X48 - Optimierung und Anpassung der Daylight Hunter-Strategie

Schriftsteller:ChaoZhang, Datum: 2023-12-18 12:19:41Tags:

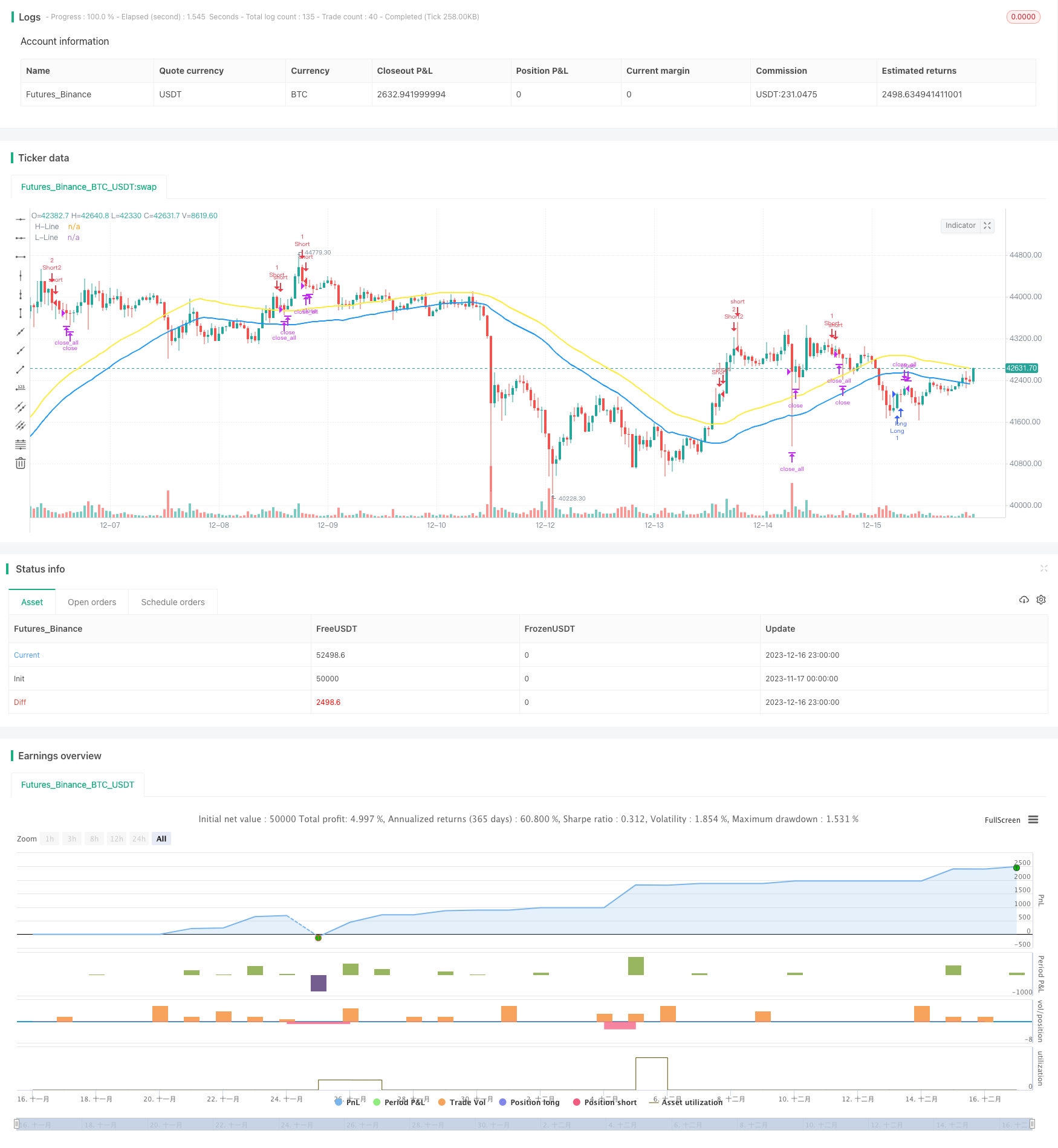

Übersicht

Diese Strategie kombiniert den klassischen Stochastischen Indikator und den SMA-Indikator, um eine starke Trendverfolgungsfähigkeit zu erzielen. Die Kernidee der Strategie besteht darin, Trendrichtungssignale mit dem Stochastischen Indikator zu identifizieren und mit dem SMA-Indikator zu filtern, um die Signalqualität zu verbessern. Es bietet auch verschiedene Risikomodi zur dynamischen Anpassung von Risiko und Belohnung. Darüber hinaus wird das Multi-Timeframe-Urteil zur Optimierung des Eintrittszeitpunkts und zur Kontrolle des Handelsrisikos verwendet.

Strategie Logik

- Die Strategie verwendet eine erweiterte Version des Stochastischen Indikators. Die Parameter umfassen %K-Periode, %K-Gleichung und %D-Gleichung zur Kontrolle der Empfindlichkeit.

- Die SMA-Indikatorparameter umfassen die obere SMA und die untere SMA, um Signale für eine höhere Qualität zu filtern.

- Es werden drei Risikomodi zur Auswahl auf der Grundlage der Risikopräferenzen vorgesehen, darunter Low Risk, Medium Risk und High Risk.

- Ein langes Signal wird identifiziert, wenn der Stoch die Schwelle überschreitet und der Schlusskurs unterhalb der unteren SMA liegt.

- Das Multi-Timeframe-Judgement-Modul überprüft die Signale über verschiedene Zeitrahmen hinweg, um den Einstiegszeitplan zu optimieren und das Handelsrisiko zu kontrollieren.

Vorteile

- Der erweiterte Stochastikindikator verbessert die Empfindlichkeit für die schnelle Erfassung von Marktveränderungen.

