Trendfolgende MA Crossover-Handelsstrategie

Überblick

Diese Strategie ist eine Trend-Following-Trading-Strategie, die auf einem Moving Average basiert. Sie verwendet den Hull Moving Average mit drei verschiedenen Parameter-Sets, um die Richtung des Preistrends zu bestimmen, und kombiniert mit einem schnellen ATR-Filter, um eine potenzielle Trendwende vorzeitig zu erkennen. Sie gibt ein Kauf- oder Verkaufssignal aus, wenn sich drei schnelle oder langsame Gleichlinien aufwärts oder abwärts kreuzen. Die Strategie verfügt sowohl über eine mobile Stop-Loss- als auch eine mobile Stop-Stop-Funktion, um das Risiko effektiv zu kontrollieren.

Strategieprinzip

Die Strategie nutzt drei Hull Moving Averages, um eine Preisentwicklung zu bestimmen, darunter ein schneller Hull MA, ein mittelschneller Hull MA und ein langsamer Hull MA. Die Richtung des Trends wird anhand ihrer Kreuzung bestimmt:

Wenn die kurze Linie die mittlere Linie durchschreitet, zeigt dies, dass der Preis in eine steigende Tendenz eingetreten ist und ein Kaufsignal ausgesendet wird.

Wenn die kurze Linie die mittlere Linie durchbricht, zeigt dies, dass der Preis in einen Abwärtstrend eingetreten ist und ein Verkaufssignal ausgegeben wird.

Um die Sensitivität der Identifizierung von Trendwechseln zu erhöhen, wurde ein RSI-basierter schneller ATR-Filter eingeführt. Dieser Filter ist in der Lage, die Volatilität des Preises zu messen, und seine Werte ändern sich deutlich, wenn sich der Preiswandel ändert. Daher können wir den Preiswandel im Voraus anhand von Auf- und Abbruch der ATR-Filter bestimmen.

Die Filtr-Funktion implementiert die Berechnungslogik dieses schnellen ATR-Filters. Sie berechnet die Größe des ATR auf der Grundlage der Werte des RSI. Wenn die Werte des ATR die RSI-Kurve über- oder unterschreiten, kann dies eine Änderung der Preisentwicklung anzeigen.

Darüber hinaus werden in der Strategie mobile Stop-Loss- und mobile Stop-Off-Bedingungen festgelegt, die eine automatische Risikomanagement gemäß den eingestellten Stop-Loss- und Stop-Off-Prozentsätzen ermöglichen.

Analyse der Stärken

Die Verwendung von drei Hull MA-Gleichlinien zur Trendrichtung filtert effektiv Marktlärm und identifiziert mittlere und längere Trends

Der Einsatz von schnellen ATR-Filtern verbessert die Fähigkeit, eine Trendwende vorzeitig zu erkennen.

Automatische Erfassung von Trendwendechancen, rechtzeitige Anpassung der Positionen, ohne Verlust von Kauf und Verkauf

Die mobile Stop-Loss-Schaltfläche stellt ein dynamisches Gleichgewicht zwischen Risiko und Rendite her.

Anpassbare Parameter für verschiedene Märkte und Handelsarten

Risikoanalyse

MA-Kreuzungsstrategien sind anfällig für Mehrkopf-False- und Leerkopf-False-Signale, die mit einem ATR-Filter unterstützt werden müssen

In stark bewegten Märkten ist der MA anfällig für häufige Kreuzungen und die Entwicklung der ATR-Kurve sollte genau beobachtet werden

Zu kleine Stop-Loss-Punkte sind leicht zu stoppen, zu große und schwer zu kontrollierte Verluste. Die Parameter müssen je nach Situation angepasst werden

Diese Strategie ist besser geeignet für Trendbewegungen als für Erschütterungen.

