FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

Author: FMZ~Lydia, Created: 2023-12-19 16:02:58, Updated: 2024-11-06 21:19:16

In the cryptocurrency asset trading space, obtaining and analyzing market data, querying rates, and monitoring account asset movements are all critical operations. Below are code examples of implementations for some common requirements.

1. How do I write the code about getting the currency with the highest increase in 4 hours on Binance Spot?

When writing a quantitative trading strategy program on FMZ platform, the first thing you need to do when you encounter a requirement is to analyze it. So based on the requirements, we analyzed the following contents:

- Which programming language to use? The plan is to use Javascript to implement it.

- Requires spot real-time quotes in all currencies

The first thing we did when we saw the requirement was to look up Binance API document to find out if there was any aggregated quotes (it’s best to have aggregated quotes, it’s a lot of work to look up one by one).

We found the aggregated quotes interface:

GET https://api.binance.com/api/v3/ticker/price. On FMZ platform, use theHttpQueryfunction to access the exchange ticker interface (public interface that does not require a signature). - Need to count data for a rolling window period of 4 hours Conceptualize how to design the structure of the statistical program.

- Calculate price fluctuations and sort them

Thinking about the price fluctuations algorithm, is it:

price fluctuations (%) = (current price - initial price) / initial price * 100in “%”.

After figuring out the problem, as well as defining the program. We then got down to the business of designing the program.

Code Design

var dictSymbolsPrice = {}

function main() {

while (true) {

// GET https://api.binance.com/api/v3/ticker/price

try {

var arr = JSON.parse(HttpQuery("https://api.binance.com/api/v3/ticker/price"))

if (!Array.isArray(arr)) {

Sleep(5000)

continue

}

var ts = new Date().getTime()

for (var i = 0; i < arr.length; i++) {

var symbolPriceInfo = arr[i]

var symbol = symbolPriceInfo.symbol

var price = symbolPriceInfo.price

if (typeof(dictSymbolsPrice[symbol]) == "undefined") {

dictSymbolsPrice[symbol] = {name: symbol, data: []}

}

dictSymbolsPrice[symbol].data.push({ts: ts, price: price})

}

} catch(e) {

Log("e.name:", e.name, "e.stack:", e.stack, "e.message:", e.message)

}

// Calculate price fluctuations

var tbl = {

type : "table",

title : "Price fluctuations",

cols : ["trading pair", "current price", "price 4 hours ago", "price fluctuations", "data length", "earliest data time", "latest data time"],

rows : []

}

for (var symbol in dictSymbolsPrice) {

var data = dictSymbolsPrice[symbol].data

if (data[data.length - 1].ts - data[0].ts > 1000 * 60 * 60 * 4) {

dictSymbolsPrice[symbol].data.shift()

}

data = dictSymbolsPrice[symbol].data

dictSymbolsPrice[symbol].percentageChange = (data[data.length - 1].price - data[0].price) / data[0].price * 100

}

var entries = Object.entries(dictSymbolsPrice)

entries.sort((a, b) => b[1].percentageChange - a[1].percentageChange)

for (var i = 0; i < entries.length; i++) {

if (i > 9) {

break

}

var name = entries[i][1].name

var data = entries[i][1].data

var percentageChange = entries[i][1].percentageChange

var currPrice = data[data.length - 1].price

var currTs = _D(data[data.length - 1].ts)

var prePrice = data[0].price

var preTs = _D(data[0].ts)

var dataLen = data.length

tbl.rows.push([name, currPrice, prePrice, percentageChange + "%", dataLen, preTs, currTs])

}

LogStatus(_D(), "\n", "`" + JSON.stringify(tbl) + "`")

Sleep(5000)

}

}

Code Analysis

- 1. Data structure

- 2. Main function main()

2.1. Infinite loop

while (true) { // … }

The program continuously monitors the Binance API trading pair prices through an infinite loop.

2.2. Get price information

var arr = JSON.parse(HttpQuery(”https://api.binance.com/api/v3/ticker/price”))

Get the current price information of the trading pair via Binance API. If the return is not an array, wait for 5 seconds and retry.

2.3. Update price data

for (var i = 0; i < arr.length; i++) { // … }

Iterate through the array of obtained price information and update the data in dictSymbolsPrice. For each trading pair, add the current timestamp and price to the corresponding data array.

2.4. Exception processing

} catch(e) { Log(“e.name:”, e.name, “e.stack:”, e.stack, “e.message:”, e.message) }

Catch exceptions and log the exception information to ensure that the program can continue to execute.

