Ripple-Strategie basierend auf dem Backtest-Intervall Coral Trend-Indikator

Überblick

Diese Strategie verwendet die LazyBear Coral Trend-Anzeige, um die Richtung der Kursentwicklung zu bestimmen, und potenzielle Einstiegspunkte durch die Identifizierung von Umkehrungen in der Richtung der Coral Trend-Anzeige. Um falsche Durchbrüche zu filtern, verwendet die Strategie die ADX-Anzeige oder die Gruppe der Absolute Strength Histogramm und HawkEye Volume-Anzeige als kooperative Bestätigungsanzeige, um zuverlässigere Einstiege zu ermöglichen.

Der Exit-Mechanismus verwendet die höchsten/niedrigsten Preise der jüngsten N-K-Linie multipliziert mit dem Ratio der konfigurierbaren Risiko-Renditen, um die Stop-Loss- und Stop-Off-Positionen einzurichten.

Strategieprinzip

Wenn der Korallentrend-Indikator die Richtung des großen Trends beurteilt, tritt ein kleiner Pullback in die entgegengesetzte Richtung auf, während die Farbe des Indikators unverändert bleibt. Wenn der Pullback endet und der Preis in die Richtung des Haupttrends zurückkehrt, die der Korallentrend angibt, kann dies als eine bessere Einstiegszeit angesehen werden.

Die Eintrittsbedingungen sind:

Die Richtung des Coral Trend-Indikators stimmt mit der Richtung des Handels überein ((mehr Kopf = grün, leerer Kopf = rot)

Seit dem letzten vollständigen Durchbruch des Coral Trend Indicators ((die Höchststände der letzten Bar überschreiten die Coral Trend Line)) gibt es mindestens 1 K-Linien, deren Tiefststände vollständig über dem Coral Trend Indicator liegen ((Mehrköpfe) oder deren Höchststände vollständig unter dem Coral Trend Indicator liegen ((Leerköpfe))

Ein kleiner Rückschlag in die entgegengesetzte Richtung (Zurückziehung), bei dem der Schlusskurs immer auf der entgegengesetzten Seite des Korallentrends bleibt

Nach einer kleinen Umkehrung kehrte der Kursabschluss in die Richtung des Haupttrends zurück, die von der Coral Trend angezeigt wurde.

Die oben genannten sind die Hauptvoraussetzungen. Gleichzeitig verwendet die Strategie die ADX-Anzeige oder das Absolute Strength Histogramm und die HawkEye Volume-Anzeige als Bestätigungsvoraussetzung für den Eintritt.

Der ADX-Indikator verlangt, dass der Wert > 20 ist und kürzlich 1 K-Linie gestiegen ist. Die Reihenfolge der grünen und roten Linie des DI entspricht der Handelsrichtung.

Das Absolute Strength Histogramm verlangt, dass die Farbe mit der Handelsrichtung übereinstimmt (Multiple = Blau, Blank = Rot). HawkEye Volume verlangt, dass die Farbe mit der Handelsrichtung übereinstimmt (Multiple = Grün, Blank = Rot).

Die Exit-Methode verwendet die höchsten oder niedrigsten Preise der jüngsten N-K-Linie multipliziert mit dem Risiko-Rendite-Verhältnis, um den Stop-Loss und den Stop-Out zu setzen. N-Werte und Risiko-Rendite-Verhältnisse können durch Parameter konfiguriert werden.

Analyse der Stärken

Der größte Vorteil dieser Strategie besteht darin, dass der Coral Trend-Indikator die Richtung des Haupttrends ermittelt und die Eintrittschancen durch die Identifizierung der Umkehrung entdeckt wird, um zu vermeiden, dass er in nicht-trendigen Märkten mit den Wellen fließt. Der Confirm-Indikator filtert gleichzeitig viele falsche Durchbrüche und erhöht somit die Erfolgsrate des Eintritts.

Darüber hinaus bietet die Strategie eine vollständige Risikokontrolle, einschließlich Stop-Loss-Margin-Einstellungen und Risiko-Margin-Prozentsatz-Kontrollen, so dass auch einzelne Verluste nicht zu einem großen Schlag auf das Gesamtkapital führen.

