Low-Point-Pyramide - Tracking-Strategie mit geringem Risiko

Die Strategie verringert das Risiko durch die Kombination verschiedener Indikatoren, die potenzielle Tiefpunkte in der Preisbewegung identifizieren, und durch die schrittweise Positionserrichtung durch Pyramidenverfolgung. Die Strategie kombiniert Stopp-, Stop- und Moving-Stop-Funktionen, um das Risiko effektiv zu kontrollieren.

Strategieübersicht

Die Strategie verwendet zunächst die Differenz zwischen dem RSI und dem EMA RSI, um potenzielle Tiefpunkte zu identifizieren. Um falsche Signale zu filtern, wird die Strategie auch mit einem Moving Average und einem Multi-Time-Frame-Random-Indikator für die Bestätigung kombiniert. Sobald ein Tiefpunktsignal bestätigt ist, werden nach und nach mehrere Aufträge an einem Punkt erstellt, der etwas niedriger ist, was die Idee der Tracking-Pyramide ist.

Strategieprinzip

Die Strategie besteht hauptsächlich aus drei Teilen: dem Modul zur Identifizierung von Tiefständen, dem Modul zur Pyramidenverfolgung und dem Modul zur Risikokontrolle.

Modul zur Identifizierung von TiefpunktenDie Verwendung des Unterschieds zwischen dem RSI-Indikator und seinem EMA zur Identifizierung eines potenziellen Tiefpunkts des Preises. Zur Verbesserung der Genauigkeit wurde auch ein Moving Average-Indikator und ein Multi-Time-Frame-Random-Indikator eingeführt, um das Signal zu filtern. Die Gültigkeit eines Tiefpunktssignals wird nur bestätigt, wenn der Preis unter dem Moving Average liegt und die K-Linie des Random-Indikators unter 30 liegt.

PyramidenverfolgungsmodulIm Zentrum der Strategie steht: Sobald das Tiefpunktsignal bestätigt ist, eröffnet die Strategie den ersten Auftrag 0.1% unterhalb des Tiefpunkts. Danach werden weitere Aufträge hinzugefügt, solange der Preis weiter sinkt und einen gewissen Prozentsatz unterhalb des Durchschnitts-Eintrittspreises liegt. Die Anzahl der neuen Aufträge steigt in Folge, so dass beispielsweise der dritte Auftrag dreimal so groß ist wie der erste.

RisikokontrollmodulEs besteht aus drei Hauptelementen: erstens, ein Gesamtstop-Loss, der auf den höchsten Preis in der letzten Periode basiert. Alle Orders werden gleichzeitig mit diesem Stop-Loss beendet. Zweitens, eine individuelle Stop-Setup für jeden Auftrag, die es erlaubt, nach einem bestimmten Prozentsatz des Einstiegspreises zu stoppen.

Strategische Vorteile

- Verringerung des Risikos für einzelne Bestellungen durch Pyramidenverfolgung und gleichzeitige Differenzierung des Gesamtrisikos

- Mehrfache Kombination von Indikatoren zur Verbesserung der Genauigkeit bei der Identifizierung von Tiefpunkten

- Gesamtschadensstopp, Stopp und mobile Schadensstopp-Funktionen können Risiken wirksam kontrollieren

- Der Zinssatzschutz schützt das Konto vor erheblichen Verlusten

- Das Risiko-Gewinn-Gleichgewicht kann durch Anpassung der Parameter gefunden werden

Strategisches Risiko

- Die Genauigkeit bei der Erkennung von Tiefpunkten ist noch begrenzt, da möglicherweise optimale Einstiegspunkte verpasst oder falsche Signale eingegeben werden.

- Die Zunahme der Bestellungen kann zu Nachteilen führen und die Verluste erhöhen.

- Längere Laufzeiten sind erforderlich, um die Vorteile der Strategie zu zeigen

- Unzureichende Einstellungen der Parameter können zu unzureichender Risikokontrolle führen

Um die oben genannten Risiken zu verringern, können Optimierungen in folgenden Bereichen vorgenommen werden:

- Ersatz oder Erweiterung von Indikatoren zur Verbesserung der Genauigkeit der Identifizierung von Tiefpunkten

- Optimierung von Parametern wie Anzahl, Intervall und Stop-to-Spread, um das Risiko für einzelne Bestellungen zu reduzieren

- Die Stop-Loss-Margin wird entsprechend verkürzt, um die Gewinne zu schützen.

- Verschiedene Sorten zu testen, wählen Sie die, die flüssig sind, die schwanken.

