Discussion on Strategy Testing Method Based on Random Ticker Generator

Author: FMZ~Lydia, Created: 2024-12-02 11:26:13, Updated: 2024-12-02 21:39:39

Preface

The backtesting system of the FMZ Quant Trading Platform is a backtesting system that is constantly iterating, updating and upgrading. It adds functions and optimizes performance gradually from the initial basic backtesting function. With the development of the platform, the backtesting system will continue to be optimized and upgraded. Today we will discuss a topic based on the backtesting system: “Strategy testing based on random tickers”.

Demand

In the field of quantitative trading, the development and optimization of strategies cannot be separated from the verification of real market data. However, in actual applications, due to the complex and changing market environment, relying on historical data for backtesting may be insufficient, such as lack of coverage of extreme market conditions or special scenarios. Therefore, designing an efficient random market generator has become an effective tool for quantitative strategy developers.

When we need to let the strategy trace back historical data on a certain exchange or currency, we can use the official data source of the FMZ platform for backtesting. Sometimes we also want to see how the strategy performs in a completely “unfamiliar” market, so we can “fabricate” some data to test the strategy.

The significance of using random ticker data is:

-

- Evaluate the robustness of strategies The random ticker generator can create a variety of possible market scenarios, including extreme volatility, low volatility, trending markets, and volatile markets. Testing strategies in these simulated environments can help evaluate whether their performance is stable under different market conditions. For example:

Can the strategy adapt to the trend and volatiity switching? Will the strategy incur a large loss in extreme market conditions?

-

- Identify potential weaknesses in the strategy By simulating some abnormal market situations (such as hypothetical black swan events), potential weaknesses in the strategy can be discovered and improved. For example:

Does the strategy rely too much on a certain market structure? Is there a risk of overfitting parameters?

-

- Optimizing strategy parameters Randomly generated data provides a more diverse testing environment for strategy parameter optimization, without having to rely entirely on historical data. This allows you to find the strategy’s parameter range more comprehensively and avoid being limited to specific market patterns in historical data.

-

- Filling the gap in historical data In some markets (such as emerging markets or small currency trading markets), historical data may not be sufficient to cover all possible market conditions. The random ticker generator can provide a large amount of supplementary data to help conduct more comprehensive testing.

-

- Rapid iterative development Using random data for rapid testing can speed up the iteration of strategy development without relying on real-time market ticker conditions or time-consuming data cleaning and organization.

However, it is also necessary to evaluate the strategy rationally. For randomly generated ticker data, please note:

-

- Although random market generators are useful, their significance depends on the quality of the generated data and the design of the target scenario:

-

- The generation logic needs to be close to the real market: If the randomly generated market is completely out of touch with reality, the test results may lack reference value. For example, the generator can be designed based on the actual market statistical characteristics (such as volatility distribution, trend ratio).

-

- It cannot completely replace real data testing: random data can only supplement the development and optimization of strategies. The final strategy still needs to be verified for its effectiveness in real market data.

Having said so much, how can we “fabricate” some data? How can we “fabricate” data for the backtesting system to use conveniently, quickly and easily?

Design Ideas

This article is designed to provide a starting point for discussion and provides a relatively simple random ticker generation calculation. In fact, there are a variety of simulation algorithms, data models and other technologies that can be applied. Due to the limited space of the discussion, we will not use complex data simulation methods.

Combining the custom data source function of the platform backtesting system, we wrote a program in Python.

-

- Generate a set of K-line data randomly and write them into a CSV file for persistent recording, so that the generated data can be saved.

-

- Then create a service to provide data source support for the backtesting system.

-

- Display the generated K-line data in the chart.