Risikoanalyse

Die größte Gefahr dieser Strategie besteht darin, dass die Verwendung von Indikatoren als Einstiegsurteile erlaubt ist. Es ist leicht zu glauben, dass die vollständige Abhängigkeit von der Parameterkonfiguration automatisch einen Gewinn bringt. In der Tat müssen die Parameteroptimierung und die Regelkonfiguration in Verbindung mit der Gesetzmäßigkeit der grundlegenden Preisänderungen und der intuitiven Beurteilung der Wirkung der Indikatoren und der Preisverbindung eingerichtet werden, um eine Konfiguration zu erstellen, die besser zu Ihrem Handelsstil und Ihrer Sorte passt.

Außerdem müssen die Einstellungen für die Stop-Loss- und die Stop-Loss-Position angemessen sein. Eine zu hohe Stop-Loss-Multiplikation kann dazu führen, dass der Spieler nicht aufhören kann, aus dem Spielfeld zu gehen, und eine zu kleine Stop-Loss-Position ist zu riskant. Dies muss je nach Schwankung der verschiedenen Sorten und der individuellen Risikobereitschaft eingestellt werden.

Optimierungsrichtung

Die Strategie kann in folgenden Bereichen optimiert werden:

Anpassung der Parameter des Coral Trend-Indikators, damit er besser auf Preisänderungen für verschiedene Sorten reagiert

Versuchen Sie, verschiedene Confirm-Indikatoren oder Kombinationen von Indikatoren, wie KDJ, MACD usw., zu verwenden, um die Einstiegssignale genauer zu machen

Die Berechnung von Stop-Loss- und Stop-Off-Lösungen wird an die Schwankungen der verschiedenen Sorten angepasst, um eine bessere Risikokontrolle zu gewährleisten

Erweiterung des Moduls für die Vermögensverwaltung, um die Einzelleistung an die Anzahl der Positionen anzupassen und die Gesamtverluste effektiv zu kontrollieren

Hinzufügung eines Trading Time Control Moduls, um Strategien nur in bestimmten Zeitabschnitten zu betreiben und Verluste in Zeiten starker Volatilität zu vermeiden

Zusammenfassen

Die Strategie nutzt zunächst den Korallen Trend, um die langen mittleren Preistrends zu ermitteln, und dann durch die Beurteilung der Umkehrung, in Verbindung mit dem falschen Durchbruch des Confirm-Signalfilters, um eine zuverlässige Trendverfolgungsstrategie zu erstellen. Gleichzeitig ermöglicht die ausgefeilte Windkontrolle die langfristige Laufzeit der Strategie und die Stabilität der Mittel. Durch weitere Parameter- und Moduloptimierungen wird die Strategie möglicherweise für mehr Sorten geeignet und hat eine bessere Stabilität und Ertragsfähigkeit.