- Der doppelte SMA-Schienenfiltermechanismus verhindert effektiv falsche Signale und verbessert die Signalqualität.

- Die verschiedenen Risikomodi ermöglichen es den Nutzern, die Parameter flexibel an ihre Risikobereitschaft anzupassen.

- Das Multi-Time-Frame-Urteil optimiert die Wahl des Eintrittszeitpunkts, um das Handelsrisiko zu reduzieren.

- Der Gesamtstrategie-Rahmen ist wissenschaftlich, stabil und anpassungsfähig.

Risiken

- Die Strategie selbst verfügt nicht über einen Stop-Loss-Mechanismus, sondern benötigt einen manuellen Stop-Loss, um das Abwärtsrisiko zu kontrollieren.

- Eine hohe Signalfrequenz kann zu einem Überhandel und zu erhöhten Transaktionskosten führen.

- Die Strategie ist auf Parameter und Einstellungen des Risikomodus angepaßt, die für optimale Ergebnisse optimiert werden müssen.

- Es kann zu großen Rückzügen kommen. Es ist möglicherweise nicht geeignet für den vollen Positionshandel. Die richtige Positionsgröße ist wichtig.

Lösungen:

- Setzen Sie die richtige Stop-Loss-Ratio basierend auf der Marktvolatilität, um die Risikokontrolle zu maximieren.

- Stoch-Parameter anpassen, um die Signalfrequenz zu reduzieren, oder einen Mindestgewinn festlegen, um unnötige Trades zu vermeiden.

- Der Modus mit geringem Risiko wird als Ausgangswert empfohlen.

- Kontrolle der Positionsgröße und Durchschnittswert der Risikopositionen zur Verringerung des Handelsrisikos.

Möglichkeiten zur Verbesserung

- Umfassende parametrische Optimierung von Stoch und SMA, um die optimale Parameterkombination zu finden.

- Erhöhung der Zahl der Urteile über mehrere Zeitrahmen, um mehr Bezugnahmen und bessere Eintrittsentscheidungen zu erzielen.

