概述(Overview)

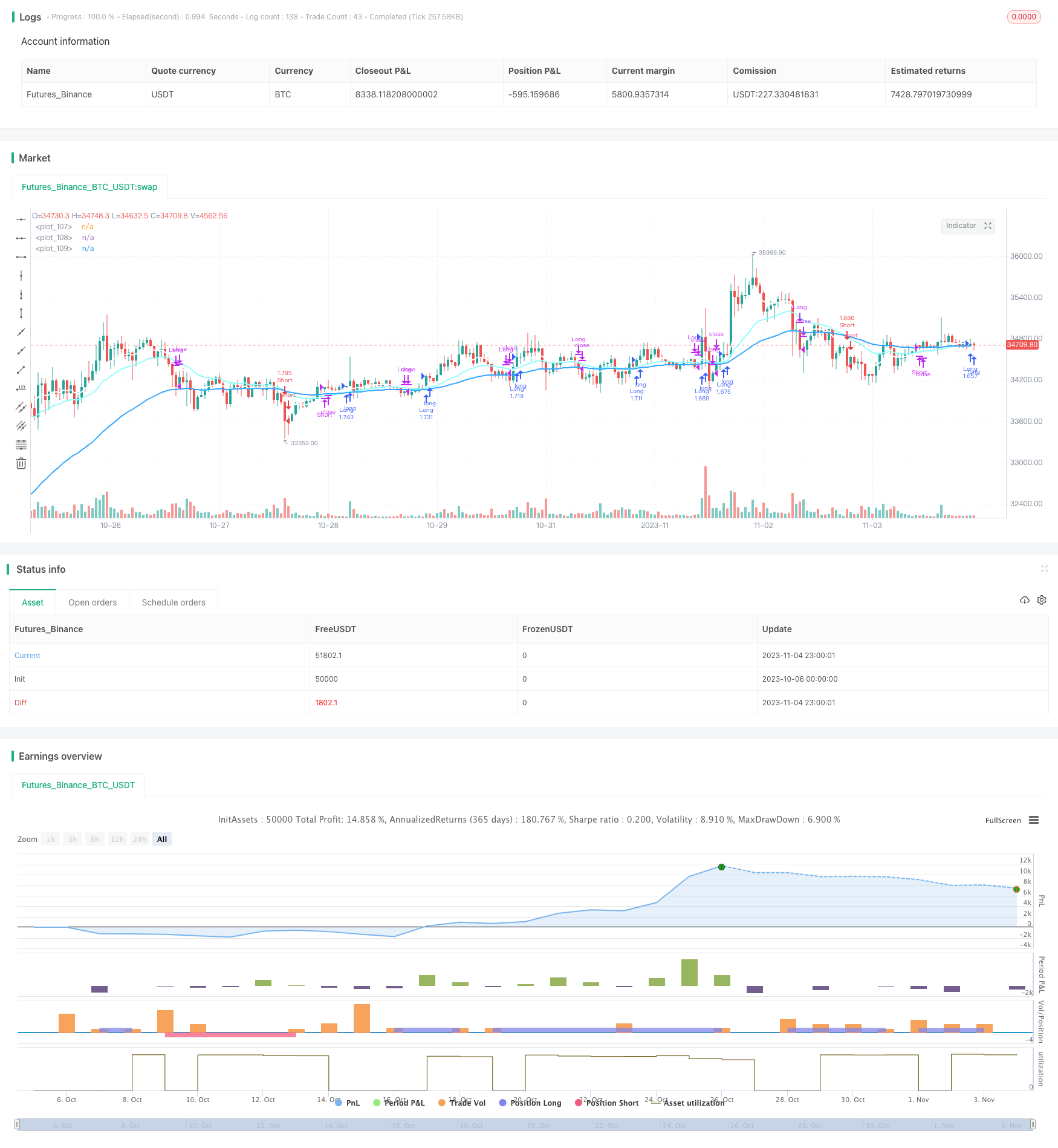

该策略采用三重移动平均线组合,根据移动平均线的顺序关系判断趋势方向,实现趋势追踪。当快速移动平均线、中速移动平均线、慢速移动平均线依次排列时,做多;当慢速移动平均线、中速移动平均线、快速移动平均线依次排列时,做空。

