Multi-Indikator-Trendfolgestrategie

Überblick

Die Strategie nutzt die AK MACD BB-Anzeige, um die kurzfristige Trendrichtung zu bestimmen, die SSL-Anzeige filtert einige falsche Signale und schließt mit der synthetischen Handelsmenge VSF, um die tatsächliche Kauf- und Verkaufskräfte zu bestimmen und so die richtige Zeit zu bestimmen. Die Strategie setzt die Stop-Loss-Anzeige vor, um die Gewinne zu sperren.

Strategieprinzip

- AK MACD BB-Indikator

Der Indikator verwendet den Brin-Band auf den MACD-Indikator, der ein Kaufsignal erzeugt, wenn er den Brin-Band durchbricht und ein Verkaufsignal erzeugt, wenn er den Brin-Band durchbricht.

- SSL-Zahlen

Der SSL-Indikator beurteilt, ob der Preis die Durchschnittslinie überschritten hat, und erkennt das Rücktrittssignal. Wenn der Preis die Durchschnittslinie überschreitet und der SSL-Indikator blau ist, ist dies ein Aufwärtstrend, und wenn der Preis die Durchschnittslinie überschreitet und der SSL-Indikator rot ist, ist dies ein Abwärtstrend.

- VSF-Indikatoren

Der VSF-Indikator beurteilt die Stärke von Käufern und Verkäufern. Die Strategie sendet nur dann ein Signal aus, wenn die Stärke des Käufers oder des Verkäufers größer als 50% ist, um einen ungültigen Durchbruch zu vermeiden.

- Schaden-Stopp-Stufen

Die Strategie beinhaltet vier Arten von progressiven Take Profit, die zwischen 1,5 und 3x eingestellt sind. Gleichzeitig wird ein fester Stop-Loss von 2% eingestellt, um den maximalen Verlust eines einzelnen Handels zu kontrollieren.

Analyse der Stärken

- Mehrindikator-Kombinationen, um genau zu sein

Durch verschiedene Indikatoren, die Trends in mehreren Zeitabschnitten bestimmen, können falsche Signale gefiltert werden, was zu einer genaueren Beurteilung führt.

- Automatische Stop-Loss, Risiken sind zu kontrollieren

Die Strategie bietet eine eingebaute Stop-Loss-Einstellung, mit der die Verluste eines einzelnen Handels auf etwa 2% begrenzt werden können, um große Verluste zu vermeiden.