Richtung der Strategieoptimierung

Die Strategie kann noch weiter optimiert werden:

- Versuchen Sie, die Schwachstellen der fortgeschrittenen Technologien wie maschinelles Lernen zu identifizieren

- Parameter wie die Anzahl der Orders, die Stop-Loss-Marge und andere, die sich an die Marktentwicklung anpassen

- Erhöhung der Stop-Loss-Strategie in der Box, um die Verluste zu vermeiden

- Erhöhung der Wiedereintrittsmechanismen

- Strategieparameter zur Optimierung von Aktien- und Kryptowährungsvarianten

Zusammenfassen

Die Strategie reduziert das Risiko für einzelne Aufträge durch die Idee der Pyramidenverfolgung. Funktionen wie Gesamtstop, Stop-Stop und Mobile Stop spielen auch eine gute Rolle bei der Risikokontrolle. Es gibt jedoch noch Optimierungsmöglichkeiten für die Identifizierung von Tiefpunkten.

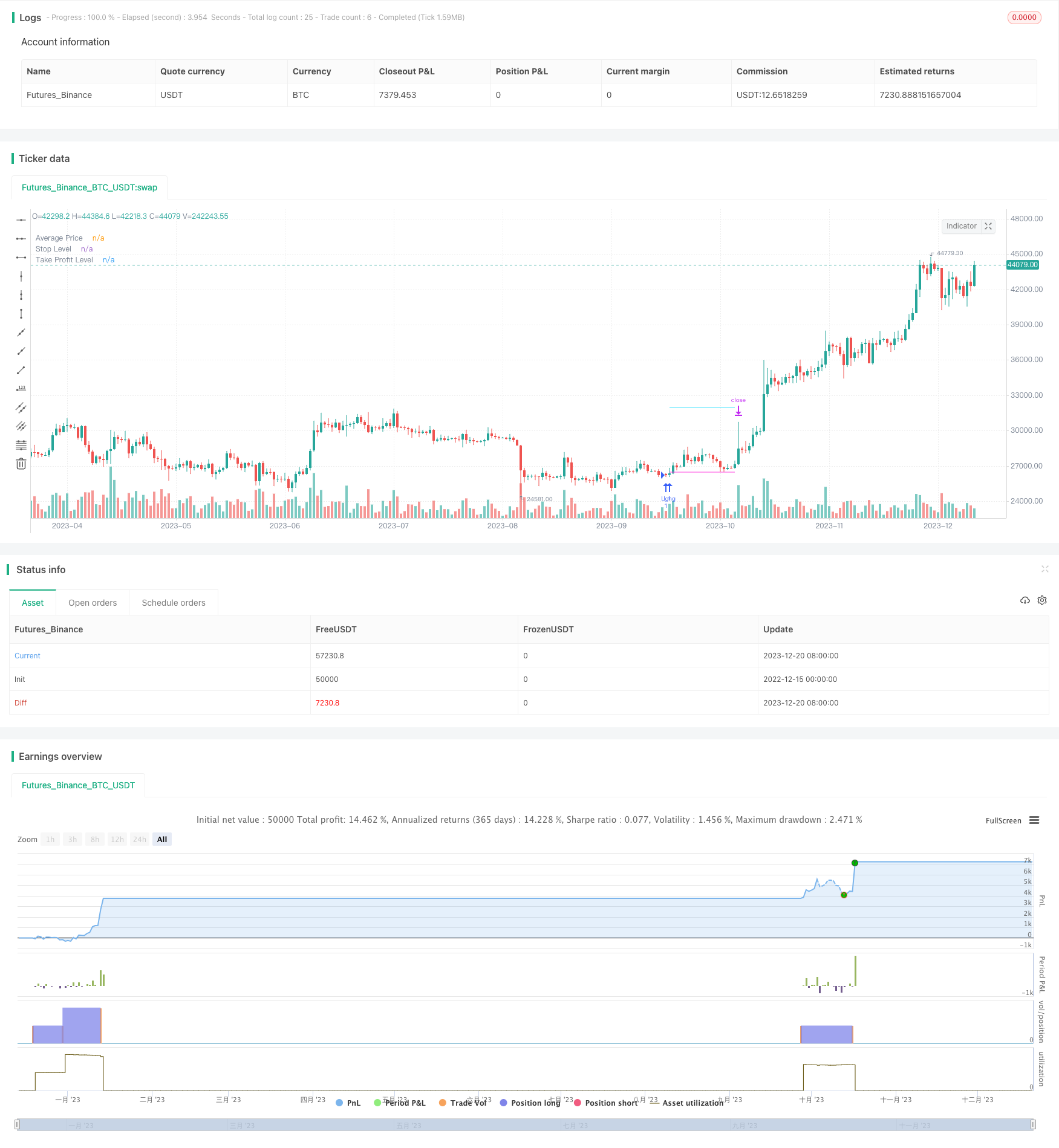

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © A3Sh

//@version=5

// Strategy that finds potential lows in the price action and spreads the risk by entering multiple positions at these lows.

