Teach you how to let an old strategy docking the websocket quotes interface

Author: Goodness, Created: 2019-10-08 14:56:58, Updated: 2023-11-06 19:41:28

There are many interesting strategies on the square page (https://www.fmz.com/square) of the FMZ Quant platform. Back then, most of the cryptocurrency exchanges API interface were using the rest protocol, Many strategies are based on the rest interface, therefore, sometimes the market quotes update is slow. In addition, there have been some cases in which the exchange’s rest interface has failed in the near future, resulting in a strategy that cannot preforming properly.

As long as the strategy is modified, adding support for the websocket interface requires some changes to the strategy code, which is usually rather troublesome (the difficulty of changing the strategy is much higher than rewriting it).

How can we not change the strategy code, but use the websocket market quote interface?

Here is the full flexibility of the FMZ Quant platform, we can use:

-

Use the strategy “template class library”.

-

Preforming a “Hook” operation for the exchange market quotes obtaining function such as

exchange.GetTicker.

Thus, without changing the strategy code, let the strategy using the data driven and pushed by the websocket market interface.

The code writing language uses the JavaScript programming language.

Analysis strategy

For example, when we need to modify a classic strategy “Icebreaker”

Strategy address : https://www.fmz.com/strategy/9929

Let’s take a look the strategy code and find that the strategy is driven by the tick market quote. It mainly uses the properties of Buy, Sell, and Last in the ticker data. The ticker data is obtained by the API function of the FMZ Quant platform: exchange.GetTicker. The goal is clear now, we can replace the exchange.GetTicker function with Hook operation (that is, replace it with another version).

However, we can’t rewrite it in the “icebreaker” strategy code, it will affect the strategy logic, we want the seamlessly docking to the websocket!

So we need the next protagonist to debut.

