Strategie zur Umkehrung

Schriftsteller:ChaoZhang, Datum: 23.11.2023Tags:

Übersicht

Die Reversal-Catcher-Strategie ist eine Umkehrhandelsstrategie, die den Volatilitätsindikator Bollinger Bands und den Impulsindikator RSI verwendet.

Strategie Logik

Die Strategie verwendet Bollinger Bands als Haupttechnischen Indikator, kombiniert mit RSI und anderen Dynamikindikatoren zur Überprüfung von Handelssignalen.

- Verwenden Sie die 50-Tage-EMA und 21-Tage-EMA-Goldkreuz/Todkreuz, um den Trend zu bestimmen.

- In einem Abwärtstrend, wenn der Preis über die Bollinger-Unterband brecht, und der RSI nur aus dem überverkauften Gebiet zurückspringt und ein goldenes Kreuz bildet, zeigt er an, dass der überverkaufte Bereich bereits den Boden erreicht hat und ein Kaufsignal gibt.

- Bei einem Aufwärtstrend, wenn der Preis unter die obere Bollinger-Bande bricht und der RSI aus dem überkauften Bereich zurückfällt und ein totes Kreuz bildet, zeigt er an, dass der überkaufte Bereich zurückfällt und ein Verkaufssignal gibt.

- Die oben genannten Kauf- und Verkaufssignale müssen zusammen ausgelöst werden, um falsche Signale zu vermeiden.

Analyse der Vorteile

Zu den Vorteilen dieser Strategie gehören:

- Durch die Kombination von Volatilitäts- und Dynamikindikatoren werden die Signale zuverlässiger.

- Der Umkehrhandel ist mit geringem Risiko ausgestattet und eignet sich für den kurzfristigen Handel.

- Handelsregeln sind für den automatischen Handel programmierbar.

- Die Kombination mit dem Trendhandel verhindert die Eröffnung von Störungen während der Marktkonsolidierung.

Risikoanalyse

Zu den Risiken dieser Strategie gehören:

- Bollinger Bands Breakout falsches Signal Risiko, braucht RSI Filter.

- Das Risiko einer fehlgeschlagenen Umkehrung erfordert einen zeitnahen Stop-Loss.

- Das Risiko einer Umkehr des Zeitpunkts, kann zu früh eingehen oder den besten Einstiegspunkt verpassen.

Um die Risiken zu kontrollieren, können wir die Stop-Loss-Ebene festlegen, um die Risikoposition zu begrenzen, und Parameter wie Bollinger Bands Periode oder RSI-Zahlen optimieren, um die Systemleistung zu verbessern.

Optimierungsrichtlinien

Zu den wichtigsten Optimierungsschwerpunkten gehören:

- Optimieren Sie die Bollinger-Bänderparameter, passen Sie die Periodenlänge und die Standardabweichung an, um eine optimale Einstellung zu finden.

- Optimieren Sie die Periode der gleitenden Durchschnitte, um die beste Periode für die Beurteilung des Trends zu bestimmen.

- Anpassung der RSI-Parameter, um den besten Überkauf-/Überverkaufsbereich zu ermitteln.

- Fügen Sie andere Indikatoren wie KDJ, MACD hinzu, um die Einstiegssignale zu diversifizieren.

- Einführung von Modellen für maschinelles Lernen zur Suche nach optimierten Parametern.

Schlussfolgerung

Die Reversal-Catcher-Strategie ist insgesamt eine wirksame kurzfristige Handelsstrategie. Durch die Kombination von Trendfilterung und Umkehrsignalen kann sie falsche Signale während der Marktkonsolidierung vermeiden und den Kampf gegen den Trend vermeiden. Durch kontinuierliche Parameter und Modelloptimierung kann eine bessere Strategieleistung erzielt werden.

