Zweifelhaft starke Trendverfolgungsstrategie für Stop Loss

Schriftsteller:ChaoZhang, Datum: 2023-11-16 15:50:54Tags:

Übersicht

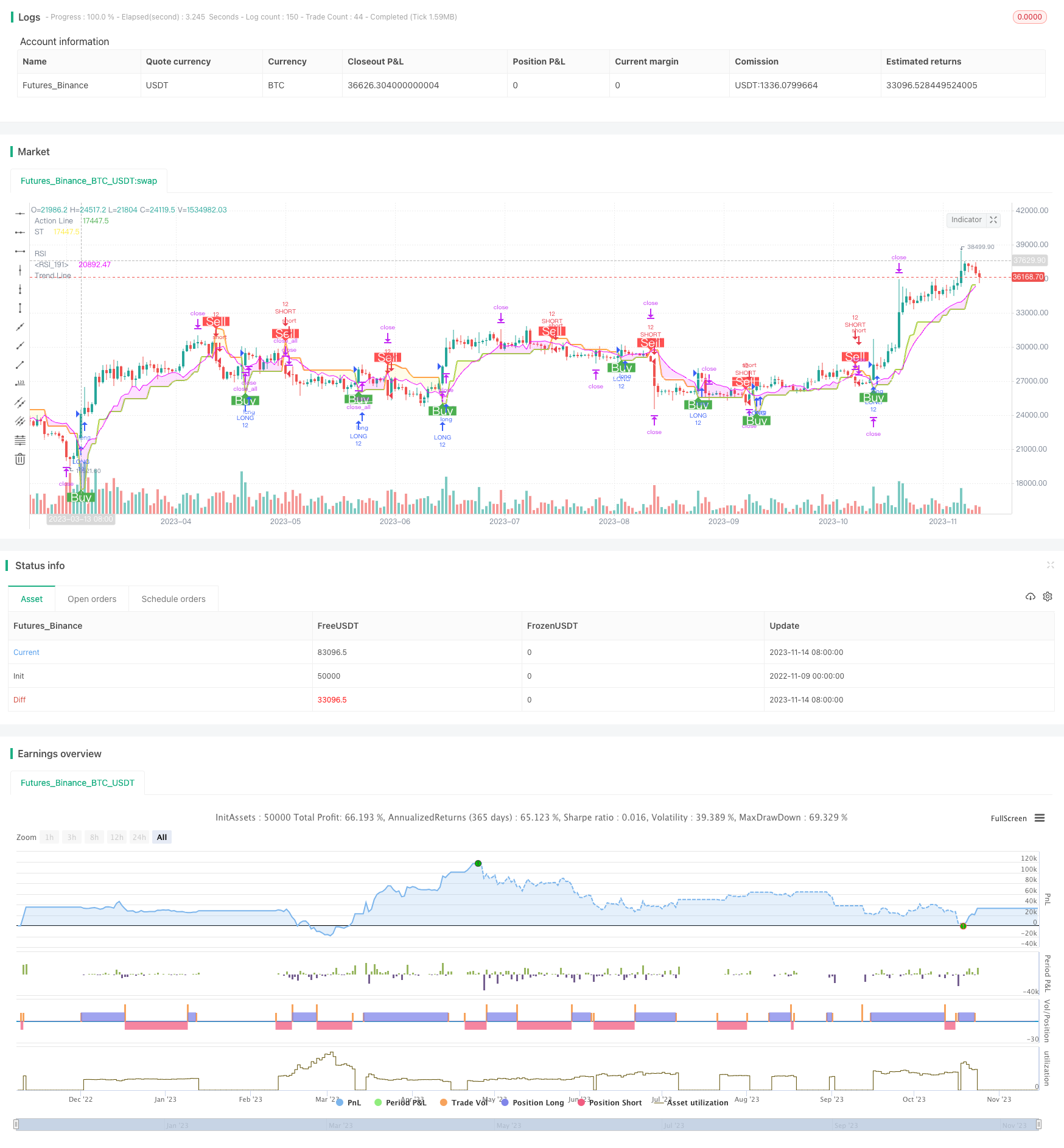

Diese Strategie ist mit doppelten Trendverfolgungsmechanismen basierend auf Supertrend und Relative Strength Index konzipiert, um den Markttrend genau zu bestimmen und angemessene Stop-Loss- und Take-Profit-Punkte festzulegen.

