dYdX strategy design paradigm - Randomized trading strategy

Author: Inventors quantify - small dreams, Created: 2021-11-03 15:40:56, Updated: 2023-09-15 21:02:48

dYdX policy design paradigm

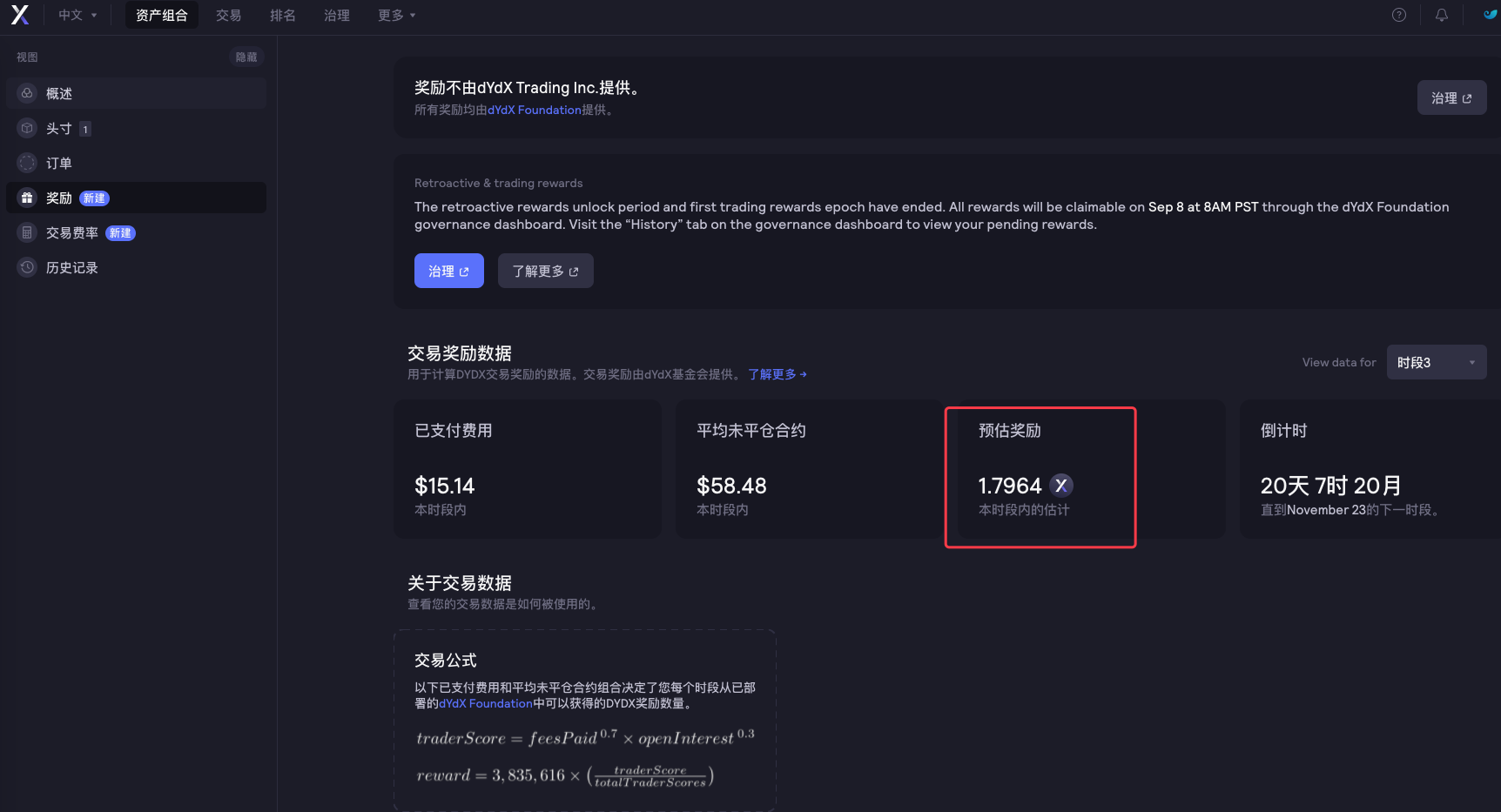

In response to a lot of users' needs, recently FMZ platform supported the dYdX decentralized exchange. Small partners with strategies can enjoy mining dYdX. Just a long time ago, I wanted to write a random trading strategy, making money and losing money without any apparent purpose is to practice hand-in-hand teaching a little strategy design.