The “template class library” function and the “init” function work together

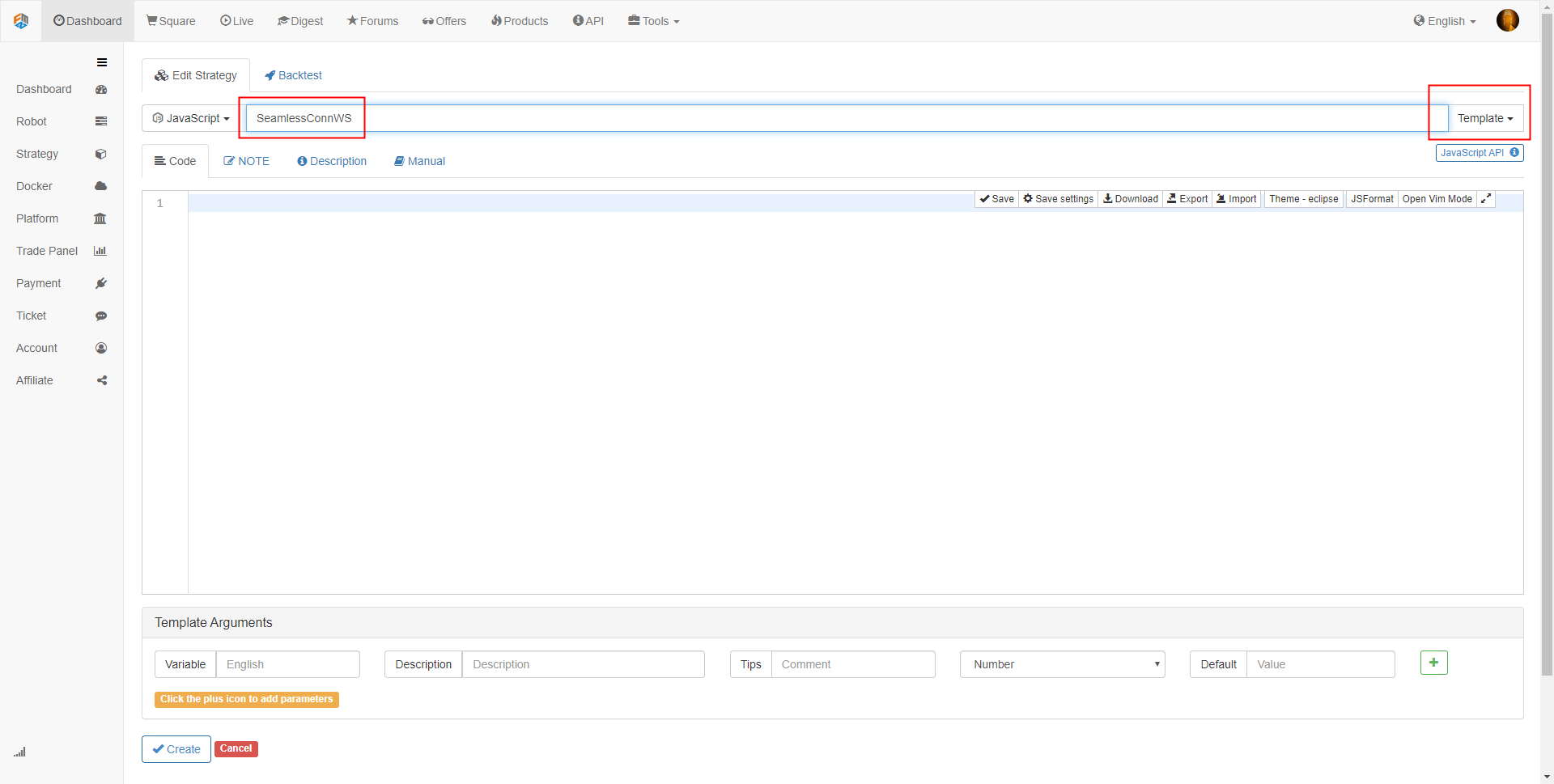

We create a “template class library” named: “SeamlessConnWS”

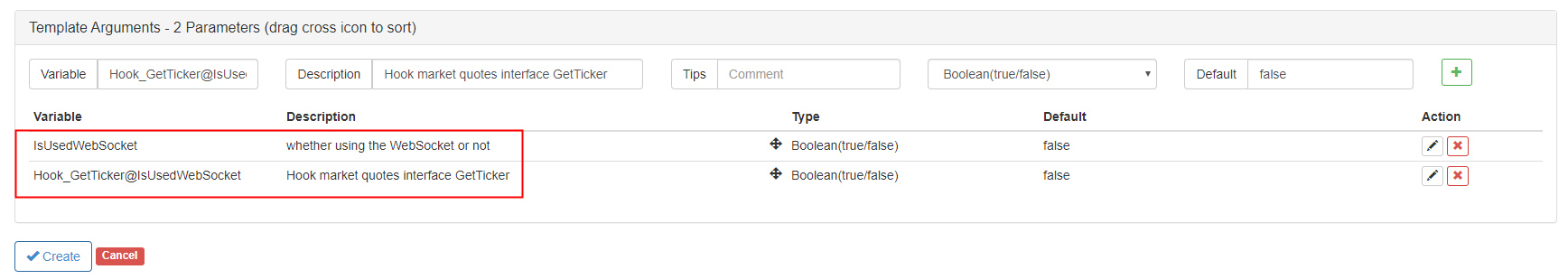

Then set 2 parameters to the SeamlessConnWS template.

- IsUsedWebSocket

- Hook_GetTicker@IsUsedWebSocket

These two are used to control whether to use the websocket interface function, and the control specifies to open a specific market quote interface. Due to the limitation of this article, we only preform the hook operation for the exchange.GetTicker interface. Therefore, we need enable the the parameter(Hook_GetTicker) of the GetTicker interface to the websocket mode.