Strategie Logik

-

Berechnen Sie den Supertrend, um die Haupttrendrichtung zu bestimmen. Supertrend kann die Trendrichtung genau beurteilen und ideale Eingangspunkte geben.

-

Berechnen Sie den Relative Strength Index (RSI) als Hilfsindikator für das Trendbeurteilen. Ein hoher RSI zeigt einen bullischen Trend in einem Bullenmarkt an. Ein niedriger RSI zeigt einen bärischen Trend in einem Bärenmarkt an.

-

Gehen Sie lang, wenn der Schlusskurs über die Supertrend-Linie geht, und kurz, wenn der Schlusskurs unter die Supertrend-Linie bricht.

-

Setzen Sie den Stop-Loss und die Take-Profit-Punkte vernünftigerweise. Wenn Sie lang gehen, setzen Sie die Supertrend-Linie als Stop-Loss und die Supertrend-Linie plus angemessener Gewinn als Take-Profit. Wenn Sie kurz gehen, setzen Sie die Supertrend-Linie als Stop-Loss und die Supertrend-Linie minus angemessener Gewinn als Take-Profit.

-

Die Stop-Loss-Punkte schweben entsprechend der Marktfluktuation. Während sich der Markt in eine günstige Richtung bewegt, bewegt sich die Stop-Loss-Linie in die günstige Richtung, um Gewinne zu sichern.

-

Treten Sie nur dann in Trades ein, wenn der RSI mit dem Supertrend übereinstimmt, was auf einen stärkeren aktuellen Trend hinweist.

Analyse der Vorteile

-

Der Dual-Trend-Judgement-Mechanismus kann falsche Signale reduzieren und die Stabilität der Strategie verbessern.

-

Die Stop-Loss-Punkte bewegen sich mit dem Trend, um die Gewinnverbindung zu maximieren und einen vorzeitigen Stop-Loss zu vermeiden.

-

Die Anwendung des RSI filtert einige schwache Handelssignale aus.

-

Eine vernünftige Gewinnpositionierung maximiert den Gewinn.

-

Anpassbare Strategieparameter können für verschiedene Produkte und Marktbedingungen optimiert werden.

-

Kontrollierbare Abzüge verleihen der Strategie starke Risikomanagementfähigkeiten.

Risikoanalyse

-

Bei schwarzen Schwanen, wie beispielsweise wichtigen politischen Nachrichten, können riesige Marktschwankungen Positionen stoppen und große Verluste verursachen.

-

Eine falsche Einstellung von Parametern kann zu unzumutbaren Stop-Loss- und Gewinnpunkten führen, Verluste vergrößern oder Gewinne schrumpfen lassen.

-

Eine Divergenz zwischen RSI und Supertrend kann während von Bereichsmärkten falsche Signale erzeugen. Vermeide den Handel und warte in solchen Fällen auf einen klaren Trend.

Optimierungsrichtlinien

-

Optimieren des ATR-Period-Parameters für verschiedene Produkte.

-

Optimieren Sie die RSI-Einstellungen, um stabilere Nebentrendenzustände zu finden.

-

Einbeziehung anderer Indikatoren wie Bollinger Bands und KDJ zur Festlegung präziserer Ein- und Ausstiegsregeln.

-

Verschiedene Gewinnstrategie wie Trailing Stop, Staggered Profit Taking, Wick Stop usw. testen, um die Rentabilität zu verbessern.