The first wave of mining.

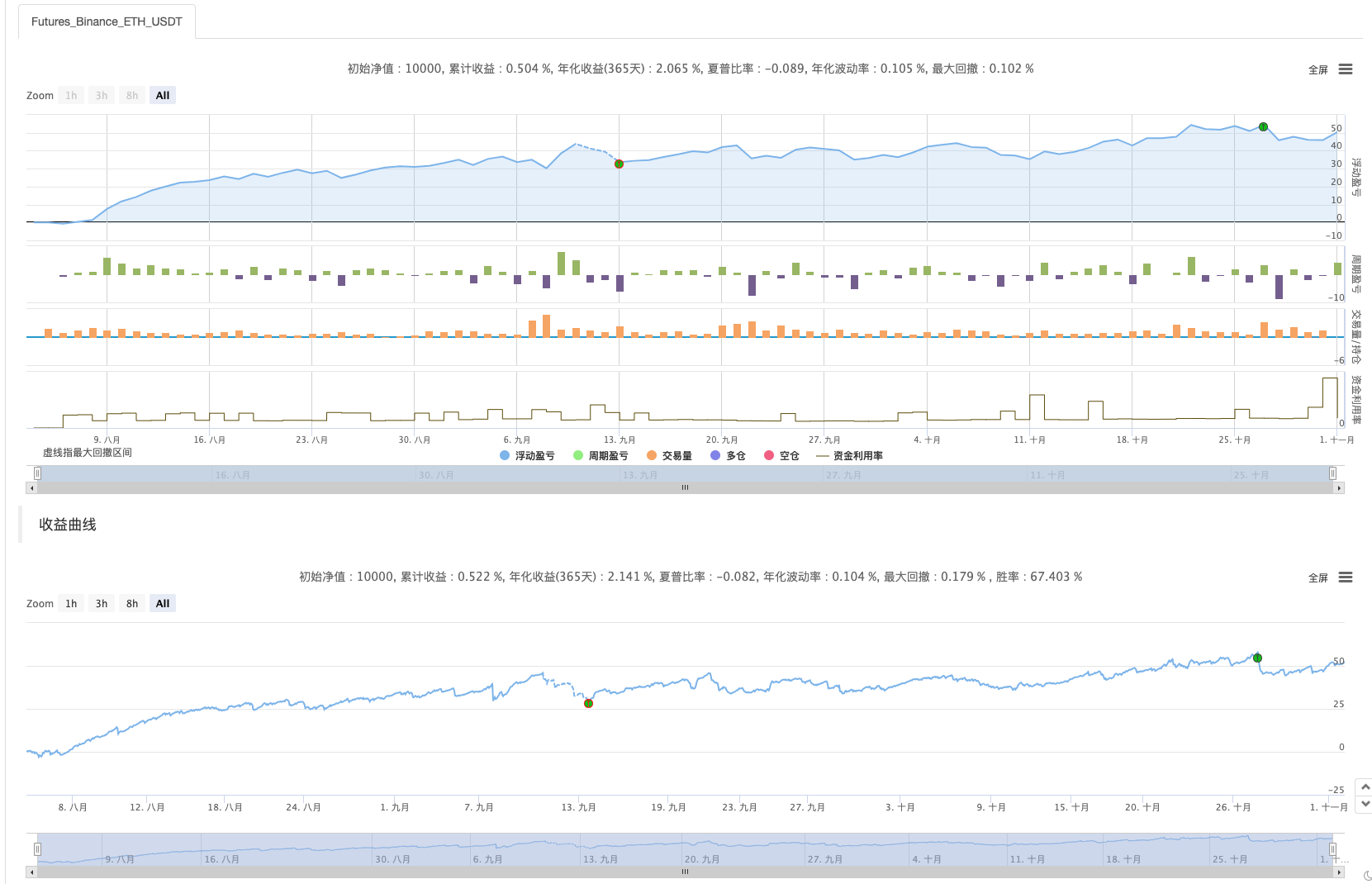

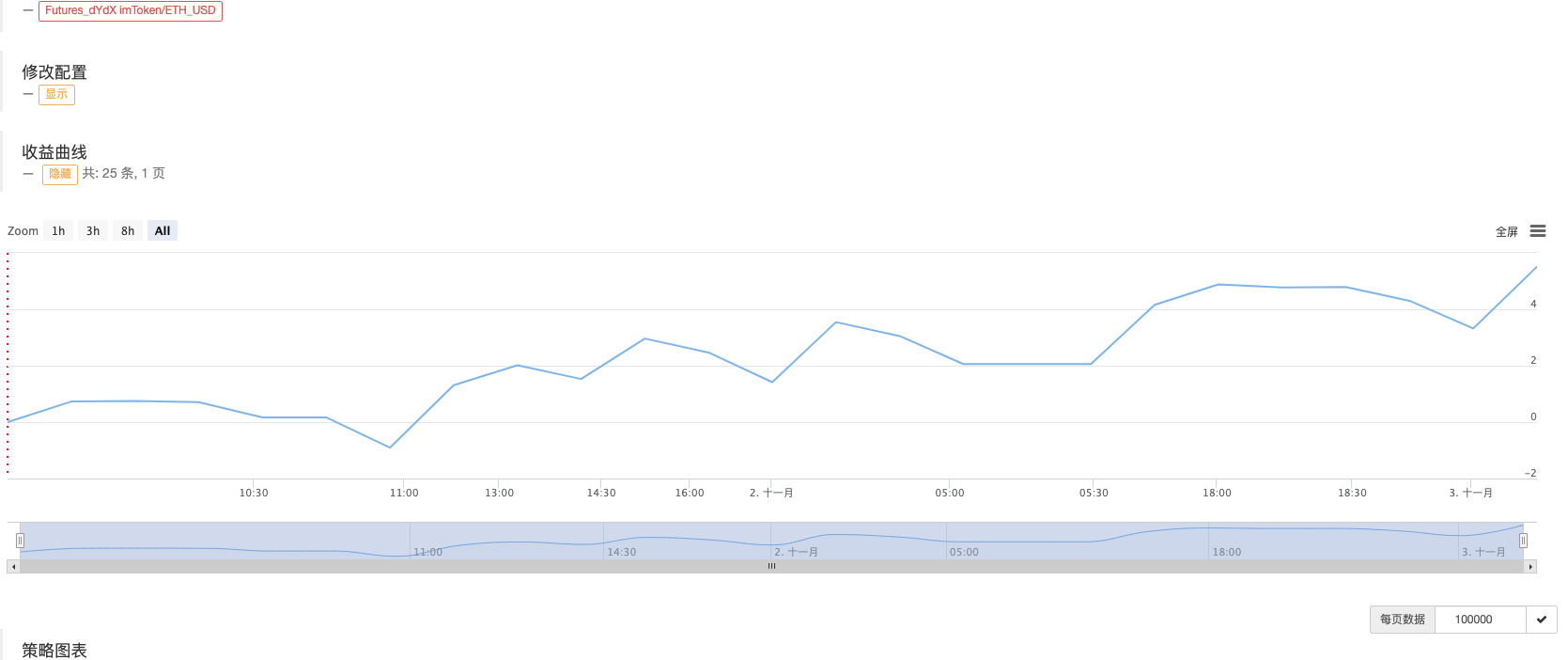

This is a screenshot of the mining strategy in this post.

If you have a good idea for a mining strategy, you are welcome to leave a comment!

Randomized trading strategy design

Let's try to think it over! We plan to design a strategy that does not look at the indicator, does not look at the price randomly ordered, the only option is to do more, do nothing, what is blocked is probability. Then we use random numbers 1 to 100 to determine how much space.

Multiple conditions: random number from 1 to 50. To do the empty condition: random number 51 to 100.