Parameteroptimierung zur Auswahl der optimalen Kombination von MA- und ATR-Perioden zur Verringerung der Falschsignalrate

Optimierungsrichtung

Versuchen Sie, den MA-Typ in eine EMA-Variante wie DEMA oder TEMA umzuwandeln, um zu sehen, ob Sie mehr Lärm filtern können

ATR-Filter können mit Keltner-Kanal-MIDDLE-Leitung umgebaut werden, um die Verbesserung der Trendwende-Beschlüsse zu überprüfen

Verschiedene Kombinationen von MA-Parametern können getestet werden, um die optimale Parameterpaare zu finden

ATR-Zyklusparameter können getestet werden, um die optimale Glättung zu finden

Hinzufügbarer quantitativer Indikator, um die Wahrscheinlichkeit eines echten oder falschen Durchbruchs zu beurteilen

Tests, ob andere Indikatoren wie MACD hinzugefügt werden, um die Signalsicherheit zu erhöhen

Zusammenfassen

Die Strategie integriert die Funktionen des Moving Averages, um die Richtung des Trends zu bestimmen. Der ATR-Filter erkennt die Rückschläge im Voraus und verwaltet die Risiken der automatischen Stop-Loss-Stopps. Sie kann Trends automatisch verfolgen und die Rückschlagsmöglichkeiten rechtzeitig erfassen.