/*backtest

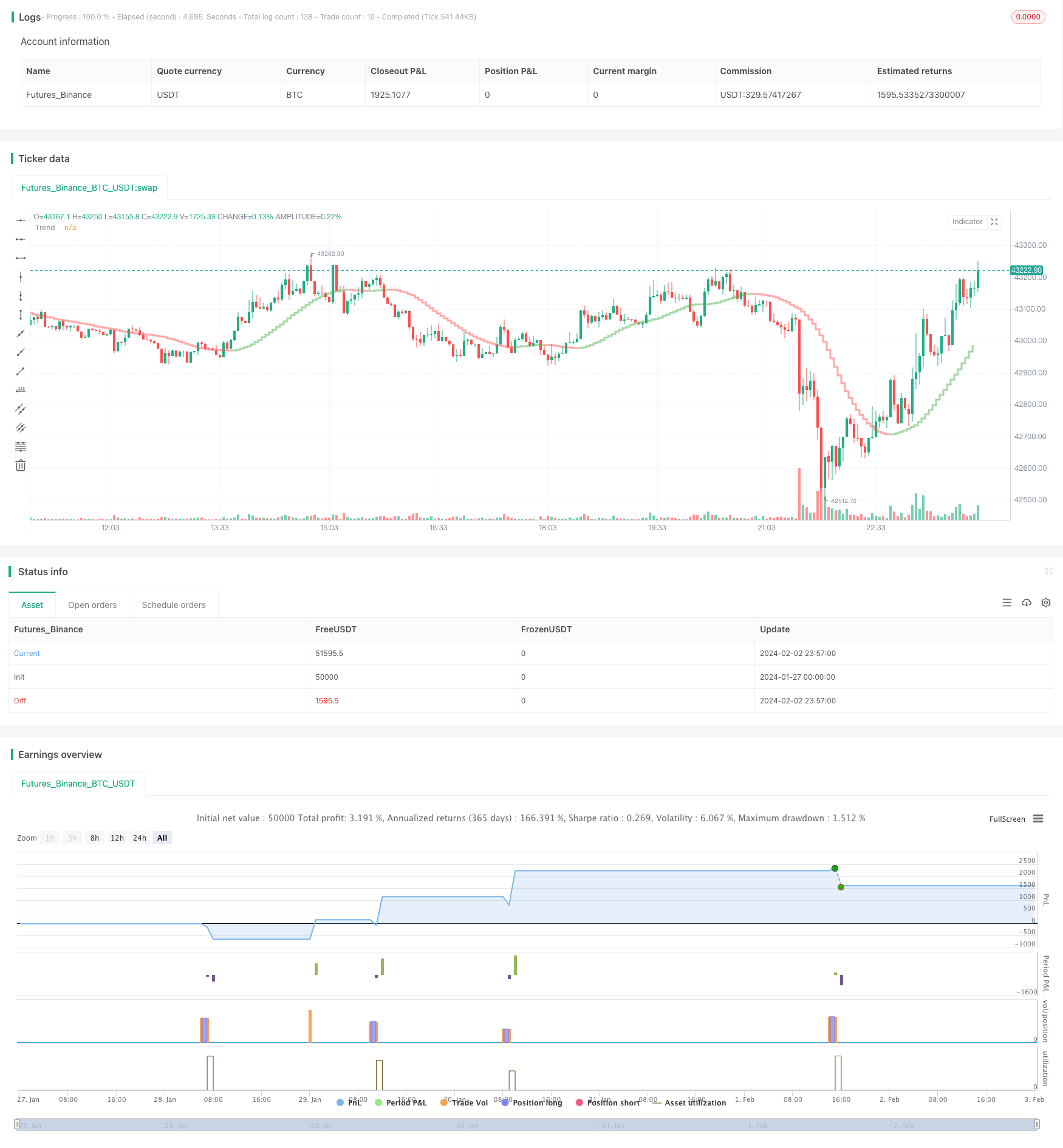

start: 2024-01-27 00:00:00

end: 2024-02-03 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @description

//

// Strategy is taken from the TradeIQ YouTube video called "I Finally Found 80% Win Rate Trading Strategy For Crypto"

// Check out the full video for further details/clarification on strategy entry/exit conditions.

//

// It incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Conditions outlines below

//

// - Trade exit: Conditions outlined below

//

// - Backtesting: Configurable backtesting range by date

//

// - Trade drawings: TP/SL boxes drawn for all trades (can be turned on and off)

// Trade exit information labels (can be turned on and off)

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: Coral Trend is bullish

// C2: At least 1 candle where low is above Coral Trend since last cross above Coral Trend

// C3: Pullback happens and price closes below Coral Trend

// C4: Coral Trend colour remains bullish for duration of pullback

// C5: After valid pullback, price then closes above Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Green line is above red line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is blue

// C6.2.2: HawkEye Volume Indicator colour is green

// SHORT: C1: Coral Trend is bearish

// C2: At least 1 candle where high is below Coral Trend since last cross below Coral Trend

// C3: Pullback happens and price closes above Coral Trend

// C4: Coral Trend colour remains bearish for duration of pullback

// C5: After valid pullback, price then closes below Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Red line is above green line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is red

// C6.2.2: HawkEye Volume Indicator colour is red

// NOTE: All the optional confirmation indicators cannot be overlayed with Coral Trend so feel free to add each separately to the chart for visual purposes

//

//

// - Trade exit: Stop Loss: Calculated by recent swing low over previous X candles (configurable with "Local High/Low Lookback")

// Take Profit: Calculated from R:R multiplier * Stop Loss size

//

// @credits

//

// Coral Trend Indicator [LazyBear] by @LazyBear

// Absolute Strength Histogram | jh by @jiehonglim

// Indicator: HawkEye Volume Indicator by @LazyBear

// ADX and DI by @BeikabuOyaji

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("Coral Trend Pullback Strategy (TradeIQ)", "Coral Trend Pullback", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ---------------

// Risk Management

// ---------------

riskReward = input.float(1.5, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

accountRiskPercent = input.float(1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM2", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

localHlLookback = input.int (5, "Local High/Low Lookback ", group = "Strategy: Stop Loss Settings", inline = "SL1", minval = 1, tooltip = "This strategy calculates the Stop Loss value from the recent local high/low. This lookback period determines the number of candles to include for the local high/low.")