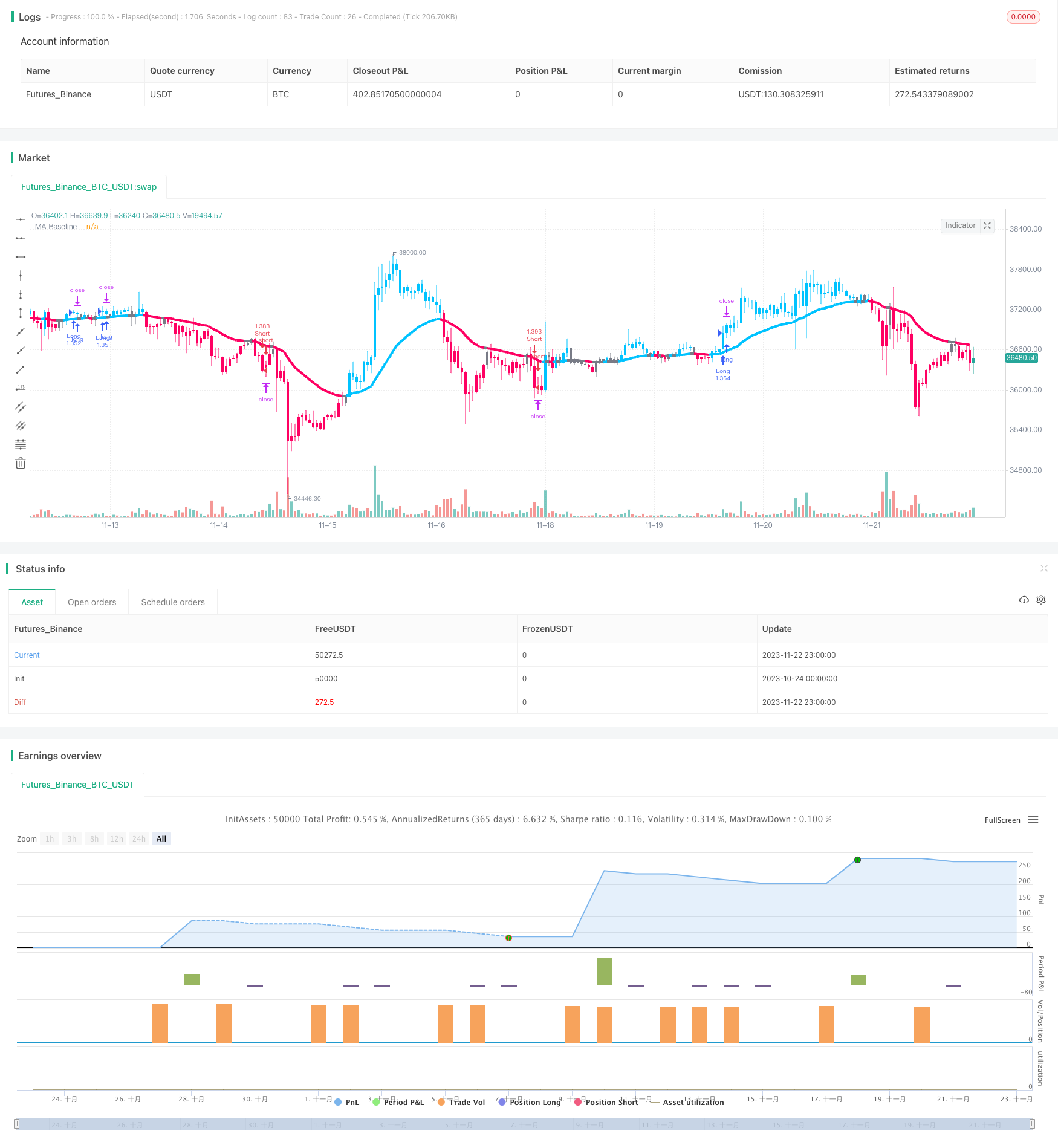

- Die Rückmeldung ist gut.

Laut Publisher Feedback erzielten die profitablen Transaktionen 74% und 427% der Gesamtgewinne aus 100 Transaktionen.

Risiko- und Gegenmaßnahmenanalyse

- Risiko für starke Marktschwankungen

Bei Schwankungen in den großen Bandbreiten kann es zu mehreren kleinen Verlusten kommen. An dieser Stelle kann die feste Stop-Loss-Werte angepasst oder der Handel ausgesetzt werden.

- Risiken von mehreren Leerköpfen

Die derzeitige Strategie kann mehr oder weniger tun. Wenn Sie nur mehr oder weniger tun, wird die Chance, keinen Gewinn zu erzielen, um die Hälfte reduziert.

- Risiken während der Transaktion

Die Strategie nutzt 5-Minuten-Daten, um zu beurteilen, dass die Stichprobenmenge unzureichend ist und die Signale unzuverlässig sein können, wenn es nur ein paar Stunden Daten an einem Handelstag gibt.

Richtung der Strategieoptimierung

- Optimierung der Stop-Loss-Parameter

Es ist möglich, verschiedene Stop-Loss-Stop-Levels zu testen, um die optimalen Parameter zu finden. Ein zu kleines Stop-Loss kann das Risiko nicht effektiv kontrollieren, ein zu großes Stop-Loss kann mehr Geld verpassen.

- Hinzufügen einer automatischen Positionsanpassung

Ein Tracking-Stop oder ein Move-Stop können eingestellt werden, um Gewinne zu sichern. Oder erhöhen Sie die Position, um mehr zu gewinnen, je nach bestimmten Bedingungen.

- In Kombination mit anderen Indikatoren

Es kann eine Kombination verschiedener Indikatoren getestet werden, um zu bestimmen, welche Kombination am besten funktioniert. Es kann auch mehr Indikatoren hinzugefügt werden, um eine Kreuzprüfung durchzuführen.

- Parameteroptimierung

Die Optimierung der Parameter kann durch Rückprüfungen mit verschiedenen Parametern ermittelt werden. In dieser Strategie kann eine Änderung der Brin-Band-Parameter oder der Mittellinien-Parameter zu besseren Ergebnissen führen.

