ATR Channel strategy Implemented on crypto market

创建于: 2020-08-21 19:29:51,

更新于:

2025-01-13 20:32:55

0

0

1272

1272

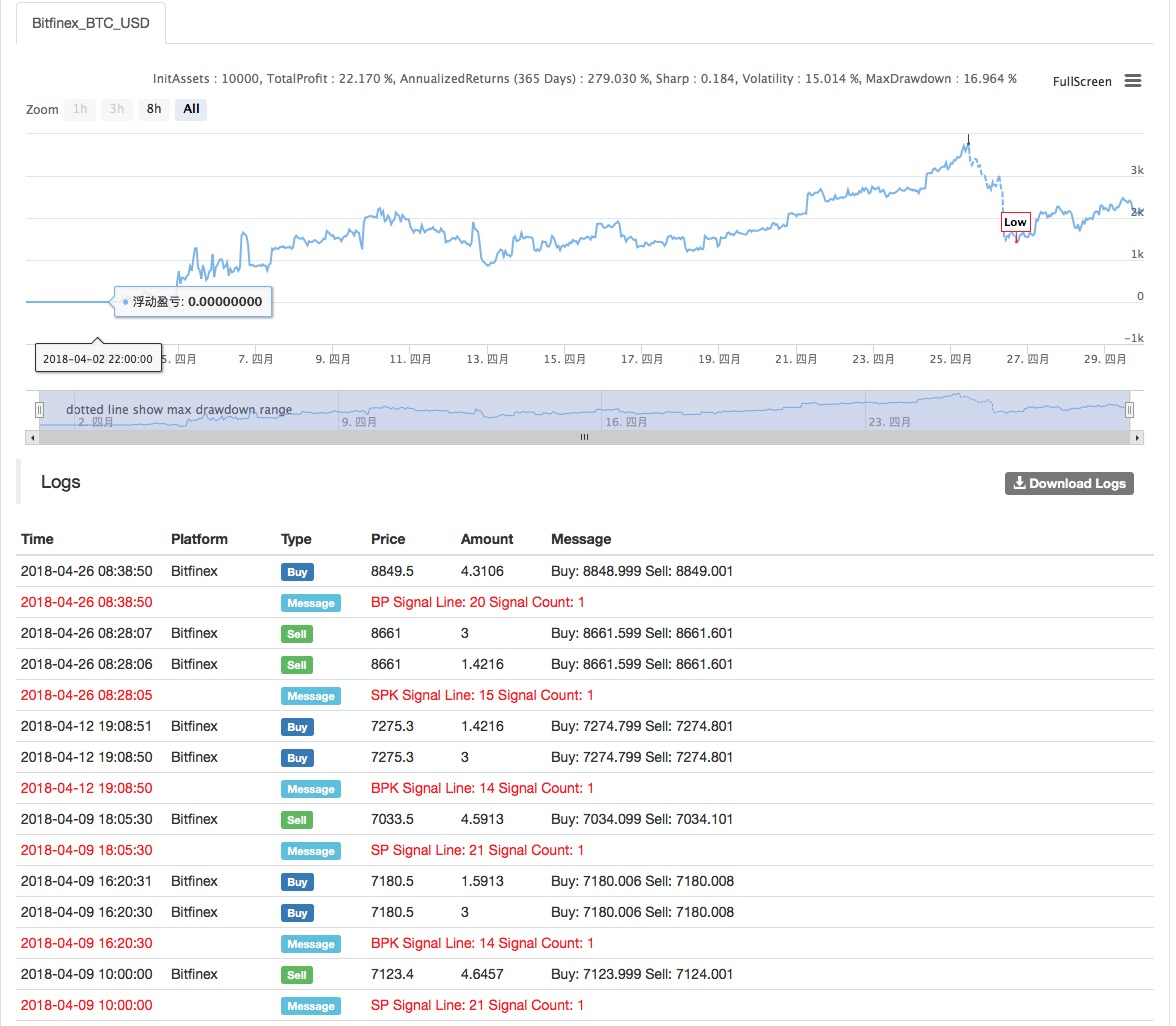

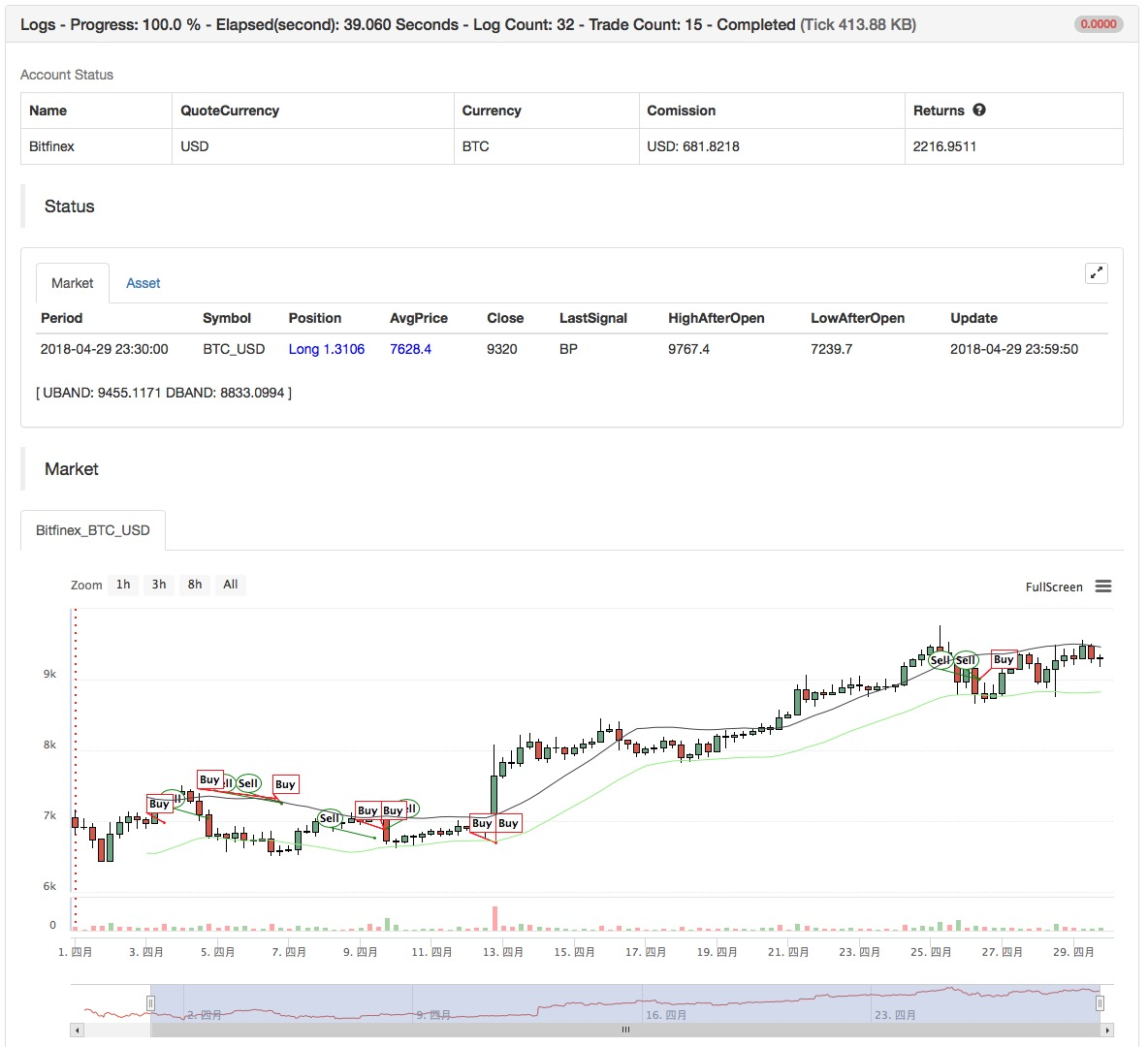

Strategy name: Channel strategy based on ATR volatility index

Strategy idea: Channel Adaptive Strategy, Fixed Stop + Floating Stop

Data Cycle: Multi-Cycle

Main chart: Draw UBAND, formula: UBAND ^^ MAC + MATR; Draw DBAND, formula: DBAND ^^ MAC-MATR;

Secondary chart: none

(*backtest

start: 2018-06-01 00:00:00

end: 2018-07-01 00:00:00

period: 1h

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["TradeAmount",10,126961],["ContractType","this_week",126961]]

*)

TR1:=MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW));

ATR:=MA(TR1,N);

MAC:=MA(C,N);

UBAND^^MAC+M*ATR;

DBAND^^MAC-M*ATR;

H>=HHV(H,N),BPK;

L<=LLV(L,N),SPK;

(H>=HHV(H,M*N) OR C<=UBAND) AND BKHIGH>=BKPRICE*(1+M*SLOSS*0.01),SP;

(L<=LLV(L,M*N) OR C>=DBAND) AND SKLOW<=SKPRICE*(1-M*SLOSS*0.01),BP;

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;

Source Code: https://www.fmz.com/strategy/128126

相关推荐

- 获取托管者发送http请求报文的解决方案

- 量化交易中服务器使用浅谈

- [千团大战]币安交割合约策略3——蝶式对冲

- 平衡挂单策略(教学策略)

- RSI2 Mean Reversion Strategy using in futures

- The futures and cryptocurrency API explanation

- Quickly implement a semi-automatic quantitative trading tool

- Introducing the Aroon indicator

- Preliminary Study on Backtesting of Digital Currency Options Strategy

- The Difference between Quantitative Trading and Subjective Trading

- Thermostat Strategy using on crypto market by MyLanguage

- hans123 intraday breakthrough strategy

- 数字货币期权策略回测初探

- TradingViewWebHook alarm directly connected to FMZ robot

- Add an alarm clock to the trading strategy

- OKEX futures contract hedging strategy by using C++

- Trading strategy based on the active flow of funds

- Use trading terminal plug-in to facilitate manual trading

- Quantitative typing rate trading strategy

- Balance strategy and grid strategy