Momentum TD Reversal Handelsstrategie

Überblick

Die Dynamik-TD-Umkehr-Handelsstrategie ist eine quantitative Handelsstrategie, die die TD Sequential-Indikator verwendet, um Preisumkehrsignale zu identifizieren. Die Strategie basiert auf der Analyse der Preisdynamik, um nach der Bestätigung eines Preisumkehrsignals eine Über- oder Unterposition zu erstellen.

Strategieprinzip

Die Strategie analysiert die Preisschwankungen mit dem TD Sequential-Indikator und identifiziert die Preisumkehrform von 9 aufeinanderfolgenden K-Linien. Insbesondere wird die Strategie als Short-Opportunity beurteilt, wenn eine fallende K-Line nach einem Anstieg von 9 aufeinanderfolgenden K-Linien identifiziert wird. Umgekehrt wird die Strategie als Mehr-Opportunity beurteilt, wenn eine steigende K-Line nach einem Rückgang von 9 aufeinanderfolgenden K-Linien identifiziert wird.

Die Vorteile des TD Sequential-Indikators ermöglichen es, ein Preisumkehrsignal vorzeitig zu erfassen. In Kombination mit einer bestimmten Anzahl von Nachschub- und Absturzmechanismen in der Strategie können nach der Bestätigung des Umkehrsignals rechtzeitig Über- oder Kurzpositionen eingerichtet werden, um eine bessere Eintrittschance zu erhalten.

Analyse der Stärken

- Der TD-Sequential-Indikator hilft, die Chancen auf eine Kursumkehr zu erkennen.

- Die Einrichtung eines Abwehrmechanismus, um die Preisumkehr zu ermitteln

- Eintrittspunkte durch Umkehrung der Formationsphase

Risikoanalyse

- Falsche Durchbrüche im TD Sequential-Index sind möglich und müssen in Kombination mit anderen Faktoren bestätigt werden

- Risikominderung durch angemessene Kontrolle der Positionsgröße und -dauer

Optimierungsrichtung

- Identifizierung von Umkehrsignalen in Kombination mit anderen Indikatoren, um das Risiko eines falschen Durchbruchs zu vermeiden

- Einrichtung von Stop-Loss-Mechanismen zur Kontrolle von Einzelschäden

- Optimierung der Positionsgröße und -dauer, Ausgewogenheit der Gewinngröße und Risikokontrolle

Zusammenfassen

Die Dynamik-TD-Umkehr-Trading-Strategie, die eine Preisumkehr durch den TD Sequential-Indikator voraussagt und nach der Bestätigung der Umkehr schnell Positionen aufbaut, ist eine Strategie, die für Dynamik-Händler geeignet ist. Die Strategie hat den Vorteil, Umkehrmöglichkeiten zu identifizieren, jedoch muss darauf geachtet werden, das Risiko zu kontrollieren, um größere Verluste durch falsche Durchbrüche zu vermeiden.