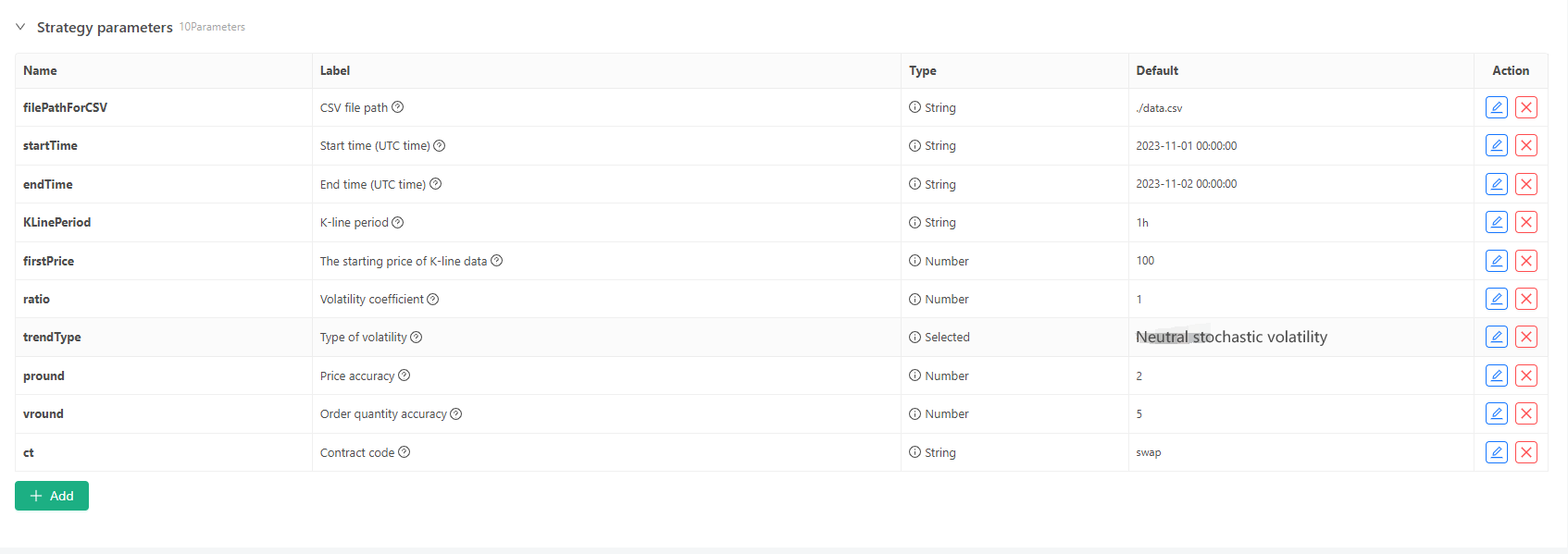

For some generation standards and file storage of K-line data, the following parameter controls can be defined:

-

Random data generation mode For the simulation of the fluctuation type of K-line data, a simple design is simply made using the probability of positive and negative random numbers. When the generated data is not much, it may not reflect the required market pattern. If there is a better method, this part of the code can be replaced. Based on this simple design, adjusting the random number generation range and some coefficients in the code can affect the generated data effect.

-

Data verification The generated K-line data also needs to be tested for rationality, to check whether the high opening and low closing prices violate the definition, and to check the continuity of the K-line data.

Backtesting System Random Ticker Generator

import _thread

import json

import math

import csv

import random

import os

import datetime as dt

from http.server import HTTPServer, BaseHTTPRequestHandler

from urllib.parse import parse_qs, urlparse

arrTrendType = ["down", "slow_up", "sharp_down", "sharp_up", "narrow_range", "wide_range", "neutral_random"]

def url2Dict(url):

query = urlparse(url).query

params = parse_qs(query)

result = {key: params[key][0] for key in params}

return result

class Provider(BaseHTTPRequestHandler):

def do_GET(self):

global filePathForCSV, pround, vround, ct

try:

self.send_response(200)

self.send_header("Content-type", "application/json")

self.end_headers()

dictParam = url2Dict(self.path)

Log("the custom data source service receives the request, self.path:", self.path, "query parameter:", dictParam)

eid = dictParam["eid"]

symbol = dictParam["symbol"]

arrCurrency = symbol.split(".")[0].split("_")

baseCurrency = arrCurrency[0]

quoteCurrency = arrCurrency[1]

fromTS = int(dictParam["from"]) * int(1000)

toTS = int(dictParam["to"]) * int(1000)

priceRatio = math.pow(10, int(pround))

amountRatio = math.pow(10, int(vround))

data = {

"detail": {

"eid": eid,

"symbol": symbol,

"alias": symbol,

"baseCurrency": baseCurrency,

"quoteCurrency": quoteCurrency,

"marginCurrency": quoteCurrency,

"basePrecision": vround,

"quotePrecision": pround,

"minQty": 0.00001,

"maxQty": 9000,

"minNotional": 5,

"maxNotional": 9000000,

"priceTick": 10 ** -pround,

"volumeTick": 10 ** -vround,

"marginLevel": 10,

"contractType": ct

},

"schema" : ["time", "open", "high", "low", "close", "vol"],

"data" : []

}

listDataSequence = []

with open(filePathForCSV, "r") as f:

reader = csv.reader(f)

header = next(reader)

headerIsNoneCount = 0

if len(header) != len(data["schema"]):