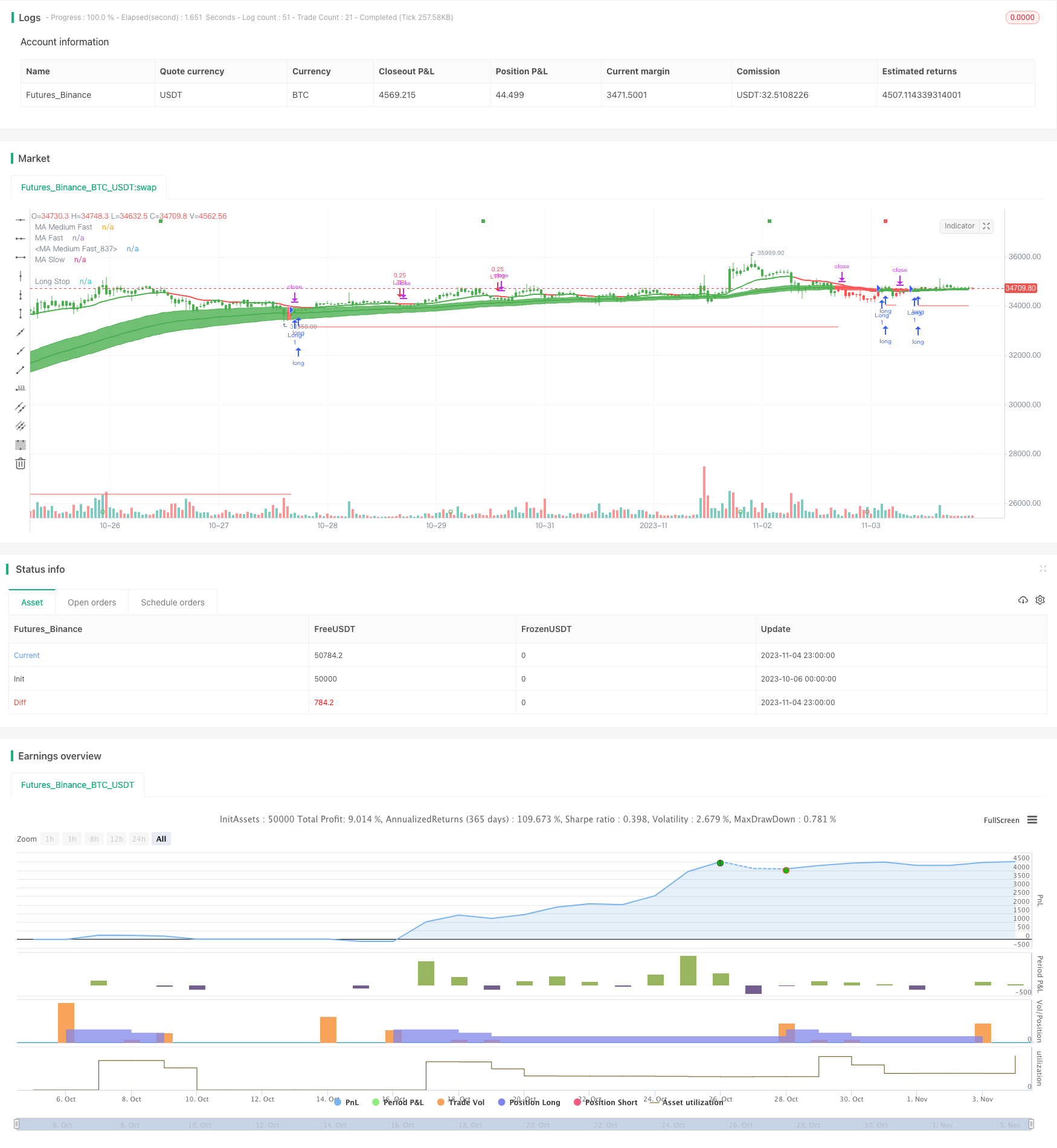

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//

//*** START of COMMENT OUT [Alerts]

//strategy(title="[Backtest]QQE Cross v6.0 by JustUncleL", shorttitle="[BT]QQEX v6.0", overlay=true,

// pyramiding=0, default_qty_value=1000, commission_value=0.1,

// commission_type=strategy.commission.percent, initial_capital=10000)

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [BackTest]

strategy(

title="[Alerts]QQE Cross v6.0 by JustUncleL",

shorttitle="[AL]QQEX v6.0",

overlay=true)

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2009, title="From Year")

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window = true // create function "within window of time"

trade_dir = input('Long Only', options=['Long Only', 'Short Only', 'Long and Short'], title='Trade Direction')

tp1_perc = input(25, step=0.25, minval=0, title='Take Profit Signal 1 Qty Percent')/100

tp2_perc = input(25, step=0.25, minval=0, title='Take Profit Signal 2 Qty Percent')/100

sl_perc = input(2, step=0.25, minval=0, title='Stop Loss Percent')/100

dir = trade_dir == 'Long Only' ? strategy.direction.long :

trade_dir == 'Short Only' ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(dir)

//*** END of COMMENT OUT [BackTest]

//

// Author: JustUncleL

// Date: 10-July-2016

// Version: v6, Major Release Nov-2018

//

// Description:

// A following indicator is Trend following that uses fast QQE crosses with Moving Averages

// for trend direction filtering. QQE or Qualitative Quantitative Estimation is based

// on the relative strength index (RSI), but uses a smoothing technique as an additional

// transformation. Three crosses can be selected (all selected by default):

// - Smooth RSI signal crossing ZERO (XZ)

// - Smooth RSI signal crossing Fast QQE line (XQ), this is like an early warning swing signal.

// - Smooth RSI signal exiting the RSI Threshhold Channel (XC), this is like a confirmed swing signal.

// An optimumal Smooth RSI threshold level is between 5% and 10% (default=10), it helps reduce

// the false swings.

// These signals can be selected to Open Short/Long and/or Close a trade, default is XC open

// trade and XQ (or opposite open) to Close trade.

//

// The (LONG/SHORT) alerts can be optionally filtered by the Moving Average Ribbons:

// - For LONG alert the Close must be above the fast MA Ribbon and

// fast MA Ribbon must be above the slow MA Ribbon.

// - For SHORT alert the Close must be below the fast MA Ribbon and

// fast MA Ribbon must be below the slow MA Ribbon.

// and/or directional filter:

// - For LONG alert the Close must be above the medium MA and the

// directional of both MA ribbons must be Bullish.

// - For SELL alert the Close must be below the medium MA and the

// directional of both MA ribbons must be Bearish.

//

// This indicator is designed to be used as a Signal to Signal trading BOT

// in automatic or semi-automatic way (start and stop when conditions are suitable).

// - For LONG and SHORT alerts I recommend you use "Once per Bar" alarm option

// - For CLOSE alerts I recommend you use "Once per Bar Close" alarm option

// (* The script has been designed so that long/short signals come at start of candles *)

// (* and close signals come at the end of candles *)

//

// Mofidifications:

// 6.0 - Major Release Version

// - Added second MA ribbon to help filter signals to the trend direction.

// - Modified Alert filtering to include second MA Ribbon

// - Change default settings to reflect Signal to Signal BOT parameters.

// - Removed older redunant alerts.

//

// 5.0 - Development series

//

// 4.1 - Fix bug with painting Buy/Sell arrows when non-repaint shunt mode selected.