Zusammenfassen

Die Strategie integriert mehrere Indikatoren, um die Trendrichtung zu bestimmen, setzt automatische Stop-Loss-Systeme ein und ist in der Lage, in starken Trends zu profitieren und einzelne Transaktionsverluste in einem sehr kleinen Bereich zu kontrollieren. Aus den Rückmeldungen der Herausgeber ist die Gewinn- und Gewinnrate sehr ideal. Durch eine gewisse Optimierung wird die Stabilität und Profitabilität der Strategie weiter verbessert werden.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #7 - MACDBB+SSL+VSF - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=1000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=1.0, commission_value=0.075, use_bar_magnifier = false)

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

//nwVqTuPe6yo

//5 min

//ak MACD BB by AlgoKid

//Disable bar colors in style

//SSL hybrid by mihkel00

// Style disable all but bar colors and ma baseline

// Change SSL1 baseline length from 60 to 30

// Change SSL1 baseline type from HMA to EMA

//volume strength Finder by Saravanan

// Get rid of bar colors on style

// Trading Rules

// SSL Hybrid.

// Buy only when price action is closed above the EMA and the line is blue color.

// Sell priace action must be closed below the EMA and the line is red color

// Volume Indicator

// Buy when Buyers strength / volume is higher than sellers volume

// Opposite

// General trading rules

// Short

// Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

// If the price action is touching the EMA but the line does not change the color, the pullback is not confirmed.

// Once we have this pullback we're going to be waiting for the MACD to issue a new continuation short signal. A red circle must appear on the indicator and these circles should not be touching accross the zero level while they are being greeen

// Sellers strength above 50% at the time the MACD indiactor issues a new short signal.

// Stop Loss at EMA line 1:1.5 risk ratio.

// Functions universal to strategy

f_priorBarsSatisfied(_objectToEval, _numOfBarsToLookBack) =>

returnVal = false

for i = 0 to _numOfBarsToLookBack

if (_objectToEval[i] == true)

returnVal = true

// AK MACD BB v 1.00 by Algokid

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//indicator('AK MACD BB v 1.00')

length = input.int(10, minval=1, title='BB Periods',group="AK MACD BB")

dev = input.float(1, minval=0.0001, title='Deviations')

//MACD

fastLength = input.int(12, minval=1)

slowLength = input.int(26, minval=1)

signalLength = input.int(9, minval=1)

fastMA = ta.ema(close, fastLength)

slowMA = ta.ema(close, slowLength)

macd = fastMA - slowMA

//BollingerBands

Std = ta.stdev(macd, length)

Upper = Std * dev + ta.sma(macd, length)

Lower = ta.sma(macd, length) - Std * dev

//Band1 = plot(Upper, color=color.new(color.gray, 0), style=plot.style_line, linewidth=2, title='Upper Band')

//Band2 = plot(Lower, color=color.new(color.gray, 0), style=plot.style_line, linewidth=2, title='lower Band')

//fill(Band1, Band2, color=color.new(color.blue, 75), title='Fill')

mc = macd >= Upper ? color.lime : color.red

// Indicator

//plot(macd, color=mc, style=plot.style_circles, linewidth=3)

zeroline = 0

//plot(zeroline, color=color.new(color.orange, 0), linewidth=2, title='Zeroline')

//buy

//barcolor(macd > Upper ? color.yellow : na)

//short

//barcolor(macd < Lower ? color.aqua : na)

//needs improvments

MACDBBNumBarsBackToLookForMACDToBelowZero = input(1, title="Number Of bars to look back to ensure MACD isn't above/below Zero Line?")

// Sell when MACD to issue a new continuation short signal. A new red circle must appear on the indicator and these circles should not be touching accross the zero level while they were previously green

MACDBBENtryShort = mc == color.red and macd < zeroline and f_priorBarsSatisfied(macd < zeroline and mc == color.lime, MACDBBNumBarsBackToLookForMACDToBelowZero)

// Buy when MACD to issue a new continuation long signal. A new green circle must appear on the indicator and these circles should not be touching accross the zero level while they were previously red

MACDBBENtryLong = mc == color.lime and macd > zeroline and f_priorBarsSatisfied(macd > zeroline and mc == color.red, MACDBBNumBarsBackToLookForMACDToBelowZero)

// SSL Hybrid by Mihkel00

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//@version=5

//AK MACD BB

//created by Algokid , February 24,2015

//@version=5

//By Mihkel00

// This script is designed for the NNFX Method, so it is recommended for Daily charts only.