// ----------

// Date Range

// ----------

startYear = input.int (2010, "Start Date ", group = "Strategy: Date Range", inline = "DR1", minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = "Strategy: Date Range", inline = "DR2", minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Drawing Settings

// ----------------

showTpSlBoxes = input.bool(true, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// ------------------

// Indicator Settings

// ------------------

// Coral Trend

ctSm = input.int (25, "Smoothing Period ", group = "Leading Indicator: Coral Trand Settings", inline = "CT1")

ctCd = input.float(0.4, "Constant D ", group = "Leading Indicator: Coral Trand Settings", inline = "CT2", step = 0.1)

// Confirmation indicator inputs

confirmationInd = input.string("ADX and DI", "Entry Confirmation Method ", group = "Confirmation Indicator: Indicator Selection", inline = "IS1", options=["None", "ADX and DI", "Absolute Strength Histogram + HawkEye Volume"], tooltip = "Select one of the possible confirmation indicator(s) which can be used to confirm entry signals from the main Coral Trend indicator conditions. See strategy conditions to understand the logic behind each confirmation indicator")

// ADX and DI

adxLen = input.int(14, "ADX Length ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD1")

midLine = input.int(20, "Mid Line ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD2", tooltip = "Mid line on standard ADX and DI indicator. In this strategy the DI must be above this line for entry confirmation.")

// Absolute Strength Histogram

ashLength = input.int(9, "Period of Evaluation ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH1")

ashSmooth = input.int(6, "Period of Smoothing ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH2")

ashSrc = input.source(close, "Source ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH3")

ashMode = input.string("RSI", "Indicator Method ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH4", options=["RSI", "STOCHASTIC", "ADX"])

sahMaType = input.string("SMA", "MA ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH5", options=["ALMA", "EMA", "WMA", "SMA", "SMMA", "HMA"])

ashAlmaOffset = input.float(0.85, "* Arnaud Legoux (ALMA) Offset", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH6", minval=0, step=0.01)

ashAlmaSigma = input.int(6, "* Arnaud Legoux (ALMA) Sigma", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH7", minval=0)

// HawkEye Volume Indicator

hevLength = input.int(200, "Length ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV1")

hevDivisor = input.float(1.6, "Divisor ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV2", step=0.1)

// =============================================================================

// INDICATORS

// =============================================================================

// -----------

// Coral Trend

// -----------

src = close

di = (ctSm - 1.0) / 2.0 + 1.0

c1 = 2 / (di + 1.0)

c2 = 1 - c1

c3 = 3.0 * (ctCd * ctCd + ctCd * ctCd * ctCd)

c4 = -3.0 * (2.0 * ctCd * ctCd + ctCd + ctCd * ctCd * ctCd)

c5 = 3.0 * ctCd + 1.0 + ctCd * ctCd * ctCd + 3.0 * ctCd * ctCd

var float i1 = na

var float i2 = na

var float i3 = na

var float i4 = na

var float i5 = na

var float i6 = na

i1 := c1 * src + c2 * nz(i1[1])

i2 := c1 * i1 + c2 * nz(i2[1])

i3 := c1 * i2 + c2 * nz(i3[1])

i4 := c1 * i3 + c2 * nz(i4[1])

i5 := c1 * i4 + c2 * nz(i5[1])

i6 := c1 * i5 + c2 * nz(i6[1])

bfr = -ctCd * ctCd * ctCd * i6 + c3 * i5 + c4 * i4 + c5 * i3

bfrC = bfr > nz(bfr[1]) ? color.new(color.green, 50) : bfr < nz(bfr[1]) ? color.new(color.red, 50) : color.new(color.blue, 50)

plot(bfr, "Trend", linewidth = 3, style = plot.style_stepline, color = bfrC)

// ----------

// ADX and DI

// ----------

TrueRange = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - nz(SmoothedTrueRange[1]) / adxLen + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - nz(SmoothedDirectionalMovementPlus[1]) / adxLen + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - nz(SmoothedDirectionalMovementMinus[1]) / adxLen + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(DX, adxLen)

