মুভিং এভারেজ রিভার্সাল কৌশল অনুসরণ করে মোমেন্টাম

ওভারভিউ

এই কৌশলটি চলমান গড়, ব্রিন ব্যান্ড, আরএসআই এবং এলোমেলো সূচকগুলির মতো একাধিক সূচক ব্যবহার করে এবং একাধিক টাইম ফ্রেম বিশ্লেষণের সাথে মিলিত হয়।

কৌশল নীতি

এই কৌশলটির কেন্দ্রীয় যুক্তি হ’ল স্বল্পমেয়াদী এবং দীর্ঘমেয়াদী মুভিং এভারেজের ক্রসগুলি অনুসরণ করা যাতে নীচে এবং শীর্ষে বিচার করা যায়, পাশাপাশি রেফারেন্স গতিশীলতার সূচক যেমন আরএসআই, এলোমেলো সূচক ইত্যাদির চূড়ান্ত মানগুলিকে অতিরিক্ত ওভারসোলিংয়ের বিচার করতে সহায়তা করে।

বিশেষত, এটি দুটি ভিন্ন প্যারামিটারের জন্য পৃথকভাবে একটি চলমান গড় আঁকবে, একটি স্বল্পমেয়াদী যা বর্তমান প্রবণতা নির্ধারণ করে এবং একটি দীর্ঘমেয়াদী যা মূল প্রবণতা নির্ধারণ করে। যখন একটি স্বল্পমেয়াদী চলমান গড় নীচে থেকে দীর্ঘমেয়াদী চলমান গড়কে অতিক্রম করে, তখন বাজারটি বিপরীত বলে মনে করা হয় এবং একটি কেনার সংকেত উত্পন্ন হয়; যখন এটি উপরে থেকে নীচে অতিক্রম করে, তখন একটি বিক্রয় সংকেত উত্পন্ন হয়।

তদুপরি, কৌশলটি আরএসআই সূচকের সাথে যুক্ত করে এটি ওভারসোল্ড অঞ্চলে প্রবেশ করেছে কিনা তা দেখার জন্য, এবং এলোমেলো সূচকটি কে লাইনটি ওভারসোল্ড অঞ্চলে প্রবেশ করেছে কিনা তা দেখার জন্য নীচের বৈশিষ্ট্যটি বিচার করার জন্য। শীর্ষস্থানীয় বৈশিষ্ট্যগুলির জন্য, এই দুটি সূচকের বিপরীত যুক্তি ব্যবহার করে বিচার করা হবে।

আউটপুটের ক্ষেত্রে, কৌশলটি একই সাথে স্টপ, স্টপ লস এবং ট্র্যাকিং স্টপ লস ব্যবহার করে পজিশন পরিচালনা করে।

সামর্থ্য বিশ্লেষণ

এটি একটি কৌশল যা প্রবণতা ট্র্যাকিং এবং বিপরীত সনাক্তকরণের সমন্বয় করে এবং গতিশীলতার সূচকগুলির ব্যবহারিক কৌশলগুলিও বিবেচনা করে। এর বেশ কয়েকটি সুবিধা রয়েছেঃ

চলমান গড়ের ক্রস সিস্টেমটি একটি সহজ এবং কার্যকর পদ্ধতি যা বিপরীতের বিচার করতে পারে। দ্বি-সমান-রেখার কৌশলটি সহজেই পরিচালনা করা যায় এবং ইতিহাসে ভাল কাজ করে।

আরএসআই এবং অন্যান্য সূচকগুলির সাথে মিলিত হয়ে রিভার্সাল সিগন্যালের নির্ভরযোগ্যতা নির্ধারণ করুন, যাতে নীচে নয় বরং শীর্ষে নয় এমন বিভ্রান্তিকর সংকেতগুলি এড়ানো যায়।

স্টপ, স্টপ লস এবং ট্র্যাক স্টপ লস ম্যানেজমেন্ট লভ্যাংশ লক করতে এবং ঝুঁকি নিয়ন্ত্রণে সহায়তা করে।

ঝুঁকি বিশ্লেষণ

যদিও এই কৌশলটির অনেক সুবিধা রয়েছে, তবে কিছু ঝুঁকি রয়েছে যা সম্পর্কে সতর্ক হওয়া দরকারঃ

দ্বি-সমতুল্য কৌশলটি অস্থিরতার মধ্যে সহজেই আটকে যায়। যদি বাজারটি দীর্ঘমেয়াদী হয়, তবে প্রায়শই পজিশন খোলা এবং সমতল করা হবে।

RSI ইত্যাদির মতো সূচকগুলি ভুল সংকেতগুলি সম্পূর্ণরূপে এড়াতে পারে না। উদাহরণস্বরূপ, একটি উচ্চতর তরঙ্গের দ্রুত ব্রেকিং RSI কে অতিরিক্ত ক্রয়ের অঞ্চলে প্রবেশ করতে দেয় না।

স্টপ পয়েন্টের চেয়ে বড় হলে ক্ষতির ঝুঁকি বাড়তে পারে। স্টপ পয়েন্টের মাত্রা নির্দিষ্ট জাতের উপর নির্ভর করে পরিবর্তিত হতে পারে।

অপ্টিমাইজেশান দিক

এই কৌশলটি আরও উন্নত করার অনেক জায়গা রয়েছেঃ

বিভিন্ন ধরনের চলমান গড় পরীক্ষা করে দেখা যায় যে কোন গড়ের সাথে কোনটি সবচেয়ে বেশি মিলবে।

আরো সহায়ক সূচক যেমন MACD, KD, Brin ইত্যাদি যোগ করা যেতে পারে যা সমৃদ্ধ কৌশলগত যুক্তি নিয়ে আসে।

মেশিন লার্নিং এবং অন্যান্য পদ্ধতির মাধ্যমে পজিশন ম্যানেজমেন্ট প্যারামিটারগুলিকে স্বয়ংক্রিয়ভাবে অপ্টিমাইজ করা যায়, যা স্টপ লস স্টপকে আরও বুদ্ধিমান করে তোলে।

বিভিন্ন জাতের প্যারামিটারগুলি পৃথকভাবে অপ্টিমাইজ করা যেতে পারে, যা বিভিন্ন জাতের বৈশিষ্ট্যগুলিকে সামঞ্জস্য করে।

সারসংক্ষেপ

সংক্ষেপে বলা যায়, গতিশীলতা ট্র্যাকিং গড়রেখা বিপরীতমুখী কৌশলটি একটি সহজ ব্যবহারিক পরিমাণগত কৌশল। এটি গড়রেখা সিস্টেম ব্যবহার করে বাজারের বিপরীতমুখী পয়েন্টগুলি বিচার করে, গতিশীলতার সূচকগুলির সাথে সংকেত নির্ভরযোগ্যতা নিশ্চিত করতে সহায়তা করে এবং বুদ্ধিমান অবস্থানের ব্যবস্থাপনা ব্যবহার করে মুনাফা লক করতে এবং ঝুঁকি নিয়ন্ত্রণ করতে। এই কৌশলটি বোঝা এবং বাস্তবায়ন করা সহজ, অনুশীলন এবং অপ্টিমাইজ করার জন্য উপযুক্ত এবং ব্যবসায়ীরা ট্রেডিংয়ের পরিমাণ নির্ধারণের জন্য একটি ভাল শুরু।