Log("The CSV file format is incorrect, the number of columns is different, please check!", "#FF0000")

return

for ele in header:

for i in range(len(data["schema"])):

if data["schema"][i] == ele or ele == "":

if ele == "":

headerIsNoneCount += 1

if headerIsNoneCount > 1:

Log("The CSV file format is incorrect, please check!", "#FF0000")

return

listDataSequence.append(i)

break

while True:

record = next(reader, -1)

if record == -1:

break

index = 0

arr = [0, 0, 0, 0, 0, 0]

for ele in record:

arr[listDataSequence[index]] = int(ele) if listDataSequence[index] == 0 else (int(float(ele) * amountRatio) if listDataSequence[index] == 5 else int(float(ele) * priceRatio))

index += 1

data["data"].append(arr)

Log("data.detail: ", data["detail"], "Respond to backtesting system requests.")

self.wfile.write(json.dumps(data).encode())

except BaseException as e:

Log("Provider do_GET error, e:", e)

return

def createServer(host):

try:

server = HTTPServer(host, Provider)

Log("Starting server, listen at: %s:%s" % host)

server.serve_forever()

except BaseException as e:

Log("createServer error, e:", e)

raise Exception("stop")

class KlineGenerator:

def __init__(self, start_time, end_time, interval):

self.start_time = dt.datetime.strptime(start_time, "%Y-%m-%d %H:%M:%S")

self.end_time = dt.datetime.strptime(end_time, "%Y-%m-%d %H:%M:%S")

self.interval = self._parse_interval(interval)

self.timestamps = self._generate_time_series()

def _parse_interval(self, interval):

unit = interval[-1]

value = int(interval[:-1])

if unit == "m":

return value * 60

elif unit == "h":

return value * 3600

elif unit == "d":

return value * 86400

else:

raise ValueError("Unsupported K-line period, please use 'm', 'h', or 'd'.")

def _generate_time_series(self):

timestamps = []

current_time = self.start_time

while current_time <= self.end_time:

timestamps.append(int(current_time.timestamp() * 1000))

current_time += dt.timedelta(seconds=self.interval)

return timestamps

def generate(self, initPrice, trend_type="neutral", volatility=1):

data = []

current_price = initPrice

angle = 0

for timestamp in self.timestamps:

angle_radians = math.radians(angle % 360)

cos_value = math.cos(angle_radians)

if trend_type == "down":

upFactor = random.uniform(0, 0.5)

change = random.uniform(-0.5, 0.5 * upFactor) * volatility * random.uniform(1, 3)

elif trend_type == "slow_up":

downFactor = random.uniform(0, 0.5)

change = random.uniform(-0.5 * downFactor, 0.5) * volatility * random.uniform(1, 3)

elif trend_type == "sharp_down":

upFactor = random.uniform(0, 0.5)

change = random.uniform(-10, 0.5 * upFactor) * volatility * random.uniform(1, 3)

elif trend_type == "sharp_up":

downFactor = random.uniform(0, 0.5)

change = random.uniform(-0.5 * downFactor, 10) * volatility * random.uniform(1, 3)

elif trend_type == "narrow_range":

change = random.uniform(-0.2, 0.2) * volatility * random.uniform(1, 3)

elif trend_type == "wide_range":

change = random.uniform(-3, 3) * volatility * random.uniform(1, 3)

else:

change = random.uniform(-0.5, 0.5) * volatility * random.uniform(1, 3)

change = change + cos_value * random.uniform(-0.2, 0.2) * volatility

open_price = current_price

high_price = open_price + random.uniform(0, abs(change))

low_price = max(open_price - random.uniform(0, abs(change)), random.uniform(0, open_price))

close_price = open_price + change if open_price + change < high_price and open_price + change > low_price else random.uniform(low_price, high_price)

if (high_price >= open_price and open_price >= close_price and close_price >= low_price) or (high_price >= close_price and close_price >= open_price and open_price >= low_price):

pass

else:

Log("Abnormal data:", high_price, open_price, low_price, close_price, "#FF0000")

high_price = max(high_price, open_price, close_price)

low_price = min(low_price, open_price, close_price)

base_volume = random.uniform(1000, 5000)

volume = base_volume * (1 + abs(change) * 0.2)

kline = {

"Time": timestamp,

"Open": round(open_price, 2),

"High": round(high_price, 2),

"Low": round(low_price, 2),

"Close": round(close_price, 2),

"Volume": round(volume, 2),

}

data.append(kline)

current_price = close_price

angle += 1

return data

def save_to_csv(self, filename, data):

with open(filename, mode="w", newline="") as csvfile:

writer = csv.writer(csvfile)

writer.writerow(["", "open", "high", "low", "close", "vol"])

for idx, kline in enumerate(data):

writer.writerow(

[kline["Time"], kline["Open"], kline["High"], kline["Low"], kline["Close"], kline["Volume"]]

