The multi-headed trend is backtracking strategy

Author: Inventors quantify - small dreams, Created: 2017-07-17 17:14:47, Updated: 2017-07-17 17:15:08The multi-headed trend is backtracking strategy

- ######################################################################################################

The idea behind the pullback is to judge whether a stock is in a strong position based on the shape of several straight lines and to grab the low buy at the time of the pullback. As the name suggests, the main point of this strategy is divided into two parts: the pullback and the pullback point.

- ############################################################################################################################################################################################################################################################

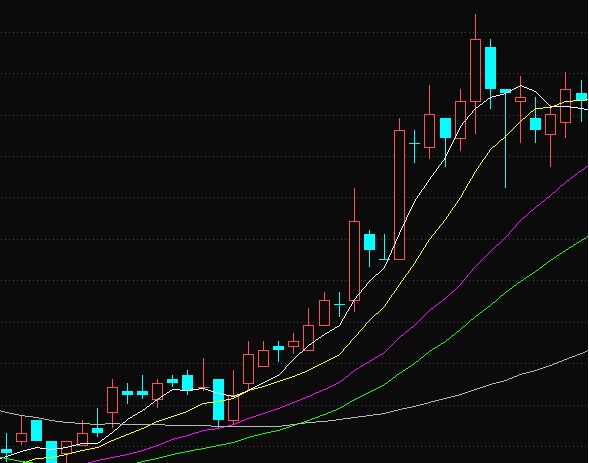

If the number of days from the short to the long moving averages are arranged from top to bottom, we judge the stock price to be in a multi-head trend.

We can think of the shorter averages as the intentions of the short-term investors, and the longer averages as the intentions of the long-term investors. So when the stock price is in a multi-head trend, it means that the short, medium and long-term investors are more consistent, that is, the stock price is in a strong phase.

Similarly, if the number of days from a short to a long straight line is arranged from the bottom to the top, then the stock price is in a hollow trend, and then the stock price tends to fall. If we find several straight lines repeatedly intersecting and entangling each other over a period of time, then the stock price is in a turbulent phase.

The problem is that these stocks are all in the uptrend phase, so how do we choose the right entry point?

- ### Point of withdrawal

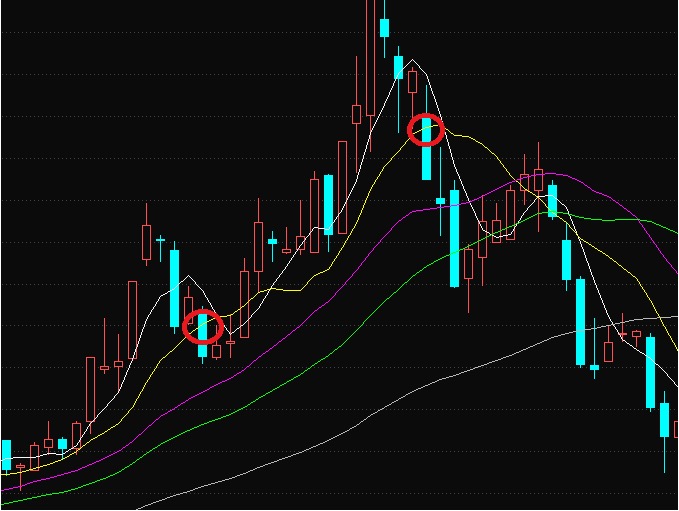

Suppose a stock is in a multi-head trend. If the price retracts to some straight line and does not break the pattern of the multi-head trend, we call it a retracement point.

The short-term investor gains in the uptrend, which leads to a downward adjustment in the stock price, which is a normal phenomenon. If in the adjustment, the multi-head trend is still broken, it means that the stock is still in the strong phase and will continue to rise, then this retracement is the right time to enter the market.

Of course, not all methods are all-powerful and not all retracements are guaranteed.

- How to filter the number of actual exchanges for multi-exchange objects in a multi-exchange strategy

- http://www.stevenwu.me/archives/871

- test

- How secure is it to retrieve an address as an external parameter?

- Inventor quantification The strategy The column diagram The drawing pattern

- Can one server run multiple hosted processes?

- Quantified trading brainstorms are waiting for you!

- The K line is the car, the straight line is the road!

- Repeated balancing issues on some exchanges

- In a scientific and philosophical sense, how can we believe in a strategy that doesn't have logic?

- The root cause of the decentralization of the market to the extreme is found!

- A sustainable and efficient trading model

- Indices: Please ask about the market for OKEX contracts, is there an index?

- Multi-platform hedge stability of the leverage V2.1 (note)

- Bitcoin is open for ETC trading, inventors quantify, when will ETC support?

- Don't miss out on the advances and breakthroughs in technology!

- Can deep learning be used to quantify transactions?

- The depth of the OKEX futures Why only get 5?

- Pandora's Box: How financial traders eat risk-free fat

- Newcomer's Question. GetRecords obtained K-line data and the chart of the retest and the actual data are inconsistent.