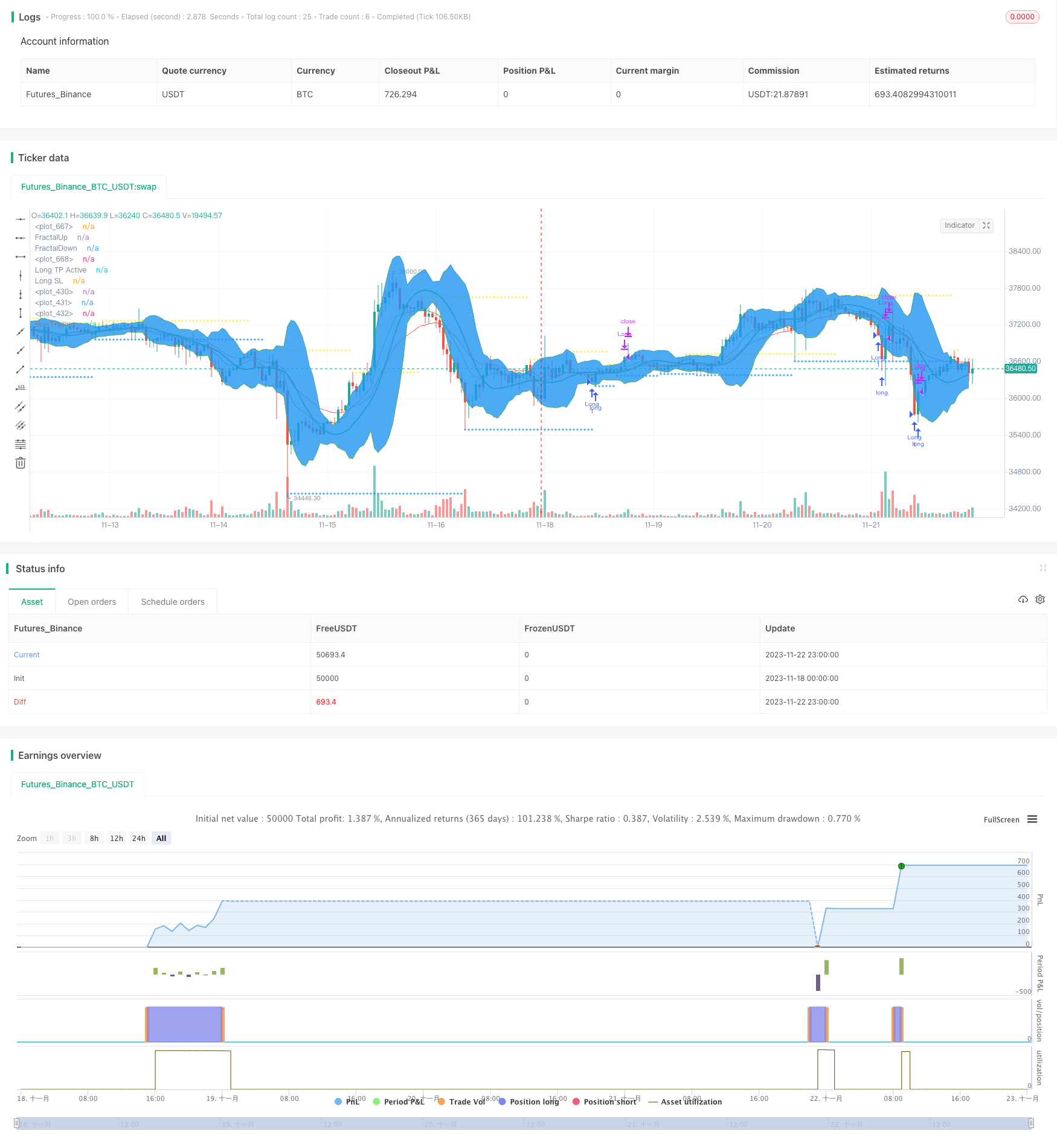

/*backtest

start: 2023-11-18 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("APEX - Tester - Buy/Sell Strategies - Basic - BACKTESTER", overlay = true)

//study("APEX - Tester - Buy/Sell Strategies - Basic ", overlay = true)

source_main = close

/////////////////////////////////////////////////

// BUY STRATEGIES - SELECTION

/////////////////////////////////////////////////

puppy_sep = input(false, title=" APEX Tester Buy/Sell Basic v01 ")

buy1_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

buy2_sep = input(false, title="******** BUY STRATEGIES ********")

ma_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MA ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

ma_length_short = input(8, minval=1, title="MA length - short")

ma_length_long = input(9, minval=1, title="MA length - long")

ma_useRes = input(false, title="Check to turn ON Different Time Frame")

ma_candle_period = input("5", title="MA - Different Time Frame")

ma_type = input("T3", title="MA Type", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

ma_detector = input("Short Crosses Above Long", title="Detector", options=["Short Crosses Above Long",

"Short Above Long","Price Cross Above Short","Price Above Short","Price Cross Above Long","Price Above Long","Price Above Both","Price Below Both"])

ma_use = input(false, title="Use Moving Average ? (On / Off)")

bb_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ BB ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

bb_length = input(10, minval=1, title="BB length")

bb_std = input(2.1, minval=0, type = float, title="BB std")

bb_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

bb_candle_period = input("3", title="BB - Time Frame")

bb_type = input("T3", title="MA", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

bb_detector = input("Price Cross Below", title="Detector", options=["Price Cross Below", "Price Below", "Price Cross Above", "Price Above"])

bb_use = input(true, title="Use BB ? (On / Off)")

rsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ RSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

rsi_length = input(2, minval=1, title="RSI length")

rsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

rsi_candle_period = input("3", title="STOCH - Time Frame")

rsi_oversold = input(defval = 12 , title = "RSI Oversold", minval=0)

rsi_detector = input("Signal Below Oversold", title="Detector", options=["Signal Below Oversold", "Cross Below Oversold", "Signal Above Oversold", "Cross Above Oversold"])

rsi_use = input(true, title="Use RSI ? (On / Off)")

stoch_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ STOCH ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

stoch_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

stoch_candle_period = input("3", title="STOCH - Time Frame")

stoch_length_fk = input(12, minval=1, title="STOCH fast K")

stoch_length_sk = input(1, minval=1, title="STOCH slow K")

stoch_type_sk = input("EMA", title="STOCH slow K", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

stoch_length_sd = input(1, minval=1, title="STOCH slow D")

stoch_type_sd = input("EMA", title="STOCH slow D", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

stoch_oversold = input(defval = 10 , title = "STOCH Oversold Treashold", minval=0)

stoch_detector = input("Signal Below Oversold", title="Detector", options=["Signal Below Oversold", "Cross Below Oversold", "Cross Above Oversold"])

stoch_use = input(true, title="Use STOCH ? (On / Off)")

srsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ SRSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

stochrsi_useDifferentRes= input(false, title="Check to turn ON Different Time Frame")

stochrsi_candle_period = input("3", title="SRSI - Time Frame")

stochrsi_len = input(14, minval=1, title="RSI length")

stochrsi_stoch = input(14, minval=1, title="Time Period")

stochrsi_length_fk = input(3, minval=1, title="Fast K")

stochrsi_length_sd = input(3, minval=1, title="Slow D(or Fast)")

stochrsi_oversold = input(defval = 30 , title = "STOCHRSI Oversold Treashold", minval=0)

stochrsi_detector = input("K Below Oversold", title="Detector", options=["K Cross Above D and Oversold", "K Cross Above D", "K Cross Above Oversold",

"K Cross Below Oversold","K Below Oversold","K Above Oversold"])

stochrsi_use = input(false, title="Use STOCHRSI (On / Off)?")

macd_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MACD ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

macd_fast = input(12, title="MACD fast")

macd_slow = input(26, title="MACD slow")

macd_signal = input(9, title="MACD signal")

macd_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

macd_candle_period = input("3", title="MACD - Time Frame")

macd_detector = input("MACD Cross Above Signal", title="Detector", options=["MACD Cross Above Signal", "MACD Above Signal", "MACD Below Signal",