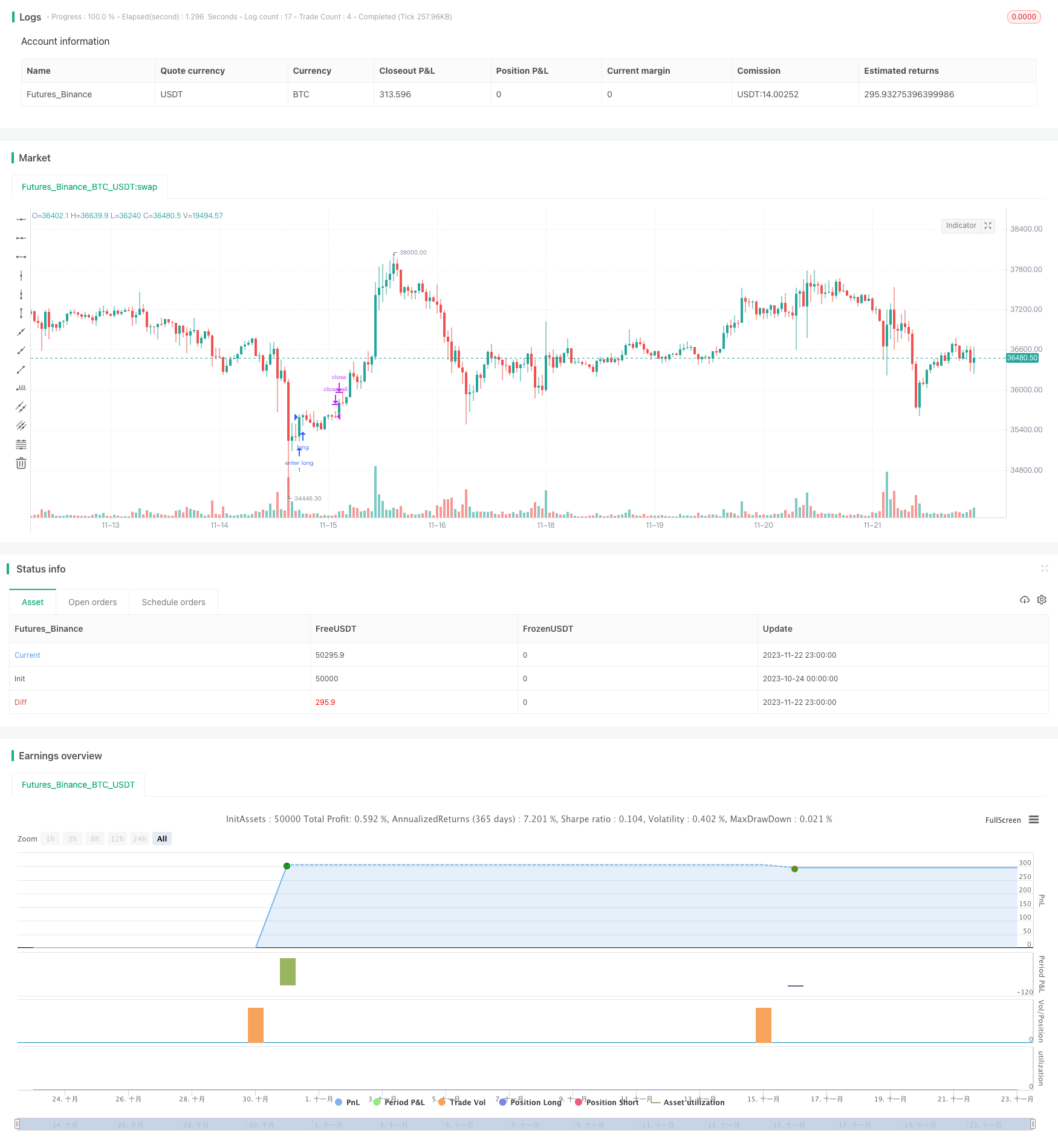

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This is an Open source work. Please do acknowledge in case you want to reuse whole or part of this code.

// Please see the documentation to know the details about this.

//@version=5

strategy('Strategy:Reversal-Catcher', shorttitle="Reversal-Catcher", overlay=true , currency=currency.NONE, initial_capital=100000)

// Inputs

src = input(close, title="Source (close, high, low, open etc.")

BBlength = input.int(defval=20, minval=1,title="Bollinger Period Length, default 20")

BBmult = input.float(defval=1.5, minval=1.0, maxval=4, step=0.1, title="Bollinger Bands Standard Deviation, default is 1.5")

fastMovingAvg = input.int(defval=21, minval=5,title="Fast Exponential Moving Average, default 21", group = "Trends")

slowMovingAvg = input.int(defval=50, minval=8,title="Slow Exponential Moving Average, default 50", group = "Trends")

rsiLenght = input.int(defval=14, title="RSI Lenght, default 14", group = "Momentum")

overbought = input.int(defval=70, title="Overbought limit (RSI), default 70", group = "Momentum")

oversold = input.int(defval=30, title="Oversold limit (RSI), default 30", group = "Momentum")

hide = input.bool(defval=true, title="Hide all plots and legends from the chart (default: true)")

// Trade related

tradeType = input.string(defval='Both', group="Trade settings", title="Trade Type", options=['Both', 'TrendFollowing', 'Reversal'], tooltip="Consider all types of trades? Or only Trend Following or only Reversal? (default: Both).")

endOfDay = input.int(defval=1500, title="Close all trades, default is 3:00 PM, 1500 hours (integer)", group="Trade settings")

mktAlwaysOn = input.bool(defval=false, title="Markets that never closed (Crypto, Forex, Commodity)", tooltip="Some markers never closes. For those cases, make this checked. (Default: off)", group="Trade settings")