// - Added option to alert just the first Buy/Sell alert after a trend swing

// - Added Long and Short Alarms. When combined with the "first Buy/Sell" in trend option,

// It is now possible to use this indicator to interface with AutoView

// or ProfitView. I suggest using the "QQEX XZ Alert" alarm to exit Long or Short

// trade. Use only "Once per bar Close" option for Alarms. This is not a full

// fledged trading BOT though with TP/SL settings.

//

// - Changed QQE defaults to be a bit smoother (14, 8, 5) instead of (6, 3, 2.618)

// which is more suited to Forex and Crypto trading.

//

// 4.0 - Added implied GPL copyright notice.

// - Changed defaults to use HullMAs instead of EMAs.

// 3.0 - No repaint on BUY/SELL alert, however, now trades should be taken when the BUY/SELL

// Alert is displayed. The alarm is still generated on the previous candle so you can

// still get a pre-warning, this enables you time to analyse the pending alert.

// - Added option to test success of alerted trades, highlight successful and failed trade bars

// and show simple stats: success rate and number of trades (out of 5000), this will help

// tune the settings for timeframe and currency PAIR.

// 2.0 - Added code to use the medium moving average (EMA20) rising/falling for additional

// trend direction filter.

// - Remove Moving Average cross over signals and other options not used in this indicator.

// - Added code to distinguish between the crosses, now only show Thresh Hold crosses as BUY/SELL

// alerts.

// - Modidied default settings to more well known MA's and slightly different QQE settings, these

// work well at lower timeframes.

// - Added circle plots at bottom of chart to show when actual BUY/SELL alerts occur.

// 1.0 - original

//

// References:

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

// - "QQE MT4 by glaz"

// Inspiration from:

// - http://www.forexstrategiesresources.com/binary-options-strategies-ii/189-aurora-binary-trading/

// - http://www.forexstrategiesresources.com/metatrader-4-trading-systems-v/652-qqe-smoothed-trading/

// - http://dewinforex.com/forex-indicators/qqe-indicator-not-quite-grail-but-accurately-defines-trend-and-flat.html

// - "Binary option trading by two previous bars" by radixvinni

//

//

// -----------------------------------------------------------------------------

// Copyright 2015 Glaz,JayRogers

//

// Copyright 2016,2017,2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

// Use Alternate Anchor TF for MAs

anchor = input(4,minval=0,maxval=100,title="Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100)")

//

// - INPUTS START

// Fast MA - type, source, length

showAvgs = input(true,title="Show Moving Average Lines")

type1 = input(defval="EMA", title="Fast MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=16, title="Fast - Length", minval=1)

gamma1 = 0.33

// Medium Fast MA - type, source, length

type2 = input(defval="EMA", title="Medium MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len2 = input(defval=21, title="Medium - Length", minval=1)

gamma2 = 0.55

// Slow MA - type, source, length

type3 = input(defval="EMA", title="Slow MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len3 = input(defval=26, title="Slow Length", minval=1)

gamma3 = 0.77

//

// QQE rsi Length, Smoothing, fast ATR factor, source

RSILen = input(14,title='RSI Length')

SF = input(8,title='RSI Smoothing Factor')

QQEfactor = input(5.0,type=float,title='Fast QQE Factor')

threshhold = input(10, title="RSI Threshhold")

//

sQQEx = input(true,title="Show QQE Signal crosses")

sQQEz = input(false,title="Show QQE Zero crosses")

sQQEc = input(true,title="Show QQE Thresh Hold Channel Exits")

//

tradeSignal = input("XC", title="Select which QQE signal to Buy/Sell", options=["XC","XQ","XZ"])

closeSignal = input("XQ", title="Select which QQE signal to Close Order", options=["XC","XQ","XZ"])

//

xfilter = input(true, title="Filter XQ Buy/Sell Orders by Threshold" )

filter = input(false,title="Use Moving Average Filter")

dfilter = input(true, title="Use Trend Directional Filter" )

ufirst = input(false, title="Only Alert First Buy/Sell in a new Trend")

RSIsrc = input(close,title="Source")

src = RSIsrc // MA source

srcclose= RSIsrc

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [Alerts]

//testStartYear = input(2018, "Backtest Start Year",minval=1980)

//testStartMonth = input(6, "Backtest Start Month",minval=1,maxval=12)

