Optimizing your trading strategy - how to choose the right investment varieties

Author: iyth888, Created: 2021-07-16 19:43:30, Updated: 2021-07-17 10:29:21The grid trading method likes high frequency vibration and does not like unilateral, the storm-type unilateral most of the time after selling the flight to reopen the net, at least a little bit of trouble is not great. But especially afraid of the crash-type unilateral, once it is fitted or broken the net, except for cutting the meat separation is very small operating space.

So not all trading varieties are suitable for running grid trading.

For example, if the ST stock is on the running grid, the probability of failure is too high, or it will fall to the floor or even go out of business.

So what kind of races are best for running nets?

A good trading variety generally has the following characteristics:

The first is that it is stable and not easily affected by thunderstorms.

2 days of high volatility.

3, Good liquidity in the transaction.

4 Transaction costs are low.

Meeting these conditions can essentially offset the drawbacks of grid trading and make running grid an efficient and stable means of earning, allowing investors to enter the threshold of stable profitability.

So, is there really such an investment?

The answer is yes.

We use the stock market as an example, because the stock market is the most popular investment market, the example is very universal and can be taken. Other markets have some suitable varieties, which are not developed, welcome exchanges of interest.

Examples of stock classes:

First of all, most of the stocks are not suitable for the running grid, because the stock is very volatile, you can't do anything, you can't do anything, you can't do anything, you can't do anything, you can't do anything.

Only those stocks that have a long-term guarantee of profitability, preferably exclusive business, are suitable for grid trading.

To illustrate, the most typical stock is Yangtze Electric [600900].

Yangjiang Electric's business model is an exclusive business, and the profits are very stable, the long-term trend of the industry is very difficult to shrink, it is very difficult to see a black swan.

Exclusive business, stable profits, business model just need the industry. Along this direction to look, the stock market has many suitable stocks that can be used to run the grid, such as the Beijing Metropolitan Railway can also be included in the reserve variety for observation.

The transaction fee is not low, and there is a fixed stamp duty, from the point of view of cost control, you can also choose a low-cost variety to run the grid.

A more typical option is to use an ETF as a grid trading fund.

Broad-based or thematic industry indices can be selected.

The broad base is commonly used for the above-mentioned 50 ETFs, the Shenzhen 300 ETFs, the Startup Board 50 ETFs, the S&P 500 ETFs, the H-Stock ETFs, etc. This type of fund is characterized by index-linked, long-term trends are positive as social wealth accumulates. It is relatively suitable for long-term operation, and the risk is relatively manageable.

Industry indices are securities ETFs, alcohol ETFs, photovoltaic ETFs, semiconductor ETFs, food ETFs, etc. The volatility of these funds will change as the market trends and trends in the industry change. The volatility is greater than the broad base, i.e. the potential gains and losses are also greater than the broad base, which is more suitable for investors with a certain analytical ability.

The advantage of ETFs is that instead of the individual stock option step, especially index funds, the stability is stronger than that of the vast majority of ordinary investors' stock options.

ETFs are in-field funds, free of stamp duty and cheaper to process than equities, equities generally have to go to 1 million or more, buy and sell funds can generally be 0.5 million. For grid trading, transaction costs are low, your trading frequency can find a way to raise, trading frequency is high, the total profit of the harvest will also be high.

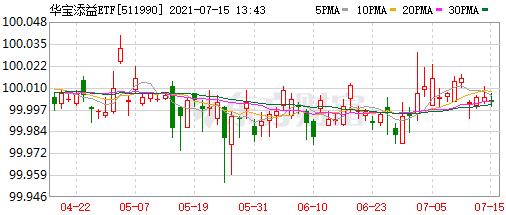

There is also a variety of ETFs that he always uses in his favorite volatile markets, so it is also extremely suitable for the trading grid. This variety is a commodity base, i.e. a currency fund, such as Huawei Add-on ETF ((511990), below is his daily chart:

Monetary funds always fluctuate around 100 yuan, and even if there is a black-eye storm, the crash will be corrected quickly, because once the 100 is deviated, the opportunity to profit will reappear, and the profiteers who flock will wipe the price gap back to 100.

There is also an advantage, which is that the transaction fee is particularly cheap, some brokers do not even charge the transaction fee, which is equivalent to running the grid without cost, which is not the case for others. The disadvantage is that the transaction frequency is not very high, the only disadvantage is that the transaction frequency is relatively small, and the only disadvantage is that it is suitable for investors with low requirements for returns and strict requirements for risk.

The last mark of the stock market that is suitable for running grid trading is transferable debt.

First of all, the transferable debt is also a very low transaction cost, generally reaching 5 parts per million (below), and the transaction costs are almost negligible, which is a good option for high-frequency networks, after all, the savings in processing fees are profits.

There are many other advantages of debt transfers that other types of debt transfers do not have.

The first is T + 0 ─ i.e. buy the same day can sell the same day, if you can transfer the same day's high, we sell a few grams, sell and then fall back, you can buy again at a low, do not need to wait until the next trading day ─ first fall, then the high is also the same.