)

Log("Current path:", os.getcwd())

with open("data.csv", "r") as file:

lines = file.readlines()

if len(lines) > 1:

Log("The file was written successfully. The following is part of the file content:")

Log("".join(lines[:5]))

else:

Log("Failed to write the file, the file is empty!")

def main():

Chart({})

LogReset(1)

try:

# _thread.start_new_thread(createServer, (("localhost", 9090), ))

_thread.start_new_thread(createServer, (("0.0.0.0", 9090), ))

Log("Start the custom data source service thread, and the data is provided by the CSV file.", ", Address/Port: 0.0.0.0:9090", "#FF0000")

except BaseException as e:

Log("Failed to start custom data source service!")

Log("error message:", e)

raise Exception("stop")

while True:

cmd = GetCommand()

if cmd:

if cmd == "createRecords":

Log("Generator parameters:", "Start time:", startTime, "End time:", endTime, "K-line period:", KLinePeriod, "Initial price:", firstPrice, "Type of volatility:", arrTrendType[trendType], "Volatility coefficient:", ratio)

generator = KlineGenerator(

start_time=startTime,

end_time=endTime,

interval=KLinePeriod,

)

kline_data = generator.generate(firstPrice, trend_type=arrTrendType[trendType], volatility=ratio)

generator.save_to_csv("data.csv", kline_data)

ext.PlotRecords(kline_data, "%s_%s" % ("records", KLinePeriod))

LogStatus(_D())

Sleep(2000)

Practice in Backtesting System

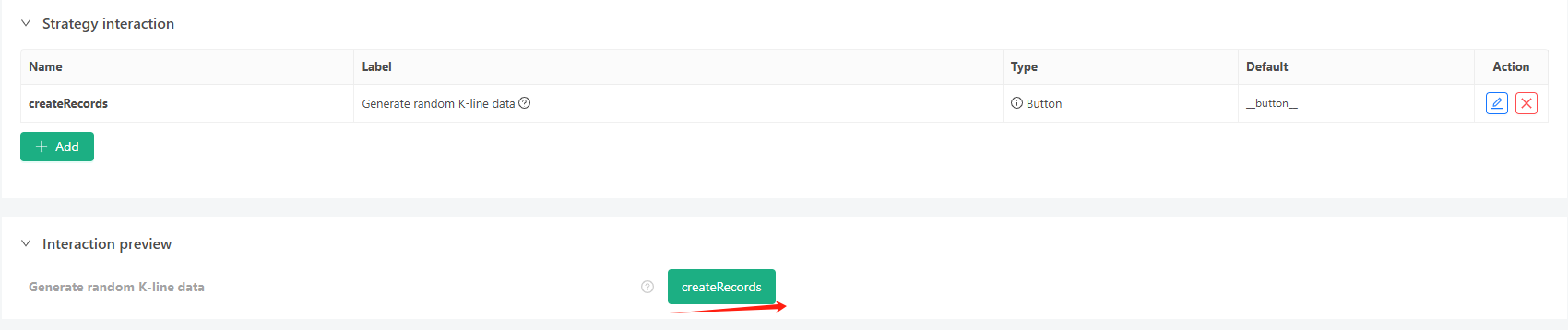

- Create the above strategy instance, configure parameters, and run it.

- The live trading (strategy instance) needs to be run on the docker deployed on the server, it needs a public network IP, so that the backtesting system can access it and obtain data.

- Click the interaction button, and the strategy will start generating random ticker data automatically.

- The generated data will be displayed on the chart for easy observation, and the data will be recorded in the local data.csv file.

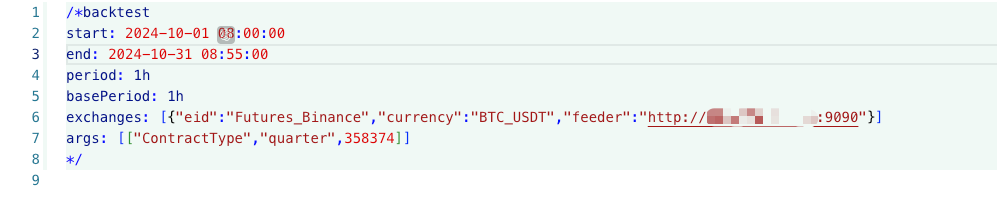

- Now we can use this randomly generated data and use any strategy for backtesting:

/*backtest

start: 2024-10-01 08:00:00

end: 2024-10-31 08:55:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","feeder":"http://xxx.xxx.xxx.xxx:9090"}]

args: [["ContractType","quarter",358374]]

*/

According to the above information, configure and adjust. http://xxx.xxx.xxx.xxx:9090 is the server IP address and open port of the random ticker generation strategy.

