How can newcomers go through the road, how to capture trends and make profits last?

Author: 善, Created: 2019-03-30 15:13:14, Updated:In trading, a single transaction result with win or loss is not the focus of quantitative traders, so what are they most concerned about? The answer is the result of trading the system after 800 or 1000 times, looking for the efficiency and results of the transaction from more data so that they can make long-term assessments of their trading systems.

For the rookie traders, in the process of implementing the trend tracking strategy, they generally have a trading psychology: unable to face their own losses, the endurance in the long-running profit of a transaction is insufficient, and can not accept their own funds to rise and fall again and again, they hope that the money will soon enter the pocket after rising.

Why is this psychology so serious when implementing the trend tracking trading strategies?

Mainly because the main central idea of trend tracking is to exchange multiple small losses for one large profits, and it is also anti-human nature. But in fact, this kind of psychology is the only way for newcomers to become the veteran, for beginners, you must learn how to bearing and accepting the reality. Let me show you what we have to do in the trend trading:

Understanding the trend cycle

This is easy to understand, we all know that the trend cycle includes: daily, hour, minute and second-level trends. Because each person’s psychological endurance is not the same, plus each level of trend represents a different form, some people may feel that minutes are more suitable for themselves, while others think that the daily period is better able to master.

So before deciding on your own strategy, the main thing is to know what your own trend cycle is. Of course, for newcomers, how do you better determine your own trend cycle? Here is a great way to find it: you can test each cycle of your strategy separately and see which one you can endurance. This method is very effective.

Confirmation of trend reversal

The so-called trend tracking can be understood from the literal point of view, tracking the market trend. So how do we determine that the trend has reversed? First we need to quantify the indicators and signals (strategies) to remind us of the trend reversal. Also determine how good or bad your trend tracking strategy can be determined by this signal. For newcomers, the technology that wants to understand how to build this signal is now available everywhere on the Internet.

A deeper understanding of your strategy

In the real trading, you need to know clearly what stage you are in the current market, what will the trend evolve. To know this, all you have to do is to understand your trading strategy, the winning percentage of the trade, the profit-loss ratio and the maximum retracement, etc., all of which must well known. If there is a situation that exceeds your expectations during the trading process, this may prove that the market may continue its current trend.

If it was a shock market at the time, and the mistake of repeated stop loss was exceeded compared with the biggest record in history, then all you have to do is stop and draw the box for the price range, then wait, wait until the price reaches out of the box, then it is the time when you trade again. Speaking of this, what is the purpose of trend trading? What is the key to it? For most trends in the existence cycle, you can capture them by applying a trend tracking strategy.

