OKEX shadow currency cross-term leverage Python real-time one-time account gain 5%

Author: fendouai, Created: 2020-05-10 15:01:00, Updated: 2020-05-10 15:04:24Overview of cross-sectional interest rates

The term cross-term arbitrage is the practice of establishing an equal number of opposite-direction trading positions on a different monthly contract of the same futures variety, and finally closing the trade by hedging or handing over. The simplest cross-term arbitrage is to buy a short-term futures variety and sell a long-term futures variety. For the digital trading market, the price of different contracts for digital currencies tends to be generally consistent, but in special markets, such as 2020-05-10, there was a large drop of about 10%, so the price is out of sync, when leverage opportunities arise.

Comparison of spot prices

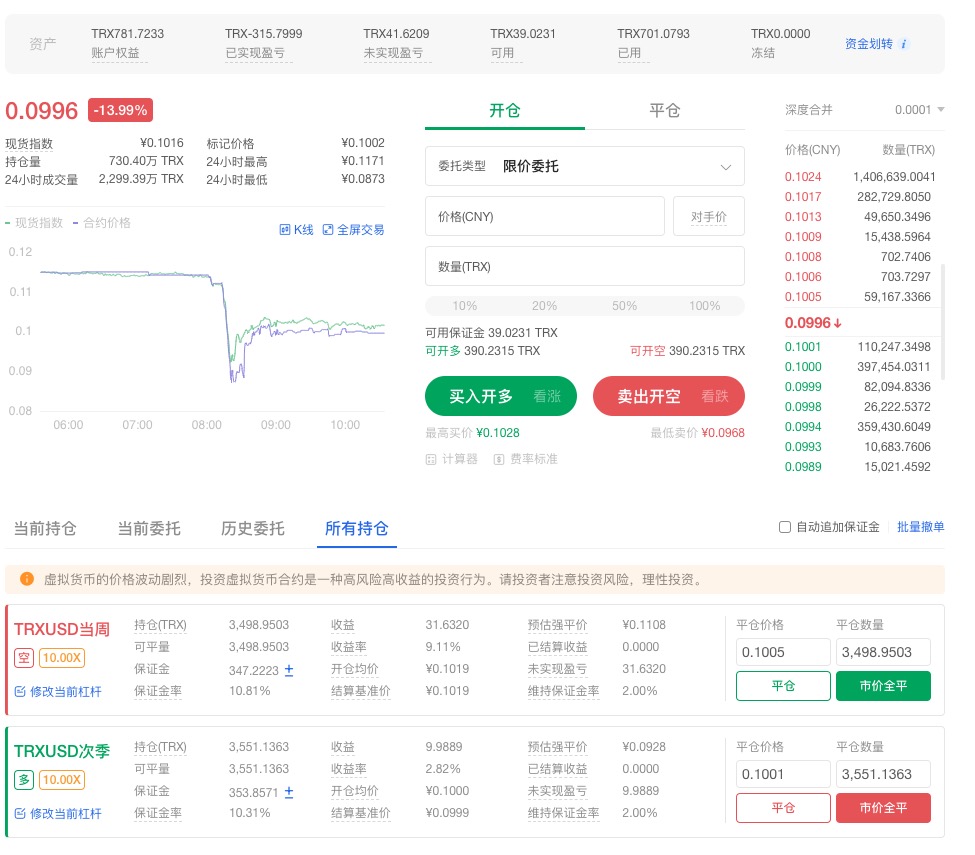

If the selected price is shown in the graph, the price difference between the terms is 5%, but the price difference below the normal market is about 1%, this is the leverage space.

Steps to maturity leverage

As shown in the above graph, the spot price is 5% higher than the futures price, in fact their difference should be back to around 1%. This can be done manually or by running a Python program. I'm using Python code to calculate whether there is a chance of real-time computation, and the formula is: score= ((price A-Price B) /price A) The score is the percentage of the price difference. If the percentage exceeds a certain threshold, the order is automatically opened in both directions.

Automated billing

Screenshot of the follow-up

After the sharp fluctuations, the market has stabilized and started to turn a profit.OKEXI'm not sure. The cost of holding is 781, and the current profit is 40, with a profit of about 5%.

Operating the trading platform

This is the first time I've seen this.OKEXThe platform has a Python API that supports automatic market access and automatic ordering. Continuous sharing of Python real-world projectsPythonOK

- Can you add multiple exchanges to the visualization policy? (default is only three)

- Is it possible to trade Bitcoin perpetuity contracts?

- Data anomalies when retested

- How do we use the system's feedback earnings graphs on a real-world basis?

- When drawing a line, two straight lines overlap.

- Why does a real disk retest return only two bars?

- ZBG platform reported error

- An error was encountered when setting up an independent quantized transaction background

- The numerical value of the TA indicator is not associated with the physical disk

- Problems with the batch orders API of the Binance contract

- Please ask questions about the Malay language

- Is it possible for FMZ platform to introduce an image recognition system?

- Where to customize indicators and display them in the marketplace

- What about template references that you don't want?

- The time difference between the market time and the correct time is 8 hours.

- Do you have any quantitative trading software that you can recommend?

- Can you tell me how to use REF in j/python?

- What is the most appropriate way to handle aerial jumps during retesting?

- Why do you have to count twice in my language when you can count one hand?

- Can GetRecords (()) set the number of reversions

The long-term freeze of BitcoinThe headline is a cross-term, the contents of the term, the screenshot gives two futures to open, so what is it?