// The low is detected based on the difference between MTF RSI and EMA based RSI, Moving Average and MTF Stochastic indicators.

// The size of each next position that is entered is multiplied by the sequential number of the position.

// Each separate position can exit when a specified take profit is triggered and re-open when detecting a new potential low.

// All positions are closed when the price action crosses over the dynamic blue stop level line.

// This strategy combines open-source code developed by fellow Tradingview community members:

// The Lowfinder code is developed by RafaelZioni

// https://www.tradingview.com/script/GzKq2RVl-Low-finder/

// Both the MTF RSI code and the MTF Stochastic code are adapted from the MTFindicators libary written by Peter_O

// https://www.tradingview.com/script/UUVWSpXR-MTFindicators/

// The Stop Level calculation is inspired by the syminfo-mintick tutorial on Kodify.net

// https://kodify.net/tradingview/info/syminfo-mintick/

strategy("LowFinder_PyraMider",

overlay=true, pyramiding=99,

precision=2,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

commission_type=strategy.commission.percent,

commission_value=0.06,

slippage=1

)

// Backtest Window

start_time = input(defval=timestamp("01 April 2021 20:00"), group = "Backtest Window", title="Start Time")

end_time = input(defval=timestamp("01 Aug 2030 20:00"), group = "Backtest Window", title="End Time")

window() => true

// Inputs

portfolio_size = input.float (100, group = 'Risk - Portfolio', title = 'Portfolio %', step=1.0) / 100

leverage = input.int (1, group = 'Risk - Portfolio', title = 'Leverage', minval = 1)

q_mode = input.string ('multiply', group = 'Risk - Order Size', title = 'Order Size Mode', options = ['base', 'multiply'], tooltip = 'Base mode: the base quantiy for each sequential order. Multiply mode: each quantity is multiplied by order number')

q_mode_m = input.int (1, group = 'Risk - Order Size', title = 'Order Size Divider (Multiply Mode)', tooltip = 'Divide Multiply by this number to lower the sequential order sizes')

fixed_q = input.bool (false, group = 'Risk - Order Size', title = 'Fixed Order Size', inline = '01', tooltip = 'Use with caution! Overrides all Risk calculations')

amount_q = input.float (1, group = 'Risk - Order Size', title = '. . Base Currency:', inline = '01')

sl_on = input.bool (false, group = 'Risk - Stop Loss', title = 'StopLoss of', inline = '03')

stopLoss = input.float (1.5, group = 'Risk - Stop Loss', title = '', step=0.1, inline = '03') / 100

sl_mode = input.string ('equity', group = 'Risk - Stop Loss', title = '% of', options = ['avg_price', 'equity'], inline = '03')

stop_len = input.int (100, group = 'Risk - Stop Level', title = 'Stop Level Length', tooltip = 'Lookback most recent highest high')

stop_deviation = input.float (0.3, group = 'Risk - Stop Level', title = 'Deviatation % above Stop Level', step=0.1) / 100

cond2_toggle = input.bool (true , group = 'Risk - Take Profit', title = 'Take Profit/Trailing Stop', inline = '04')

tp_all = input.float (1.0, group = 'Risk - Take Profit', title = '..........%', step=0.1, inline = '04') / 100

tp_on = input.bool (true, group = 'Risk - Take Profit', title = 'Exit Crossover Take Profit and .....', inline = '02')

exit_mode = input.string ('stoplevel', group = 'Risk - Take Profit', title = '', options = ['close', 'stoplevel'], inline = '02')

takeProfit = input.float (10.0, group = 'Risk - Take Profit', title = 'Take Profit % per Order', tooltip = 'Each separate order exits when hit', step=0.1)

posCount = input.int (12, group = 'Pyramiding Settings', title = 'Max Number of Orders')

next_entry = input.float (0.2, group = 'Pyramiding Settings', title = 'Next Order % below Avg. Price', step=0.1)

oa_lookback = input.int (0, group = 'Pyramiding Settings', title = 'Next Order after X candles', tooltip = 'Prevents opening too much orders in a Row')