//testStartDay = input(12, "Backtest Start Day",minval=1,maxval=31)

//testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

//testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

//testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

//testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

//testPeriod = time >= testPeriodStart and time <= testPeriodStop ? true : false

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

// - INPUTS END

gold = #FFD700

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier, base on time in mins

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := not isintraday? 1 : mult // Only available Daily or less

// Anchor is a relative multiplier based on current TF.

mult = anchor>0 ? anchor : 1

// - FUNCTIONS END

// - Fast ATR QQE

//

Wilders_Period = RSILen * 2 - 1

//

Rsi = rsi(RSIsrc,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex[1] - RSIndex)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

//

newshortband= RSIndex + DeltaFastAtrRsi

newlongband= RSIndex - DeltaFastAtrRsi

longband = 0.0

shortband=0.0

trend = 0

longband:=RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1],newlongband) : newlongband

shortband:=RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1],newshortband) : newshortband

trend:=cross(RSIndex, shortband[1])? 1 : cross(longband[1], RSIndex) ? -1 : nz(trend[1],1)

FastAtrRsiTL = trend==1 ? longband : shortband

// - SERIES VARIABLES

// MA's

ma_fast = variant(type1, srcclose, len1, gamma1)

ma_medium = variant(type2, srcclose, len2, gamma2)

ma_slow = variant(type3, srcclose, len3, gamma3)

// MA's

ma_fast_alt = variant(type1, srcclose, len1*mult, gamma1)

ma_medium_alt = variant(type2, srcclose, len2*mult, gamma2)

ma_slow_alt = variant(type3, srcclose, len3*mult, gamma3)

// Get Direction From Medium Moving Average

direction = rising(ma_medium,3) ? 1 : falling(ma_medium,3) ? -1 : 0

altDirection = rising(ma_medium_alt,3) ? 1 : falling(ma_medium_alt,3) ? -1 : 0

//

// Find all the QQE Crosses

QQExlong = 0, QQExlong := nz(QQExlong[1])

QQExshort = 0, QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL< RSIndex ? QQExlong+1 : 0

QQExshort := FastAtrRsiTL> RSIndex ? QQExshort+1 : 0

// Zero cross

QQEzlong = 0, QQEzlong := nz(QQEzlong[1])

QQEzshort = 0, QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex>=50 ? QQEzlong+1 : 0

QQEzshort := RSIndex<50 ? QQEzshort+1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0, QQEclong := nz(QQEclong[1])

QQEcshort = 0, QQEcshort := nz(QQEcshort[1])

QQEclong := RSIndex>(50+threshhold) ? QQEclong+1 : 0

QQEcshort := RSIndex<(50-threshhold) ? QQEcshort+1 : 0

//

// Check Filtering.

QQEflong = mult == 1 ? (not filter or (srcclose>ma_medium and ma_medium>ma_slow and ma_fast>ma_medium)) and (not dfilter or (direction>0 )) :

(not filter or (ma_medium>ma_medium_alt and srcclose>ma_fast and ma_fast>ma_medium)) and (not dfilter or (direction>0 and altDirection>0 and srcclose>ma_medium))

QQEfshort = mult == 1 ? (not filter or (srcclose<ma_medium and ma_medium<ma_slow and ma_fast<ma_medium)) and (not dfilter or (direction<0 )) :

(not filter or (ma_medium<ma_medium_alt and srcclose<ma_fast and ma_fast<ma_medium)) and (not dfilter or (direction<0 and altDirection<0 and srcclose<ma_medium))

QQExfilter = (not xfilter or RSIndex>(50+threshhold) or RSIndex<(50-threshhold))

//

// Get final BUY / SELL alert determination

buy_ = 0, buy_ := nz(buy_[1])

sell_ = 0, sell_ := nz(sell_[1])

// Make sure Buy/Sell are non-repaint and occur after close signal.

buy_ := tradeSignal=="XC"? (QQEclong[1]==1 and QQEflong[1] ? buy_+1 : 0) :

tradeSignal=="XQ"? (QQExlong[1]==1 and QQEflong[1] and QQExfilter[1]? buy_+1 : 0) :

tradeSignal=="XZ"? (QQEzlong[1]==1 and QQEflong[1] ? buy_+1 : 0) : 0

sell_ := tradeSignal=="XC"? (QQEcshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) :

tradeSignal=="XQ"? (QQExshort[1]==1 and QQEfshort[1] and QQExfilter[1]? sell_+1 : 0) :

tradeSignal=="XZ"? (QQEzshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) : 0

//

// Find the first Buy/Sell in trend swing.

