স্টোকাস্টিক সুপারট্রেন্ড ট্রেইলিং স্টপ ট্রেডিং কৌশল

ওভারভিউ

এটি একটি ট্রেডিং কৌশল যা একাধিক প্রযুক্তিগত সূচককে একত্রিত করে। সুপারট্রেন্ড, স্টোক্যাস্টিক, 200-দিনের মুভিং এভারেজ এবং এটিআর স্টপগুলি মূলত ট্রেডিং সিগন্যাল সনাক্ত করতে এবং স্টপ লস সেট করার জন্য ব্যবহৃত হয়। এই কৌশলটি মাঝারি এবং দীর্ঘ লাইনের ট্রেন্ড ট্রেডিংয়ের জন্য উপযুক্ত এবং ঝুঁকি কার্যকরভাবে নিয়ন্ত্রণ করতে পারে।

কৌশল নীতি

যখন স্টোক্যাস্টিক কে লাইন ওভারবয় এলাকা থেকে নেমে আসে, সুপারট্রেন্ড নির্দেশ করে যে প্রবণতাটি উপরে রয়েছে, যখন দাম 200 দিনের চলমান গড়কে অতিক্রম করে, তখন বেশি করুন; যখন স্টোক্যাস্টিক কে লাইন ওভারসেল এলাকা থেকে উঠে আসে, সুপারট্রেন্ড নির্দেশ করে যে প্রবণতাটি নীচে রয়েছে, যখন দাম 200 দিনের চলমান গড়কে অতিক্রম করে, তখন শূন্য করুন। লেনদেনের পরে, এটিআর নির্দেশক ব্যবহার করে গতিশীল স্টপ লস সেট করুন।

সুনির্দিষ্টভাবে বলতে গেলে, যখন স্টোক্যাস্টিক কে 80 অতিক্রম করে, তখন এটি একটি ওভার-বই সংকেত হিসাবে বিবেচিত হয়; যখন স্টোক্যাস্টিক কে 20 অতিক্রম করে, তখন এটি একটি ওভার-বিক্রয় সংকেত হিসাবে বিবেচিত হয়। সুপারট্রেন্ড সূচকটি মূল্যের প্রবণতার দিক নির্ধারণ করে, যখন সুপারট্রেন্ড নির্দেশিত হয় তখন দামটি উত্থানের প্রবণতায় থাকে, যখন সুপারট্রেন্ড নির্দেশিত হয় তখন দামটি হ্রাসের প্রবণতায় থাকে। এটিআর সূচকটি প্রকৃত তরঙ্গের পরিমাণ গণনা করতে ব্যবহৃত হয়।

একাধিক সংকেত ট্রিগার করার শর্তঃ স্টোক্যাস্টিক কে লাইন সুপার-বয় অঞ্চল থেকে নিচে (<80); সুপারট্রেন্ড নির্দেশ করে উপরে; দাম 200 দিনের চলমান গড়ের উপরে।

স্টোকাসটিক কে লাইন সুপার সেল এলাকা থেকে ঊর্ধ্বমুখী (২০ এর ঊর্ধ্বমুখী), সুপারট্রেন্ড নির্দেশ করে নিম্নমুখী, দাম ২০০ দিনের মুভিং এভারেজের নিচে।

প্রবেশের পরে, মূল্যের ওঠানামা নিয়ন্ত্রণের ঝুঁকি অনুসরণ করতে এটিআর স্টপ সেট করুন। একাধিক স্টপ সর্বনিম্ন মূল্য হ্রাস করে এটিআর মান গুণিত ফ্যাক্টর; খালি স্টপ সর্বোচ্চ মূল্যের সাথে এটিআর মান গুণিত ফ্যাক্টর।