2.5. Calculate the price fluctuations

for (var symbol in dictSymbolsPrice) { // … }

Iterate through dictSymbolsPrice, calculate the price fluctuations of each trading pair, and remove the earliest data if it is longer than 4 hours.

2.6. Sort and generate tables

var entries = Object.entries(dictSymbolsPrice) entries.sort((a, b) => b[1].percentageChange - a[1].percentageChange)

for (var i = 0; i < entries.length; i++) { // … }

Sort the trading pairs in descending order of their price fluctuations and generate a table containing information about the trading pairs.

2.7. Log output and delay

LogStatus(_D(), “\n”, “" + JSON.stringify(tbl) + "”)

Sleep(5000)

Output the table and the current time in the form of a log and wait for 5 seconds to continue the next round of the loop.

The program obtains the real-time price information of the trading pair through Binance API, then calculates the price fluctuations, and outputs it to the log in the form of a table. The program is executed in a continuous loop to realize the function of real-time monitoring of the prices of trading pairs. Note that the program includes exception processing to ensure that the execution is not interrupted by exceptions when obtaining price information.

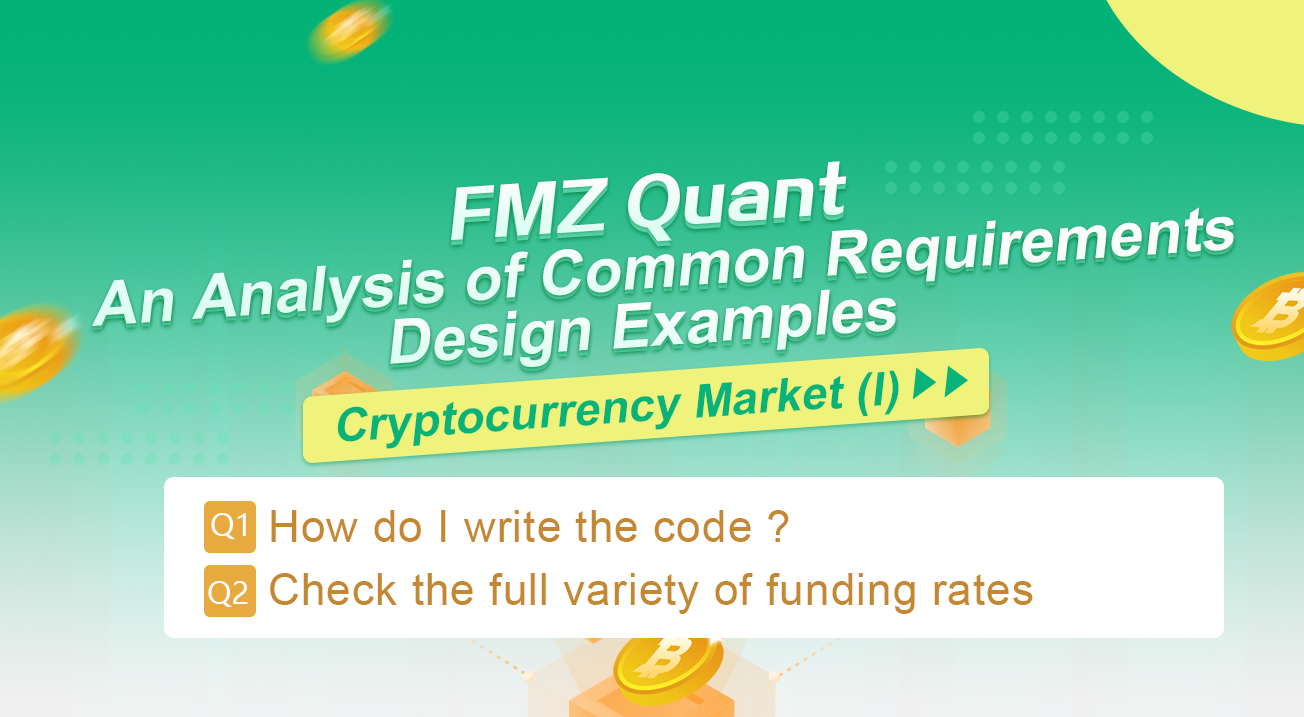

### Live Trading Running Test

Since data can only be collected bit by bit at the beginning, it is not possible to calculate the price fluctuations on a rolling basis without collecting enough data for a 4-hour window. Therefore, the initial price is used as the base for calculation, and after collecting enough data for 4 hours, the oldest data will be eliminated in order to maintain the 4-hour window for calculating the price fluctuations.