-

Anpassung der Positionsgröße auf der Grundlage von Rückprüfungsergebnissen zur Verringerung der einzelnen Handelsrisiken.

Schlussfolgerung

Die Strategie zeigt insgesamt eine starke Stabilität und Rentabilität. Das duale Trend-Urteil filtert das Rauschen effektiv aus und die Stop-Loss/Profit-Taking-Strategie sperrt Gewinne und kontrolliert Risiken. Die kontinuierliche Optimierung von Parametern und Eintritts-/Ausgangsbedingungen ermöglicht eine gute Performance in verschiedenen Marktumgebungen. Es kann als ausgezeichnete Vorlagestrategie für den quantitativen Handel dienen und ist eine eingehende Forschung und Anwendung wert.

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title='DEO SESSSION', shorttitle='DEO S', overlay=true, precision=8, calc_on_order_fills=true, calc_on_every_tick=true, backtest_fill_limits_assumption=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000, currency=currency.USD, linktoseries=true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title='════════════ FROM ════════════', defval=true)

// selected dates

i_startTime = input(title="START FILTER", defval=timestamp("02 Jan 2023 00:00 +0000"), group="RISK MANAGEMENT", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="END FILTER", defval=timestamp("12 Dec 2100 00:00 +0000"), group="RISK MANAGEMENT", tooltip="End date & time to stop searching for setups")

afterStartDate = true

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title='══════════ STRATEGY ══════════', defval=true)

// === INPUT TO SELECT POSITION ===

positionType = input.string(defval='LONG', title='Position Type', options=['LONG', 'SHORT'])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input.float(defval=3.0, minval=0.0, title='Initial Stop Loss')

// === INPUT TO SELECT BARS BACK

barsBack = input(title='ATR Period', defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input.float(title='ATR multplierFactoriplier', step=0.1, defval=3.0)

RSI = input.int(title='RSI', defval=7, minval=1, maxval=100)

calcSection = input(title='══════════ LOT CALC ══════════', defval=true)

accountBalance = input.float(title="ACCOUNT BALANCE", defval=250000, minval=1, group="INPUTS")

entryPrice = input.float(title="ENTRY PRICE", defval=100, minval=1, group="INPUTS")

slPrice = input.float(title="STOP LOSS PRICE", defval=100, minval=1, group="INPUTS")

riskPer = input.float(title="RISK USD", defval=1, minval=0.1, group="INPUTS")

lotSize = input.float(title="LOT SIZE", defval=10, minval=0.1, group="INPUTS")

RiskSize = riskPer

qtyLongTargetPrice = math.abs((RiskSize / ((entryPrice - slPrice) * syminfo.pointvalue)) / lotSize)

trendcSection = input(title='══════════ TREND LINE ══════════', defval=true)

// ema trend

tLen = input.int(200, minval=1, title="Trend Line")

tSrc = input(close, title="Source")

thisEma = ta.ema(tSrc, tLen)

plot(thisEma, title = "Trend Line",color=#ffffff)

MTSection = input(title='══════════ MT LOGIN ══════════', defval=true)

exchange = input.string(defval='MT5', title='EXCHANGE', options=['MT4', 'MT5'])

mtLogin= input.string(defval="", title='MT LOGIN', group = "mt")

mtPassword =input.string(defval='', title='MT PASSWORD', group = "mt")

mtServer =input.string(defval='', title='MT SERVER', group = "mt")

mtIsOn = input.string(defval='ON', title='STRATEGY ON', options=['ON', 'OFF'])

mtEntryMode = input.string(defval='CLOSE OPEN', title='ENTRY MODE', options=['CLOSE OPEN', 'OPEN'])

displaySection = input(title='══════════ DISPLAY LOGIN ══════════', defval=true)

displayTable = input(title="DISPLAY TABLE", defval=false, group = 'PRODUCTION', tooltip = "MAKES YOUR STRATEGY TRIGGER SLOWER")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * ta.atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if direction == 1