Secondly, convertible bonds have the dual attributes of both bonds and options, you can hold them as bonds and wait for the maturity to pay the principal; you can also convert convertible bonds into stocks within a specified period. It is both defensive of bonds and aggressive of options, it is amazing.

The value of transferable debt is that it has a very small probability of losing capital, giving us unlimited room for imagination to go up. Winning less than stocks and falling more without stocks is the magic of transferable debt.

Why this is so is because if the equity goes up, then I have the right to exchange it for equity, then my profit and the profit on equity is synchronized. And if the equity falls, I can not change the stock, and directly let the listed company redeem my transferable debt, the tiny profit.

Equivalent to a decline in the stock, I do not change shares, let the listed company redeem the bonds only to earn interest; a decline in the stock is the difference in the price of the stock.

The transferable debt ratio is infinitely limited and perfect. Especially the transferable debt of 3A, which has a high rating, equity security is also relatively strong, and most of the transferable debt attributions are above 130. Because there is a bottom, the grid basically does not break the net, so we do not have a lot of psychological pressure when we execute the purchase in the fall, do not make the bottom but do not dare to increase the stake, or even the disaster of cutting meat at the bottom.

Therefore, in terms of security, transferable debt is the most suitable variety for grid trading, not one of them. Plus, the transaction costs are low, so you can be sure to go bold.

However, there are many types of transfers, there are only a few hundred, be careful to avoid some of the low-value, low-rated types of transfers, when these junk transfers fall to 90, it is difficult to know if there is a black swan behind it.

So for the stock market, convertible bonds are the most suitable benchmark for trading on the grid, but there are several hundred convertible bonds, unlike ETFs that only have one, so it is also a skill to choose the right convertible bonds as an investment benchmark, which are welcome to exchange.

In general, as long as the variety of investment indicators is well selected, the weaknesses of the grid trading law can be largely avoided, and the profit margin can be achieved by using the grid trading to achieve a stable increase in the value of the asset.

The last principle of selecting varieties, the principle of diversified investment, is that it is best not to put all your money on one variety, even if this variety is suitable for the running grid. Since the network transaction can be automated, it also means that it does not consume too much of the investor's daily pot energy. The scientific practice is to spread the funds and choose three or more varieties to run.

For example, the choice of a stock, an ETF, a convertible bond, and the decentralization of the industry for these indices are also used to avoid black swan and ensure that there is no loss.

There are also always volatile trading varieties in the cryptocurrency market, such as stablecoin pairs, such as the BUSD-USDT of Binance. These two stablecoins are both pegged to the dollar, so they basically fluctuate near 1, and the occasional black-day plug will also pull back in a few hours.

The advantages of improving the investment varieties of the network trading law, about these. Other aspects of improvement, please refer to other articles in the column of the network trading law universe, you can also contact me at any time.

Written by V: wgjyfyz

Some of the ideas from the network trading law:https://www.fmz.cn/bbs-topic/7567The rules of trading are detailed in the scientific principles of stable profitabilityhttps://www.fmz.cn/bbs-topic/7568Advantages and disadvantages of grid trading and strategies for optimizinghttps://www.fmz.cn/bbs-topic/7569Optimizing your trading strategy - how to choose the right investment varietieshttps://www.fmz.cn/bbs-topic/7570Optimized grid trading strategies - solving the problem of one-sided decline, reducing the network breakdown ratehttps://www.fmz.cn/bbs-topic/7571Optimization of grid trading strategies - how to use position management to quickly unlockhttps://www.fmz.cn/bbs-topic/7572Net trading is ultimately optimized - net trading yields five times higherhttps://www.fmz.cn/bbs-topic/7524The idea of a grid strategy for high-frequency brushing

- number of decimal units that the okex perpetual contract cannot open

- Please, God, look at this.

- The k-line seems to have a problem.

- Please tell me how to save the data for daily voting.

- It's not fair.

- How do I get the current account, the number of coins and the current value of the coins?

- Why is the balance negative?

- Net trading is ultimately optimized - net trading yields five times higher

- Optimization of grid trading strategies - how to use position management to quickly unlock

- Optimized grid trading strategies - solving the problem of one-sided decline, reducing the network breakdown rate

- Advantages and disadvantages of grid trading and strategies for optimizing

- The rules of trading are detailed in the scientific principles of stable profitability

- A bug in the digital accuracy of the currency's disks

- How many times do you open a position for ten?

- If you want to see if there's a bull market in the review, the cycle gains and losses on the yield curve should not be visible.

- Upstream testing

- Traceback (most recent call last): File "<stdin>", line 13, in <module> File "<string>", line 23, in <module> ValueError: bad marshal data (unknown type code)

- Ask for a brushed script/code

- Please, is the accuracy of this trading variety not worth 2?Huobi/XRP_BTC

- What's the maximum length of support for k-line feedback in 1 minute?

dewangVery good