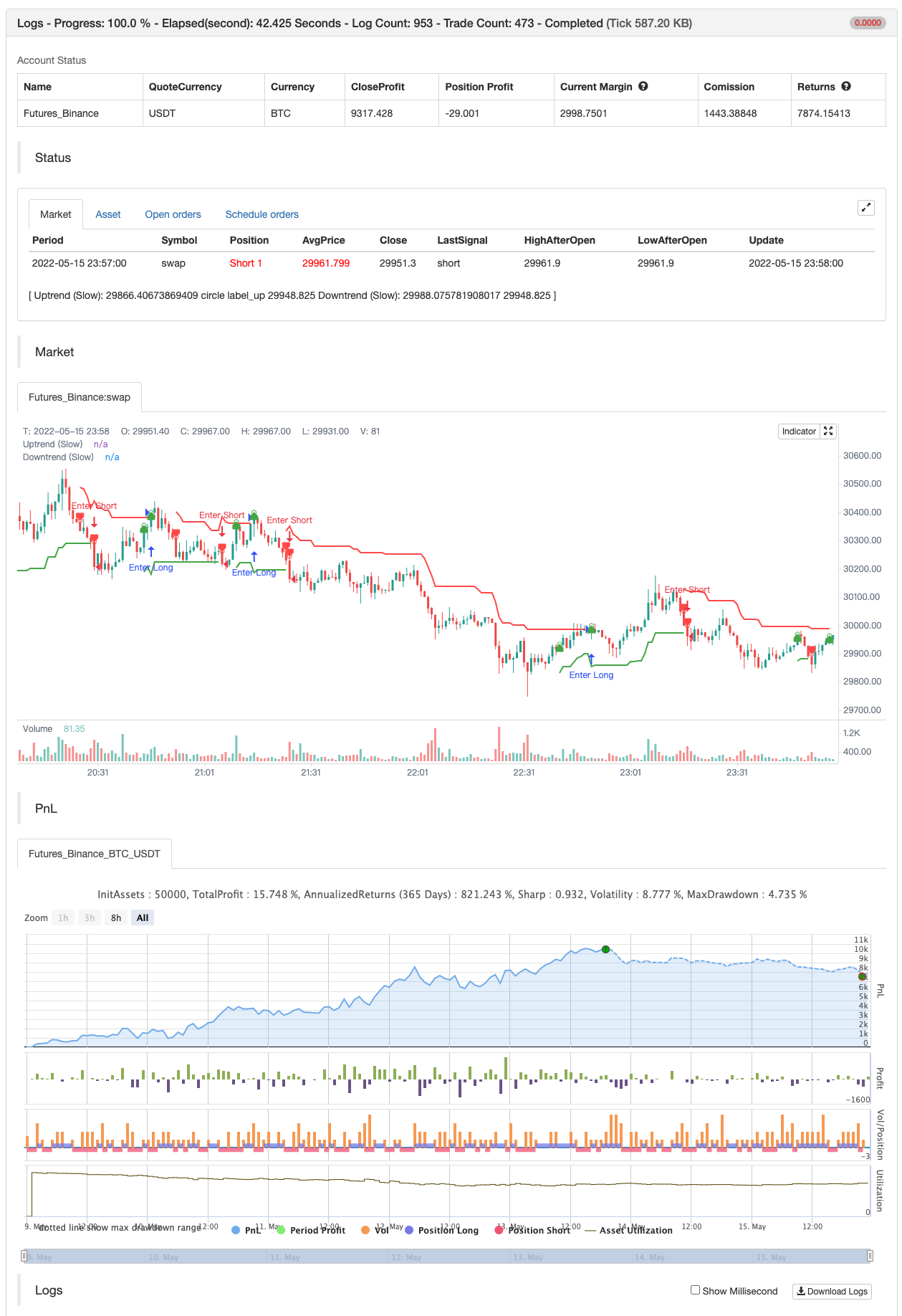

কনসেপ্ট ডুয়াল সুপারট্রেন্ড

লেখক:চাওঝাং, তারিখ: ২০২২-০৫-১৭ ১৪ঃ৪০ঃ৪০ট্যাগঃএসএমএএটিআর

সহজ সুপারট্রেন্ড সূচক আপনাকে একটি একক স্ক্রিপ্টে দুটি সুপারট্রেন্ড প্রদর্শন করার বিকল্প plus অতিরিক্ত কাস্টমাইজেশন বৈশিষ্ট্য দেয়। আয় হাঙ্গর দ্বারা অনুপ্রাণিত দ্বৈত সেটআপ

ব্যাকটেস্ট

/*backtest

start: 2022-05-09 00:00:00

end: 2022-05-15 23:59:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

indicator(title='Concept Dual SuperTrend', shorttitle='ConceptDST', overlay=true, format=format.price, precision=2, timeframe='')

src = input(hl2, title='Source')

multiplier = input.float(title='ATR Multiplier (Fast)', step=0.1, defval=2)

multiplier2 = input.float(title='ATR Multiplier (Slow)', step=0.1, defval=3)

periods = input(title='ATR Period (Fast)', defval=10)

periods2 = input(title='ATR Period (Slow)', defval=10)

transp_st = input.float(title='Line Transparency', step=1, minval=0, maxval=100, defval=70)

transp_hl = input.float(title='Shading Transparency', step=1, minval=0, maxval=100, defval=90)

changeATR = input(title='Change ATR Calculation Method?', defval=true)

highlighting = input(title='Show Shading? (Fast)', defval=true)

highlighting2 = input(title='Show Shading? (Slow)', defval=true)

showlabels = input(title='Show Buy/Sell Labels?', defval=true)

