Calculation and application of DMI indicators

Author: Inventors quantify - small dreams, Created: 2019-07-03 14:03:53, Updated: 2023-10-25 20:00:58

Calculation and application of DMI indicators

Indicators

DMI指标又叫动向指标或趋向指标,其全称叫“Directional Movement Index,简称DMI”,

也是由美国技术分析大师威尔斯·威尔德(Wells Wilder)所创造的,是一种中长期股市技术分析(Technical Analysis)方法。

DMI指标是通过分析股票价格在涨跌过程中买卖双方力量均衡点的变化情况,

即多空双方的力量的变化受价格波动的影响而发生由均衡到失衡的循环过程,从而提供对趋势判断依据的一种技术指标。

-

Calculation of indicators

Recently, a number of friends in the quantitative circle have asked me how to use the DMI indicator on the inventor's quantitative trading platform. I started thinking it was a simple problem, and I opened the API documentation to search for this indicator function. I found out that the omnipotent talib indicator library does not have this indicator. It was found that this indicator is made up of a combination of four indicators, the algorithm is not very complex, just write it according to the algorithm in the data.

Example address:https://www.fmz.com/strategy/154050

-

Please post the indicator source code.

// 指标函数 function ADX(MDI, PDI, adx_period) { if(typeof(MDI) == "undefined" || typeof(PDI) == "undefined"){ return false } if(MDI.length < 10 || PDI.length < 10){ return false } /* DX = abs(DIPlus-DIMinus) / (DIPlus+DIMinus)*100 ADX = sma(DX, len) */ var dx = [] for(var i = 0; i < MDI.length; i++){ if(!MDI[i] || !PDI[i]){ continue } var dxValue = Math.abs((PDI[i] - MDI[i])) / (PDI[i] + MDI[i]) * 100 var obj = { Close : dxValue, } dx.push(obj) } if(dx.length < adx_period){ return false } var adx = talib.SMA(dx, adx_period) return adx } function DMI(records, pdi_period, mdi_period, adxr_period, adx_period) { var recordsHLC = [] for(var i = 0; i < records.length ; i++){ var bar = { High : records[i].High, Low : records[i].Low, Close : records[i].Close, } recordsHLC.push(bar) } var m_di = talib.MINUS_DI(recordsHLC, mdi_period) var p_di = talib.PLUS_DI(recordsHLC, pdi_period) var adx = ADX(m_di, p_di, adx_period) // ADXR=(当日的ADX+前n日的ADX)÷2 var n = 0 var adxr = [] for (var j = 0 ; j < adx.length; j++) { if (typeof(adx[j]) == "number") { n++ } if (n >= adxr_period) { var currAdxr = (adx[j] + adx[j - adxr_period]) / 2 adxr.push(currAdxr) } else { adxr.push(NaN) } } return [m_di, p_di, adx, adxr] } -