策略原理(Strategy Principle)

该策略使用三条不同周期的移动平均线,包括快速移动平均线、中速移动平均线和慢速移动平均线。

入场条件: 1. 做多:当快速移动平均线 > 中速移动平均线 > 慢速移动平均线时,认为行情处于上涨趋势,做多。 2. 做空:当慢速移动平均线 < 中速移动平均线 < 快速移动平均线时,认为行情处于下跌趋势,做空。

出场条件: 1. 移动平均线出场:三条移动平均线顺序发生反转时平仓。 2. 止盈止损出场:设定固定止盈止损点,如止盈幅度为12%,止损幅度为1%,达到止盈或止损价格后平仓。

该策略简单直接,利用三条移动平均线判断市场趋势方向,实现趋势跟踪交易,适合趋势性较强的市场。

优势分析(Advantage Analysis)

- 使用三条移动平均线判断趋势,过滤市场噪音,识别趋势方向。

- 采用不同周期移动平均线,可以更准确判断趋势转折点。

- 结合移动平均线指标和固定止盈止损管理资金风险。

- 策略思路简单直观,容易理解实现。

- 可方便优化移动平均线周期参数,适应不同周期行情。

风险及改进(Risks and Improvements)

- 大周期行情中,移动平均线可能产生较多误判,导致不必要的亏损。

- 可考虑加入其他指标或过滤条件,提高获利率。

- 可优化移动平均线周期参数组合,适应更广泛市场行情。

- 可结合趋势强弱指标,避免追顶杀跌。

- 可加入自动止损,避免亏损扩大。

总结(Conclusion)

该三重移动平均线趋势跟随策略整体思路清晰易懂,利用移动平均线判别趋势方向,实现简单的趋势跟随交易。策略优点是容易实现,通过调整移动平均线周期参数可适应不同周期行情。但是也存在一定的误判风险,可通过加入其他指标或条件进行优化,减少不必要的损失,提高策略获利率。总体来说,该策略适合对趋势交易有兴趣的初学者进行学习和实践。

策略源码

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Jompatan

//@version=5

strategy('Strategy Triple Moving Average', overlay=true, initial_capital = 1000, commission_value=0.04, max_labels_count=200)

//INPUTS

mov_ave = input.string(defval="EMA", title='Moving Average type:', options= ["EMA", "SMA"])

period_1 = input.int(9, title='Period 1', inline="1", group= "============== Moving Average Inputs ==============")

period_2 = input.int(21, title='Period 2', inline="2", group= "============== Moving Average Inputs ==============")

period_3 = input.int(50, title='Period 3', inline="3", group= "============== Moving Average Inputs ==============")

source_1 = input.source(close, title='Source 1', inline="1", group= "============== Moving Average Inputs ==============")

source_2 = input.source(close, title='Source 2', inline="2", group= "============== Moving Average Inputs ==============")

source_3 = input.source(close, title='Source 3', inline="3", group= "============== Moving Average Inputs ==============")

//EXIT CONDITIONS

exit_ma = input.bool(true, title= "Exit by Moving average condition", group="================ EXIT CONDITIONS ================")

exit_TPSL = input.bool(false, title= "Exit by Take Profit and StopLoss", group="================ EXIT CONDITIONS ================")

TP = input.int(12, title='Take Profit', step=1, group="================ EXIT CONDITIONS ================")

SL = input.int(1, title='Stop Loss', step=1, group="================ EXIT CONDITIONS ================")

plot_TPSL = input.bool(false, title='Show TP/SL lines', group="================ EXIT CONDITIONS ================")

