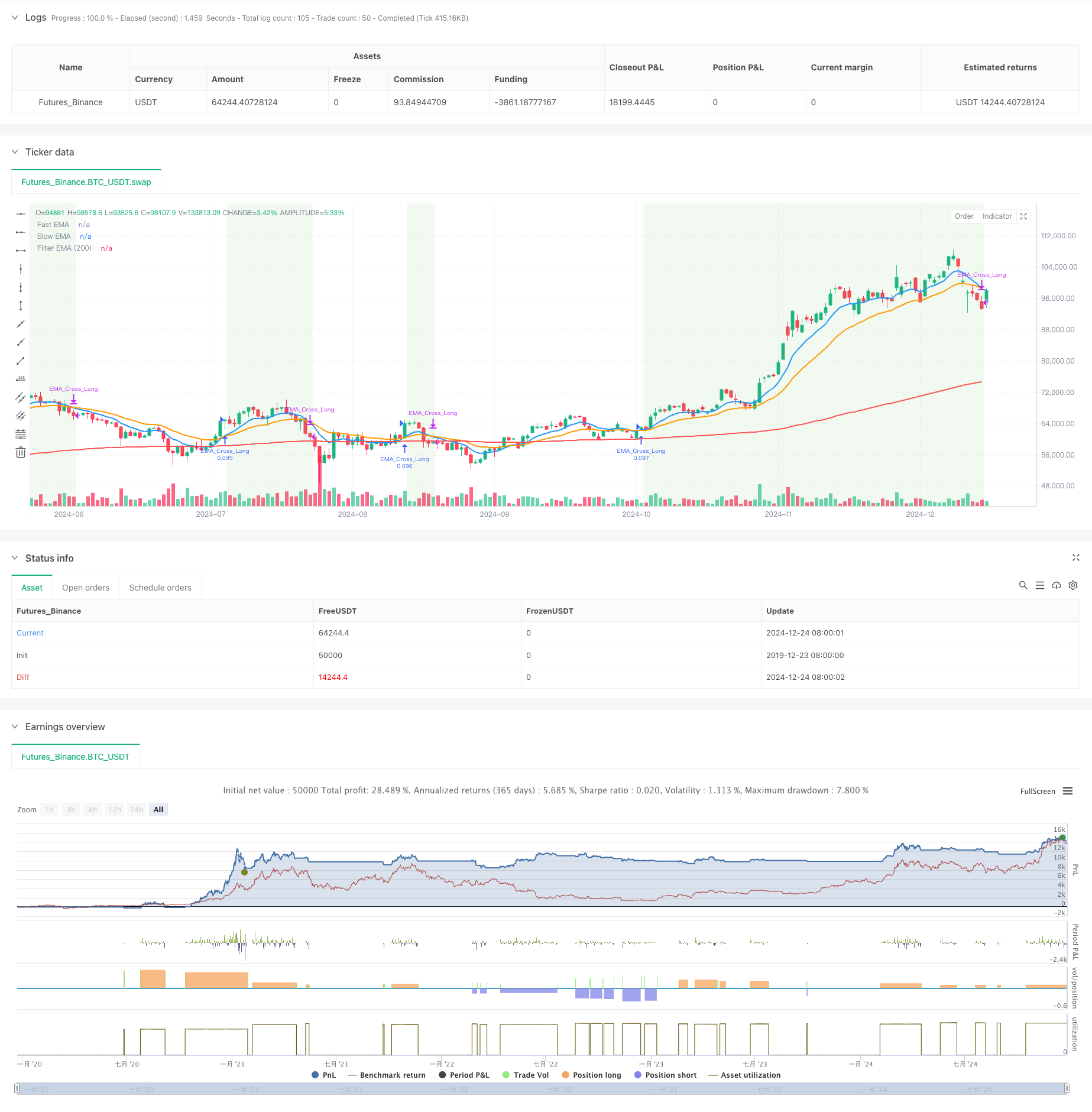

该策略是一个基于多重指数移动平均线(EMA)交叉的量化交易系统。它通过9日EMA、21日EMA和200日EMA三条均线的配合,构建了一个完整的趋势跟踪交易框架。策略通过判断快速均线与慢速均线的交叉以及它们与长期均线的位置关系,来识别市场趋势并进行交易。

策略原理

策略的核心逻辑是通过三重均线交叉来捕捉市场趋势。具体来说: 1. 使用9日EMA作为快速均线,反映短期价格走势 2. 使用21日EMA作为中期均线,过滤短期噪音 3. 使用200日EMA作为长期均线,确定主要趋势方向 当快速均线向上穿越慢速均线,且两条均线都位于200日均线之上时,系统产生做多信号;当快速均线向下穿越慢速均线,且两条均线都位于200日均线之下时,系统产生做空信号。这种设计既能捕捉趋势的转折点,又能避免在盘整市场中频繁交易。

