Exposure of an unprofessional QC

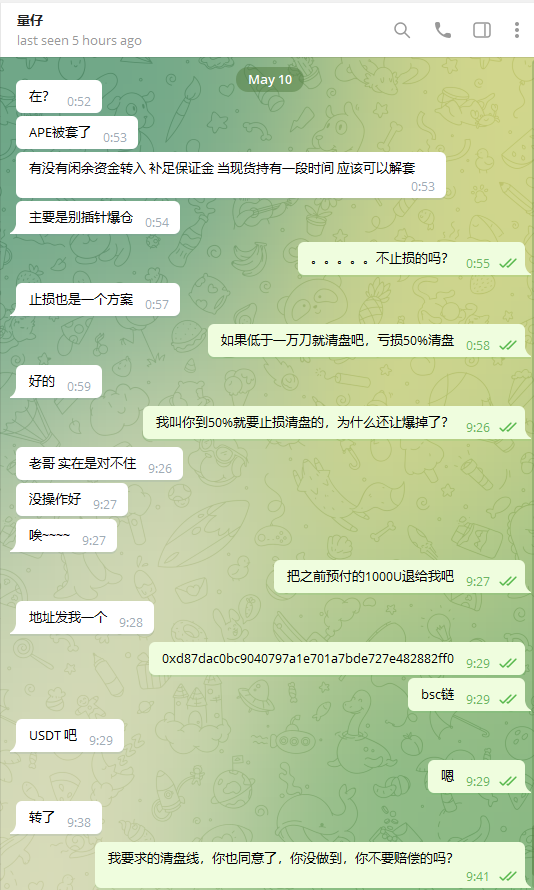

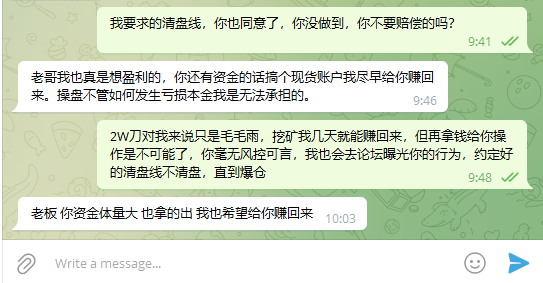

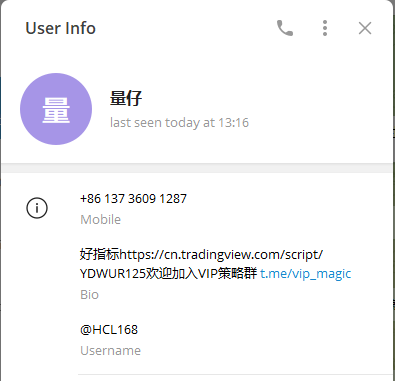

Author: hzzgood48, Created: 2022-05-10 19:04:35, Updated:2W U, which was placed in custody on April 13 this year, was running at a measured rate, the transaction loss was undeniable, after all, no one could cover it, but I was not satisfied with the loss until the stock market crashed.

- Can the stock exchange retesting variety add more?

- It is recommended to use several versions of the PINE single-trade versus multi-trade pair demo strategy of the Martin Grid to learn the comparison.

- Why isn't TradingView on the lookup and trading terminals?

- This is the first time I have seen this video.

- Please tell me how to add a flat full store.

- Please guys, tradeview's alert_message changes how to pair FMZ.

- Questions about the retesting system

- I've been trying to figure out why this is happening all of a sudden today.

- The two days ago, because of these two mistakes, the show stopped, and I asked God to help me see.

- Help

- The real-time records read and the actual data read are incompatible.

- exchange.Buy ((Price, Amount) did not return ID

- FMZ PINE Script documentation is provided.

- BTCUP and BTCDOWN hedging

- Guys, buy a tactic and run it wrong, trouble god help me to see what caused it.

- Interaction patterns

- Parameter adjustment of the retesting system

- Follow the system

- Problems with the ta library source code

- FMZ PINE Script Doc

Rental of empty grids in JinanThis is the most common type of hedging strategy. The logic is simple: The strategy is to double open the position by over-space, split the position, the profit-directional band is reversed to float, there will be large fluctuations at the beginning and even a decrease in the wallet balance, when the position is slowly replenished and the even price is pulled very close, this time it will be profitable, and then by setting the global stop-loss parameter to trigger the clearing of the entire stop-loss from the new position, the leverage automatically scheduling the transfer of cash and capital separation, and then continue to open the position at the latest price, preventing the over-space range especially from more days of no profit or even float. Each operation will be accurately calculated, when encountering a large unilateral market, the reverse will be likely to stop opening positions, as a trend judge, when the trend market slightly weakens or even retracts, the reverse will continue to open automatically, when the unilateral trigger, the global stop lock will automatically temporarily fail to achieve maximum returns, even double the capital, while triggering the wind control core system.

NO.1I'm not going to do it. I'm going to do it.

xunfeng91I've been mining for a couple of days and I've got 2WU, bullshit.

RegentBig brother, can we work together?

The grassBefore running a strategy, you need to have a good understanding of the strategy and know the risks.

hzzgood48I know the risk, the risk of loss, I certainly don't complain, but the agreed liquidation line is not clear, which leads to a boom, it's definitely the trustee's problem.