概述

该策略的核心思想是利用动态移动平均线进行趋势跟踪,设置止损止盈,并结合海克林蜡烛技术指示做多空信号判断。ATR指标用于计算动态移动平均线和止损位置。

策略原理

该策略首先计算ATR指标,然后结合输入的价格源和参数,计算出动态移动平均线。当价格高于/低于动态移动平均线时产生做多/空信号。同时设置止损止盈位置,跟踪价格变动实时更新。

具体来说,首先计算ATR指标及参数nLoss。然后计算当前周期价格及上一周期的止损位置,比较两者更新止损线。当价格突破上一周期止损线时产生做多/空信号pos和相应颜色;交易信号产生时,画出箭头标记。最后根据止损止盈逻辑平仓。

优势分析

该策略最大的优势在于利用动态移动平均线实时跟踪价格变化。这比传统固定移动平均线更能捕捉趋势,降低止损可能性。另外结合ATR止损,可以根据市场波动幅度灵活调整止损位置,有效控制风险。

风险及解决方法

该策略主要风险在于价格可能会有较大跳空,从而突破止损线产生错误信号。此外,条件设置不当也可能导致过于频繁交易。

解决方法是优化移动平均线期数,调整ATR和止损系数大小,降低错误信号概率。另外可以设置过滤条件,避免过于密集交易。

优化方向

该策略可以从以下方面进行优化:

测试不同类型和周期的移动平均线,找到最佳参数组合

优化ATR周期参数,平衡止损灵敏度

添加额外过滤条件和指标,提高信号质量

调整止损止盈数值,优化收益风险比

总结

本策略核心思路是动态移动平均线实时跟踪价格变化,运用ATR指标动态设置止损位置,在跟踪趋势的同时严格控制风险。通过参数优化和规则修正,可以将该策略调教成一个非常实用的量化系统。