Buy = 0, Buy := nz(Buy[1])

Sell = 0, Sell := nz(Sell[1])

Buy := sell_>0 ? 0 : buy_==1 or Buy>0 ? Buy+1 : Buy

Sell := buy_>0 ? 0 : sell_==1 or Sell>0 ? Sell+1 : Sell

// Select First or all buy/sell alerts.

buy = ufirst ? Buy : buy_

sell = ufirst ? Sell : sell_

closeLong = 0, closeLong := nz(closeLong[1])

closeShort = 0, closeShort := nz(closeShort[1])

closeLong := closeSignal=="XC" ? (QQEcshort==1 ? closeLong+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExshort==1 ? closeLong+1 : 0) : ((QQExshort==1 or QQEzshort or QQEcshort) ? closeLong+1 : 0) :

closeSignal=="XZ" ? (QQEzshort==1 ? closeLong+1 : 0) : 0

closeShort := closeSignal=="XC" ? (QQEclong==1 ? closeShort+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExlong==1 ? closeShort+1 : 0) : ((QQExlong==1 or QQEzlong or QQEclong==1) ? closeShort+1 : 0) :

closeSignal=="XZ" ? (QQEzlong==1 ? closeShort+1 : 0) : 0

tradestate = 0, tradestate := nz(tradestate[1])

tradestate := tradestate==0 ? (buy==1 ? 1 : sell==1 ? 2 : 0) : (tradestate==1 and closeLong==1) or (tradestate==2 and closeShort==1)? 0 : tradestate

isLong = change(tradestate) and tradestate==1

isShort = change(tradestate) and tradestate==2

isCloseLong = change(tradestate) and tradestate==0 and nz(tradestate[1])==1

isCloseShort = change(tradestate) and tradestate==0 and nz(tradestate[1])==2

// - SERIES VARIABLES END

// - PLOTTING

// Ma's

tcolor = direction<0?red:green

// ma1=plot(showAvgs?ma_fast:na, title="MA Fast", color=tcolor, linewidth=1, transp=0)

ma2=plot(showAvgs?ma_medium:na, title="MA Medium Fast", color=tcolor, linewidth=2, transp=0)

// ma3=plot(showAvgs?ma_slow:na, title="MA Slow", color=tcolor, linewidth=1, transp=0)

// fill(ma1,ma3,color=tcolor,transp=90)

// Ma's

altTcolor=altDirection<0?red:green

barcolor(altDirection<0? red:green)

ma4=plot(showAvgs and mult>1?ma_fast_alt:na, title="MA Fast", color=altTcolor, linewidth=1, transp=0)

ma5=plot(showAvgs and mult>1?ma_medium_alt:na, title="MA Medium Fast", color=altTcolor, linewidth=2, transp=0)

ma6=plot(showAvgs and mult>1?ma_slow_alt:na, title="MA Slow", color=altTcolor, linewidth=1, transp=0)

fill(ma4,ma6,color=altTcolor,transp=90)

// Color Changes

turned_aqua = altTcolor[1] == red and altTcolor == green

turned_blue = altTcolor[1] == green and altTcolor == red

take_profit_long = ma_slow > ma_fast_alt and ma_slow > ma_slow_alt and tcolor[1] == green and tcolor == red

take_profit_short = ma_slow < ma_fast_alt and ma_slow < ma_slow_alt and tcolor[1] == red and tcolor == green

// plotshape(turned_aqua, title="MA's Green Buy", style=shape.triangleup, location=location.belowbar, text="Long", color=green, transp=20, size=size.normal)

// plotshape(turned_blue, title="MA's Red Sell", style=shape.triangledown, location=location.abovebar, text="Short", color=red, transp=20, size=size.normal)

// plotshape(take_profit_long, title="Take Profit Long", style=shape.triangledown, location=location.abovebar, text="Take Profit Long", color=purple, transp=20, size=size.tiny)