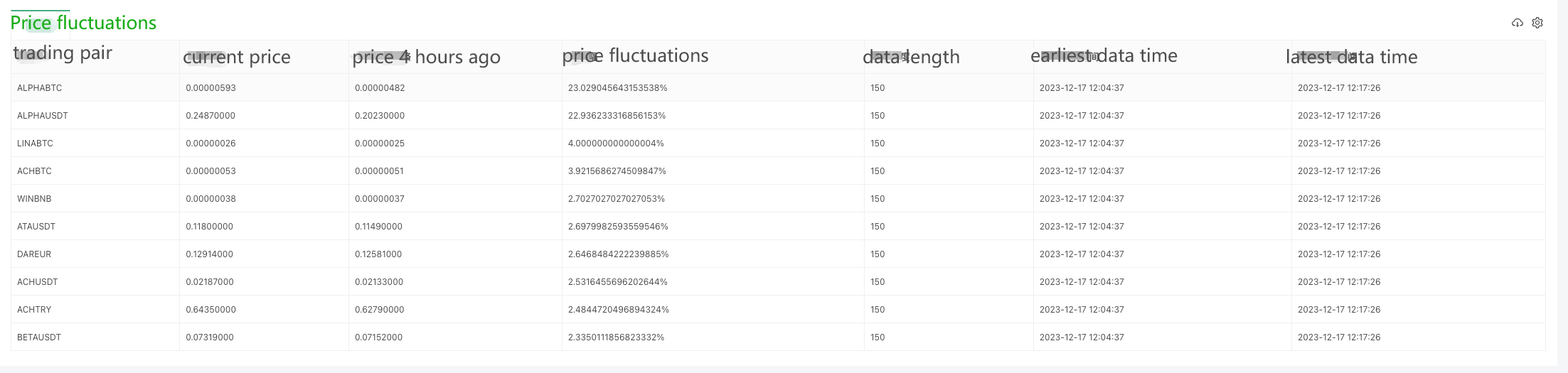

## 2. Check the full variety of funding rates for Binance U-denominated contracts

Checking the funding rate is similar to the above code, first of all, we need to check the Binance API documentation to find the funding rate related interface. Binance has several interfaces that allow us to query the rate of funds, here we take the interface of the U-denominated contract as an example:

GET https://fapi.binance.com/fapi/v1/premiumIndex

### Code Implementation

Since there are so many contracts, we're exporting the top 10 largest funding rates here.

function main() { while (true) { // GET https://fapi.binance.com/fapi/v1/premiumIndex try { var arr = JSON.parse(HttpQuery(”https://fapi.binance.com/fapi/v1/premiumIndex”)) if (!Array.isArray(arr)) { Sleep(5000) continue }

arr.sort((a, b) => parseFloat(b.lastFundingRate) - parseFloat(a.lastFundingRate))

var tbl = {

type: "table",

title: "Top 10 funding rates for U-denominated contracts",

cols: ["contracts", "funding rate", "marked price", "index price", "current rate time", "next rate time"],

rows: []

}

for (var i = 0; i < 9; i++) {

var obj = arr[i]

tbl.rows.push([obj.symbol, obj.lastFundingRate, obj.markPrice, obj.indexPrice, _D(obj.time), _D(obj.nextFundingTime)])

}

LogStatus(_D(), "\n", "`" + JSON.stringify(tbl) + "`")

} catch(e) {

Log("e.name:", e.name, "e.stack:", e.stack, "e.message:", e.message)

}

Sleep(1000 * 10)

}

}

The returned data structure is as follows, and check the Binance documentation, it shows that lastFundingRate is the funding rate we want.