"MACD Above Treshold", "MACD Below Treshold", "Centerline Cross Upward", "Centerline Cross Downward"])

macd_treshold = input(defval = 0 , title = "Treshold", type = float)

macd_use = input(false, title="Use MACD (On / Off)?")

cci_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ CCI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

cci_len = input(14, title="CCI Length")

cci_treshold = input(100, title="CCI Treshold")

cci_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

cci_candle_period = input("3", title="CCI - Time Frame")

cci_detector = input("Signal Below Treshold", title="Detector", options=["Signal Cross Above Treshold", "Signal Above Treshold", "Signal Cross Below Treshold", "Signal Below Treshold"])

cci_use = input(false, title="Use CCI (On / Off)?")

vwap_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ VWAP ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

vwap_useRes = input(false, title="Check to turn ON Different Time Frame")

vwap_candle_period = input("5", title="VWAP - Time Frame")

vwap_detector = input("Price Above", title="Detector", options=["Price Cross Above","Price Above","Price Cross Below","Price Below"])

vwap_use = input(false, title="Use VWAP (On / Off)?")

pc_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻Perc.Chan.⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

pc_change = input(-2, type=float, title="Drop Percent")

pc_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

pc_candle_period = input("3", title="Percent Change - Time Frame")

pc_use = input(false, title="Use Percent Change (On / Off)?")

///////////////////////////////////////////////

// SELL STRATEGIES - SELECTION

///////////////////////////////////////////////

sell0_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

sell1_sep = input(false, title="******** SELL STRATEGIES ********")

sell_ma_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MA ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_ma_length_short = input(10, minval=1, title="MA length - short")

sell_ma_length_long = input(20, minval=1, title="MA length - long")

sell_ma_useRes = input(false, title="Check to turn ON Different Time Frame")

sell_ma_candle_period = input("5", title="MA - Different Time Frame")

sell_ma_type = input("EMA", title="MA Type", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_ma_detector = input("Short Crosses Below Long", title="Detector", options=["Short Crosses Below Long",

"Short Below Long","Short Above Long","Price Cross Below Short","Price Below Short","Price Cross Below Long","Price Below Long","Price Above Both MA","Price Below Both MA"])

sell_ma_use = input(true, title="Use Moving Average ? (On / Off)")

sell_bb_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ BB ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_bb_length = input(10, minval=1, title="BB length")

sell_bb_std = input(2.1, minval=0, type = float, title="BB std")

sell_bb_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_bb_candle_period = input("3", title="BB - Time Frame")

sell_bb_type = input("T3", title="MA", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_bb_detector = input("Price Cross Below", title="Detector", options=["Price Cross Above", "Price Above","Price Cross Below", "Price Below"])

sell_bb_use = input(false, title="Use BB ? (On / Off)")

sell_rsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ RSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_rsi_length = input(2, minval=1, title="RSI length")

sell_rsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_rsi_candle_period = input("3", title="STOCH - Time Frame")

sell_rsi_overbought = input(defval = 12 , title = "RSI Overbought", minval=0)

sell_rsi_detector = input("Signal Above Overbought", title="Detector", options=["Signal Below Overbought", "Cross Below Overbought", "Signal Above Overbought", "Cross Above Overbought"])

sell_rsi_use = input(false, title="Use RSI ? (On / Off)")

sell_stoch_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ STOCH ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_stoch_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_stoch_candle_period = input("3", title="STOCH - Time Frame")

sell_stoch_length_fk = input(12, minval=1, title="STOCH fast K")

sell_stoch_length_sk = input(1, minval=1, title="STOCH slow K")

sell_stoch_type_sk = input("EMA", title="STOCH slow K", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_stoch_length_sd = input(1, minval=1, title="STOCH slow D")

sell_stoch_type_sd = input("EMA", title="STOCH slow D", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_stoch_overbought = input(defval = 10 , title = "STOCH Overbought Treashold", minval=0)

sell_stoch_detector = input("Signal Above Overbought", title="Detector", options=["Signal Above Overbought", "Cross Below Overbought", "Cross Above Overbought"])

sell_stoch_use = input(false, title="Use STOCH ? (On / Off)")

sell_stochrsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ SRSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_stochrsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_stochrsi_candle_period = input("3", title="SRSI - Time Frame")

sell_stochrsi_len = input(14, minval=1, title="RSI length")

sell_stochrsi_stoch = input(14, minval=1, title="Time Period")

sell_stochrsi_length_fk = input(3, minval=1, title="Fast K")

sell_stochrsi_length_sd = input(3, minval=1, title="Slow D(or Fast)")

sell_stochrsi_overbought = input(defval = 30 , title = "STOCHRSI Overbought Treashold", minval=0)

sell_stochrsi_detector = input("K Above Overbought", title="Detector", options=["K Cross Above D and Overbought", "K Cross Above D", "K Cross Above Overbought",

"K Cross Below Overbought","K Below Overbought","K Above Overbought"])

sell_stochrsi_use = input(false, title="Use STOCHRSI (On / Off)?")

sell_macd_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MACD ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_macd_fast = input(12, title="MACD fast")

sell_macd_slow = input(26, title="MACD slow")

sell_macd_signal = input(9, title="MACD signal")

sell_macd_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_macd_candle_period = input("3", title="MACD - Time Frame")

sell_macd_detector = input("MACD Cross Below Signal", title="Detector", options=["MACD Cross Below Signal", "MACD Above Signal", "MACD Below Signal",

"MACD Above Treshold", "MACD Below Treshold", "Centerline Cross Upward", "Centerline Cross Downward"])

sell_macd_treshold = input(defval = 0 , title = "Treshold", type = float)

sell_macd_use = input(false, title="Use MACD (On / Off)?")

sell_cci_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ CCI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_cci_len = input(14, title="CCI Length")

sell_cci_treshold = input(100, title="CCI Treshold")

sell_cci_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_cci_candle_period = input("3", title="CCI - Time Frame")

sell_cci_detector = input("Signal Below Treshold", title="Detector", options=["Signal Cross Above Treshold", "Signal Above Treshold", "Signal Cross Below Treshold", "Signal Below Treshold"])

sell_cci_use = input(false, title="Use CCI (On / Off)?")

sell_vwap_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ VWAP ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_vwap_useRes = input(false, title="Check to turn ON Different Time Frame")

sell_vwap_candle_period = input("5", title="VWAP - Time Frame")

sell_vwap_detector = input("Price Above", title="Detector", options=["Price Cross Above","Price Above","Price Cross Below","Price Below"])

sell_vwap_use = input(false, title="Use VWAP (On / Off)?")

sell_pc_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻Perc.Chan.⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_pc_change = input(2, type=float, title="Rise Percent")

sell_pc_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_pc_candle_period = input("3", title="Percent Change - Time Frame")

sell_pc_use = input(false, title="Use Percent Change (On / Off)?")

strat1_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

strat2_sep = input(false, title="******** STRATEGY SETTINGS ********")