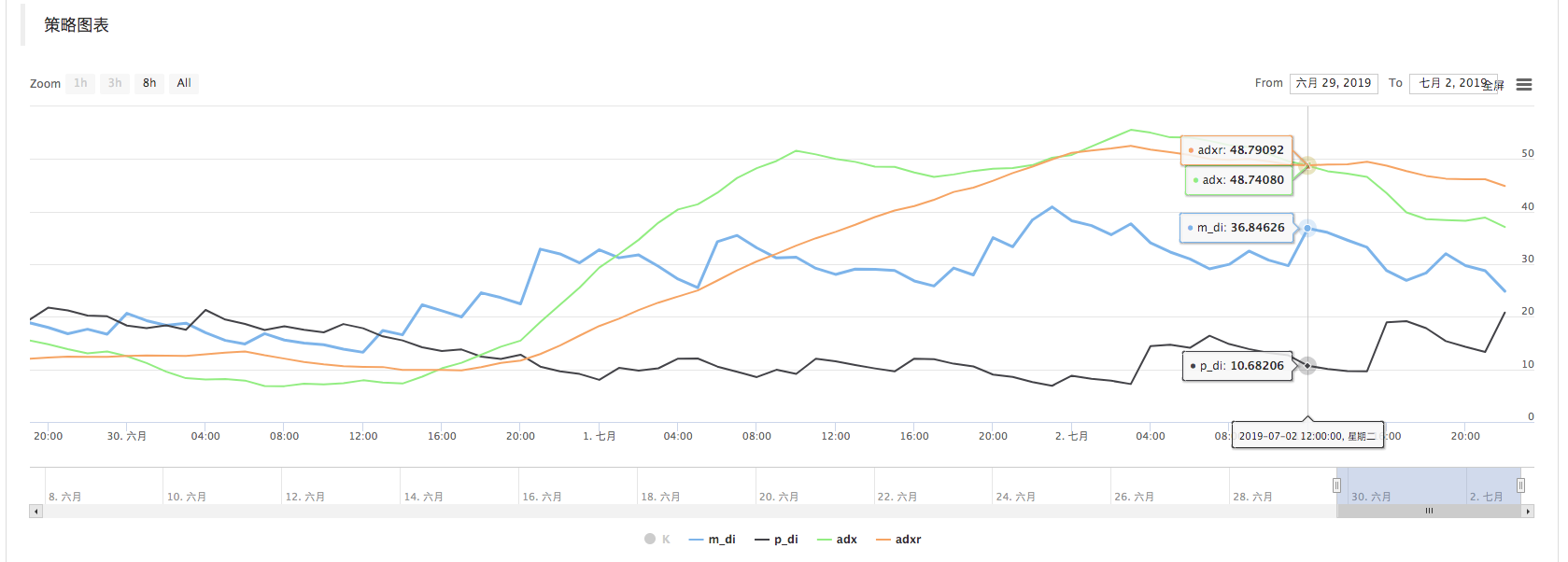

The contrast

Using the inventor's quantized drawing line library, it is easy to draw a graph that can be compared to other DMI on the graph below

Comparing the indicator values on several Kbars, the values are basically the same (a slight four-fifths deviation).

-

Use

Directly using the DMI function (e.g. how to call the main function in the example), the K-line data is transmitted, and the indicator parameter is set, usually 14. The function returns a two-dimensional array of data representing four lines.

- DI- : m_di,

- DI+ : p_di,

- ADX : adx,

- ADXR: adxr,

In the DMI indicator, these four lines, of which DI-, DI+ are multi-space indicators, represent the strength of both multi-space indicators. ADX and ADXR are a pair of indicator lines used as a trend indicator, reflecting the current market trends and directions.

The higher the value of DI+, the stronger the current market, and the weaker the current market. DI-, indicator is opposite. DI+, DI- are often intertwined, and the closer the numbers are, the more likely the market is in a stalemate.

-

The signal

1, search for the bottom.

After a long-term decline, if the following conditions are met in the short-term, the short-term bottom has been identified and there may be a rebound or reversal of the over-fall.

-

1, the DI+ line, representing the multihead force, is below 10, at the over-drop position and the upward curve, and the DI+ line is at the high position.

-

2, the ADX line representing the trend is at a higher position above 65 and bends downward and forms a dead fork with the ADXR line.

2, the dome

After a long-term uptrend, a short-term peak has been identified and a short-term adjustment or reversal may occur if the following conditions are met in the short-term:

-

1, the DI line, which represents the head force, is below 10, is low and curves up, and the DI+ line is high.

-

2, the ADX line representing the trend is at a higher position above 65 and bends downward and forms a dead fork with the ADXR line.

3 The Rise

After a period of fluctuation, the four DMI indicator lines wrap around each other at low levels, and then suddenly a long k-line with a gain of more than 5% of the volume appears. The DI+ line passes through the DI-line, ADX line and ADXR line consecutively for two days, representing a new uptrend.

-

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Pivot Point day trading system

- Three potential models in quantitative trading

- RangeBreak strategy combined with real-world use of volatility

- Neural network and digital currency quantitative trading series ((1)

LSTM predicts Bitcoin price - Principles and writing of stop-loss models

- Visualizing modules to build trading strategies - a basic understanding

- Digital currency adaptive even-line trading system and KAMA algorithm solver based inventor-based quantitative trading software

- FMZ inventors quantify platform feedback

- A simple demonstration of moving averages using the curve.

- Industry giant reveals algorithmic trading: inventors quantify platforms as market strategy

- An intraday trading strategy using the mean value return between SPY and IWM

- Application of technical indicators in quantitative trading

- Use JavaScript to implement a quantification policy while running the Go function in a wrapper.

- 19 professionals share their tips for trading digital currencies

- Shannon's demonic spell applied to digital currency

- Creating a Bitcoin trading robot that won't lose money

- From quantitative trading to asset management to developing CTA strategies for the ultimate payoff

- Nine trading rules that helped a trader go from $1,000 to $46,000 in less than a year

- Inventors introduce quantitative trading - from the basics to the real world.

- 5.5 Trading strategy optimization

lonelymanAs if we knew each other

wuzhenyuvCan you write a trend-judging strategy based on DMI?

Inventors quantify - small dreamsWell, there is time to write an example.