{ “symbol”:“STMXUSDT”, “markPrice”:“0.00883606”, “indexPrice”:“0.00883074”, “estimatedSettlePrice”:“0.00876933”, “lastFundingRate”:“0.00026573”, “interestRate”:“0.00005000”, “nextFundingTime”:1702828800000, “time”:1702816229000 }

Live trading running test:

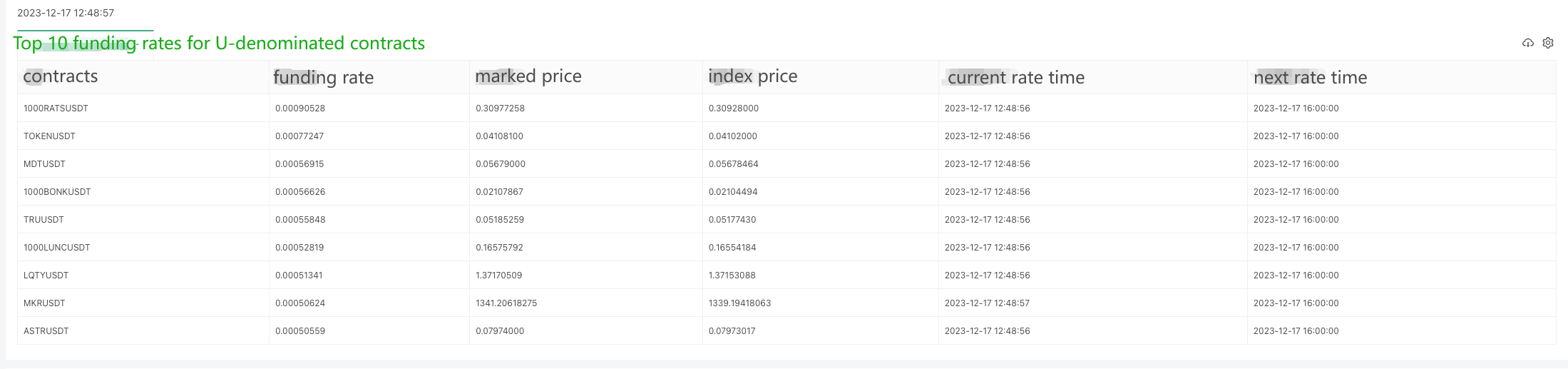

### Getting OKX exchange contract funding rates of Python version

A user has asked for a Python version of the example, and it's for the OKX exchange. Here is an example:

The data returned by the interface ```https://www.okx.com/priapi/v5/public/funding-rate-all?currencyType=1```:

{ “code”:“0”, “data”:[ { “fundingTime”:1702828800000, “fundingList”:[ { “instId”:“BTC-USDT-SWAP”, “nextFundingRate”:“0.0001102188733642”, “minFundingRate”:“-0.00375”, “fundingRate”:“0.0000821861465884”, “maxFundingRate”:“0.00375” } …

Specific code:

import requests import json from time import sleep from datetime import datetime

def main(): while True: # https://www.okx.com/priapi/v5/public/funding-rate-all?currencyType=1 try: response = requests.get(”https://www.okx.com/priapi/v5/public/funding-rate-all?currencyType=1”) arr = response.json()[“data”][0][“fundingList”] Log(arr) if not isinstance(arr, list): sleep(5) continue

arr.sort(key=lambda x: float(x["fundingRate"]), reverse=True)

tbl = {

"type": "table",

"title": "Top 10 funding rates for U-denominated contracts",

"cols": ["contracts", "next rate", "minimum", "current", "maximum"],

"rows": []

}

for i in range(min(9, len(arr))):

obj = arr[i]

row = [

obj["instId"],

obj["nextFundingRate"],

obj["minFundingRate"],

obj["fundingRate"],

obj["maxFundingRate"]

]

tbl["rows"].append(row)

LogStatus(_D(), "\n", '`' + json.dumps(tbl) + '`')

except Exception as e:

Log(f"Error: {str(e)}")

sleep(10)

”` Live trading running test:

END

These examples provide basic design ideas and calling methods, the actual project may need to make appropriate changes and extensions based on the specific needs. Hopefully, these codes can help you better meet the various needs in cryptocurrency digital asset trading.

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- An Essential Tool in the Field of Quantitative Trading - FMZ Quant Data Exploration Module

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)

- WexApp, the FMZ Quant Cryptocurrency Demo Exchange, is Newly Launched

- Detailed Explanation of Perpetual Contract Grid Strategy Parameter Optimization

- Teach You to Use the FMZ Extended API to Batch Modify Parameters of the Bot

- Teach you how to use the FMZ Extension API to modify disk parameters in bulk

- Optimization of the parameters of the permanent contract grid strategy

- Instructions for Installing Interactive Brokers IB Gateway in Linux Bash

- How to install the penetration security IB GATEWAY under Linux bash

- Which is More Suitable for Bottom Fishing, Low Market Value or Low Price?

- I'm not sure which is better, the low market value or the low price.