কৌশলগত সুবিধা

এই কৌশলটি ট্রেন্ডের দিকনির্দেশনা এবং প্রবেশের সময় নির্ধারণের জন্য বিভিন্ন সূচকের সাথে মিলিত হয়, যা মিথ্যা সংকেতগুলিকে কার্যকরভাবে ফিল্টার করতে পারে। একই সাথে, এটিআর গতিশীল ট্র্যাকিং স্টপ লস ব্যবহার করে, বাজারের ওঠানামা অনুযায়ী ঝুঁকি নিয়ন্ত্রণ করতে পারে এবং সর্বাধিক পরিমাণে অর্থ সংরক্ষণ করতে পারে।

এই কৌশলটি সহজ সরল গড়ের মতো প্রবণতা অনুসরণকারী কৌশলগুলির তুলনায় বিপরীত বিন্দুগুলিকে আরও ভালভাবে ধরতে পারে। এটিআর গতিশীল স্টপগুলি একক স্টপ পদ্ধতির তুলনায় আরও নমনীয় হতে পারে। সুতরাং, এই কৌশলটির সামগ্রিকভাবে একটি ভাল ঝুঁকি-লাভের অনুপাত রয়েছে।

কৌশলগত ঝুঁকি

এই কৌশলটি মূলত সূচকের বিচারের উপর নির্ভর করে, যদি সূচকটি ভুল সংকেত দেয় তবে এটি বিপরীত অপারেশনের কারণে ক্ষতির কারণ হতে পারে। তাছাড়া, কাঁপুনির ক্ষেত্রে, স্টপ লসটি ঘন ঘন ট্রিগার করা যেতে পারে, যা ক্ষতির কারণ হতে পারে।

উপরন্তু, এটিআর স্টপ যদিও স্টপ পয়েন্টকে ওলটপালট অনুসারে সামঞ্জস্য করতে পারে, তবে স্টপ পয়েন্টটি আঘাত হানার সম্ভাবনাকে পুরোপুরি এড়াতে পারে না। দামের উঁচুতে উঠলে স্টপ ওয়ালগুলি সরাসরি ট্রিগার হতে পারে।

কৌশল অপ্টিমাইজেশন

এই কৌশলটি নিম্নলিখিত মাত্রাগুলি থেকে অপ্টিমাইজ করা যেতে পারেঃ

সূচক প্যারামিটারগুলি সামঞ্জস্য করুন এবং ক্রয়-বিক্রয় সংকেতের নির্ভুলতা অনুকূলিত করুন। উদাহরণস্বরূপ, স্টোক্যাস্টিক সূচক যা বিভিন্ন প্যারামিটার পরীক্ষা করতে পারে, বা সুপারট্রেন্ড সূচকের জন্য এটিআর পিরিয়ড এবং গুণিতক প্যারামিটারগুলি সামঞ্জস্য করুন।

অন্যান্য স্টপ পদ্ধতির কার্যকারিতা পরীক্ষা করুন। উদাহরণস্বরূপ, এটিআর স্টপের চেয়ে আরও নমনীয় স্বনির্ধারিত স্মার্ট স্টপ অ্যালগরিদম চেষ্টা করা যেতে পারে, বা স্টপটি একটি চলমান স্টপ পজিশনের সাথে অনুসরণ করার বিষয়টি বিবেচনা করা যেতে পারে।

ফিল্টারিংয়ের শর্তগুলি যুক্ত করুন, আরও নির্ভরযোগ্য পরিস্থিতিতে প্রবেশ করুন। উদাহরণস্বরূপ, ট্রানজেকশন ভলিউম এনার্জি সূচকগুলির মতো ফিল্টারগুলি যুক্ত করা যেতে পারে, যখন ভলিউমটি অপর্যাপ্ত থাকে তখন সূচকের ভিত্তিতে ভুল প্রবেশ এড়ানো যায়।