len_rsi = input.int (5, group = 'MTF LowFinder Settings', title = 'Lookback of RSI')

mtf_rsi = input.int (1, group = 'MTF LowFinder Settings', title = 'Higher TimeFrame Multiplier RSI', tooltip='Multiplies the current timeframe by specified value')

ma_length = input.int (26, group = 'MTF LowFinder Settings', title = 'MA Length / Sensitivity')

new_entry = input.float (0.1, group = 'MTF LowFinder Settings', title = 'First Order % below Low',step=0.1, tooltip = 'Open % lower then the found low')/100

ma_signal = input.int (100, group = 'Moving Average Filter', title = 'Moving Average Length')

periodK = input.int (14, group = 'MTF Stochastic Filter', title = 'K', minval=1)

periodD = input.int (3, group = 'MTF Stochastic Filter', title = 'D', minval=1)

smoothK = input.int (3, group = 'MTF Stochastic Filter', title = 'Smooth', minval=1)

lower = input.int (30, group = 'MTF Stochastic Filter', title = 'MTF Stoch Filter (above gets filtered)')

mtf_stoch = input.int (10, group = 'MTF Stochastic Filter', title = 'Higher TimeFrame Multiplier', tooltip='Multiplies the current timeframe by specified value')

avg_on = input.bool (true, group = 'Plots', title = 'Plot Average Price')

plot_ma = input.bool (false, group = 'Plots', title = 'Plot Moving Average')

plot_ts = input.bool (false, group = 'Plots', title = 'Plot Trailing Stop Level')

// variables //

var entry_price = 0.0 // The entry price of the first entry

var previous_entry = 0.0 // Stores the price of the previous entry

var iq = 0.0 // Inititial order quantity before risk calculation

var nq = 0.0 // Updated new quantity after the loop

var oq = 0.0 // Old quantity at the beginning or the loop

var q = 0.0 // Final calculated quantity used as base order size

var int order_after = 0

// Order size calaculations //

// Order size based on max amount of pyramiding orders or fixed by user input ///

// Order size calculation based on 'base' mode or ' multiply' mode //

if fixed_q

q := amount_q

else if q_mode == 'multiply'

iq := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

oq := iq

for i = 0 to posCount

nq := oq + (iq * ( i/ q_mode_m + 1))

oq := nq

q := (iq * posCount / oq) * iq

else

q := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

// Function to calcaulate final order size based on order size modes and round the result with 1 decimal //

quantity_mode(index,string q_mode) =>

q_mode == 'base' ? math.round(q,1) : q_mode == 'multiply' ? math.round(q * (index/q_mode_m + 1),1) : na

// LowFinder Calculations //

// MTF RSI by Peter_O //

rsi_mtf(float source, simple int mtf,simple int len) =>

change_mtf=source-source[mtf]

up_mtf = ta.rma(math.max(change_mtf, 0), len*mtf)

down_mtf = ta.rma(-math.min(change_mtf, 0), len*mtf)

rsi_mtf = down_mtf == 0 ? 100 : up_mtf == 0 ? 0 : 100 - (100 / (1 + up_mtf / down_mtf))

// Lowfinder by RafaelZioni //

vrsi = rsi_mtf(close,mtf_rsi,len_rsi)

pp=ta.ema(vrsi,ma_length)

dd=(vrsi-pp)*5

cc=(vrsi+dd+pp)/2

lows=ta.crossover(cc,0)

// MTF Stoch Calcualation // MTF Stoch adapted from Peter_O //

stoch_mtfK(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

stoch_mtfD(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

d = ta.sma(k, periodD * mtf)

mtfK = stoch_mtfK(close, mtf_stoch, periodK)

mtfD = stoch_mtfD(close, mtf_stoch, periodK)

// Open next position % below average position price //

below_avg = close < (strategy.position_avg_price * (1 - (next_entry / 100)))

// Moving Average Filter //

moving_average_signal = ta.sma(close, ma_signal)

plot (plot_ma ? moving_average_signal : na, title = 'Moving Average', color = color.rgb(154, 255, 72))

// Buy Signal //

buy_signal = lows and close < moving_average_signal and mtfK < lower

// First Entry % Below lows //

if buy_signal

entry_price := close * (1 - new_entry)

// Plot Average Price of Position//

plot (avg_on ? strategy.position_avg_price : na, title = 'Average Price', style = plot.style_linebr, color = color.new(color.white,0), linewidth = 1)