//------------------------------------------------

// Calculations (Fast)

atrA = ta.sma(ta.tr, periods)

atr = changeATR ? ta.atr(periods) : atrA

up = src - multiplier * atr

upA = nz(up[1], up)

up := close[1] > upA ? math.max(up, upA) : up

dn = src + multiplier * atr

dnA = nz(dn[1], dn)

dn := close[1] < dnA ? math.min(dn, dnA) : dn

// Trend (Fast)

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dnA ? 1 : trend == 1 and close < upA ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title='Uptrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.green, transp_st))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='Uptrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, transp_st))

plotshape(buySignal and showlabels ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Downtrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.red, transp_st))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='Downtrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, transp_st))

plotshape(sellSignal and showlabels ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, color=na)

longFillColor = highlighting ? trend == 1 ? color.green : color.black : color.black

shortFillColor = highlighting ? trend == -1 ? color.red : color.black : color.black

fill(mPlot, upPlot, title='Uptrend Shading (Slow)', color=color.new(longFillColor, transp_hl))

fill(mPlot, dnPlot, title='Downtrend Shading (Slow)', color=color.new(shortFillColor, transp_hl))

//------------------------------------------------

// Calculations (Slow)

atrA2 = ta.sma(ta.tr, periods2)

atr2 = changeATR ? ta.atr(periods2) : atrA2

up2 = src - multiplier2 * atr2

upA2 = nz(up2[1], up2)

up2 := close[1] > upA2 ? math.max(up2, upA2) : up2

dn2 = src + multiplier2 * atr2

dnA2 = nz(dn2[1], dn2)

dn2 := close[1] < dnA2 ? math.min(dn2, dnA2) : dn2

// Trend (Slow)

trend2 = 1

trend2 := nz(trend2[1], trend2)

trend2 := trend2 == -1 and close > dnA2 ? 1 : trend2 == 1 and close < upA2 ? -1 : trend2

upPlot2 = plot(trend2 == 1 ? up2 : na, title='Uptrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.green, transp_st))

buySignal2 = trend2 == 1 and trend2[1] == -1

plotshape(buySignal2 ? up2 : na, title='Uptrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, transp_st))

plotshape(buySignal2 and showlabels ? up2 : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot2 = plot(trend2 == 1 ? na : dn2, title='Downtrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.red, transp_st))

sellSignal2 = trend2 == -1 and trend2[1] == 1

plotshape(sellSignal2 ? dn2 : na, title='Downtrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, transp_st))

plotshape(sellSignal2 and showlabels ? dn2 : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot2 = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, color=na)

longFillColor2 = highlighting2 ? trend2 == 1 ? color.green : color.black : color.black

shortFillColor2 = highlighting2 ? trend2 == -1 ? color.red : color.black : color.black

fill(mPlot2, upPlot2, title='Uptrend Shading (Slow)', color=color.new(longFillColor2, transp_hl))

fill(mPlot2, dnPlot2, title='Downtrend Shading (Slow)', color=color.new(shortFillColor2, transp_hl))

if buySignal2

strategy.entry("Enter Long", strategy.long)

else if sellSignal2

strategy.entry("Enter Short", strategy.short)

সম্পর্কিত

- ডায়নামিক ভোলটাইলিটি ফিল্টার সহ মাল্টি-পিরিয়ড মুভিং এভারেজ ক্রসওভার কৌশল

- ATR স্টপ-লস সিস্টেমের সাথে মাল্টি-এসএমএ সাপোর্ট লেভেল মিথ্যা ব্রেকআউট কৌশল

- এটিআর এবং ভলিউমকে একত্রিত করার কৌশল অনুসরণ করে ডাইনামিক সিগন্যাল লাইন ট্রেন্ড

- আলফা ট্রেন্ড

- ঝুঁকি নিয়ন্ত্রণের সাথে ডাবল মুভিং মিডিয়ার রিভার্সন কৌশল

- ইচিমোকু ক্লাউড এবং এটিআর কৌশল

- লাইন নির্দেশক অনুসরণ করুন

- ইনট্রা-ডে স্কেলযোগ্য ভোল্টেবিলিটি ট্রেডিং কৌশল

- সুপারট্রেন্ড+৪চলমান

- এটিআর গড় ব্রেকআউট কৌশল

আরো

- ফুকুইজ ট্রেন্ড

- জনির বট

- এসএসএল হাইব্রিড

- চ্যান্ডেলিয়ারের প্রস্থান

- রিসোটো

- ইএমএ ক্লাউড ইনট্রা-ডে স্ট্র্যাটেজি

- পিভট পয়েন্ট সুপারট্রেন্ড

- সুপারট্রেন্ড+৪চলমান

- গতির উপর ভিত্তি করে ZigZag

- ভিউম্যানচু সিফার বি + ডিভার্জেন্স কৌশল

- সুপার স্কালপার

- ব্যাকটেস্টিং- সূচক

- প্রচলিত

- এসএমএ বিটিসি খুনি

- এমএল সতর্কতা টেমপ্লেট

- বিরতি সহ ফিবোনাচি অগ্রগতি

- আরএসআই এমটিএফ ওব+ও

- ফুকুইজ ওক্টা-ইএমএ + ইচিমোকু

- সিসিআই এমটিএফ ওব+ও

- আরও স্মার্ট ম্যাকডি