valueToPlot := longStop

colorToPlot := color.green

colorToPlot

else

valueToPlot := shortStop

colorToPlot := color.red

colorToPlot

//RSI

src = close

ep = 2 * RSI - 1

auc = ta.ema(math.max(src - src[1], 0), ep)

adc = ta.ema(math.max(src[1] - src, 0), ep)

x1 = (RSI - 1) * (adc * 70 / (100 - 70) - auc)

ub = x1 >= 0 ? src + x1 : src + x1 * (100 - 70) / 70

x2 = (RSI - 1) * (adc * 30 / (100 - 30) - auc)

lb = x2 >= 0 ? src + x2 : src + x2 * (100 - 30) / 30

//Affichage

plot(math.avg(ub, lb), color=color.white ,linewidth=1, title='RSI')

plot(valueToPlot == 0.0 ? na : valueToPlot, title='Action Line', linewidth=2, color=color.new(colorToPlot, 0))

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title='Buy', style=shape.labelup, location=location.absolute, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title='Sell', style=shape.labeldown, location=location.absolute, size=size.normal, text='Sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

p_ma1 = plot(valueToPlot, title = "ST", color = color.rgb(255, 236, 66))

p_ma2 = plot(math.avg(ub, lb), title = "RSI", color = color.rgb(234, 0, 255))

// Definitions: Trends

TrendUp1() =>

valueToPlot > math.avg(ub, lb)

TrendDown1() =>

valueToPlot < math.avg(ub, lb)

trendColor1 = TrendUp1() ? color.rgb(255, 236, 66, 85): TrendDown1() ? color.rgb(234, 0, 255, 85) : color.rgb(255, 255, 255, 85)

fill(p_ma1, p_ma2, color=trendColor1)

longCondition () =>

ta.crossover(close, valueToPlot)

shortCondition () =>

ta.crossunder(close, valueToPlot)

IsLongShort() =>

strategy.position_size != 0

getNewLotSize() =>

math.abs(riskPer / (close - valueToPlot))

// plot(getNewLotSize(), "new lot size")

newLotS = getNewLotSize()

alertManagement = str.tostring(exchange) + "," + str.tostring(mtLogin) + "," +str.tostring(mtPassword) + ","

alertManagement += str.tostring(mtServer) + "," + str.tostring(newLotS)

// alertManagement += str.tostring(stopLoss) + "," + str.tostring(applyingSL) + "," + str.tostring(applyTrailingStop) + ","

// alertManagement += str.tostring(exchange) + "," + str.tostring(exchangeAccount) + "," + str.tostring(slAmount) + "," + str.tostring(closeTpAmount) + ","

// alertManagement += str.tostring(exchangeLeverage) + "," + str.tostring(exchangeLeverageType) + ","

// alertManagement += str.tostring(mtLogin) + "," + str.tostring(mtPassword) + "," + str.tostring(mtServer) + "," + str.tostring(mtLot) + ","

// alertManagement += str.tostring(mtTp) + "," + str.tostring(mtTs) + "," + str.tostring(orderStrategy)

// alertManagement = "alertManagement"

myStop = 0.0

myTarget = 0.0

if (longCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("LONG", strategy.long, qty=12, comment="LONG", alert_message=alertManagement)

strategy.exit("TPL", "LONG", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

if (shortCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("SHORT", strategy.short, qty=12, comment="SHORT", alert_message=alertManagement)

strategy.exit("TPS", "SHORT", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