策略优势

- 趋势确认度高:通过三重均线的配合使用,能够更准确地确认市场趋势

- 风险控制完善:利用长期均线作为趋势过滤器,有效降低假突破风险

- 操作规则明确:入场和出场条件清晰,易于执行和回测

- 适应性强:可以根据不同市场特征调整参数,具有良好的普适性

- 计算简单:使用常用技术指标,运算效率高,适合实时交易

策略风险

- 滞后性风险:均线指标本身具有滞后性,可能导致入场或出场时机延迟

- 震荡市风险:在横盘震荡市场中可能产生频繁假信号

- 趋势反转风险:在趋势突然反转时可能承受较大回撤

- 参数敏感性:不同参数组合可能导致策略表现差异较大 建议通过设置止损位置、控制仓位大小等方式来管理这些风险。

策略优化方向

- 引入成交量指标:结合成交量变化来确认趋势强度

- 增加波动率过滤:在高波动率环境下调整交易频率

- 优化参数选择:针对不同市场周期动态调整均线参数

- 加入趋势强度指标:使用ADX等指标评估趋势可靠性

- 完善止损机制:设计更灵活的止损止盈规则

总结

这是一个设计合理、逻辑清晰的趋势跟踪策略。通过多重均线的协同配合,能够有效捕捉市场趋势,同时具备良好的风险控制能力。策略的优化空间较大,通过持续改进可以进一步提升其稳定性和盈利能力。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("EMA Cross with both MinhTuan", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Tham số EMA

fastLength = input.int(9, title="Fast EMA Length", minval=1)

slowLength = input.int(21, title="Slow EMA Length", minval=1)

filterLength = input.int(200, title="EMA Filter Length", minval=1)

// Tùy chọn chế độ giao dịch

tradeMode = input.string("Both", options=["Long", "Short", "Both"], title="Trade Mode")

// Tính toán EMA

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

filterEMA = ta.ema(close, filterLength)

// Điều kiện vào lệnh Long: EMA nhanh cắt lên EMA chậm và cả hai nằm trên EMA 200

longCondition = ta.crossover(fastEMA, slowEMA) and fastEMA > filterEMA and slowEMA > filterEMA

// Điều kiện vào lệnh Short: EMA nhanh cắt xuống EMA chậm và cả hai nằm dưới EMA 200

shortCondition = ta.crossunder(fastEMA, slowEMA) and fastEMA < filterEMA and slowEMA < filterEMA

// Điều kiện thoát lệnh: EMA nhanh cắt ngược lại EMA chậm

closeLongCondition = ta.crossunder(fastEMA, slowEMA) // Thoát lệnh Long

closeShortCondition = ta.crossover(fastEMA, slowEMA) // Thoát lệnh Short

// Thực hiện lệnh Long

if (longCondition and (tradeMode == "Long" or tradeMode == "Both"))

strategy.entry("EMA_Cross_Long", strategy.long)

label.new(x=bar_index, y=low, text="Long", color=color.green, textcolor=color.white, size=size.small)

// Thực hiện lệnh Short

if (shortCondition and (tradeMode == "Short" or tradeMode == "Both"))

strategy.entry("EMA_Cross_Short", strategy.short)

label.new(x=bar_index, y=high, text="Short", color=color.red, textcolor=color.white, size=size.small)

// Thoát lệnh Long

if (closeLongCondition)

strategy.close("EMA_Cross_Long")

label.new(x=bar_index, y=high, text="Close Long", color=color.orange, textcolor=color.white, size=size.small)

// Thoát lệnh Short

if (closeShortCondition)

strategy.close("EMA_Cross_Short")

label.new(x=bar_index, y=low, text="Close Short", color=color.blue, textcolor=color.white, size=size.small)

// Vẽ đường EMA nhanh, EMA chậm, và EMA 200

plot(fastEMA, title="Fast EMA", color=color.blue, linewidth=2)

plot(slowEMA, title="Slow EMA", color=color.orange, linewidth=2)

plot(filterEMA, title="Filter EMA (200)", color=color.red, linewidth=2)

// Hiển thị nền khi đang giữ lệnh

bgcolor(strategy.position_size > 0 ? color.new(color.green, 90) : strategy.position_size < 0 ? color.new(color.red, 90) : na)

相关推荐