// Utils

annotatePlots(txt, val, hide) =>

if (not hide)

var l1 = label.new(bar_index, val, txt, style=label.style_label_left, size = size.tiny, textcolor = color.white, tooltip = txt)

label.set_xy(l1, bar_index, val)

/////////////////////////////// Indicators /////////////////////

vwap = ta.vwap(src)

plot(hide ? na : vwap, color=color.purple, title="VWAP", style = plot.style_line)

annotatePlots('VWAP', vwap, hide)

// Bollinger Band of present time frame

[BBbasis, BBupper, BBlower] = ta.bb(src, BBlength, BBmult)

p1 = plot(hide ? na : BBupper, color=color.blue,title="Bollinger Bands Upper Line")

p2 = plot(hide ? na : BBlower, color=color.blue,title="Bollinger Bands Lower Line")

p3 = plot(hide ? na : BBbasis, color=color.maroon,title="Bollinger Bands Width", style=plot.style_circles, linewidth = 1)

annotatePlots('BB-Upper', BBupper, hide)

annotatePlots('BB-Lower', BBlower, hide)

annotatePlots('BB-Base(20-SMA)', BBbasis, hide)

// RSI

rsi = ta.rsi(src, rsiLenght)

// Trend following

ema50 = ta.ema(src, slowMovingAvg)

ema21 = ta.ema(src, fastMovingAvg)

annotatePlots('21-EMA', ema21, hide)

annotatePlots('50-EMA', ema50, hide)

// Trend conditions

upTrend = ema21 > ema50

downTrend = ema21 < ema50

// Condition to check Special Entry: HH_LL

// Long side:

hhLLong = barstate.isconfirmed and (low > low[1]) and (high > high[1]) and (close > high[1])

hhLLShort = barstate.isconfirmed and (low < low[1]) and (high < high[1]) and (close < low[1])

longCond = barstate.isconfirmed and (high[1] < BBlower[1]) and (close > BBlower) and (close < BBupper) and hhLLong and ta.crossover(rsi, oversold) and downTrend

shortCond = barstate.isconfirmed and (low[1] > BBupper[1]) and (close < BBupper) and (close > BBlower) and hhLLShort and ta.crossunder(rsi, overbought) and upTrend

// Trade execute

h = hour(time('1'), syminfo.timezone)

m = minute(time('1'), syminfo.timezone)

hourVal = h * 100 + m

totalTrades = strategy.opentrades + strategy.closedtrades

if (mktAlwaysOn or (hourVal < endOfDay))

// Entry

var float sl = na

var float target = na

if (longCond)

strategy.entry("enter long", strategy.long, 1, limit=na, stop=na, comment="Long[E]")

sl := low[1]

target := high >= BBbasis ? BBupper : BBbasis

alert('Buy:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

if (shortCond)

strategy.entry("enter short", strategy.short, 1, limit=na, stop=na, comment="Short[E]")

sl := high[1]

target := low <= BBbasis ? BBlower : BBbasis

alert('Sell:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

// Exit: target or SL

if ((close >= target) or (close <= sl))

strategy.close("enter long", comment=close < sl ? "Long[SL]" : "Long[T]")

if ((close <= target) or (close >= sl))

strategy.close("enter short", comment=close > sl ? "Short[SL]" : "Short[T]")

else if (not mktAlwaysOn)

// Close all open position at the end if Day

strategy.close_all(comment = "EoD[Exit]", alert_message = "EoD Exit", immediately = true)

- Preisumkehrstrategie nach Preiskanal

- KST-Indikator Gewinnstrategie

- Dynamische Zwei-Wege-Positionsstrategie

- Relative Strength Index Flat-Reversal-Strategie

- Schnelle RSI-Gap-Handelsstrategie für Kryptowährungen

- KDJ RSI Crossover Kauf-Verkaufssignalstrategie

- Ichimoku Backtester mit TP, SL und Cloud-Bestätigung

- Strategie für Gyroskopbanden auf der Grundlage von mehreren Zeitrahmen und durchschnittlicher Amplitude

- Strategie zur Umkehrung des doppelten gleitenden Durchschnitts

- Dynamische Strategie zur Verfolgung des gleitenden Durchschnitts

- Strategie zur Umkehrung der RSI-Lücke

- 3 Minuten kurze Strategie nur für Expertenberater

- Aktionszone ATR Umkehrfolge Quant Strategie

- MACD-Trend nach Strategie

- Momentum-Analyse Ichimoku Wolkennebel Blitz Handelsstrategie

- Verkehrslichthandelsstrategie auf der Grundlage der EMA

- Bei der Bewertung der Risikopositionen werden die Risikopositionen gemäß Artikel 42 Absatz 1 Buchstabe b der CRR berücksichtigt.

- Umgekehrte Las Vegas Algorithmische Handelsstrategie

- Strategie für das solide gleitende Durchschnittssystem

- Erweiterte Bollinger Band Moving Average Grid Trend Tracking-Strategie