概述

本策略是一个基于机器学习的自适应超级趋势交易系统,通过整合波动率聚类、自适应ATR趋势检测和结构化的进出场机制,提高了传统SuperTrend指标的可靠性。策略核心在于通过机器学习方法对市场波动率进行分类,在合适的市场环境下进行趋势跟踪交易,同时运用动态的止损止盈来控制风险。

策略原理

策略包含三个关键组成部分:1)基于ATR的自适应SuperTrend计算,用于确定趋势方向和转折点;2)基于K-means算法的波动率聚类,将市场状态分为高、中、低三种波动环境;3)基于波动率环境的差异化交易规则。在低波动率环境下寻找趋势性机会,在高波动率环境下保持谨慎。系统通过ta.crossunder和ta.crossover函数捕捉趋势转向信号,并结合价格与SuperTrend线的位置关系确定交易方向。

策略优势

- 自适应性强:通过机器学习方法动态调整对市场波动率的判断,使策略能够适应不同的市场环境。

- 风险控制完善:基于ATR的动态止损止盈机制,能够根据市场波动情况自动调整风险控制参数。

- 假信号过滤:通过波动率聚类方法有效过滤掉高波动期间的虚假信号。

- 应用范围广:策略可以应用于外汇、加密货币、股票和大宗商品等多个市场。

- 多时间周期适用:从15分钟到月线等不同时间周期都具有良好的适用性。

策略风险

- 参数敏感性:ATR长度、SuperTrend因子等参数的选择会显著影响策略表现。

- 趋势反转风险:在强趋势突然反转时可能造成较大回撤。

- 市场环境依赖:在震荡市场中可能产生频繁交易并累积交易成本。

- 计算复杂度:机器学习组件增加了策略的计算复杂度,可能影响实时执行效率。

策略优化方向

- 优化波动率聚类算法:可以考虑使用更先进的聚类方法如DBSCAN或GMM来提高市场状态分类的准确性。

- 引入多重时间框架分析:结合更长周期的趋势判断来提高交易方向的准确性。

- 动态调整参数:开发自适应参数调整机制,根据市场表现自动优化ATR长度和SuperTrend因子。

- 增加市场情绪指标:整合基于成交量和价格动量的市场情绪指标,提高信号质量。

- 完善资金管理:引入更复杂的仓位管理算法,优化资金利用效率。

总结

该策略通过将机器学习技术与传统技术分析方法相结合,创造了一个智能化的趋势跟踪系统。策略的核心优势在于其自适应性和风险控制能力,通过波动率聚类实现了对市场状态的智能识别。虽然存在参数敏感性等风险,但通过持续优化和完善,策略有望在各类市场环境中保持稳定的表现。建议交易者在实盘应用时充分测试参数敏感性,并结合市场具体特征进行针对性优化。