// ---------------------------

// Absolute Strength Histogram

// ---------------------------

ashMa(ashType, ashSrc, ashLen) =>

float result = 0

if ashType == 'SMA' // Simple

result := ta.sma(ashSrc, ashLen)

result

if ashType == 'EMA' // Exponential

result := ta.ema(ashSrc, ashLen)

result

if ashType == 'WMA' // Weighted

result := ta.wma(ashSrc, ashLen)

result

if ashType == 'SMMA' // Smoothed

ashWma = ta.wma(ashSrc, ashLen)

ashSma = ta.sma(ashSrc, ashLen)

result := na(ashWma[1]) ? ashSma : (ashWma[1] * (ashLen - 1) + ashSrc) / ashLen

result

if ashType == 'HMA' // Hull

result := ta.wma(2 * ta.wma(ashSrc, ashLen / 2) - ta.wma(ashSrc, ashLen), math.round(math.sqrt(ashLen)))

result

if ashType == 'ALMA' // Arnaud Legoux

result := ta.alma(ashSrc, ashLen, ashAlmaOffset, ashAlmaSigma)

result

result

Price = ashSrc

Price1 = ashMa('SMA', Price, 1)

Price2 = ashMa('SMA', Price[1], 1)

//RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

//STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ashLength)

Bears1 = ta.highest(Price1, ashLength) - Price1

//ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ashMode == 'RSI' ? Bulls0 : ashMode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ashMode == 'RSI' ? Bears0 : ashMode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = ashMa(sahMaType, Bulls, ashLength)

AvgBears = ashMa(sahMaType, Bears, ashLength)

SmthBulls = ashMa(sahMaType, AvgBulls, ashSmooth)

SmthBears = ashMa(sahMaType, AvgBears, ashSmooth)

isTrendBullish = SmthBulls > SmthBears ? true : false

// ------------------------

// HawkEye Volume Indicator

// ------------------------

hevRange1 = high - low

hevRangeAvg = ta.sma(hevRange1, hevLength)

hevVolumeA = ta.sma(volume, hevLength)

hevHigh1 = high[1]

hevLow1 = low[1]

hevMid1 = hl2[1]

hevU1 = hevMid1 + (hevHigh1 - hevLow1) / hevDivisor

hevD1 = hevMid1 - (hevHigh1 - hevLow1) / hevDivisor

rEnabled1 = hevRange1 > hevRangeAvg and close < hevD1 and volume > hevVolumeA

rEnabled2 = close < hevMid1

rEnabled = rEnabled1 or rEnabled2

gEnabled1 = close > hevMid1

gEnabled2 = hevRange1 > hevRangeAvg and close > hevU1 and volume > hevVolumeA

gEnabled3 = high > hevHigh1 and hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA

gEnabled4 = low < hevLow1 and hevRange1 < hevRangeAvg / 1.5 and volume > hevVolumeA

gEnabled = gEnabled1 or gEnabled2 or gEnabled3 or gEnabled4

grEnabled1 = hevRange1 > hevRangeAvg and close > hevD1 and close < hevU1 and volume > hevVolumeA and volume < hevVolumeA * 1.5 and volume > volume[1]

grEnabled2 = hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA / 1.5

grEnabled3 = close > hevD1 and close < hevU1

grEnabled = grEnabled1 or grEnabled2 or grEnabled3

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// ---------

// FUNCTIONS

// ---------

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

printVerticalLine(col) => line.new(bar_index, close, bar_index, close * 1.01, extend = extend.both, color = col)

// ----------

// CONDITIONS

// ----------

inDateRange = true

// Condition 1: Coral Trend color matches trend direction (long=green, short=red)

isCoralBullish = bfr > nz(bfr[1])

isCoralBearish = bfr < nz(bfr[1])

// Condition 2: At least 1 candle completely above/below (long/short) Coral Trend since last cross above/below (long/short) Coral Trend (could potentially try also with only close above)

sincePrePullbackBullBreakout= ta.barssince(ta.crossover(close, bfr))

sincePrePullbackBearBreakout= ta.barssince(ta.crossunder(close, bfr))

prePullbackBullBreakout = ta.barssince(low > bfr and high > bfr) < sincePrePullbackBullBreakout[1]

prePullbackBearBreakout = ta.barssince(low < bfr and high < bfr) < sincePrePullbackBearBreakout[1]

