Binance Perpetual Funding Rate Arbitrage (100% of Annualized Rate in Bull Market)

Author: Ninabadass, Created: 2022-04-25 11:36:56, Updated: 2022-04-25 11:37:54Sign up for Binance Thousand League combat, and get free strategies to use: https://www.fmz.com/bbs-topic/6609

Perpetual Contract & Funding Rate

In the earliest cryptocurrency industry, contracts were only delivery contracts, and later BitMEX published perpetual contracts, which were very popular with the public. And now, basically all mainstream platforms support perpetual contracts.

The farther the delivery date of the delivery contract is, the greater the price fluctuation, the greater the deviation between the contract price and the spot price, but the settlement is forced to be based on the spot price on the delivery day, so the price will always return. Different from the timed delivery of delivery contracts, perpetual contracts can be held all the time, and a mechanism is needed to ensure that the contract price is consistent with the spot price. That is the funding rate mechanism. If the price is bullish for a period of time and many people do long, it will cause the perpetual price to be higher than the spot price. At this time, the funding rate is generally positive, that is, the long side must pay the short side according to the positions held; the greater the market deviation is, the higher the funding rate will be, which results in that the spread tends to fall. Long trading perpetual contracts are equivalent to borrowing funds and adding leverage, and funds have usage costs, so most of the time it is a positive rate of 0.01%. Funding rates are charged every 8 hours, so perpetual prices tend to be very close to the spot ones.

Arbitrage Return Analysis

The funding rate is positive most of the time. If you short the perpetual contract, long the spot, and hold it for a long time, theoretically, you can get a positive funding rate return for a long time regardless of the rise and fall of symbol prices. We will analyze the feasibility in detail down below.

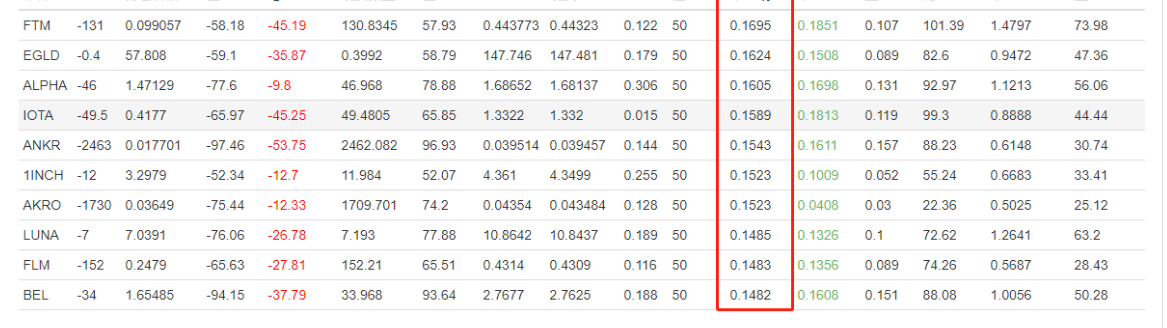

Binance provided the history data of funding rate: https://www.binance.com/cn/futures/funding-history/1 , and here I make some examples:

Recent (March, 2021) currency symbol average funding rate:

It can be seen that the average funding rate of multiple currency symbols is over 0.15% (due to the recent bull market, the rate is high, but it is difficult to sustain). According to the most recent return, the daily rate of return will be 0.15%*3 = 0.45%, not including the annualized return rate at 164%. Considering spot hedging, double leverage of futures, plus unfavorable factors such as loss, premium, and closing of positions, the annualized rate should be at 100%. Retracements are almost negligible. In the non-bull market, the annualized rate is also around 20%.

Risk Analysis & Control

Negative funding rate

The lowest funding rate can be -0.75%. If it occurs once, the loss is equivalent to 75 times of the return gained by 0.01%. Although the currency symbols with the average funding rate have been screened, it is inevitable that there will be unexpected market conditions. In addition to avoiding new currency symbols and symbols like BSV, the most important solution is to decentralize hedging. If you hedge more than 30 at one time, the loss of one symbol will only account for a small part. In addition, in this case, you need to close the positions in advance, but due to the handling fee and the cost of closing positions, you cannot close positions when you encounter a negative funding rate. Generally, when the rate is below -0.2%, you can close positions to avoid control the risk. Generally, when the price is negative, the perpetual price is lower than the spot price, and the negative premium makes it possible to make a profit after deducting the handling fee.

Premium change

Generally, a positive funding rate means that the perpetual contract has a premium for the spot. If the premium is high, it may also earn a certain return from the premium. Of course, the strategy has been holding positions for a long time, so this part of the profit will not be taken. You need to be careful not to open positions with a high negative premium. Of course, in the long run, the issue of premium changes can be ignored.

Contract liquidation risk

Due to decentralized hedging, the risk of liquidation is much smaller. Taking the perpetual 2-time leverage as an example; unless the overall price rises by 50%, there will not be liquidation, and due to spot hedging, there is no loss at this time. Just close positions to transfer funds, or you can guarantee to increase the margin at any time. The higher the perpetual leverage, the higher the funding rate, and the greater the risk of contract liquidation.

Long-term bear market

Most funding rates of bull market are positive, and the average rate of many currencies can exceed 0.02%, and occasionally there will be a high rate. If the market turns into a long-term bear market, the average rate will decrease, and the probability of large negative rates will increase, which will respectively reduce returns.

Specific Idea

- Automatically screen the currency symbol or manually specify the currency symbol; you can refer to the historical funding rates, and only trade if the threshold is exceeded.

- Obtain the current funding rate, and if it exceeds the set threshold, start to place futures and spot orders at the same time for hedging, and fix a certain value.

- If the price of a single currency symbol rises too much, the strategy can automatically close the positions to avoid high risk of perpetual contracts.

- If the rate of a certain currency symbol is too low, you need to close the positions to avoid being charged.

- The strategy has no requirements on the speed of opening positions. Iceberg orders are used to open and close positions to reduce the impact.

Conclusion

The overall risk of funding rate arbitrage strategy is low, the asset capacity is large, so the strategy is relatively stable, although the profit is not high. It is suitable for those who pursue low-risk arbitrage. You can consider running this strategy if all funds of yours are idle on the platform.

- Problems with the ta library source code

- FMZ PINE Script Doc

- Notes & Explanation of Futures Reverse Doubling Algorithm Strategy

- Solutions to Obtaining Docker Http Request Message

- Extending Custom Template by Visual (Blockly ) Strategy Editing

- Profit Harvester Strategy Analysis (2)

- Profit Harvester Strategy Analysis (1)

- If you want to change the usdt perpetual contract transaction in python to the busd perpetual transaction, which function does that affect?

- Add Stoploss to control risks — What's the Price

- Discussion on High-Frequency Strategy Design —— Magically Modified Profit Harvester

- Use Cryptocurrency Platform Aggregated Market Interface to Construct Multi-Symbol Strategy

- My language is written in this way so that there is a signal. Print and output once.

- Dynamic Delta Hedging of Deribit Options

- Use SQLite to Construct FMZ Quant Database

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (8)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (7)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (6)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (3)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (2)

- My inventor's timing is wrong.