// Calculate the average profit per open trade

// avgProfit = profitSum / strategy.opentrades

getTotalProfit()=>

// Sum the profit of all open trades

profitSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) > 0

profitSum += strategy.closedtrades.profit(tradeNumber)

result = profitSum

getTotalLoss()=>

// Sum the profit of all open trades

lossSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) < 0

lossSum += strategy.closedtrades.profit(tradeNumber)

result = lossSum

maxLossRun()=>

lossRun = 0.0

currentMaxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNo) < 0.0

lossRun += strategy.closedtrades.profit(tradeNo)

else

currentMaxLoss := math.min(currentMaxLoss, lossRun)

lossRun := 0.0

result = currentMaxLoss

TotalTrades() =>

strategy.closedtrades + strategy.opentrades

maxDrawDown() =>

maxDrawdown = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxDrawdown := math.max(maxDrawdown, strategy.closedtrades.max_drawdown(tradeNo))

result = maxDrawdown

maxRunUp() =>

maxRunup = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxRunup := math.max(maxRunup, strategy.closedtrades.max_runup(tradeNo))

result = maxRunup

tradeMaxLossReached() =>

maxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxLoss := math.min(maxLoss, strategy.closedtrades.profit(tradeNo))

result = maxLoss

tradingStartTime() =>

strategy.closedtrades.entry_time(0)

daysBetween(t1, t2) => (t1 - t2) / 86400000

// Table

var InfoPanel = table.new(position = position.bottom_right, columns = 2, rows = 40, border_width = 1)

ftable(_table_id, _column, _row, _text, _bgcolor) =>

table.cell(_table_id, _column, _row, _text, 0, 0, color.black, text.align_right, text.align_center, size.small, _bgcolor)

tfString(int timeInMs) =>

// @function Produces a string corresponding to the input time in days, hours, and minutes.

// @param (series int) A time value in milliseconds to be converted to a string variable.

// @returns (string) A string variable reflecting the amount of time from the input time.

float s = timeInMs / 100000

float m = s / 60

float h = m / 60

float d = h / 24

float mo = d / 30.416

int tm = math.floor(m % 60)

int tr = math.floor(h % 24)

int td = math.floor(d % 30.416)

int tmo = math.floor(mo % 12)

int ys = math.floor(d / 365)

string result =

switch

d == 30 and tr == 10 and tm == 30 => "1M"

d == 7 and tr == 0 and tm == 0 => "1W"

=>

string yStr = ys ? str.tostring(ys) + "Y " : ""

string moStr = tmo ? str.tostring(tmo) + "M " : ""

string dStr = td ? str.tostring(td) + "D " : ""

string hStr = tr ? str.tostring(tr) + "H " : ""

string mStr = tm ? str.tostring(tm) + "min" : ""

yStr + moStr + dStr + hStr + mStr

if displayTable

maxLossRunInMarket= maxLossRun()

maxLossReached = tradeMaxLossReached()

tradeMaxLossReached = tradeMaxLossReached()

tradingInDays=daysBetween(time, tradingStartTime())

totalTrades=TotalTrades()

- Strategie für den Handel mit Festnetzen

- Relative Strength Index Lang-/Kurzstrategie

- Strategie für einen doppelten Momentum-Ausbruch

- Handelsstrategie für mittlere Umkehrung auf der Grundlage von Bollinger-Bändern und Goldenen Verhältnissen

- Impulstrend nach Schwingungsstrategie

- WaveTrend und CMF-basierte Trendstrategie

- Adaptive Bollinger-Trendverfolgungsstrategie

- Die Risikopositionen werden in der Tabelle 1 aufgeführt.

- Trendbreakout-Strategie auf Basis von Bollinger-Bändern

- Adaptiver regulierter gleitender Durchschnittsmarkt-Arbitragestrategie

- Strategie für den Momentumindikator

- Heikin-Ashi Umkehrstrategie

- Dynamische Oszillationsbreakout-Strategie

- Trend nach der 5-minütigen EMA-Crossover-Strategie

- RSI-Trend nach Strategie

- RSI-Divergenzstrategie

- Quantifizierte schrittweise gewichtete DCA-Handelsstrategie

- Doppelte gleitende Durchschnittsdifferenz kombiniert mit dem Trend des ATR-Indikators nach Strategie

- Strategie für mehrere Trends

- Preisstrategie zur Gewinn- und Verlustsicherung