- Einführung dynamischer Stop-Loss-Mechanismen wie ATR Trailing Stop, um das Abwärtsrisiko besser zu begrenzen.

- Bauen Sie Signalfilterungs- und Bestätigungsmechanismen wie Lautstärke, um Fallen zu vermeiden.

- Zusätzliches Positionsgrößenmodul zur aktiven Anpassung der Positionsgröße anhand der Marktbedingungen, um das Risikopositionsniveau pro Handel zu senken.

Zusammenfassung

Diese Strategie kombiniert die Stärken von Stochastic und SMA-Indikatoren, um eine starke Trendverfolgungsfähigkeit zu erreichen. Der Rahmen ist solide und die Indikatoranwendung ist flüssig. Durch die Kontrolle von Parametern und Risikomodi wird die Natur der Indikatoren für eine bessere Stabilität wiederhergestellt. Das Multi-Timeframe-Urteil verbessert auch die Anpassungsfähigkeit über Produkte und Zeitrahmen hinweg. Insgesamt hat es eine gute Vielseitigkeit und ein enormes Potenzial für weitere Optimierungen und Verbesserungen.

/*backtest

start: 2023-11-17 00:00:00

end: 2023-12-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//►►►► Description ►►►►

//1. The Original Pine Script

//- Stochastic

//- SMA

//1.1 Concepts

//- Stochastic crossover and crossunder with range 80/20 or 70/30 or 50/50 from your risk you can adjust it from config

//- Confirm Signal by SMA High and Low Original Range is 50 or you can adjust by your self in config Setting

//1.2 Condition

//- Buy Condition = Stochastic crossover Sto Signal Line and SMA Filter <= 20 or 30 or 50 from your risk

//- Sell Condition = Stochastic crossunder Sto Signal Line and SMA Filter >= 80 or 70 or 50 from your risk

//1.3 Idea For Trading

//- Trend Runing If you use "Trend" Mode is Martingale Your Position Until You Have a Profit

//- Scalping You Can Adjust TP for Little Profit and Increase Your Winrate

//►►►► Strategy results ►►►►

// ►► Use an account size ►►

// - For Newbie i recommend try to use 50$ you can test in MT4 Or MT5 Start With 50$ Leverage : 1000

// - For Some User Have a Exp. Trading : 500$ you can use martingale for help your trading

// - For Expert User : 5000$ or 5000$ (Cent) you can use martingale for help your trading

// ►► realistic commission AND slippage ►►

// - Some Broker Not Have a commission for Gold and Forex.

// - slippage : default i'm Setting is 350 point, (it's mean 35 pip) it's average or your account is ECN or Zero Spread You can Set = 0

// ►► Size For Trading ►►

// - This strategy is Start From 0.01 lot and use martingale for next position

// - This not perfect strategy. it's have equity drawdown. just try and test your config you like.

// ►► Sample size Dataset Trading ►►

// - This Strategy Recommend For Long-Term Trading Becuase It's Have Martingale Help Your Next Position

//►►►► strategy's default Properties ►►►►

// - From Default Setting : Slippage or Spread Set = 0 (Becuase I don't know your account spread) you can set in Properties

// ** Some Broeker Are 2 Digits or 3 Digit You Must Set By Your Self (like 35 point or 350 point from your account spread)

// - From Default Setting : commission = 0 (Becuase I don't know your account commission) you can set in Properties

// ** Some Broeker Are not commission for forex and gold

//@version=5

var int slippage = 0

strategy("X48 - DayLight Hunter | Strategy | V.01.03", overlay=true)

var int hedge_mode = 0

var int sto_buy = 0

var int sto_sell = 0

Trade_Mode = input.string(defval = "Trend", title = "⚖️ Mode For Trade [Oneway / Hedge / ⭐Trend]", options = ["Oneway", "Hedge", "Trend"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "Oneway = Switching Position Type With Signal\nHedge Mode = Not Switching Position Type Unitl TP or SL")