///////////////////////////////////////////////

// GLOBAL FUNCTIONS

///////////////////////////////////////////////

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

mama(src, len)=>

fl=0.5

sl=0.05

pi = 3.1415926

sp = (4*src + 3*src[1] + 2*src[2] + src[3]) / 10.0

p = 0.0

i2 = 0.0

q2 = 0.0

dt = (.0962*sp + .5769*nz(sp[2]) - .5769*nz(sp[4])- .0962*nz(sp[6]))*(.075*nz(p[1]) + .54)

q1 = (.0962*dt + .5769*nz(dt[2]) - .5769*nz(dt[4])- .0962*nz(dt[6]))*(.075*nz(p[1]) + .54)

i1 = nz(dt[3])

jI = (.0962*i1 + .5769*nz(i1[2]) - .5769*nz(i1[4])- .0962*nz(i1[6]))*(.075*nz(p[1]) + .54)

jq = (.0962*q1 + .5769*nz(q1[2]) - .5769*nz(q1[4])- .0962*nz(q1[6]))*(.075*nz(p[1]) + .54)

i2_ = i1 - jq

q2_ = q1 + jI

i2 := .2*i2_ + .8*nz(i2[1])

q2 := .2*q2_ + .8*nz(q2[1])

re_ = i2*nz(i2[1]) + q2*nz(q2[1])

im_ = i2*nz(q2[1]) - q2*nz(i2[1])

re = 0.0

im = 0.0

re := .2*re_ + .8*nz(re[1])

im := .2*im_ + .8*nz(im[1])

p1 = iff(im!=0 and re!=0, 2*pi/atan(im/re), nz(p[1]))

p2 = iff(p1 > 1.5*nz(p1[1]), 1.5*nz(p1[1]), iff(p1 < 0.67*nz(p1[1]), 0.67*nz(p1[1]), p1))

p3 = iff(p2<6, 6, iff (p2 > 50, 50, p2))

p := .2*p3 + .8*nz(p3[1])

spp = 0.0

spp := .33*p + .67*nz(spp[1])

phase = 180/pi * atan(q1 / i1)

dphase_ = nz(phase[1]) - phase

dphase = iff(dphase_< 1, 1, dphase_)

alpha_ = fl / dphase

alpha = iff(alpha_ < sl, sl, iff(alpha_ > fl, fl, alpha_))

mama = 0.0

mama := alpha*src + (1 - alpha)*nz(mama[1])

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = sma(sma(src, ceil(len / 2)), floor(len / 2) + 1) // TRIMA

v7 = kama(src, len) // KAMA

v8 = mama(src, len) // MAMA

v9 = t3(src, len) // T3

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="TRIMA"?v6 : type=="KAMA"?v7 : type=="MAMA"?v8 : type=="T3"?v9 : v1

calc_cci(src, len, res) =>

cci_ma = sma(src, len)

cci = (src - cci_ma) / (0.015 * dev(src, len))

cci_res = request.security(syminfo.tickerid, res, cci)

calc_macd(macd_fast, macd_slow, src, res) =>

macd = ema(src, macd_fast) - ema(src, macd_slow)

res_macd = request.security(syminfo.tickerid, res, macd)

///////////////////////////////////////////////

// BUY STRATEGIES LOGIC

///////////////////////////////////////////////

//RSI

rsi = rsi(source_main, rsi_length)

per_rsi = rsi_useDifferentRes?request.security(syminfo.tickerid, rsi_candle_period, rsi):rsi

rsiBelow = false

rsiCrossBelow = false

rsiCrossAbove = false

rsiAbove = false

rsiBelow := per_rsi<rsi_oversold

rsiCrossBelow := crossunder(per_rsi, rsi_oversold)

rsiCrossAbove := crossover(per_rsi, rsi_oversold)

rsiAbove := per_rsi>rsi_oversold

rsiBuy = rsi_use ? (

rsi_detector=="Signal Below Oversold"?rsiBelow:

rsi_detector=="Cross Below Oversold"?rsiCrossBelow:

rsi_detector=="Cross Above Oversold"?rsiCrossAbove:

rsi_detector=="Signal Above Oversold"?rsiAbove:

false ) : true

//STOCH

stoch_k = variant(stoch_type_sk, stoch(source_main, high, low, stoch_length_fk), stoch_length_sk)

stoch_d = variant(stoch_type_sd, stoch_k, stoch_length_sd)

per_stoch_k = stoch_useDifferentRes?request.security(syminfo.tickerid, stoch_candle_period, stoch_k):stoch_k

per_stoch_d = stoch_useDifferentRes?request.security(syminfo.tickerid, stoch_candle_period, stoch_d):stoch_d

stochBelow = false

stochCrossBelow = false

stochCrossAbove = false

stochBelow := per_stoch_k<stoch_oversold

stochCrossBelow := crossunder(per_stoch_k, stoch_oversold)

stochCrossAbove := crossover(per_stoch_k, stoch_oversold)

stochBuy = stoch_use ? (

stoch_detector=="Signal Below Oversold"?stochBelow:

stoch_detector=="Cross Below Oversold"?stochCrossBelow:

stoch_detector=="Cross Above Oversold"?stochCrossAbove:

false ) : true

//STOCHRSI

stochrsi_rsi = rsi(source_main, stochrsi_len)

stochrsi_stoch_k = sma(stoch(stochrsi_rsi, stochrsi_rsi, stochrsi_rsi, stochrsi_stoch), stochrsi_length_fk)

stochrsi_stoch_d = sma(stochrsi_stoch_k, stochrsi_length_sd)

per_stochrsi_k = stochrsi_useDifferentRes?request.security(syminfo.tickerid, stochrsi_candle_period, stochrsi_stoch_k):stochrsi_stoch_k

per_stochrsi_d = stochrsi_useDifferentRes?request.security(syminfo.tickerid, stochrsi_candle_period, stochrsi_stoch_d):stochrsi_stoch_d

stochrsiKDCrossOversold = false

stochrsiKDCross = false

stochrsiKCrossAboveOversold = false

stochrsiKCrossBelowOversold = false

stochrsiKBelowOversold = false

stochrsiKAboveOversold = false

stochrsiKDCrossOversold := crossover(per_stochrsi_k, per_stochrsi_d) and per_stochrsi_k<stochrsi_oversold

stochrsiKDCross := crossover(per_stochrsi_k, per_stochrsi_d)

stochrsiKCrossAboveOversold := crossover(per_stochrsi_k, stochrsi_oversold)

stochrsiKCrossBelowOversold := crossunder(per_stochrsi_k, stochrsi_oversold)

stochrsiKBelowOversold := per_stochrsi_k<stochrsi_oversold

stochrsiKAboveOversold := per_stochrsi_k>stochrsi_oversold

stochrsiBuy = stochrsi_use ? (

stochrsi_detector=="K Cross Above D and Oversold"?stochrsiKDCrossOversold:

stochrsi_detector=="K Cross Above D"?stochrsiKDCross:

stochrsi_detector=="K Cross Above Oversold"?stochrsiKCrossAboveOversold:

stochrsi_detector=="K Cross Below Oversold"?stochrsiKCrossBelowOversold:

stochrsi_detector=="K Below Oversold"?stochrsiKBelowOversold:

stochrsi_detector=="K Above Oversold"?stochrsiKAboveOversold:

false ) : true

//CCI

per_cci = calc_cci(hlc3, cci_len, cci_candle_period)

cciBelow = false

cciCrossBelow = false

cciCrossAbove = false

cciAbove = false

cciBelow := per_cci<cci_treshold

cciCrossBelow := crossover(per_cci, cci_treshold)

cciCrossAbove := crossunder(cci_treshold, per_cci)

cciAbove := per_cci>cci_treshold

cciBuy = cci_use ? (

cci_detector=="Signal Below Treshold"?cciBelow:

cci_detector=="Signal Cross Belove Treshold"?cciCrossBelow:

cci_detector=="Signal Cross Above Treshold"?cciCrossAbove:

cci_detector=="Signal Above Treshold"?cciAbove:

false ) : true

//MACD

fastMA = ema(source_main, macd_fast)

slowMA = ema(source_main, macd_slow)

macd = fastMA - slowMA

signal = sma(macd, macd_signal)

delta = macd - signal

outmacd = request.security(syminfo.tickerid, macd_candle_period, macd)

outsignal = request.security(syminfo.tickerid, macd_candle_period, signal)

outdelta = request.security(syminfo.tickerid, macd_candle_period, delta)

plot_macd = macd_useDifferentRes?outmacd:macd

plot_signal = macd_useDifferentRes?outsignal:signal

plot_delta = macd_useDifferentRes?outdelta:delta

MACDCrossAboveSignal = false

CenterlineCrossUpwards = false

CenterlineCrossDownwards = false

MACDAboveSignal = false

MACDBelowSignal = false

MACDAboveTreshold = false

MACDBelowTreshold = false

MACDCrossAboveSignal := crossunder(plot_signal, plot_macd)