//Date filters

desde = input(defval= timestamp("01 Jan 2023 00:00 -3000"), title="From", inline="12", group= "============= DATE FILTERS =============")

hasta = input(defval= timestamp("01 Oct 2099 00:00 -3000"), title="To ", inline="13", group= "============= DATE FILTERS =============")

enRango = true

//COMMENTS

//entry_long_comment = input.string(defval=" ", title="Entry Long comment: ", inline="14", group="============= COMMENTS =============")

//exit_long_comment = input.string(defval=" ", title="Exit Long comment: ", inline="15", group="============= COMMENTS =============")

//entry_short_comment = input.string(defval=" ", title="Entry Short comment:", inline="16", group="============= COMMENTS =============")

//exit_short_comment = input.string(defval=" ", title="Exit Short comment: ", inline="17", group="============= COMMENTS =============")

//============================================================

//Selecting Moving average type

ma1 = mov_ave == "EMA" ? ta.ema(source_1, period_1) : ta.sma(source_1, period_1)

ma2 = mov_ave == "EMA" ? ta.ema(source_2, period_2) : ta.sma(source_2, period_2)

ma3 = mov_ave == "EMA" ? ta.ema(source_3, period_3) : ta.sma(source_3, period_3)

//============================================================

//Entry Long condition: Grouped Moving average from: (ma fast > ma middle > ma slow)

long_condition = (ma1 > ma2) and (ma2 > ma3)

//Entry Short condition: Grouped Moving average from: (ma fast < ma middle < ma slow)

short_condition = (ma1 < ma2) and (ma2 < ma3)

//============================================================

cantidad = strategy.equity / close

comprado_long = strategy.position_size > 0

comprado_short = strategy.position_size < 0

var long_profit_price = 0.0

var long_stop_price = 0.0

var short_profit_price = 0.0

var short_stop_price = 0.0

//============================================================

//ENTRY LONG

if not comprado_long and not comprado_short and long_condition and not long_condition[1] and enRango

strategy.entry('Long', strategy.long, qty=cantidad, comment= "Entry Long")

if exit_TPSL

long_profit_price := close * (1 + TP/100)

long_stop_price := close * (1 - SL/100)

else

long_profit_price := na

long_stop_price := na

//============================================================

//ENTRY SHORT

if not comprado_long and not comprado_short and short_condition and not short_condition[1] and enRango

strategy.entry('Short', strategy.short, qty=cantidad, comment= "Entry Short")

if exit_TPSL

short_profit_price := close * (1 - TP/100)

short_stop_price := close * (1 + SL/100)

else

short_profit_price := na

short_stop_price := na

//============================================================

//EXIT LONG

if comprado_long and exit_ma and long_condition[1] and not long_condition

strategy.close('Long', comment='Exit-Long(MA)')

if comprado_long and exit_TPSL

strategy.exit('Long', limit=long_profit_price, stop=long_stop_price, comment='Exit-Long(TP/SL)')

//============================================================

//EXIT SHORT

if comprado_short and exit_ma and short_condition[1] and not short_condition

strategy.close('Short', comment='Exit-Short(MA)')

if comprado_short and exit_TPSL

strategy.exit('Short', limit=short_profit_price, stop=short_stop_price, comment='Exit-Short(TP/SL)')

//============================================================

//PLOTS

plot(ma1, linewidth=2, color=color.rgb(255, 255, 255))

plot(ma2, linewidth=2, color=color.rgb(144, 255, 252))

plot(ma3, linewidth=2, color=color.rgb(49, 167, 255))

//Plot Take Profit line

plot(plot_TPSL ? comprado_long ? long_profit_price : comprado_short ? short_profit_price : na : na, color=color.new(color.lime, 30), style= plot.style_linebr)

//Plot StopLoss line

plot(plot_TPSL ? comprado_long ? long_stop_price : comprado_short ? short_stop_price : na : na, color=color.new(color.red, 30), style= plot.style_linebr)

更多内容