Risk_Mode = input.string(defval = "Low Risk", title = "⚖️ Risk Signal Mode [⭐Low / Medium / High]", options = ["Low Risk", "Medium Risk", "High Risk"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "[[Signal Form Stochastic]]\nLow Risk is >= 80 and <= 20\nMedium Risk is >= 70 and <= 30\nHigh Risk is >= 50 and <=50")

if Trade_Mode == "Oneway"

hedge_mode := 0

else if Trade_Mode == "Hedge"

hedge_mode := 1

else if Trade_Mode == "Trend"

hedge_mode := 2

if Risk_Mode == "Low Risk"

sto_buy := 20

sto_sell := 80

else if Risk_Mode == "Medium Risk"

sto_buy := 30

sto_sell := 70

else if Risk_Mode == "High Risk"

sto_buy := 50

sto_sell := 50

periodK = input.int(15, title="%K Length", minval=1, group = "Stochastic Setting", inline = "Sto0")

smoothK = input.int(3, title="%K Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

periodD = input.int(3, title="%D Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

GRSMA = "=== 🧮 SMA Filter Mode ==="

SMA_Mode = input.bool(defval = true, title = "🧮 SMA High and Low Filter Mode", group = GRSMA, tooltip = "Sell Signal With Open >= SMA High\nBuy Signal With Close <= SMA Low")

SMA_High = input.int(defval = 50, title = "SMA High", group = GRSMA, inline = "SMA1")

SMA_Low = input.int(defval = 50, title = "SMA Low", group = GRSMA, inline = "SMA1")

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

high_line = ta.sma(high, SMA_High)

low_line = ta.sma(low, SMA_Low)

plot(SMA_Mode ? high_line : na, "H-Line", color = color.yellow, linewidth = 2)

plot(SMA_Mode ? low_line : na, "L-Line", color = color.blue, linewidth = 2)

entrybuyprice = strategy.position_avg_price

var bool longcondition = na

var bool shortcondition = na

if SMA_Mode == true

longcondition := ta.crossover(k,d) and d <= sto_buy and close < low_line and open < low_line// or ta.crossover(k, 20)// and close <= low_line

shortcondition := ta.crossunder(k,d) and d >= sto_sell and close > high_line and open > high_line// or ta.crossunder(k, 80)// and close >= high_line

else

longcondition := ta.crossover(k,d) and d <= sto_buy

shortcondition := ta.crossunder(k,d) and d >= sto_sell

//longcondition_double = ta.crossover(d,20) and close < low_line// and strategy.position_size > 0

//shortcondition_double = ta.crossunder(d,80) and close > high_line// and strategy.position_size < 0

//=============== TAKE PROFIT and STOP LOSS by % =================

tpsl(percent) =>

strategy.position_avg_price * percent / 100 / syminfo.mintick

GR4 = "=====🆘🆘🆘 TAKE PROFIT & STOP LOSS BY [%] 🆘🆘🆘====="

mode= input.bool(title="🆘 Take Profit & Stop Loss By Percent (%)", defval=true, group=GR4, tooltip = "Take Profit & Stop Loss by % Change\n0 = Disable")

tp_l = tpsl(input.float(0, title='🆘 TP [LONG] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

tp_s = tpsl(input.float(0, title='🆘 TP [SHORT] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

sl = tpsl(input.float(0, title='🆘 Stop Loss % [All Mode / 1st Position]', group=GR4, tooltip = "0 = Disable"))

tp_pnl = input.float(defval = 1, title = "🆘 TakeProfit by PNL ($) eg. (0.1 = 0.1$)", group = GR4, tooltip = "All Mode TP by PNL")

spread_size = input.float(defval = 0.350, title = "🆘 Spread Point Size(Eg. 35 Point or 350 Point From Your Broker Digits)", tooltip = "Spread Point Form Your Broker \nEg. 1920.124 - 1920.135 or 1920.12 - 1920.13\nPlease Check From Your Broker", group = GR4)