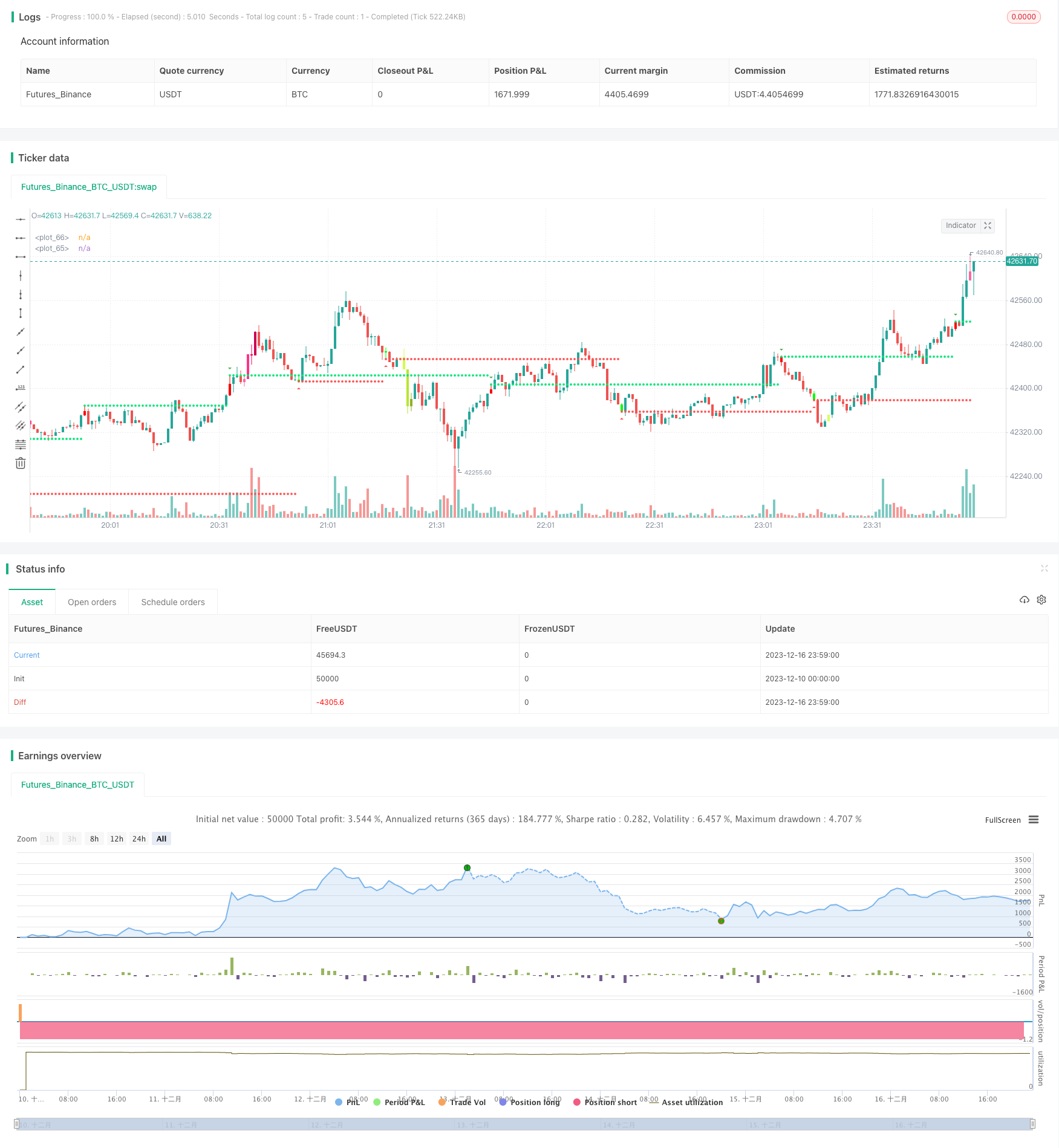

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//This strategy is based on TD sequential study from glaz.

//I made some improvement and modification to comply with pine script version 4.

//Basically, it is a strategy based on proce action, supports and resistance.

strategy("Sequential Up/Down", overlay=true )

source = input(close)

BarsCount = input(9, "Count of consecutive bars")

useLinearRegression = input(false)

LR_length = input(13,"Linear Regression length")

SR = input(true,"Shows Supports and Resistance lines")

Barcolor = input(true,"Color bars when there is a signal")

transp = input(0, "Transparency of triangle Up or Downs")

Numbers = input(true,"Plot triangle Up or Downs at signal")

//Calculation

src=useLinearRegression?linreg(source,LR_length,0):source

UP = 0

DW = 0

UP := src > src[4] ? nz(UP[1]) + 1 : 0

DW := src < src[4] ? nz(DW[1]) + 1 : 0

UPUp = UP - valuewhen(UP < UP[1], UP, 1)

DWDn = DW - valuewhen(DW < DW[1], DW, 1)

plotshape(Numbers ? UPUp == BarsCount ? true : na : na, style=shape.triangledown, text="", color=color.green, location=location.abovebar, transp=transp)

plotshape(Numbers ? DWDn == BarsCount ? true : na : na, style=shape.triangleup, text="", color=color.red, location=location.belowbar, transp=transp)

// S/R Code By johan.gradin

//------------//

// Sell Setup //

//------------//

priceflip = barssince(src < src[4])

sellsetup = src > src[4] and priceflip

sell = sellsetup and barssince(priceflip != BarsCount)

sellovershoot = sellsetup and barssince(priceflip != BarsCount+4)

sellovershoot1 = sellsetup and barssince(priceflip != BarsCount+5)

sellovershoot2 = sellsetup and barssince(priceflip != BarsCount+6)

sellovershoot3 = sellsetup and barssince(priceflip != BarsCount+7)

//----------//

// Buy setup//

//----------//

priceflip1 = barssince(src > src[4])

buysetup = src < src[4] and priceflip1

buy = buysetup and barssince(priceflip1 != BarsCount)

buyovershoot = barssince(priceflip1 != BarsCount+4) and buysetup

buyovershoot1 = barssince(priceflip1 != BarsCount+5) and buysetup

buyovershoot2 = barssince(priceflip1 != BarsCount+6) and buysetup

buyovershoot3 = barssince(priceflip1 != BarsCount+7) and buysetup

//----------//

// TD lines //

//----------//

TDbuyh = valuewhen(buy, high, 0)

TDbuyl = valuewhen(buy, low, 0)

TDsellh = valuewhen(sell, high, 0)

TDselll = valuewhen(sell, low, 0)

//----------//

// Plots //

//----------//

plot(SR ? TDbuyh ? TDbuyl : na : na, style=plot.style_circles, linewidth=1, color=color.red)

plot(SR ? TDselll ? TDsellh : na : na, style=plot.style_circles, linewidth=1, color=color.lime)

barcolor(Barcolor ? sell ? #FF0000 : buy ? #00FF00 : sellovershoot ? #FF66A3 : sellovershoot1 ? #FF3385 : sellovershoot2 ? #FF0066 : sellovershoot3 ? #CC0052 : buyovershoot ? #D6FF5C : buyovershoot1 ? #D1FF47 : buyovershoot2 ? #B8E62E : buyovershoot3 ? #8FB224 : na : na)

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 100, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => buy or buyovershoot or buyovershoot1 or buyovershoot2 or buyovershoot3// functions can be used to wrap up and work out complex conditions

//exitLong() => oscillator <= 0

strategy.entry(id = "Buy", long = true, when = enterLong() )// use function or simple condition to decide when to get in

//strategy.close(id = "Buy", when = exitLong() )// ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => sell or sellovershoot or sellovershoot2 or sellovershoot3

//exitShort() => oscillator >= 0

strategy.entry(id = "Sell", long = false, when = enterShort())

//strategy.close(id = "Sell", when = exitShort() )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Buy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Sell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)