概述

本策略是一个结合均线和MACD双重技术指标的趋势跟踪交易系统。它主要通过EMA9均线与价格的交叉,以及MACD指标中快线(DIF)与慢线(DEA)的交叉来捕捉市场趋势。同时,策略采用基于过去5根K线的自适应止损方式,并使用3.5倍风险收益比来设置盈利目标,形成了一个完整的交易系统。

策略原理

策略的核心逻辑分为多空两个方向: 1. 做多条件:当收盘价从下向上突破EMA9,同时MACD的DIF线从下向上穿越DEA线时,系统发出做多信号。 2. 做空条件:当收盘价从上向下跌破EMA9,同时MACD的DIF线从上向下穿越DEA线时,系统发出做空信号。 3. 风险管理: - 多单止损设置在前5根K线最低点之下 - 空单止损设置在前5根K线最高点之上 - 利润目标为止损距离的3.5倍

策略优势

- 双重确认机制:通过均线和MACD的协同配合,能够有效过滤虚假信号,提高交易的准确性。

- 自适应止损:基于近期价格波动设置的止损位,可以根据市场波动性自动调整保护位置。

- 明确的风险收益比:固定3.5倍的风险收益设置,有助于长期稳定盈利。

- 策略逻辑清晰:入场、出场条件明确,易于理解和执行。

- 适应性强:可以根据不同市场条件调整参数。

策略风险

- 震荡市场风险:在横盘震荡市场中可能频繁出现假突破,导致连续止损。

- 滑点风险:在快速行情中,实际止损和获利价格可能与预期有偏差。

- 参数敏感性:EMA和MACD的周期设置对策略表现有较大影响。

- 趋势依赖:策略在没有明确趋势的市场环境下表现可能不佳。

策略优化方向

- 加入趋势过滤器:可以引入更长周期的趋势指标,只在主趋势方向开仓。

- 动态风险倍数:根据市场波动性自动调整风险收益比。

- 时间过滤:加入交易时间段过滤,避开低流动性时段。

- 仓位管理优化:可以根据信号强度动态调整持仓比例。

- 引入波动率指标:用于动态调整止损距离。

总结

该策略通过技术指标的双重确认和严格的风险管理,构建了一个完整的趋势跟踪交易系统。虽然存在一定的市场环境依赖性,但通过合理的参数优化和风险管理,策略展现出良好的适应性和稳定性。后续优化方向主要集中在趋势识别的准确性和风险管理的动态性上,以提升策略的整体表现。