The number of spaces is 50 numbers. Next, we will think about how to equalize, since it is a draw, then there must be a win-win standard. Then in trading, we will set a fixed stop loss as a win-win standard. Stop loss is a win, stop loss is a loss.

It's not cost-free, there are slippage points, fees, and other factors that are enough to push our winning odds of random trades to less than 50%. It's better to design a multiple bet, since since it's a jackpot, the probability of losing 10 consecutive 8 random trades shouldn't be very high. So I wanted to design the first trade with a small amount, and then increase the next amount if the jackpot loses.

OK, the strategy is simple enough to design.

Design source code:

var openPrice = 0

var ratio = 1

var totalEq = null

var nowEq = null

function cancelAll() {

while (1) {

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

break

}

for (var i = 0 ; i < orders.length ; i++) {

exchange.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

Sleep(500)

}

}

function main() {

if (isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("重置所有数据", "#FF0000")

}

exchange.SetContractType(ct)

var initPos = _C(exchange.GetPosition)

if (initPos.length != 0) {

throw "策略启动时有持仓!"

}

exchange.SetPrecision(pricePrecision, amountPrecision)

Log("设置精度", pricePrecision, amountPrecision)

if (!IsVirtual()) {

var recoverTotalEq = _G("totalEq")

if (!recoverTotalEq) {

var currTotalEq = _C(exchange.GetAccount).Balance // equity

if (currTotalEq) {

totalEq = currTotalEq

_G("totalEq", currTotalEq)

} else {

throw "获取初始权益失败"

}

} else {

totalEq = recoverTotalEq

}

} else {

totalEq = _C(exchange.GetAccount).Balance

}

while (1) {

if (openPrice == 0) {

// 更新账户信息,计算收益

var nowAcc = _C(exchange.GetAccount)

nowEq = IsVirtual() ? nowAcc.Balance : nowAcc.Balance // equity

LogProfit(nowEq - totalEq, nowAcc)

var direction = Math.floor((Math.random()*100)+1) // 1~50 , 51~100

var depth = _C(exchange.GetDepth)

if (depth.Asks.length <= 2 || depth.Bids.length <= 2) {

Sleep(1000)

continue

}

if (direction > 50) {

// long

openPrice = depth.Bids[1].Price

exchange.SetDirection("buy")

exchange.Buy(Math.abs(openPrice) + slidePrice, amount * ratio)

} else {

// short

openPrice = -depth.Asks[1].Price

exchange.SetDirection("sell")

exchange.Sell(Math.abs(openPrice) - slidePrice, amount * ratio)

}

Log("下", direction > 50 ? "买单" : "卖单", ",价格:", Math.abs(openPrice))

continue

}

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

var pos = _C(exchange.GetPosition)

if (pos.length == 0) {

openPrice = 0

continue

}

// 平仓检测

while (1) {

var depth = _C(exchange.GetDepth)

if (depth.Asks.length <= 2 || depth.Bids.length <= 2) {

Sleep(1000)

continue

}

var stopLossPrice = openPrice > 0 ? Math.abs(openPrice) - stopLoss : Math.abs(openPrice) + stopLoss

var stopProfitPrice = openPrice > 0 ? Math.abs(openPrice) + stopProfit : Math.abs(openPrice) - stopProfit

var winOrLoss = 0 // 1 win , -1 loss

// 画线

$.PlotLine("bid", depth.Bids[0].Price)

$.PlotLine("ask", depth.Asks[0].Price)

// 止损

if (openPrice > 0 && depth.Bids[0].Price < stopLossPrice) {

exchange.SetDirection("closebuy")

exchange.Sell(depth.Bids[0].Price - slidePrice, pos[0].Amount)

winOrLoss = -1

} else if (openPrice < 0 && depth.Asks[0].Price > stopLossPrice) {

exchange.SetDirection("closesell")

exchange.Buy(depth.Asks[0].Price + slidePrice, pos[0].Amount)

winOrLoss = -1

}

// 止盈

if (openPrice > 0 && depth.Bids[0].Price > stopProfitPrice) {

exchange.SetDirection("closebuy")

exchange.Sell(depth.Bids[0].Price - slidePrice, pos[0].Amount)

winOrLoss = 1

} else if (openPrice < 0 && depth.Asks[0].Price < stopProfitPrice) {

exchange.SetDirection("closesell")

exchange.Buy(depth.Asks[0].Price + slidePrice, pos[0].Amount)

winOrLoss = 1

}

// 检测挂单

Sleep(2000)