তহবিল ব্যবস্থাপনা কৌশল অনুকূলিতকরণ, যেমন গতিশীলভাবে পজিশনের পরিবর্তন

সারসংক্ষেপ

Stochastic Supertrend ট্র্যাকিং স্টপ লস ট্রেডিং কৌশলটি প্রবণতা দিকনির্দেশের জন্য একাধিক সূচক ব্যবহার করে এবং এটিআর স্মার্ট ট্র্যাকিং ব্যবহার করে ঝুঁকি নিয়ন্ত্রণের জন্য। এই কৌশলটি কার্যকরভাবে গোলমাল ফিল্টার করতে পারে এবং একটি ভাল ঝুঁকি-লাভের অনুপাত রয়েছে। আমরা এই কৌশলটি ক্রমাগত অপ্টিমাইজ করতে পারি, যেমন প্যারামিটারগুলি সামঞ্জস্য করা, স্টপ লস পদ্ধতি পরিবর্তন করা এবং ফিল্টার শর্তাদি যুক্ত করা, যাতে এটি আরও জটিল বাজারের পরিবেশের সাথে খাপ খাইয়ে নিতে পারে।

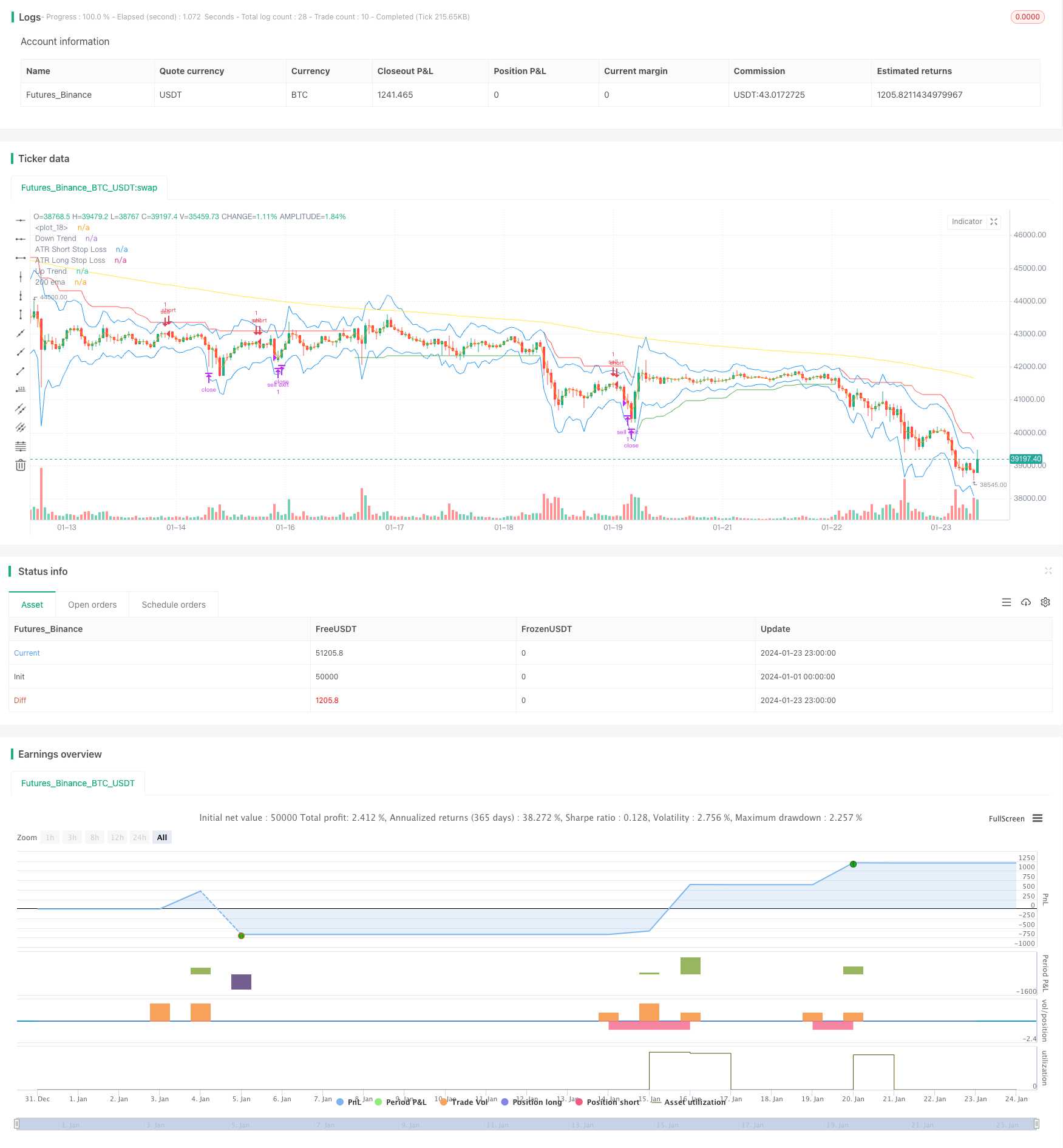

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © araamas

//@version=5

strategy("stoch supertrd atr 200ma", overlay=true, process_orders_on_close=true)

var B = 0

if strategy.position_size > 0 //to figure out how many bars away did buy order happen

B += 1

if strategy.position_size == 0

B := 0

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

ema = ta.ema(close, 200)

plot(ema, title="200 ema", color=color.yellow)

b = input.int(defval=14, title="length k%")

d = input.int(defval=3, title="smoothing k%")

s = input.int(defval=3, title="smoothing d%")

smooth_k = ta.sma(ta.stoch(close, high, low, b), d)

smooth_d = ta.sma(smooth_k, s)

////////////////////////////////////////////////////////////////////////////////

length = input.int(title="Length", defval=12, minval=1)

smoothing = input.string(title="Smoothing", defval="SMA", options=["RMA", "SMA", "EMA", "WMA"])

m = input(1.5, "Multiplier")

src1 = input(high)

src2 = input(low)

pline = input(true, "Show Price Lines")

col1 = input(color.blue, "ATR Text Color")