// Condition 3: Pullback closes below/above (long/short) Coral Trend

barssinceBullPullbackStart = ta.barssince(ta.crossunder(close, bfr))

barssinceBearPullbackStart = ta.barssince(ta.crossover(close, bfr))

barssincePullbackStart = isCoralBullish ? barssinceBullPullbackStart : isCoralBearish ? barssinceBearPullbackStart : na

// Condition 4: Coral Trend colour matched trend direction for duration of pullback

sinceBullish = ta.barssince(ta.crossover(bfr, nz(bfr[1])))

sinceBearish = ta.barssince(ta.crossunder(bfr, nz(bfr[1])))

barssinceCoralflip = isCoralBullish ? sinceBullish : isCoralBearish ? sinceBearish : na

isPullbackValid = barssincePullbackStart < barssinceCoralflip

// Condition 5: After valid pullback, price then closes above/below (long/short) Coral Trend

entryBreakout = (isCoralBullish and ta.crossover(close, bfr)) or (isCoralBearish and ta.crossunder(close, bfr))

// Condition 6: Confirmation indicators (6.1 or 6.2, optional depending on settings) confirms trade entry

// 6.1: ADX and DI

// 6.1.1: Green and red match trend (long=(green > red), short=(red > green))

// 6.1.2: Blue > 20

// 6.1.3: Blue trending up over last 1 candle

// 6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator

// 6.2.1: Absolute Strengeh Histogram colour matches trend (long=blue, short=red)

// 6.2.2: HawkEye Volume Indicator colour matches trend (long=green, short=red)

var longTradeConfirmed = false

var shortTradeConfirmed = false

if confirmationInd == "ADX and DI"

isAdxUp = ADX > ADX [1]

isAdxValid = ADX > midLine and isAdxUp

longTradeConfirmed := DIPlus > DIMinus and isAdxValid

shortTradeConfirmed:= DIMinus > DIPlus and isAdxValid

else if confirmationInd == "Absolute Strength Histogram + HawkEye Volume"

isAshBullish = SmthBulls > SmthBears ? true : false

isHevBullish = not grEnabled and gEnabled ? true : false

isHevBearish = not grEnabled and rEnabled ? true : false

longTradeConfirmed := isAshBullish and isHevBullish

shortTradeConfirmed:= not isAshBullish and isHevBearish

else if confirmationInd == "None"

longTradeConfirmed := true

shortTradeConfirmed:= true

// Combine all entry conditions

goLong = inDateRange and isCoralBullish and prePullbackBullBreakout and isPullbackValid and entryBreakout and longTradeConfirmed

goShort = inDateRange and isCoralBearish and prePullbackBearBreakout and isPullbackValid and entryBreakout and shortTradeConfirmed

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

var entryPrice = 0.

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// Exit calculations

entryPrice := close

longSlPrice = ta.lowest(localHlLookback)

shortSlPrice = ta.highest(localHlLookback)

slAmount = isCoralBullish ? entryPrice - longSlPrice : shortSlPrice - entryPrice

slPercent = math.abs((1 - (entryPrice - slAmount) / entryPrice) * 100)

tpPercent = slPercent * riskReward

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

ctEntryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

// printTpSlHitBox(tradeEntryBar, bar_index, slHit, tpHit, ctEntryPrice, slPrice, tpPrice)

// printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, ctEntryPrice, pnl)

// Print TP/SL box for current open trade

// if barstate.islastconfirmedhistory and strategy.position_size != 0

// printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// // =============================================================================

// // DEBUGGING

// // =============================================================================

// Data window plots

plotchar(prePullbackBullBreakout, "prePullbackBullBreakout", "")

plotchar(prePullbackBearBreakout, "prePullbackBearBreakout", "")

plotchar(barssincePullbackStart, "barssincePullbackStart", "")

plotchar(isCoralBullish, "isCoralBullish", "")

plotchar(isCoralBearish, "isCoralBearish", "")

plotchar(barssinceCoralflip, "barssinceCoralflip", "")

plotchar(isPullbackValid, "isPullbackValid", "")

plotchar(entryBreakout, "entryBreakout", "")

plotchar(slHit, "slHit", "")

plotchar(tpHit, "tpHit", "")

plotchar(slPrice, "slPrice", "")

// Label plots

// plotDebugLabels = false

// if plotDebugLabels

// if bar_index == tradeEntryBar

// printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))