GR5 = "===💮💮💮 Hedge / Martingale Mode 💮💮💮==="

//hedge_mode = input.bool(defval = true, title = "⚖️ Hedge / Martingale Mode", group = GR5)

hedge_point = input.int(defval = 500, title = "💯 Hedge Point Range / Martingale Range", group = GR5, tooltip = "After Entry Last Position And Current Price More Than Point Range Are Open New Hedge Position")

hedge_gale = input.float(defval = 2.0, title = "✳️ Martingale For Hedge Multiply [default = 2]", tooltip = "Martingale For Multiply Hedge Order", group = GR5)

hedge_point_size = hedge_point/100

calcStopLossPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else

na

calcStopLossL_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

calcStopLossS_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else

na

calcTakeProfitL_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitS_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

var stoploss = 0.

var stoploss_l = 0.

var stoploss_s = 0.

var takeprofit = 0.

var takeprofit_l = 0.

var takeprofit_s = 0.

var takeprofit_ll = 0.

var takeprofit_ss = 0.

if mode == true

if (strategy.position_size > 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_l := stoploss

else if sl <= 0

stoploss := na

if tp_l > 0

takeprofit := tp_l

takeprofit_ll := close + ((close/100)*tp_l)

//takeprofit_s := na

else if tp_l <= 0

takeprofit := na

if (strategy.position_size < 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_s := stoploss

else if sl <= 0

stoploss := na

if tp_s > 0

takeprofit := tp_s

takeprofit_ss := close - ((close/100)*tp_s)

//takeprofit_l := na

else if tp_s <= 0

takeprofit := na

else if strategy.position_size == 0

stoploss := na

takeprofit := na

//takeprofit_l := calcTakeProfitL_AlertPrice(tp_l)

//takeprofit_s := calcTakeProfitS_AlertPrice(tp_s)

//stoploss_l := calcStopLossL_AlertPrice(sl)

//stoploss_s := calcStopLossS_AlertPrice(sl)

//////////// INPUT BACKTEST RANGE ////////////////////////////////////////////////////

var string BTR1 = '════════⌚⌚ INPUT BACKTEST TIME RANGE ⌚⌚════════'

i_startTime = input(defval = timestamp("01 Jan 1945 00:00 +0000"), title = "Start", inline="timestart", group=BTR1, tooltip = 'Start Backtest YYYY/MM/DD')

i_endTime = input(defval = timestamp("01 Jan 2074 23:59 +0000"), title = "End", inline="timeend", group=BTR1, tooltip = 'End Backtest YYYY/MM/DD')

//////////////// Strategy Alert For X4815162342 BOT //////////////////////

Text_Alert_Future = '{{strategy.order.alert_message}}'

copy_Fu = input( defval= Text_Alert_Future , title="Alert Message for BOT", inline = '00' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It' ,tooltip = 'Alert For X48-BOT > Copy and Paste To Alert Function')

TimeFrame_input = input(defval= 'Input Your TimeFrame [1m, 15m, 1h, 4h, 1d ,1w]' , title="TimeFrame Text Alert", inline = '01' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It', tooltip = "[1m, 15m, 1h, 4h, 1d ,1w]")

string Alert_EntryL = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ll)+' $\n❌ SL : '+str.tostring(stoploss_l)+' $\n⏰ Time : {{timenow}}'

string Alert_EntryS = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ss)+' $\n❌ SL : '+str.tostring(stoploss_s)+' $\n⏰ Time : {{timenow}}'

string Alert_TPSL = '🪙 Asset : {{ticker}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💹 {{strategy.order.comment}}\n💸 Price : {{strategy.order.price}} $\n⏰ Time : {{timenow}}'

if true

if (longcondition and strategy.position_size == 0) or (longcondition and strategy.position_size < 0 and hedge_mode == 0)

strategy.entry("Long", strategy.long, comment = "🌙", alert_message = Alert_EntryL)