col2 = input(color.teal, "Low Text Color",inline ="1")

col3 = input(color.red, "High Text Color",inline ="2")

collong = input(color.teal, "Low Line Color",inline ="1")

colshort = input(color.red, "High Line Color",inline ="2")

ma_function(source, length) =>

if smoothing == "RMA"

ta.rma(source, length)

else

if smoothing == "SMA"

ta.sma(source, length)

else

if smoothing == "EMA"

ta.ema(source, length)

else

ta.wma(source, length)

a = ma_function(ta.tr(true), length) * m

x = ma_function(ta.tr(true), length) * m + src1

x2 = src2 - ma_function(ta.tr(true), length) * m

p1 = plot(x, title = "ATR Short Stop Loss", color=color.blue)

p2 = plot(x2, title = "ATR Long Stop Loss", color= color.blue)

///////////////////////////////////////////////////////////////////////////////////////////////

shortCondition = high < ema and direction == 1 and smooth_k > 80

if (shortCondition) and strategy.position_size == 0

strategy.entry("sell", strategy.short)

longCondition = low > ema and direction == -1 and smooth_k < 20

if (longCondition) and strategy.position_size == 0

strategy.entry("buy", strategy.long)

g = (strategy.opentrades.entry_price(0)-x2) * 2

k = (x - strategy.opentrades.entry_price(0)) * 2

if strategy.position_size > 0

strategy.exit(id="buy exit", from_entry="buy",limit=strategy.opentrades.entry_price(0) + g, stop=x2)

if strategy.position_size < 0

strategy.exit(id="sell exit", from_entry="sell",limit=strategy.opentrades.entry_price(0) - k, stop=x)

//plot(strategy.opentrades.entry_price(0) - k, color=color.yellow)

//plot(strategy.opentrades.entry_price(0) + g, color=color.red)