CenterlineCrossUpwards := crossover(plot_delta, 0)

CenterlineCrossDownwards := crossunder(plot_delta, 0)

MACDAboveSignal := plot_macd > plot_signal

MACDBelowSignal := plot_macd < plot_signal

MACDAboveTreshold := plot_macd > macd_treshold

MACDBelowTreshold := plot_macd < macd_treshold

macdBuy=macd_use ? (

macd_detector=="MACD Cross Above Signal"?MACDCrossAboveSignal:

macd_detector=="Centerline Cross Upwards"?CenterlineCrossUpwards:

macd_detector=="Centerline Cross Downwards"?CenterlineCrossDownwards:

macd_detector=="MACD above Signal"?MACDAboveSignal:

macd_detector=="MACD below Signal"?MACDBelowSignal:

macd_detector=="MACD above Treshold"?MACDAboveTreshold:

macd_detector=="MACD below Treshold"?MACDBelowTreshold:

false ) : true

//BB

bb_basis = variant(bb_type, source_main, bb_length)

bb_dev = bb_std * stdev(source_main, bb_length)

bb_upper = bb_basis + bb_dev

bb_lower = bb_basis - bb_dev

per_lower_bb = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_lower):bb_lower

per_upper_bb = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_upper):bb_upper

per_bb_basis = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_basis):bb_basis

bbBelow = false

bbCrossBelow = false

bbCrossAbove = false

bbAbove = false

bbBelow := per_lower_bb>close or per_lower_bb>low

bbAbove := per_lower_bb<high or per_lower_bb<close

bbCrossAbove := crossover(source_main, per_lower_bb)

bbCrossBelow := crossunder(source_main, per_lower_bb)

bbBuy = stochrsi_use ? (

bb_detector=="Price Cross Below"?bbCrossBelow:

bb_detector=="Price Below"?bbBelow:

bb_detector=="Price Cross Above"?bbCrossAbove:

bb_detector=="Price Above"?bbAbove:false ) : true

plot(per_bb_basis, color=green, linewidth=2)

p1 = plot(per_upper_bb, color=green)

p2 = plot(per_lower_bb, color=green)

fill(p1, p2)

//MA Calculation

ma_short = variant(ma_type, source_main, ma_length_short)

ma_long = variant(ma_type, source_main, ma_length_long)

per_ma_short = ma_useRes?request.security(syminfo.tickerid, ma_candle_period, ma_short):ma_short

per_ma_long = ma_useRes?request.security(syminfo.tickerid, ma_candle_period, ma_long ):ma_long

p1ma = plot(ma_use?per_ma_short:na, color=green)

p2ma = plot(ma_use?per_ma_long:na , color=red)

ShortCrossesAboveLong = false

ShortAboveLong = false

PriceCrossesAboveShort = false

PriceAboveShort = false

PriceCrossesAboveLong = false

PriceAboveLong = false

PriceAboveBoth = false

PriceBelowBoth = false

ShortCrossesAboveLong := crossover(per_ma_short, per_ma_long)

ShortAboveLong := per_ma_short > per_ma_long

PriceCrossesAboveShort := ( close > per_ma_short or high > per_ma_short ) and low < per_ma_short

PriceAboveShort := close > per_ma_short or high > per_ma_short

PriceCrossesAboveLong := ( close > per_ma_long or high > per_ma_long ) and low < per_ma_long

PriceAboveLong := close > per_ma_long or high > per_ma_long

PriceAboveBoth := ( close > per_ma_long or high > per_ma_long ) and (close > per_ma_short or high > per_ma_short )

PriceBelowBoth := ( close < per_ma_long or low < per_ma_long ) and (close < per_ma_short or low < per_ma_short )

maBuy = ma_use ? ( ma_detector=="Short Crosses Above Long"?ShortCrossesAboveLong:

ma_detector=="Short Above Long"?ShortAboveLong:

ma_detector=="Price Cross Above Short"?PriceCrossesAboveShort:

ma_detector=="Price Above Short"?PriceAboveShort:

ma_detector=="Price Crosses Above Long"?PriceCrossesAboveLong:

ma_detector=="Price Above Long"?PriceAboveLong:

ma_detector=="Price Above Both"?PriceAboveBoth:

ma_detector=="Price Below Both"?PriceBelowBoth:

false ) : true

//VWAP

var_vwap = vwap(hlc3)

per_vwap = vwap_useRes?request.security(syminfo.tickerid,vwap_candle_period,var_vwap):var_vwap

PriceCrossAbove = false

PriceAbove = false

PriceCrossBelow = false

PriceBelow = false

PriceCrossAbove := ( close > per_vwap or high > per_vwap ) and low < per_vwap

PriceAbove := close > per_vwap or high > per_vwap

PriceCrossBelow := ( close < per_vwap or low < per_vwap ) and high > per_vwap

PriceBelow := close < per_vwap or low < per_vwap

vwapBuy = false

vwapBuy := vwap_use ?(

vwap_detector=="Price Cross Above"?PriceCrossAbove:

vwap_detector=="Price Above"?PriceAbove:

vwap_detector=="Price Cross Below"?PriceCrossBelow:

vwap_detector=="Price Below"?PriceBelow:false ) : true

//PC

price_change = (close - close[1])/close[1]*100

per_price_change = pc_useDifferentRes?request.security(syminfo.tickerid, pc_candle_period, price_change):price_change

pcBuy = false

pcBuy := pc_use ? ( per_price_change < pc_change ) : true

///////////////////////////////////////////////

// SELL STRATEGIES LOGIC

///////////////////////////////////////////////

//SELL RSI

sell_rsi = rsi(source_main, sell_rsi_length)

sell_per_rsi = sell_rsi_useDifferentRes?request.security(syminfo.tickerid, sell_rsi_candle_period, sell_rsi):sell_rsi

sell_rsiBelow = false

sell_rsiCrossBelow = false

sell_rsiCrossAbove = false

sell_rsiAbove = false

sell_rsiBelow := sell_per_rsi<sell_rsi_overbought

sell_rsiCrossBelow := crossunder(sell_per_rsi, sell_rsi_overbought)

sell_rsiCrossAbove := crossover(sell_per_rsi, sell_rsi_overbought)

sell_rsiAbove := sell_per_rsi>sell_rsi_overbought

sell_rsiBuy = sell_rsi_use ? (

sell_rsi_detector=="Signal Below Overbought"?sell_rsiBelow:

sell_rsi_detector=="Cross Below Overbought"?sell_rsiCrossBelow:

sell_rsi_detector=="Cross Above Overbought"?sell_rsiCrossAbove:

sell_rsi_detector=="Signal Above Overbought"?sell_rsiAbove:

false ) : true

//SELL STOCH

sell_stoch_k = variant(sell_stoch_type_sk, stoch(source_main, high, low, sell_stoch_length_fk), sell_stoch_length_sk)

sell_stoch_d = variant(sell_stoch_type_sd, sell_stoch_k, sell_stoch_length_sd)

sell_per_stoch_k = sell_stoch_useDifferentRes?request.security(syminfo.tickerid, sell_stoch_candle_period, sell_stoch_k):sell_stoch_k

sell_per_stoch_d = sell_stoch_useDifferentRes?request.security(syminfo.tickerid, sell_stoch_candle_period, sell_stoch_d):sell_stoch_d