//if longcondition_double

// //strategy.cancel_all()

// strategy.entry("Long2", strategy.long, comment = "🌙🌙")

// //strategy.exit("Exit",'Long', qty_percent = 100 , profit = takeprofit, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L")

if (shortcondition and strategy.position_size == 0) or (shortcondition and strategy.position_size > 0 and hedge_mode == 0)

strategy.entry("Short", strategy.short, comment = "👻", alert_message = Alert_EntryS)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S")

//if shortcondition_double

// //strategy.cancel_all()

// strategy.entry("Short2", strategy.short, comment = "👻👻")

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 1

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 1

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

if longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 2

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 2

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

last_price_l = (strategy.opentrades.entry_price(strategy.opentrades - 1) + (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) + spread_size

last_price_s = (strategy.opentrades.entry_price(strategy.opentrades - 1) - (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) - spread_size

current_price = request.security(syminfo.tickerid, "1", close)

current_pricel = request.security(syminfo.tickerid, "1", close) + spread_size

current_prices = request.security(syminfo.tickerid, "1", close) - spread_size

//if mode == true

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚%L", comment_loss = "SL💚%L", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚LL", comment_loss = "SL💚L", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️%S", comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//else if strategy.position_size < 0 and strategy.opentrades > 1

// lastsize = (strategy.position_size) * -1

// lastprofitorder = strategy.openprofit

// if lastprofitorder >= 0.07

// strategy.close_all(comment = "TP❤️️SS", alert_message = Alert_TPSL)

//===================== เรียกใช้ library =========================

import X4815162342/X48_LibaryStrategyStatus/2 as fuLi

//แสดงผล Backtest

show_Net = input.bool(true,'Monitor Profit&Loss', inline = 'Lnet', group = '= PNL MONITOR SETTING =')

position_ = input.string('bottom_center','Position', options = ['top_right','middle_right','bottom_right','top_center','middle_center','bottom_center','middle_left','bottom_left'] , inline = 'Lnet')

size_i = input.string('auto','size', options = ['auto','tiny','small','normal'] , inline = 'Lnet')

color_Net = input.color(color.blue,"" , inline = 'Lnet')

// fuLi.NetProfit_Show(show_Net , position_ , size_i, color_Net )

- Handelsstrategie des MACD-Robot

- Bollinger-Bänder Handelsstrategie mit doppelter Standardabweichung

- Handelsstrategie auf Basis von MACD- und RSI-Crossover-Signalen

- Handelsstrategie für RSI nach Bayesian Condition

- Strategie zur Umkehrung des Drehpunkts

- Quantitative Handelsstrategie auf der Grundlage von TSI-Indikatoren und Hull- gleitenden Durchschnitten

- Kanaltrendstrategie

- CCI-Strategie "nur für lange Zeit"

- Strategie für das gleitende Durchschnittsband

- MACD Dual Moving Average-Verfolgungsstrategie

- Heikin-Ashi - 0,5% Veränderung der kurzfristigen Handelsstrategie

- Positive Kanal-EMA-Strailing-Stop-Strategie

- Die Kreuzung der gleitenden Durchschnittswerte von Galileo Galilei

- AC-Backteststrategie des Williams-Indikators

- Niedrige Volatilität Richtungskauf mit Gewinnübernahme und Stop Loss

- Festverzinsliche Stop-Loss- und Take-Profit-Strategie auf Basis gleitender Durchschnitte

- Quantitative Handelsstrategie auf der Grundlage der doppelten EMA und des Preisvolatilitätsindex

- Momentum Breakout - Bidirektionale Verfolgungsstrategie

- Super Trend LSMA Langzeitstrategie

- Drei- und Vier-Bar-Breakout-Umkehrstrategie