Once the template is created, we can write a specific access to the exchange’s websocket interface in the template, subscribe to certain quotes, and then wait for the function code of the exchange to push the data. The specific code is not described here, you can refer to the SeamlessConnWS code (already open sourced) and the FMZ Quant official API documentation. One thing need to mentioned is that the init function in the template and the global variables _DictConnectCreater, _ConnMap:

Code part:

var _DictConnectCreater = {

"Huobi" : WSConnecter_Huobi,

"Binance" : WSConnecter_Binance,

}

var _ConnMap = {}

function init () {

if (IsUsedWebSocket) {

var connectCreater = null

if (exchanges.length != 1) {

Log("Switching to the ws interface only for the "exchange" exchange object (ie, the first added exchange object)")

}

var isFound = false

for (var name in _DictConnectCreater) {

if (exchange.GetName() == name) {

connectCreater = _DictConnectCreater[name]

isFound = true

}

}

if (!isFound) {

throw "Did not find an implementation"

}

if (Hook_GetTicker) {

var symbol = exchange.GetCurrency()

_ConnMap.GetTicker = connectCreater("GetTicker", symbol)

exchange.GetTicker = function () {

return _C(_ConnMap.GetTicker.Read)

}

}

// ...

}

}

It can be seen that this template only implements the websocket market interface of two exchanges, which are the Binance and Huobi. The init function is to make sure that when the “Icebreaker” strategy call the SeamlessConnWS template, the init function will execute first during the real market running progress.

we can replace the content of the exchange.GetTicker function with the code of using the websocket interface, thus achieving seamless docking to the websocket market.