// Take profit per Open Order //

take_profit_price = close * takeProfit / 100 / syminfo.mintick

// Calculate different Stop Level conditions to exit All //

// Stop Level Caculation //

stop_long1_level = ta.highest (high, stop_len)[1] * (1 + stop_deviation)

stop_long2_level = ta.highest (high, stop_len)[2] * (1 + stop_deviation)

stop_long3_level = ta.highest (high, stop_len)[3] * (1 + stop_deviation)

stop_long4_level = ta.highest (high, stop_len)[1] * (1 - 0.008)

// Stop triggers //

stop_long1 = ta.crossover(close,stop_long1_level)

stop_long2 = ta.crossover(close,stop_long2_level)

stop_long4 = ta.crossunder(close,stop_long4_level)

// Exit Conditions, cond 1 only Stop Level, cond2 Trailing Stop option //

exit_condition_1 = close < strategy.position_avg_price ? stop_long1 : close > strategy.position_avg_price ? stop_long2 : na

exit_condition_2 = close < strategy.position_avg_price * (1 + tp_all) ? stop_long2 :

close > strategy.position_avg_price * (1 + tp_all) ? stop_long4 :

close < strategy.position_avg_price ? stop_long1 : na

// Switch between conditions //

exit_conditions = cond2_toggle ? exit_condition_2 : exit_condition_1

// Exit when take profit //

ex_m = exit_mode == 'close' ? close : stop_long2_level

tp_exit = ta.crossover(ex_m, strategy.position_avg_price * (1 + tp_all)) and close > strategy.position_avg_price * 1.002

// Plot stoplevel, take profit level //

plot_stop_level = strategy.position_size > 0 ? stop_long2_level : na

plot_trailing_stop = cond2_toggle and plot_ts and strategy.position_size > 0 and close > strategy.position_avg_price * (1 + tp_all) ? stop_long4_level : na

plot(plot_stop_level, title = 'Stop Level', style=plot.style_linebr, color = color.new(#41e3ff, 0), linewidth = 1)

plot(plot_trailing_stop, title = 'Trailing Stop', style=plot.style_linebr, color = color.new(#4cfca4, 0), linewidth = 1)

plot_tp_level = cond2_toggle and strategy.position_size > 0 ? strategy.position_avg_price * (1 + tp_all) : na

plot(plot_tp_level, title = 'Take Profit Level', style=plot.style_linebr, color = color.new(#ff41df, 0), linewidth = 1)

// Calculate Stop Loss based on equity and average price //

loss_equity = ((strategy.position_size * strategy.position_avg_price) - (strategy.equity * stopLoss)) / strategy.position_size

loss_avg_price = strategy.position_avg_price * (1 - stopLoss)

stop_loss = sl_mode == 'avg_price' ? loss_avg_price : loss_equity

plot(strategy.position_size > 0 and sl_on ? stop_loss : na, title = 'Stop Loss', color=color.new(color.red,0),style=plot.style_linebr, linewidth = 1)

// Enter first position //

if ta.crossunder(close,entry_price) and window() and strategy.position_size == 0

strategy.entry('L_1', strategy.long, qty = math.round(q,1), comment = '+' + str.tostring(math.round(q,1)))

previous_entry := close

// Enter next pyramiding positions //

if buy_signal and window() and strategy.position_size > 0 and below_avg

order_after := order_after + 1

for i = 1 to strategy.opentrades

entry_comment = '+' + str.tostring((quantity_mode(i,q_mode))) // Comment with variable //

if strategy.opentrades == i and i < posCount and order_after > oa_lookback

entry_price := close

entry_id = 'L_' + str.tostring(i + 1)

strategy.entry(id = entry_id, direction=strategy.long, limit=entry_price, qty= quantity_mode(i,q_mode), comment = entry_comment)

previous_entry := entry_price

order_after := 0

// Exit per Position //

if strategy.opentrades > 0 and window()

for i = 0 to strategy.opentrades

exit_comment = '-' + str.tostring(strategy.opentrades.size(i))

exit_from = 'L_' + str.tostring(i + 1)

exit_id = 'Exit_' + str.tostring(i + 1)

strategy.exit(id= exit_id, from_entry= exit_from, profit = take_profit_price, comment = exit_comment)

// Exit All //

if exit_conditions or (tp_exit and tp_on and cond2_toggle) and window()

strategy.close_all('Exti All')

entry_price := 0

if ta.crossunder(close,stop_loss) and sl_on and window()

strategy.close_all('StopLoss')

entry_price := 0