sell_stochAbove = false

sell_stochBelow = false

sell_stochCrossAbove = false

sell_stochAbove := sell_per_stoch_k>sell_stoch_overbought

sell_stochBelow := sell_per_stoch_k<sell_stoch_overbought

sell_stochCrossAbove := crossover(sell_per_stoch_k, sell_stoch_overbought)

sell_stochBuy = sell_stoch_use ? (

sell_stoch_detector=="Signal Above Overbought"?sell_stochAbove:

sell_stoch_detector=="Signal Below Overbought"?sell_stochBelow:

sell_stoch_detector=="Cross Above Overbought"?sell_stochCrossAbove:

false ) : true

//SELL STOCHRSI

sell_stochrsi_rsi = rsi(source_main, sell_stochrsi_len)

sell_stochrsi_stoch_k = sma(stoch(sell_stochrsi_rsi, sell_stochrsi_rsi, sell_stochrsi_rsi, sell_stochrsi_stoch), sell_stochrsi_length_fk)

sell_stochrsi_stoch_d = sma(sell_stochrsi_stoch_k, sell_stochrsi_length_sd)

sell_per_stochrsi_k = sell_stochrsi_useDifferentRes?request.security(syminfo.tickerid, sell_stochrsi_candle_period, sell_stochrsi_stoch_k):sell_stochrsi_stoch_k

sell_per_stochrsi_d = sell_stochrsi_useDifferentRes?request.security(syminfo.tickerid, sell_stochrsi_candle_period, sell_stochrsi_stoch_d):sell_stochrsi_stoch_d

sell_stochrsiKDCrossOverbought = false

sell_stochrsiKDCross = false

sell_stochrsiKCrossAboveOverbought = false

sell_stochrsiKCrossBelowOverbought = false

sell_stochrsiKBelowOverbought = false

sell_stochrsiKAboveOverbought = false

sell_stochrsiKDCrossOverbought := crossover(sell_per_stochrsi_k, sell_per_stochrsi_d) and sell_per_stochrsi_k>sell_stochrsi_overbought

sell_stochrsiKDCross := crossover(sell_per_stochrsi_k, sell_per_stochrsi_d)

sell_stochrsiKCrossAboveOverbought := crossover(sell_per_stochrsi_k, sell_stochrsi_overbought)

sell_stochrsiKCrossBelowOverbought := crossunder(sell_per_stochrsi_k, sell_stochrsi_overbought)

sell_stochrsiKBelowOverbought := sell_per_stochrsi_k<sell_stochrsi_overbought

sell_stochrsiKAboveOverbought := sell_per_stochrsi_k>sell_stochrsi_overbought

sell_stochrsiBuy = sell_stochrsi_use ? (

sell_stochrsi_detector=="K Cross Below D and Overbought"?sell_stochrsiKDCrossOverbought:

sell_stochrsi_detector=="K Cross Below D"?sell_stochrsiKDCross:

sell_stochrsi_detector=="K Cross Above Overbought"?sell_stochrsiKCrossAboveOverbought:

sell_stochrsi_detector=="K Cross Below Overbought"?sell_stochrsiKCrossBelowOverbought:

sell_stochrsi_detector=="K Below Overbought"?sell_stochrsiKBelowOverbought:

sell_stochrsi_detector=="K Above Overbought"?sell_stochrsiKAboveOverbought:

false ) : true

//SELL CCI

sell_per_cci = calc_cci(hlc3, sell_cci_len, sell_cci_candle_period)

sell_cciBelow = false

sell_cciCrossBelow = false

sell_cciCrossAbove = false

sell_cciAbove = false

sell_cciBelow := sell_per_cci<sell_cci_treshold

sell_cciCrossBelow := crossunder(sell_per_cci, sell_cci_treshold)

sell_cciCrossAbove := crossover(sell_cci_treshold, sell_per_cci)

sell_cciAbove := sell_per_cci>sell_cci_treshold

sell_cciBuy = sell_cci_use ? (

sell_cci_detector=="Signal Below Treshold"?sell_cciBelow:

sell_cci_detector=="Signal Cross Belove Treshold"?sell_cciCrossBelow:

sell_cci_detector=="Signal Cross Above Treshold"?sell_cciCrossAbove:

sell_cci_detector=="Signal Above Treshold"?sell_cciAbove:

false ) : true

//SELL MACD

sell_fastMA = ema(close, sell_macd_fast)

sell_slowMA = ema(close, sell_macd_slow)

sell_macd = sell_fastMA - sell_slowMA

sell_signal = sma(sell_macd, sell_macd_signal)

sell_delta = sell_macd - sell_signal

sell_outmacd = request.security(syminfo.tickerid, sell_macd_candle_period, sell_macd)

sell_outsignal = request.security(syminfo.tickerid, sell_macd_candle_period, sell_signal)

sell_outdelta = request.security(syminfo.tickerid, sell_macd_candle_period, sell_delta)

sell_plot_macd = sell_macd_useDifferentRes?sell_outmacd:sell_macd

sell_plot_signal = sell_macd_useDifferentRes?sell_outsignal:sell_signal

sell_plot_delta = sell_macd_useDifferentRes?sell_outdelta:sell_delta

sell_MACDCrossBelowSignal = false

sell_CenterlineCrossUpwards = false

sell_CenterlineCrossDownwards = false

sell_MACDAboveSignal = false

sell_MACDBelowSignal = false

sell_MACDAboveTreshold = false

sell_MACDBelowTreshold = false

sell_MACDCrossBelowSignal := crossover(sell_plot_signal, sell_plot_macd)

sell_CenterlineCrossUpwards := crossover(sell_plot_delta, 0.0)

sell_CenterlineCrossDownwards := crossunder(sell_plot_delta, 0.0)

sell_MACDAboveSignal := sell_plot_macd > sell_plot_signal

sell_MACDBelowSignal := sell_plot_macd < sell_plot_signal

sell_MACDAboveTreshold := sell_plot_macd > sell_macd_treshold

sell_MACDBelowTreshold := sell_plot_macd < sell_macd_treshold

sell_macdBuy=sell_macd_use ? (

sell_macd_detector=="MACD Cross Below Signal"?sell_MACDCrossBelowSignal:

sell_macd_detector=="Centerline Cross Upwards"?sell_CenterlineCrossUpwards:

sell_macd_detector=="Centerline Cross Downwards"?sell_CenterlineCrossDownwards:

sell_macd_detector=="MACD above Signal"?sell_MACDAboveSignal:

sell_macd_detector=="MACD below Signal"?sell_MACDBelowSignal:

sell_macd_detector=="MACD above Treshold"?sell_MACDAboveTreshold:

sell_macd_detector=="MACD below Treshold"?sell_MACDBelowTreshold:

false ) : true

//SELL BB

sell_bb_basis = variant(bb_type, source_main, sell_bb_length)

sell_bb_dev = sell_bb_std * stdev(source_main, sell_bb_length)

sell_bb_upper = sell_bb_basis + sell_bb_dev

sell_bb_lower = sell_bb_basis - sell_bb_dev

sell_per_lower_bb = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_lower):sell_bb_lower

sell_per_upper_bb = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_upper):sell_bb_upper

sell_per_bb_basis = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_basis):sell_bb_basis

sell_bbBelow = false

sell_bbCrossBelow = false

sell_bbCrossAbove = false

sell_bbAbove = false

sell_bbBelow := sell_per_upper_bb>close or sell_per_upper_bb>low

sell_bbAbove := sell_per_upper_bb<high or sell_per_upper_bb<close

sell_bbCrossAbove := crossover(source_main, sell_per_upper_bb)

sell_bbCrossBelow := crossunder(source_main, sell_per_upper_bb)

sell_bbBuy = sell_bb_use ? (

sell_bb_detector=="Price Cross Below"?sell_bbCrossBelow:

sell_bb_detector=="Price Below"?sell_bbBelow:

sell_bb_detector=="Price Cross Above"?sell_bbCrossAbove:

sell_bb_detector=="Price Above"?sell_bbAbove:false ) : true

//SELL MA Calculation

sell_ma_short = variant(sell_ma_type, source_main, sell_ma_length_short)

sell_ma_long = variant(sell_ma_type, source_main, sell_ma_length_long)

sell_per_ma_short = sell_ma_useRes?request.security(syminfo.tickerid, sell_ma_candle_period, sell_ma_short):sell_ma_short

sell_per_ma_long = sell_ma_useRes?request.security(syminfo.tickerid, sell_ma_candle_period, sell_ma_long ):sell_ma_long

sell_p1ma = plot(sell_ma_use?sell_per_ma_short:na, color=green)

sell_p2ma = plot(sell_ma_use?sell_per_ma_long:na , color=red)

sell_ShortCrossesBelowLong = false

sell_ShortBelowLong = false

sell_ShortAboveLong = false

sell_PriceCrossesBelowShort = false

sell_PriceBelowShort = false

sell_PriceCrossesBelowLong = false

sell_PriceBelowLong = false

sell_PriceAboveBoth = false

sell_PriceBelowBoth = false

sell_ShortCrossesBelowLong := crossunder(sell_per_ma_short, sell_per_ma_long)

sell_ShortBelowLong := sell_per_ma_short < sell_per_ma_long

sell_ShortAboveLong := sell_per_ma_short > sell_per_ma_long

sell_PriceCrossesBelowShort := ( close > sell_per_ma_short or high > sell_per_ma_short ) and low < sell_per_ma_short

sell_PriceBelowShort := close > sell_per_ma_short or high > sell_per_ma_short

sell_PriceCrossesBelowLong := ( close > sell_per_ma_long or high > sell_per_ma_long ) and low < sell_per_ma_long

sell_PriceBelowLong := close > sell_per_ma_long or high > sell_per_ma_long

sell_PriceAboveBoth := ( close > sell_per_ma_long or high > sell_per_ma_long ) and (close > sell_per_ma_short or high > sell_per_ma_short )

sell_PriceBelowBoth := ( close < sell_per_ma_long or low < sell_per_ma_long ) and (close < sell_per_ma_short or low < sell_per_ma_short )

sell_maBuy = sell_ma_use ? (

sell_ma_detector=="Short Crosses Below Long"?sell_ShortCrossesBelowLong:

sell_ma_detector=="Short Below Long"?sell_ShortBelowLong :

sell_ma_detector=="Price Cross Below Short"?sell_PriceCrossesBelowShort:

sell_ma_detector=="Price Below Short"?sell_PriceBelowShort:

sell_ma_detector=="Price Cross Below Long"?sell_PriceBelowShort:

sell_ma_detector=="Price Below Long"?sell_PriceCrossesBelowLong:

sell_ma_detector=="Price Above Both"?sell_PriceAboveBoth:

sell_ma_detector=="Price Below Both"?sell_PriceBelowBoth:

false ) : true

//SELL VWAP

sell_var_vwap = vwap(hlc3)

sell_per_vwap = sell_vwap_useRes?request.security(syminfo.tickerid,sell_vwap_candle_period,sell_var_vwap):sell_var_vwap

sell_PriceCrossAbove = false

sell_PriceAbove = false

sell_PriceCrossBelow = false

sell_PriceBelow = false

sell_PriceCrossAbove := ( close > sell_per_vwap or high > sell_per_vwap ) and low < sell_per_vwap

sell_PriceAbove := close > sell_per_vwap or high > sell_per_vwap

sell_PriceCrossBelow := ( close < sell_per_vwap or low < sell_per_vwap ) and high > sell_per_vwap

sell_PriceBelow := close < sell_per_vwap or low < sell_per_vwap

sell_vwapBuy = false

sell_vwapBuy := sell_vwap_use ?(

sell_vwap_detector=="Price Cross Above"?sell_PriceCrossAbove:

sell_vwap_detector=="Price Above"?sell_PriceAbove:

sell_vwap_detector=="Price Cross Below"?sell_PriceCrossBelow:

sell_vwap_detector=="Price Below"?sell_PriceBelow:false ) : true

//PC

sell_price_change = (close - close[1])/close[1]*100

sell_per_price_change = sell_pc_useDifferentRes?request.security(syminfo.tickerid, sell_pc_candle_period, sell_price_change):sell_price_change

sell_pcBuy = false

sell_pcBuy := sell_pc_use ? ( sell_per_price_change > sell_pc_change ) : true

///////////////////////////////////////////////

// MAIN LOGIC

///////////////////////////////////////////////

allBuy = false

allBuy := rsiBuy and bbBuy and stochBuy and stochrsiBuy and cciBuy and macdBuy and maBuy and vwapBuy and pcBuy

allSell = false

allSell := sell_rsiBuy and sell_bbBuy and sell_stochBuy and sell_stochrsiBuy and sell_cciBuy and sell_macdBuy and sell_maBuy and sell_vwapBuy and sell_pcBuy

buy = allBuy

sell = (

sell_pc_use?sell_pcBuy:false or

sell_vwap_use?sell_vwapBuy:false or

sell_rsi_use?sell_rsiBuy:false or

sell_ma_use?sell_maBuy:false or

sell_bb_use?sell_bbBuy:false or

sell_cci_use?sell_cciBuy:false or

sell_macd_use?sell_macdBuy:false or

sell_stoch_use?sell_stochBuy:false or

sell_stochrsi_use?sell_stochrsiBuy:false ) ? true : false

//////////////////////////////////////////////////////////////////////////////////////////

//*** This Trade Management Section of code is a modified version of that found in ***//

//*** "How to automate this strategy for free using a chrome extension" by CryptoRox ***//

//*** Modifications and tradeState engine by JustUncleL. ***//

//////////////////////////////////////////////////////////////////////////////////////////

//

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

// * https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

// * https://www.tradingview.com/u/pbergden/ *//

// * Modifications made by JustUncleL*//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(9, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(20, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

//////////////////////////

//* Strategy Component *//

//////////////////////////

high_ = high

low_ = low

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

//

//fastExit = input(false,title="Use Opposite Trade as a Close Signal")

//clrBars = input(true,title="Colour Candles to Trade Order state")

fastExit = true

clrBars = false

//orderType = input("LongsOnly",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

orderType = "LongsOnly"

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//////////////////////////////////////////////////

//* Put Entry and special Exit conditions here *//

//////////////////////////////////////////////////

//////////////////////////

//* tradeState Engine *//

INACTIVE = 0 // No trades open

ACTIVELONG = 1 // Long Trade Started

ACTIVESHORT = -1 // Short Trade Started

//

//////////////////////////

// Keep track of current trade state

longClose = false, longClose := nz(longClose[1],false)

shortClose = false, shortClose := nz(shortClose[1],false)

tradeState = INACTIVE, tradeState := nz(tradeState[1])

tradeState := tradeState==INACTIVE ? buy==1 and (barstate.isconfirmed or barstate.ishistory) and isLong and not longClose and not shortClose? ACTIVELONG :

sell==1 and (barstate.isconfirmed or barstate.ishistory) and isShort and not longClose and not shortClose? ACTIVESHORT :

tradeState : tradeState

//Entry Triggers, this happens when tradeState changes from neutral to active

longCondition = false

shortCondition = false

longCondition := change(tradeState) and tradeState==ACTIVELONG

shortCondition := change(tradeState) and tradeState==ACTIVESHORT

if orderType=="Flip"

temp = longCondition

longCondition := shortCondition

shortCondition := temp

//end if

//SPECIAL Exit Condition.