// Tried to implement a few VP NNFX Rules

// This script has a SSL / Baseline (you can choose between the SSL or MA), a secondary SSL for continiuation trades and a third SSL for exit trades.

// Alerts added for Baseline entries, SSL2 continuations, Exits.

// Baseline has a Keltner Channel setting for "in zone" Gray Candles

// Added "Candle Size > 1 ATR" Diamonds from my old script with the criteria of being within Baseline ATR range.

// Credits

// Strategy causecelebre https://www.tradingview.com/u/causecelebre/

// SSL Channel ErwinBeckers https://www.tradingview.com/u/ErwinBeckers/

// Moving Averages jiehonglim https://www.tradingview.com/u/jiehonglim/

// Moving Averages everget https://www.tradingview.com/u/everget/

// "Many Moving Averages" script Fractured https://www.tradingview.com/u/Fractured/

//indicator('SSL Hybrid', overlay=true)

show_Baseline = input(title='Show Baseline', defval=true, group="SSL Hybrid")

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='EMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=30)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

//

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

//

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

//plotshape(candlesize_violation, color=color.new(color.white, 0), size=size.tiny, style=shape.diamond, location=location.top, title='Candle Size > 1xATR')

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

//plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color_bar, linewidth=4, title='MA Baseline', transp=0)

//DownPlot = plot(show_SSL1 ? sslDown : na, title='SSL1', linewidth=3, color=color_ssl1, transp=10)

barcolor(show_color_bar ? color_bar : na)

//up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title='Baseline Upper Channel')

//low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title='Basiline Lower Channel')

//fill(up_channel, low_channel, color=color_bar, transp=90)

////SSL2 Continiuation from ATR

atr_crit = input.float(0.9, step=0.1, title='Continuation ATR Criteria')

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

//LongPlot = plot(sslDown2, title='SSL2', linewidth=2, color=atr_fill, style=plot.style_circles, transp=0)

//u = plot(show_atr ? upper_band : na, '+ATR', color=color.new(color.white, 80))

//l = plot(show_atr ? lower_band : na, '-ATR', color=color.new(color.white, 80))

//ALERTS

alertcondition(ta.crossover(close, sslDown), title='SSL Cross Alert', message='SSL1 has crossed.')

alertcondition(ta.crossover(close, sslDown2), title='SSL2 Cross Alert', message='SSL2 has crossed.')

alertcondition(sell_atr, title='Sell Continuation', message='Sell Continuation.')

alertcondition(buy_atr, title='Buy Continuation', message='Buy Continuation.')

alertcondition(ta.crossover(close, sslExit), title='Exit Sell', message='Exit Sell Alert.')

alertcondition(ta.crossover(sslExit, close), title='Exit Buy', message='Exit Buy Alert.')

alertcondition(ta.crossover(close, upperk), title='Baseline Buy Entry', message='Base Buy Alert.')

alertcondition(ta.crossover(lowerk, close), title='Baseline Sell Entry', message='Base Sell Alert.')

// Buy only when price action is closed above the EMA and the line is blue color.

SSLHybridEntryLong1 = src > BBMC and color_bar == #00c3ff

// Sell only when action must be closed below the EMA and the line is red color

SSLHybridEntryShort1 = src < BBMC and color_bar == #ff0062

sslHybridNumBarsBackToLookForPullBack = input(4, title="Number Of bars back to look for SSL pullback")

// Buy when Price action must be moving above the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from blue to gray or from blue to red.

SSLHybridEntryLong2 = color_bar == #00c3ff and (f_priorBarsSatisfied(color_bar == #ff0062,sslHybridNumBarsBackToLookForPullBack) or f_priorBarsSatisfied(color_bar == color.gray, sslHybridNumBarsBackToLookForPullBack))

// Sell when Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

SSLHybridEntryShort2 = color_bar == #ff0062 and (f_priorBarsSatisfied(color_bar == #00c3ff,sslHybridNumBarsBackToLookForPullBack) or f_priorBarsSatisfied(color_bar == color.gray, sslHybridNumBarsBackToLookForPullBack))

SSLHybridEntryLong = SSLHybridEntryLong1 and SSLHybridEntryLong2

SSLHybridEntryShort = SSLHybridEntryShort1 and SSLHybridEntryShort2

// Price action must be moving below the EMA and then it has to create a pullback . The pullback is confirmed when the color changes from red to gray or from red to blue.