This is the custom data source, which can be found in the Custom Data Source section of the platform API document.

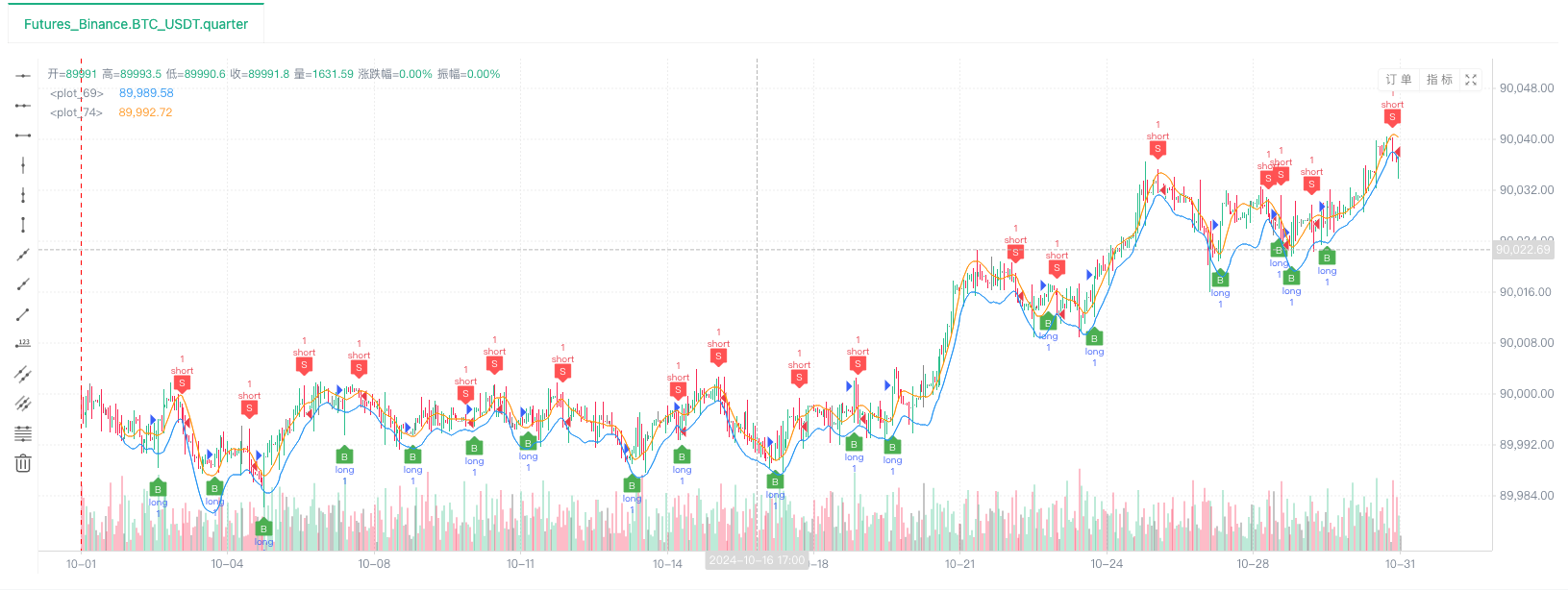

- After the backtest system sets up the data source, we can test the random market data:

At this time, the backtest system is tested with our “fabricated” simulated data. According to the data in the ticker chart during the backtest, the data in the live trading chart generated by the random market is compared. The time is: 17:00 on October 16, 2024, and the data is the same.

- Oh, yes, I almost forgot to mention it! The reason why this Python program of random ticker generator creates a live trading is to facilitate demonstration, operation, and display of generated K-line data. In actual application, you can write an independent Python script, so you don’t have to run the live trading.

Strategy source code: Backtesting System Random Ticker Generator

Thank you for your support and reading.

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Inventors quantify new functionality: Easily create HTTP services using the _Serve function

- FMZ Quant Trading Platform Custom Protocol Access Guide

- FMZ Funding Rate Acquisition and Monitoring Strategy

- FMZ funding rate acquisition and monitoring strategies

- A Strategy Template Allows You to Use WebSocket Market Seamlessly

- A policy template that allows you to use WebSocket seamlessly

- Inventors Quantified Exchange Platforms General Protocol Access Guide

- How to Build a Universal Multi-Currency Trading Strategy Quickly after FMZ Upgrade