// Exit on Average Fast/Slow MA cross over, force no repaint

longExitC = sell ? 1 : 0

shortExitC = 0

// Exit Trigger without SL set and trade Actine

longExit = change(longExitC) and longExitC==1 and tradeState==1

shortExit = change(shortExitC) and shortExitC==1 and tradeState==-1

// -- debugs

//plotchar(tradeState,"tradeState at Event",location=location.bottom, color=na)

//plotchar(longCondition, title="longCondition",color=na)

//plotchar(shortCondition, title="shortCondition",color=na)

//plotchar(tradeState, title="tradeState",color=na)

// -- /debugs

/////////////////////////////////////

//======[ Deal Entry Prices ]======//

/////////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

//////////////////////////////////

//======[ Position State ]======//

//////////////////////////////////

in_longCondition = tradeState == ACTIVELONG

in_shortCondition = tradeState == ACTIVESHORT

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

// This Trailing Stop Starts as soon as trade is Started

isTS = input(false, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

// Initialise and track highs and lows

short_ts = false, long_ts = false

last_high = 0.0, last_high := nz(last_high[1],na)

last_low = 0.0, last_low := nz(last_low[1],na)

last_high_short = 0.0, last_high_short := nz(last_high_short[1],na)

last_low_long = 0.0, last_low_long := nz(last_low_long[1],na)

// LONGS TSL

if in_longCondition == true

last_high := (na(last_high) or high_ > last_high) ? high_ : last_high

last_low_long := (na(last_low_long) or low_ < last_low_long) ? low_ : last_low_long

long_ts := isTS and (low_ <= last_high - last_high * ts)

//else

if in_longCondition == false

long_ts := false

last_high := na

last_low_long := na

//end if

//SHORTS TSL

if in_shortCondition == true

last_low := (na(last_low) or low_ < last_low) ? low_ : last_low

last_high_short := (na(last_high_short) or high_ > last_high_short) ? high_ : last_high_short

short_ts := isTS and (high_ >= last_low + last_low * ts)

if in_shortCondition == false

short_ts := false

last_low := na

last_high_short := na

//end if

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(1.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(0.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and in_longCondition and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and in_shortCondition and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(true, "Stop Loss")

sl = input(2.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and in_longCondition and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and in_shortCondition and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////////////////

//======[ Stop on Opposite ]======//

////////////////////////////////////

//NOTE Short exit signal is non-repainting, no need to force it, if Pyramiding keep going

long_sos = (fastExit or (not isTS and not isSL)) and longExit and in_longCondition

short_sos = (fastExit or (not isTS and not isSL)) and shortExit and in_shortCondition

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

// Create a single close for all the different closing conditions, all conditions here are non-repainting

longClose := isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose := isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

//LONGS

plot(isTS and in_longCondition?

last_high - last_high * ts : na, "Buy Trailing", fuchsia, style=2, linewidth=1,offset=1)

plot(isTP and in_longCondition and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=1,offset=1)

plot(isTP and in_longCondition and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Buy Trailing", black, style=2, linewidth=1,offset=1)

plot(isSL and in_longCondition and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=1,offset=1)

//SHORTS

plot(isTS and in_shortCondition?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=1,offset=1)

plot(isTP and in_shortCondition and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=1,offset=1)

plot(isTP and in_shortCondition and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=1,offset=1)

plot(isSL and in_shortCondition and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=1,offset=1)

// Colour code the candles for Profit/Loss: Profit=LIGHT colour, Loss=DARK colour

bclr = not clrBars ? na : tradeState==INACTIVE ? GRAY :

in_longCondition ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

// //LONGS

// plotshape(longCondition?close:na, title="Buy", color=green, textcolor=green, transp=0,

// style=shape.triangleup, location=location.belowbar, size=size.small,text="Buy",offset=0)

// plotshape(longClose?close:na, title="Sell", color=longCloseCol, textcolor=white, transp=0,

// style=shape.labeldown, location=location.abovebar, size=size.small,text="Sell",offset=0)

// //SHORTS

// plotshape(shortCondition?close:na, title="Short", color=red, textcolor=red, transp=0,

// style=shape.triangledown, location=location.abovebar, size=size.small,text="SHORT",offset=0)

// plotshape(shortClose?close:na, title="Short Close", color=shortCloseCol, textcolor=white, transp=0,

// style=shape.labelup, location=location.belowbar, size=size.small,text="Short",offset=0)

// Autoview alert syntax - This assumes you are trading coins BUY and SELL on Binance Exchange

// WARNING*** Only use Autoview to automate a strategy after you've sufficiently backtested and forward tested the strategy.

// You can learn more about the syntax here:

// http://autoview.with.pink/#syntax and you can watch this video here: https://www.youtube.com/watch?v=epN5Tjinuxw

// For the opens you will want to trigger BUY orders on LONGS (eg ETHBTC) with alert option "Once Per Bar Close"

// and SELL orders on SHORTS (eg BTCUSDT)

// b=buy q=0.001 e=binance s=ethbtc u=currency t=market ( LONG )

// or b=sell q=0.001 e=binance s=btcusdt t=market ( SHORT )

//alertcondition(longCondition, "Open Long", "LONG")

//alertcondition(shortCondition, "Open Short", "SHORT")

// For the closes you will want to trigger these alerts on condition with alert option "Once Per Bar"

// (NOTE: with Renko you can only use "Once Per Bar Close" option)

// b=sell q=99% e=binance s=ethbtc t=market ( CLOSE LONGS )

// or b=buy q=99% e=binance s=btcusdt u=currency t=market ( CLOSE SHORTS )

// This gets it as it happens and typically results in a better exit live than in the backtest.

// It works really well for counteracting some market slippage

//alertcondition(longClose, "Close Longs", "CLOSE LONGS")

//alertcondition(shortClose, "Close Shorts", "CLOSE SHORTS")

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose )

//if testPeriod() and isShort

// strategy.entry("Short", 0, when=shortCondition)

// strategy.close("Short", when=shortClose )

// --- Debugs

//plotchar(longExit,title="longExit",location=location.bottom,color=na)

//plotchar(longCondition,title="longCondition",location=location.bottom,color=na)

//plotchar(in_longCondition,title="in_longCondition",location=location.bottom,color=na)

//plotchar(longClose,title="longClose",location=location.bottom,color=na,color=na)

//plotchar(buy,title="buy",location=location.bottom,color=na)

// --- /Debugs

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or shortClose

tradeState := INACTIVE

in_longCondition := false

in_shortCondition := false

last_low := na

last_low_long := na

last_high := na

last_high_short := na

// EOF

//-- SUPPORT/RESISTANCE LINES by:ByDipsOnly -----------------------------------------------------------------------------

sr_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ S/R Lines ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

show_SPlines_input = input(true, "Show S/R Lines")

tf = timeframe.period

vamp = input(title="VolumeMA", defval=6)

vam = sma(volume, vamp)

upside = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

downside = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

calcup() =>

fractalup = na

fractalup := upside ? high[3] : fractalup[1]

calcdown() =>

fractaldown = na

fractaldown := downside ? low[3] : fractaldown[1]

fuptf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, calcup())

fdowntf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, calcdown())

plotup = show_SPlines_input==true?fuptf:na

plotdown = show_SPlines_input==true?fdowntf:na

plot(plotup, "FractalUp", color=yellow, linewidth=1, style=cross, transp=0, offset =-3, join=false)

plot(plotdown, "FractalDown", color=blue, linewidth=1, style=cross, transp=0, offset=-3, join=false)

fractalupalert = na

fractalup = na

fractalup := upside ? high[3] : fractalup[1]

fractalupalert := high[3] > open or fractalup[1] > open

alertcondition(show_SPlines_input?fractalupalert:na, title="R Line", message='R Line')

//-- END SUPPORT/RESISTANCE LINES -------------------------------------------------------------------------------------------