策略源码

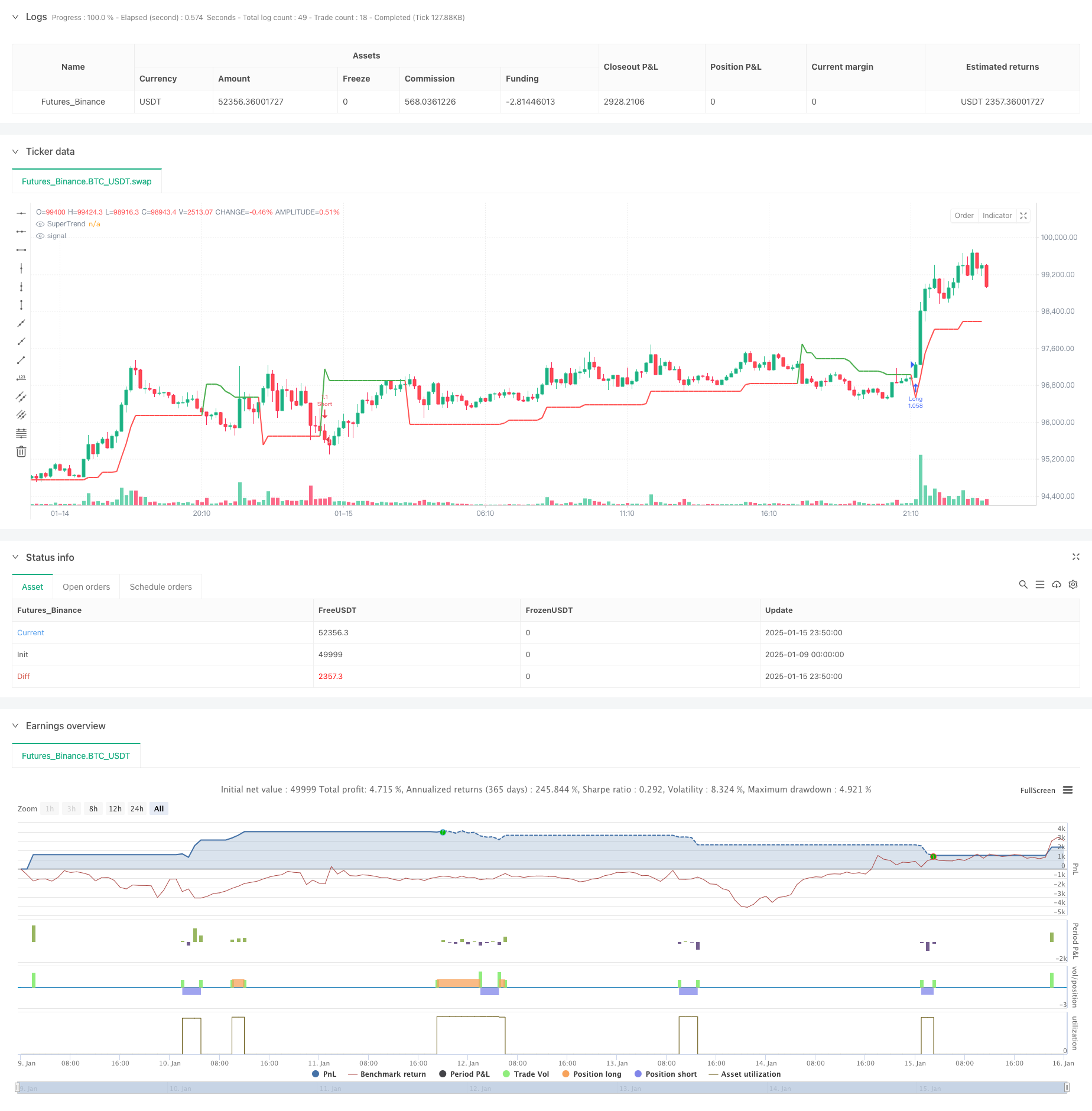

/*backtest

start: 2025-01-09 00:00:00

end: 2025-01-16 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Adaptive SuperTrend Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Import Indicator Components

atr_len = input.int(10, "ATR Length", group="SuperTrend Settings")

fact = input.float(3, "SuperTrend Factor", group="SuperTrend Settings")

training_data_period = input.int(100, "Training Data Length", group="K-Means Settings")

// Volatility Clustering

volatility = ta.atr(atr_len)

upper = ta.highest(volatility, training_data_period)

lower = ta.lowest(volatility, training_data_period)

high_volatility = lower + (upper-lower) * 0.75

medium_volatility = lower + (upper-lower) * 0.5

low_volatility = lower + (upper-lower) * 0.25

cluster = volatility >= high_volatility ? 0 : volatility >= medium_volatility ? 1 : 2

// SuperTrend Calculation

pine_supertrend(factor, atr) =>

src = hl2

upperBand = src + factor * atr

lowerBand = src - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

lowerBand := lowerBand > prevLowerBand or close[1] < prevLowerBand ? lowerBand : prevLowerBand

upperBand := upperBand < prevUpperBand or close[1] > prevUpperBand ? upperBand : prevUpperBand

int _direction = na

float superTrend = na

prevSuperTrend = superTrend[1]

if na(atr[1])

_direction := 1

else if prevSuperTrend == prevUpperBand

_direction := close > upperBand ? -1 : 1

else

_direction := close < lowerBand ? 1 : -1

superTrend := _direction == -1 ? lowerBand : upperBand

[superTrend, _direction]

[ST, dir] = pine_supertrend(fact, volatility)

// Entry Conditions

longEntry = ta.crossunder(dir, 0) and cluster > 1 and close > ST

shortEntry = ta.crossover(dir, 0) and cluster == 0 and close < ST

// Stop Loss & Take Profit

atr_mult = input.float(2, "ATR Multiplier for SL/TP", group="Risk Management")

sl = atr_mult * ta.atr(atr_len)

longStopLoss = close - sl

longTakeProfit = close + (sl * 1.5)

shortStopLoss = close + sl

shortTakeProfit = close - (sl * 1.5)

// Execute Trades

if longEntry

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

if shortEntry

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

// Plot SuperTrend

plot(ST, title="SuperTrend", color=dir > 0 ? color.green : color.red, linewidth=2)

// Alerts

alertcondition(longEntry, title="Long Entry Signal", message="Buy Signal - Trend Shift Up")

alertcondition(shortEntry, title="Short Entry Signal", message="Sell Signal - Trend Shift Down")

相关推荐