策略源码

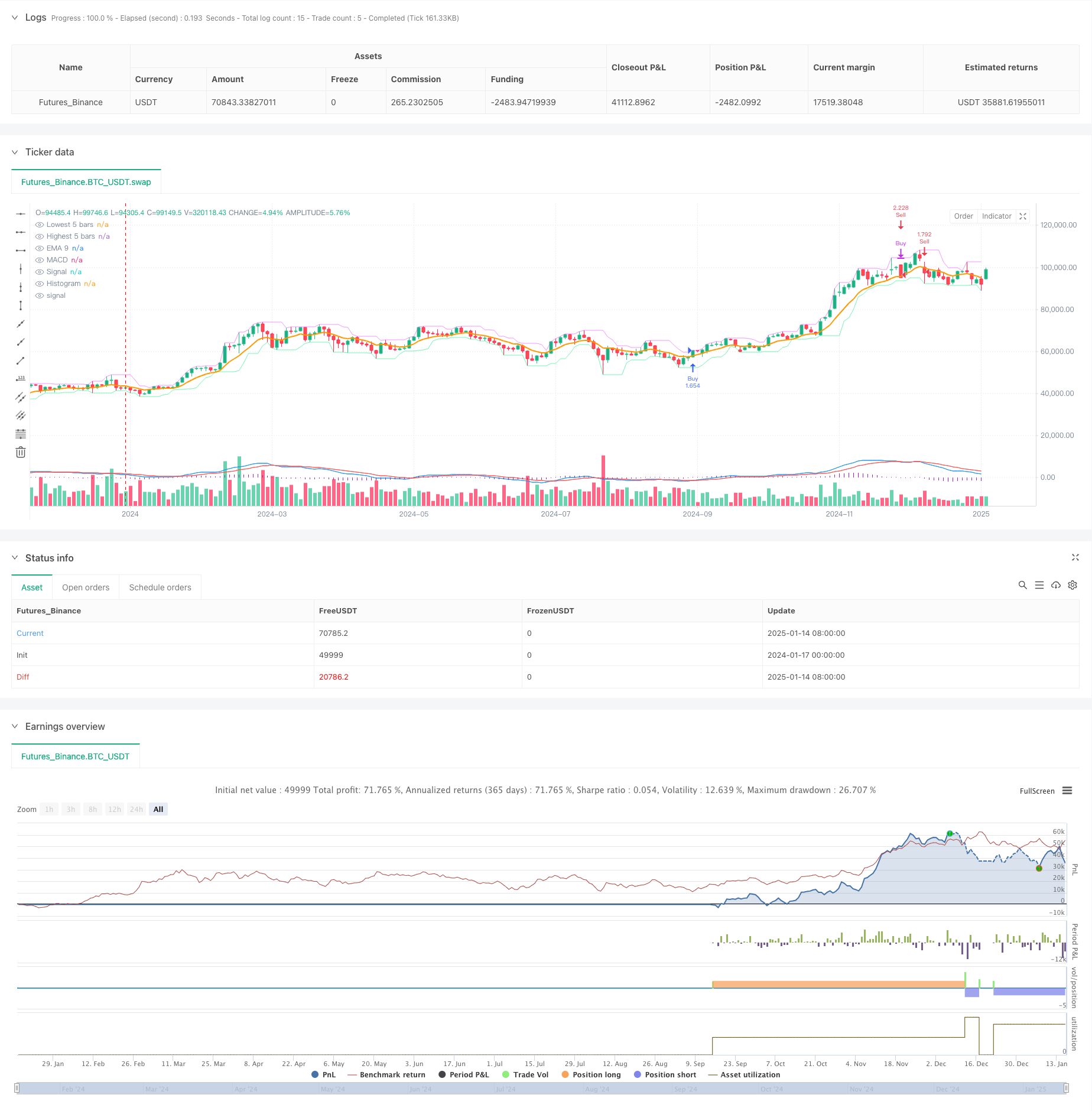

/*backtest

start: 2024-01-17 00:00:00

end: 2025-01-16 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

// =======================

// @version=6

strategy(title="MACD + EMA9 3 h",

shorttitle="MACD+EMA9+StopTP_5candles",

overlay=true,

initial_capital=100000, // Ajuste conforme desejar

default_qty_type=strategy.percent_of_equity,

default_qty_value=200) // Ajuste % de risco ou quantidade

// ----- Entradas (Inputs) -----

emaLen = input.int(9, "Período da EMA 9", minval=1)

macdFastLen = input.int(12, "Período MACD Rápido", minval=1)

macdSlowLen = input.int(26, "Período MACD Lento", minval=1)

macdSignalLen = input.int(9, "Período MACD Signal", minval=1)

riskMultiplier = input.float(3.5, "Fator de Multiplicação do Risco (TP)")

lookbackCandles = input.int(5, "Quantidade de candles p/ Stop", minval=1)

// ----- Cálculo da EMA -----

ema9 = ta.ema(close, emaLen)

// ----- Cálculo do MACD -----

[macdLine, signalLine, histLine] = ta.macd(close, macdFastLen, macdSlowLen, macdSignalLen)

// DIF cruza DEA para cima ou para baixo

macdCrossover = ta.crossover(macdLine, signalLine) // DIF cruza DEA p/ cima

macdCrossunder = ta.crossunder(macdLine, signalLine) // DIF cruza DEA p/ baixo

// ----- Condições de Compra/Venda -----

// Compra quando:

// 1) Preço cruza EMA9 de baixo pra cima

// 2) MACD cruza a linha de sinal para cima

buySignal = ta.crossover(close, ema9) and macdCrossover

// Venda quando:

// 1) Preço cruza EMA9 de cima pra baixo

// 2) MACD cruza a linha de sinal para baixo

sellSignal = ta.crossunder(close, ema9) and macdCrossunder

// ----- Execução das ordens -----

// Identifica o menor e o maior preço dos últimos 'lookbackCandles' candles.

// A função ta.lowest() e ta.highest() consideram, por padrão, a barra atual também.

// Se você quiser EXCLUIR a barra atual, use low[1] / high[1] dentro do ta.lowest() / ta.highest().

lowestLow5 = ta.lowest(low, lookbackCandles)

highestHigh5= ta.highest(high, lookbackCandles)

// >>> Quando há sinal de COMPRA <<<

if (buySignal)

// Fecha posição vendida, se existir

strategy.close("Sell")

// Entra comprado

strategy.entry("Buy", strategy.long)

// STOP: abaixo do menor preço dos últimos 5 candles

stopPrice = lowestLow5

// Risco = (preço de entrada) - (stop)

// Note que strategy.position_avg_price só fica disponível a partir da barra seguinte.

// Por isso, o exit costuma funcionar corretamente apenas na barra seguinte.

// Para fins de teste, podemos usar 'close' como proxy do "entry" (ou aceitar essa limitação).

// A forma "correta" de usar strategy.position_avg_price seria via calc_on_order_fills = true,

// mas isso pode exigir algumas configurações adicionais.

risk = strategy.position_avg_price - stopPrice

// Take Profit = entrada + 2,5 * risco

takeProfitPrice = strategy.position_avg_price + riskMultiplier * risk

// Registra a saída (stop e alvo) vinculada à posição "Buy"

strategy.exit("Exit Buy", "Buy", stop=stopPrice, limit=takeProfitPrice)

// >>> Quando há sinal de VENDA <<<

if (sellSignal)

// Fecha posição comprada, se existir

strategy.close("Buy")

// Entra vendido

strategy.entry("Sell", strategy.short)

// STOP: acima do maior preço dos últimos 5 candles

stopPrice = highestHigh5

// Risco = (stop) - (preço de entrada)

risk = stopPrice - strategy.position_avg_price

// Take Profit = entrada - 2,5 * risco

takeProfitPrice = strategy.position_avg_price - riskMultiplier * risk

// Registra a saída (stop e alvo) vinculada à posição "Sell"

strategy.exit("Exit Sell", "Sell", stop=stopPrice, limit=takeProfitPrice)

// ----- Plotagens visuais -----

plot(ema9, color=color.orange, linewidth=2, title="EMA 9")

plot(macdLine, color=color.new(color.blue, 0), title="MACD")

plot(signalLine, color=color.new(color.red, 0), title="Signal")

plot(histLine, color=color.new(color.purple, 0), style=plot.style_histogram, title="Histogram")

// Só para auxiliar na visualização, vamos plotar a linha do lowestLow5 e highestHigh5

plot(lowestLow5, color=color.new(color.lime, 70), style=plot.style_line, title="Lowest 5 bars")

plot(highestHigh5, color=color.new(color.fuchsia,70),style=plot.style_line, title="Highest 5 bars")

相关推荐