// plotshape(take_profit_short, title="Take Profit Short", style=shape.triangleup, location=location.belowbar, text="Take Profit Short", color=purple, transp=20, size=size.tiny)

strategy.entry("Long", strategy.long, when=turned_aqua and window)

strategy.entry("short", strategy.short, when=turned_blue and window)

entered_long = strategy.position_size[1] <= 0 and strategy.position_size > 0

entered_short = strategy.position_size[1] >= 0 and strategy.position_size < 0

long_tp_count = 0

long_tp_count := entered_long ? 0 : take_profit_long ? long_tp_count[1] + 1 : long_tp_count[1]

short_tp_count = 0

short_tp_count := entered_short ? 0 : take_profit_short ? short_tp_count[1] + 1 : short_tp_count[1]

// take_off_long = long_tp_count == 0 ? tp1_perc : long_tp_count == 1 ? tp2_perc : na

// take_off_short = short_tp_count == 0 ? tp1_perc : short_tp_count == 1 ? tp2_perc : na

long_tp1_qty = na

long_tp2_qty = na

short_tp1_qty = na

short_tp2_qty = na

long_tp1_qty := entered_long ? strategy.position_size * tp1_perc : long_tp1_qty[1]

long_tp2_qty := entered_long ? strategy.position_size * tp2_perc : long_tp2_qty[1]

short_tp1_qty := entered_short ? -strategy.position_size * tp1_perc : short_tp1_qty[1]

short_tp2_qty := entered_short ? -strategy.position_size * tp2_perc : short_tp2_qty[1]

long_sl_level = sl_perc == 0 ? na : strategy.position_avg_price * (1 - sl_perc)

short_sl_level = sl_perc == 0 ? na : strategy.position_avg_price * (1 + sl_perc)

strategy.order("LTP1", strategy.short, qty=long_tp1_qty, when=strategy.position_size > 0 and take_profit_long and long_tp_count[1]==0 and not turned_blue)

strategy.order("LTP2", strategy.short, qty=long_tp2_qty, when=strategy.position_size > 0 and take_profit_long and long_tp_count[1]==1 and not turned_blue)

strategy.order("STP1", strategy.long, qty=short_tp1_qty, when=strategy.position_size < 0 and take_profit_short and short_tp_count[1]==0 and not turned_aqua)

strategy.order("STP2", strategy.long, qty=short_tp2_qty, when=strategy.position_size < 0 and take_profit_short and short_tp_count[1]==1 and not turned_aqua)

strategy.exit("L-SL", "Long", stop=long_sl_level)

strategy.exit("S-SL", "Short", stop=short_sl_level)

// SL PLOTS

// --------

plot(strategy.position_size > 0 ? long_sl_level : na, color=red, style=linebr, title="Long Stop")

plot(strategy.position_size < 0 ? short_sl_level : na, color=maroon, style=linebr, title="Short Stop")

// ALERTS (STUDY ONLY)

alertcondition(turned_aqua, title="Long", message="Ma's Turned Green")

alertcondition(turned_blue, title="Short", message="Ma's Turned Red")

alertcondition(take_profit_long, title="Take Profit Long", message="Take Profit Long")

alertcondition(take_profit_short, title="Take Profit Short", message="Take Profit Short")

alertcondition(isLong, title="QQEX Long", message="QQEX LONG") // use "Once per Bar" option

alertcondition(isShort, title="QQEX Short", message="QQEX SHORT") // use "Once per Bar" option

alertcondition(isCloseLong, title="QQEX Close Long", message="QQEX CLOSE LONG") // use "Once per Bar Close" option

alertcondition(isCloseShort, title="QQEX Close Short", message="QQEX CLOSE SHORT") // use "Once per Bar Close" option

// show only when alert condition is met and bar closed.

plotshape(isLong or isShort,title= "Cross Alert Completed", location=location.bottom, color=isShort?red:green, transp=0, style=shape.circle,size=size.auto,offset=0)

plotshape(isCloseShort[1] or isCloseLong[1],title= "Close Order", location=location.top, color=isCloseShort[1]?red:green, transp=0, style=shape.square,size=size.auto,offset=-1)

// Test Plots

// ---------

// plot(long_tp_count)

// plot(short_tp_count, color=red)

//EOF