// If the price action is touching the EMA but the line does not change the color, the pullback is not confirmed.

// Volume Strength Finder by Saravanan_Ragavan

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Saravanan_Ragavan

//@version=5

//indicator('Volume Strength Finder', 'VSF', overlay=true)

T1 = time(timeframe.period, '0915-0916:23456')

T2 = time(timeframe.period, '0915-1530:23456')

Y = bar_index

Z1 = ta.valuewhen(T1, bar_index, 0)

L = Y - Z1 + 1

SSPV = 0.00

SSNV = 0.00

pdw = 0.00

ndw = 0.00

total_w = 0.00

for i = 1 to L - 1 by 1

total_w := high[i] - low[i]

positive = close[i] - low[i]

negative = high[i] - close[i]

pdw := positive / total_w * 100

ndw := negative / total_w * 100

SSPV := volume[i] * pdw / 100 + SSPV

SSNV := volume[i] * ndw / 100 + SSNV

SSNV

total_v = SSPV + SSNV

Pos = SSPV / total_v * 100

Neg = SSNV / total_v * 100

bgc = SSPV > SSNV ? color.green : SSPV < SSNV ? color.red : color.white

//barcolor(bgc)

var table sDisplay = table.new(position.top_right, 1, 5, bgcolor=color.aqua, frame_width=2, frame_color=color.black)

if barstate.islast

table.cell(sDisplay, 0, 0, 'Today\'s Volume : ' + str.tostring(total_v), text_color=color.white, text_size=size.large, bgcolor=color.aqua)

table.cell(sDisplay, 0, 1, 'Buyers Volume: ' + str.tostring(math.round(SSPV)), text_color=color.white, text_size=size.large, bgcolor=color.green)

table.cell(sDisplay, 0, 2, 'Sellers Volume: ' + str.tostring(math.round(SSNV)), text_color=color.white, text_size=size.large, bgcolor=color.red)

table.cell(sDisplay, 0, 3, 'Buyers Strength: ' + str.tostring(math.round(Pos)) + '%', text_color=color.white, text_size=size.large, bgcolor=color.green)

table.cell(sDisplay, 0, 4, 'Sellers Strength: ' + str.tostring(math.round(Neg)) + '%', text_color=color.white, text_size=size.large, bgcolor=color.red)

// Sellers strength above 50% at the time the MACD indiactor issues a new short signal.

VSFShortEntry = math.round(Neg) > 50

// Buyers strength above 50% at the time the MACD indiactor issues a new long signal.

VSFLongEntry = math.round(Pos) > 50

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = SSLHybridEntryLong and VSFLongEntry and MACDBBENtryLong

shortCondition =SSLHybridEntryShort and VSFShortEntry and MACDBBENtryShort

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(high)

adxdown = -ta.change(low)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=1, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=2, minval=0.01, group='Stop Loss') * 0.01

slLongClose = close < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = close > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / close * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(open) + ',' + str.tostring(high) + ',' + str.tostring(low) + ',' + str.tostring(close) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

// showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=true)

// f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

// _cellText = _title + "\n" + _value

// table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// // Draw dashboard table

// if showDashboard

// var bgcolor = color.new(color.black,0)

// // Keep track of Wins/Losses streaks

// newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// varip int winRow = 0

// varip int lossRow = 0

// varip int maxWinRow = 0

// varip int maxLossRow = 0

// if newWin

// lossRow := 0

// winRow := winRow + 1

// if winRow > maxWinRow

// maxWinRow := winRow

// if newLoss

// winRow := 0

// lossRow := lossRow + 1

// if lossRow > maxLossRow

// maxLossRow := lossRow

// // Prepare stats table

// var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

// if barstate.islastconfirmedhistory

// // Update table

// dollarReturn = strategy.netprofit

// f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

// f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

// _profit = (strategy.netprofit / strategy.initial_capital) * 100

// f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

// _numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

// f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

// _winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

// f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

// f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

// f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

// f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)