Locking in leverage space Boxed leverage in options trading strategies

Author: Inventors quantify - small dreams, Created: 2017-12-18 09:53:23, Updated:Locking in leverage space Boxed leverage in options trading strategies

A boxed option is a risk-free option strategy consisting of four basic options positions, which are risk-free and have very little profit margin, sometimes even eroding profit margin due to fees. This strategy is also based on a buy-sell parity relationship (PCP, footnote), which can lock in a certain margin if the PCP is seriously violated.

Of course, in the real market, the distance between the PCP relationships is often small, and the time spent in the market is not too long. It is not easy to capture the opportunity, or even if the opportunity is captured, it will still cost a lot of fees. From this point of view, this opportunity is more suitable for advanced players, with a lower fee, most of them are option traders.

- ###############################################################################################################################################################################################################################################################

Most of the time, the market will deviate from the PCP relationship, only not very serious, the profit margin is small, and will be eroded by the procedure fees. Even if there is enough profit margin, the opportunity will be quickly chased away by the market.

- ###############################################################################################################################################################################################################################################################

A boxed swap position consists of four options positions at two execution prices, one high and one low.

The following examples can be seen directly:

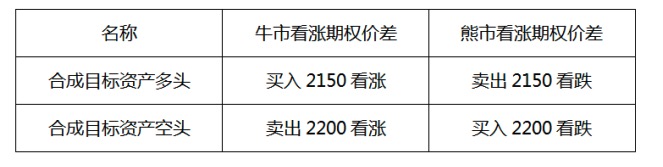

Assuming that the following table is the closing price of $300 today, perform the following operation: buy the execution price at $2150; sell $2200; sell $2150; buy $2200; and so on.

The following is a list of the transactions listed above.

From the table, this operation is a combination of bullish bullish and bearish bearish options, and a combination of synthetic target asset heads and synthetic target asset heads.

- #####################################################################################################################################################################################################

Holding this combination position to maturity is profitable. After calculation, the holding price of the compound target asset price multiple heads is equivalent to 2150 + 74.9-53.1 = 2171.8 ((Yuan)).

The holding price of the compounded target asset price blank is equivalent to 2200- ((77.0-52.6) = 2174.7 ((Yuan)).

If held to maturity, it is equivalent to buying the Shenzhen 300 index at 2171.8 and selling it at 2174.7 ⋅ The seven contracts multiplied by the Shenzhen 300 stock are 100, and the total return of the strategy is 100X ((2174.7-2171.8) = 290 ((Yuan)). Of course, this is not the case when the handling fee has not yet been calculated.

Note: Pull-Call parity refers to the fundamental relationship that must exist between the price of a financial instrument with the same exercise price and the price of a financial instrument with the same expiration date.

Source: Shanghai School of Topography

- How can you do this without refreshing the chart after restarting the policy?

- Problems with PY2 and PY3

- Inventor quantification supports the use of mobile watch strategies?

- This quantity and price of the c++ version are the same number.

- The exchange.Go))) method is not working, please check the following version of C++

- The js form shows the conversion to C++, how to write it

- Is the robot's Records turned on by default?

- How to use IO

- Okayx's API has an error.

- Bitcoin strategy: find someone to write a strategy or buy a strategy

- Options contracts are sold out.

- Is there a bug in the python policy?

- BotVS simulation disk with instructions for use

- How to catch bugs in robots

- Please allow access to some external URLs in the code

- Does the robot support the WebSocket for the token?

- Thinking about the Uniform Mechanical System

- c++ version GetCommand ((); is this command invalid?

- Can inventors quantify their A-share?

- HitBTC and OKEX have been calling GetTicker for a timeout.