SeamlessConnWS template address: https://www.fmz.com/strategy/167755

How to use it

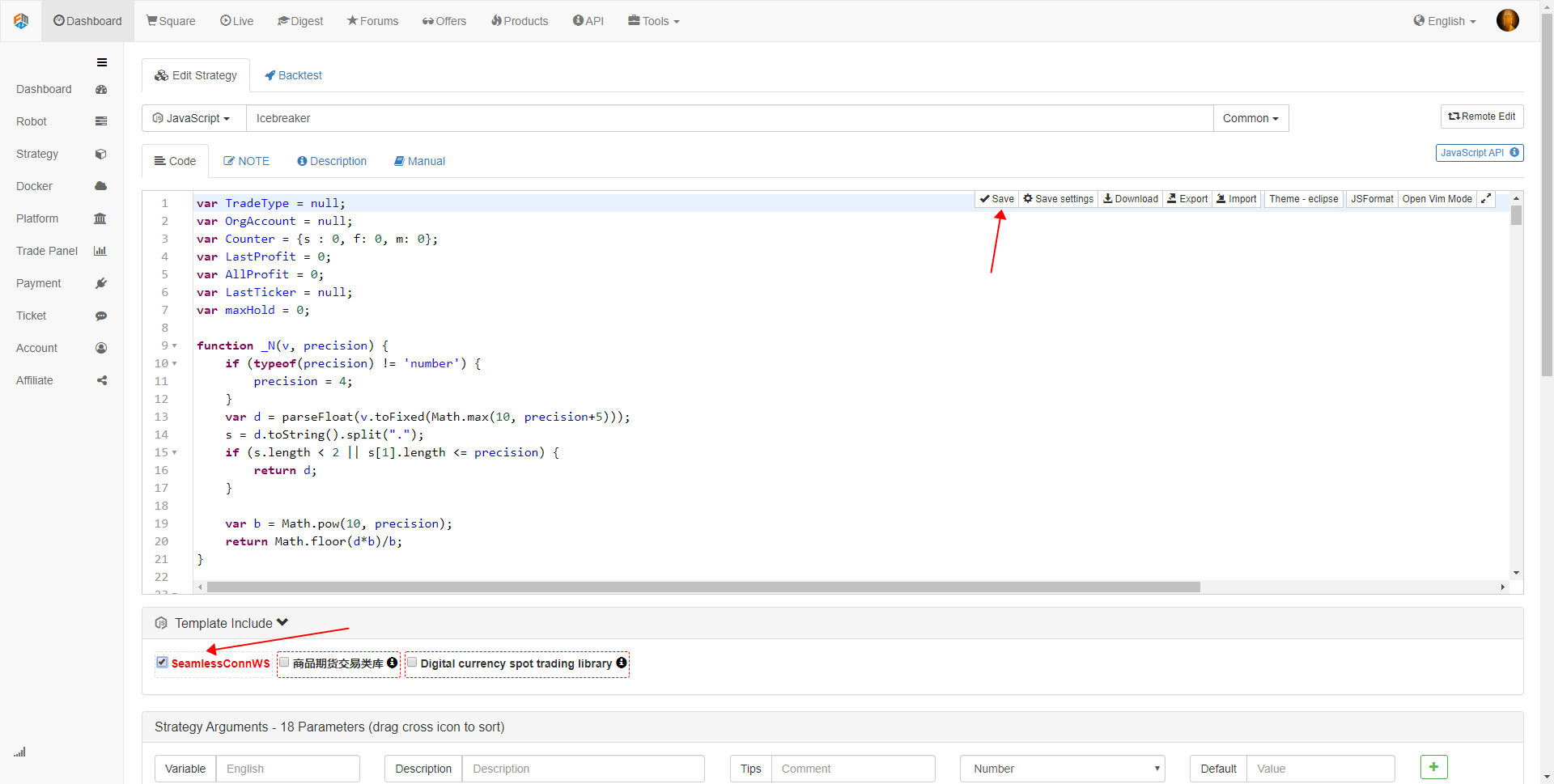

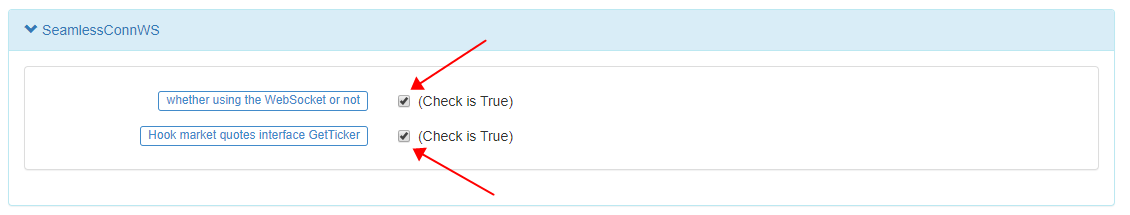

A piece of cake! After copying the SeamlessConnWS template into your strategy library, you can just use the “Icebreaker” strategy to reference it, as shown in the figure:

make sure to click check the template, and the save button.

Create a “Icebreaker” strategy real-time robot, the exchange chooses the trading pair.

Open the control parameters on the SeamlessConnWS template.

Run it up:

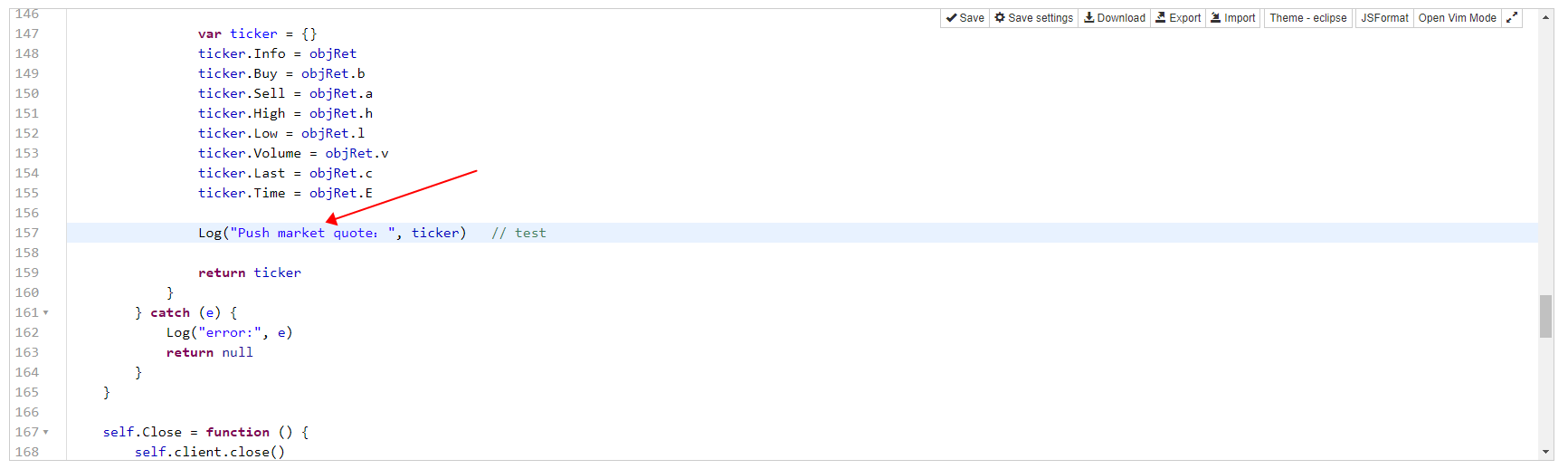

In order to easily see the pushed data, on line 157, we specifically added a print log code, it will output the data pushed by the exchange.

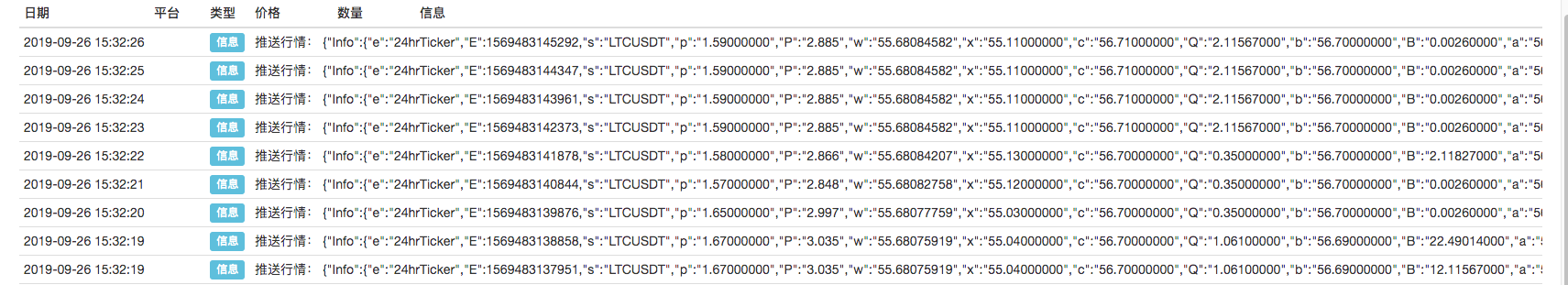

Display on the robot log:

This way, we don’t need modify any line of the strategy code, and achieves seamless docking with the websocket market interface.

This example is only for the strategy of using the exchange.GetTicker market interface function, other market interfaces such as exchange.GetDepth, exchange.GetTrades and exchange.GetRecords are the same routine! For the standard template SeamlessConnWS, you can try to expand it further.

For the implementation of the specific link websocket in the template, use the Dial function (see the API documentation about the Dial function), which can be adjusted as needed. For example, you can specify the parameter -2 to the read() function, which returns only the latest data in the buffer that the websocket connection accepts.

Thanks for reading

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Inventors quantify new functionality: Easily create HTTP services using the _Serve function

- FMZ Quant Trading Platform Custom Protocol Access Guide

- FMZ Funding Rate Acquisition and Monitoring Strategy

- FMZ funding rate acquisition and monitoring strategies

- A Strategy Template Allows You to Use WebSocket Market Seamlessly

- A policy template that allows you to use WebSocket seamlessly

- Inventors Quantified Exchange Platforms General Protocol Access Guide

- How to Build a Universal Multi-Currency Trading Strategy Quickly after FMZ Upgrade

- How to quickly build a universal multi-currency trading strategy after FMZ upgrade

- DCA Trading: A Widely Used Quantitative Strategy