策略源码

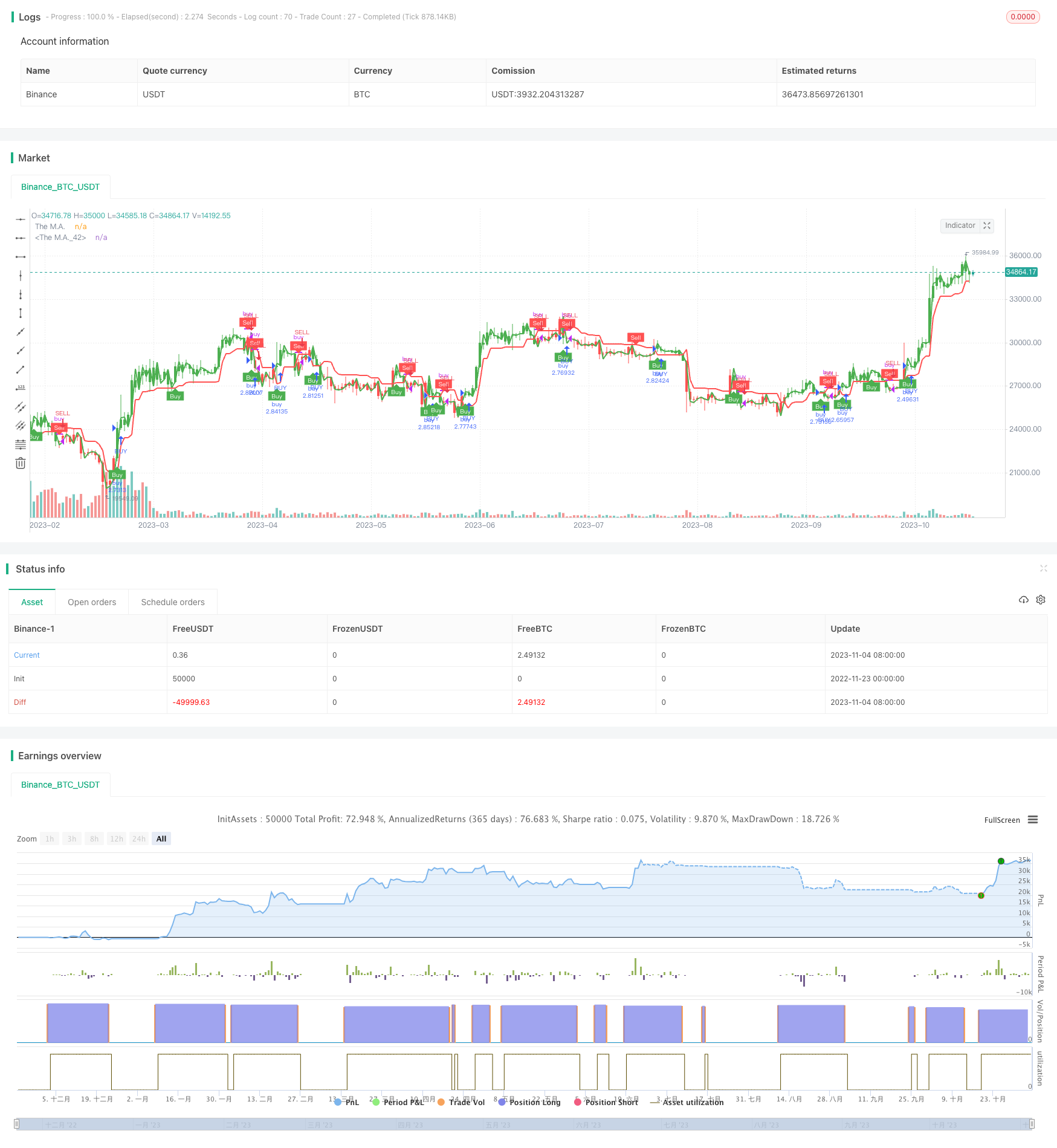

/*backtest

start: 2022-11-23 00:00:00

end: 2023-11-05 05:20:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BTC_USDT","stocks":0}]

*/

//@version=5

strategy(title='UT Bot v5', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

//CREDITS to HPotter for the orginal code. The guy trying to sell this as his own is a scammer lol.

//Edited and converted to @version=5 by SeaSide420 for Paperina

// Inputs

AllowBuy = input(defval=true, title='Allow Buy?')

AllowSell = input(defval=false, title='Allow Sell?')

h = input(false, title='Signals from Heikin Ashi Candles')

//revclose = input(defval=true, title='Close when reverse signal?')

Price = input(defval=open, title='Price Source (recommended OPEN to avoid repainting)')

smoothing = input.string(title="Moving Average Type", defval="HMA", options=["SMA", "EMA", "WMA", "HMA"])

MA_Period = input(2, title='This changes the MAPeriod')

a = input.float(1, title='This changes the sensitivity',step=0.1)

c = input(11, title='ATR Period')

TakeProfit = input.int(defval=50000, title='Take Profit ($)', minval=1)

StopLoss = input.int(defval=50000, title='Stop Loss ($)', minval=1)

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, Price, lookahead=barmerge.lookahead_off) : Price

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ma_function(src, MA_Period) =>

switch smoothing

"SMA" => ta.sma(src, MA_Period)

"EMA" => ta.ema(src, MA_Period)

"WMA" => ta.wma(src, MA_Period)

=> ta.hma(src, MA_Period)

thema = ma_function(src, MA_Period)

above = ta.crossover(thema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, thema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

plot(thema,title="The M.A.",color=color.green,linewidth=2)

plot(xATRTrailingStop,title="The M.A.",color=color.red,linewidth=2)

plotshape(buy, title = "Buy", text = "Buy", style = shape.labelup, location = location.belowbar, color= color.green, textcolor = color.white, size = size.tiny)

plotshape(sell, title = "Sell", text = "Sell", style = shape.labeldown, location = location.abovebar, color= color.red, textcolor = color.white, size = size.tiny)

barcolor(barbuy ? color.green : na)

barcolor(barsell ? color.red : na)

strategy.close_all(when=strategy.openprofit>TakeProfit,alert_message="Close- TakeProfit", comment = "TP")

strategy.close_all(when=strategy.openprofit<StopLoss-(StopLoss*2),alert_message="Close- StopLoss", comment = "SL")

strategy.close("buy", when = sell and AllowSell==false , comment = "close buy")

strategy.close("sell", when = buy and AllowBuy==false, comment = "close sell")

strategy.entry("buy", strategy.long, when = buy and AllowBuy)

strategy.entry("sell", strategy.short, when = sell and AllowSell)