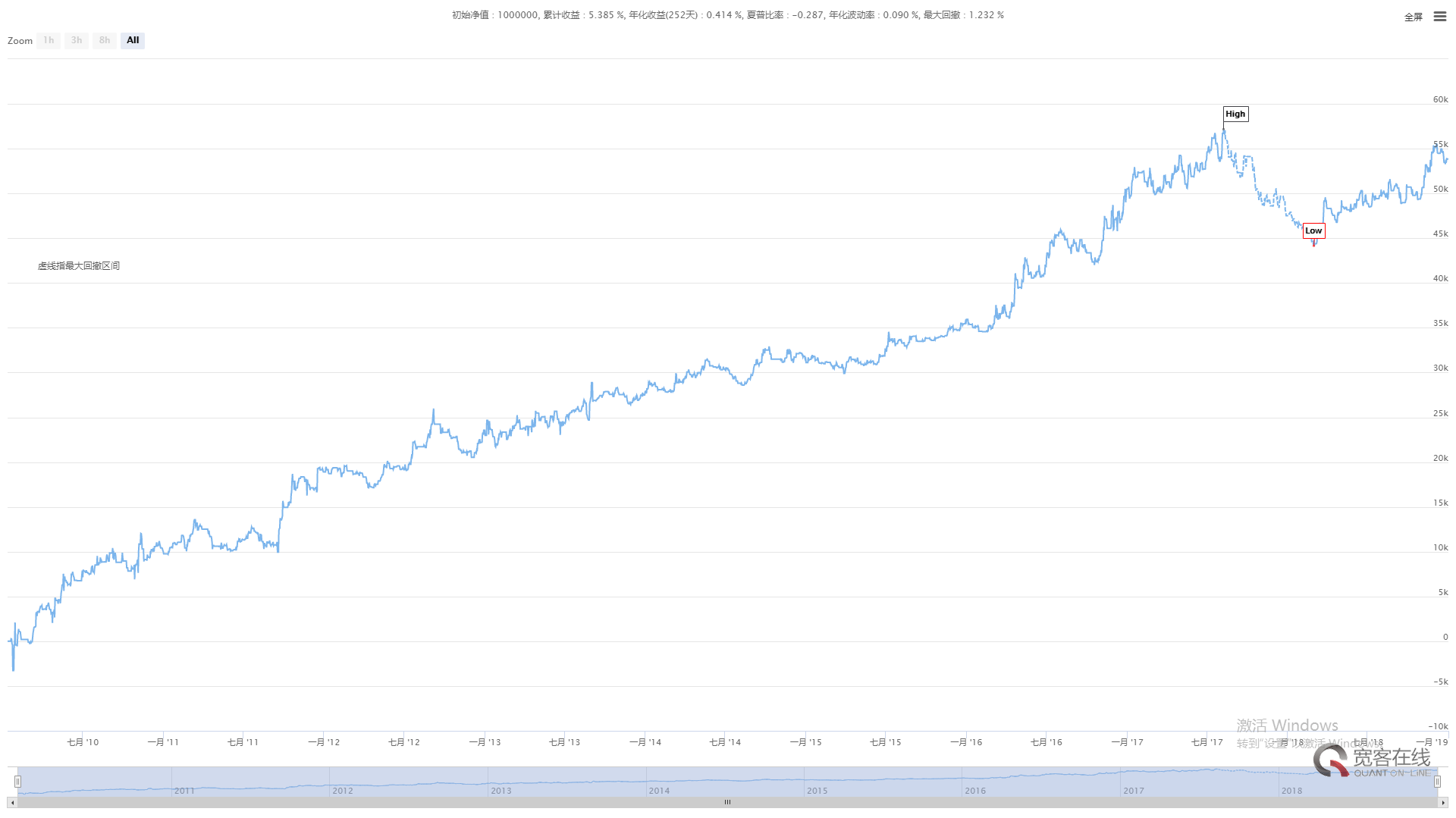

It is able to capture most of the single, highly profitable trading chances. On the contrary, during the trend trading progress, you always loss money, can’t caught the big trend of profits. when this happens, it also leads to our focus - extreme trading in trend trading. Obviously, the source of trend-tracking profits comes from extreme price moves. Let’s take a look at the following figure. The following figure is an overview of the trend-trading strategy applied to the index of Rebar. The trend period is 1 hour:

The key to trend tracking is tracking. Once the big profit opportunity arises, it is necessary to insist on holding until the reverse signal is touched. Otherwise, if you miss a few big profits, the effect of the strategy will be reduced a lot. In fact, if we have an extreme loss in our strategy and can deal with it quickly, it can also increase the wining profitability of the strategy. Finally, we must emphasize that trend tracking is to continue tracking 24 hours a day!

The key to trend tracking is tracking. Once the big profit opportunity arises, it is necessary to insist on holding until the reverse signal is touched. Otherwise, if you miss a few big profits, the effect of the strategy will be reduced a lot. In fact, if we have an extreme loss in our strategy and can deal with it quickly, it can also increase the wining profitability of the strategy. Finally, we must emphasize that trend tracking is to continue tracking 24 hours a day!

- FMZ beginer tutorial

- BitMEX exchange API note

- 请求交易所API,偶尔出现 Timeout

- Implementing MACD in Python

- OKEX get depth 报错

- 回测问题请教

- ZBG交易所不能用

- 小白问题,怎么用blockly可视化编程下市价交易单?

- 发明者数字货币量化平台websocket使用指南(Dial函数升级后详解)

- 获取robotdetail接口里的参数3是啥意思

- Beginner's Guide to Time Series Analysis

- Backtesting a Forecasting Strategy for the S&P500 in Python with pandas

- “Always understand when to quit” – 6 exit strategies

- FMZ公众号互动

- What are the Different Types of Quant Funds?

- Backtesting An Intraday Mean Reversion Pairs Strategy Between SPY And IWM

- Backtesting a Moving Average Crossover in Python with pandas

- How to Identify Algorithmic Trading Strategies

- Event-Driven Backtesting with Python - Part VIII

- Blockchain Quantitative Investment Series - Dynamic Balance Strategy