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

pos = _C(exchange.GetPosition)

if (pos.length == 0) {

if (winOrLoss == -1) {

ratio++

} else if (winOrLoss == 1) {

ratio = 1

}

break

}

} else {

// 撤销挂单

cancelAll()

Sleep(2000)

pos = _C(exchange.GetPosition)

// 撤销后更新持仓,需要再次检查

if (pos.length == 0) {

if (winOrLoss == -1) {

ratio++

} else if (winOrLoss == 1) {

ratio = 1

}

break

}

}

var tbl = {

"type" : "table",

"title" : "info",

"cols" : ["totalEq", "nowEq", "openPrice", "bid1Price", "ask1Price", "ratio", "pos.length"],

"rows" : [],

}

tbl.rows.push([totalEq, nowEq, Math.abs(openPrice), depth.Bids[0].Price, depth.Asks[0].Price, ratio, pos.length])

tbl.rows.push(["pos", "type", "amount", "price", "--", "--", "--"])

for (var j = 0 ; j < pos.length ; j++) {

tbl.rows.push([j, pos[j].Type, pos[j].Amount, pos[j].Price, "--", "--", "--"])

}

LogStatus(_D(), "\n", "`" + JSON.stringify(tbl) + "`")

}

} else {

// 撤销挂单

// 重置openPrice

cancelAll()

openPrice = 0

}

Sleep(1000)

}

}

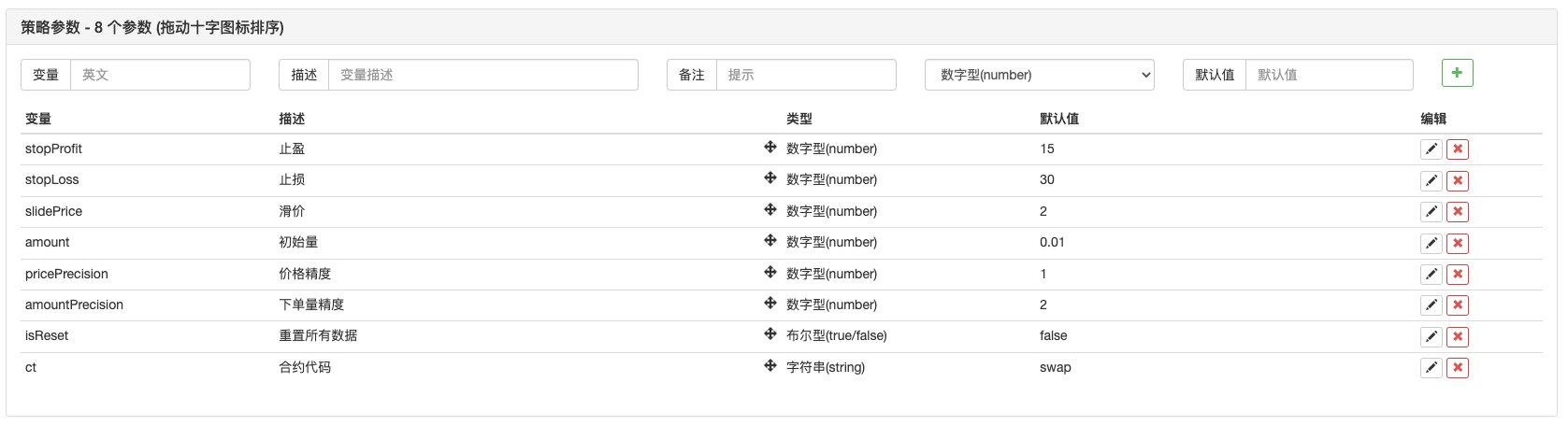

The policy parameters:

Oh yeah! The trick needs a name, just call it guess size (dYdX version)

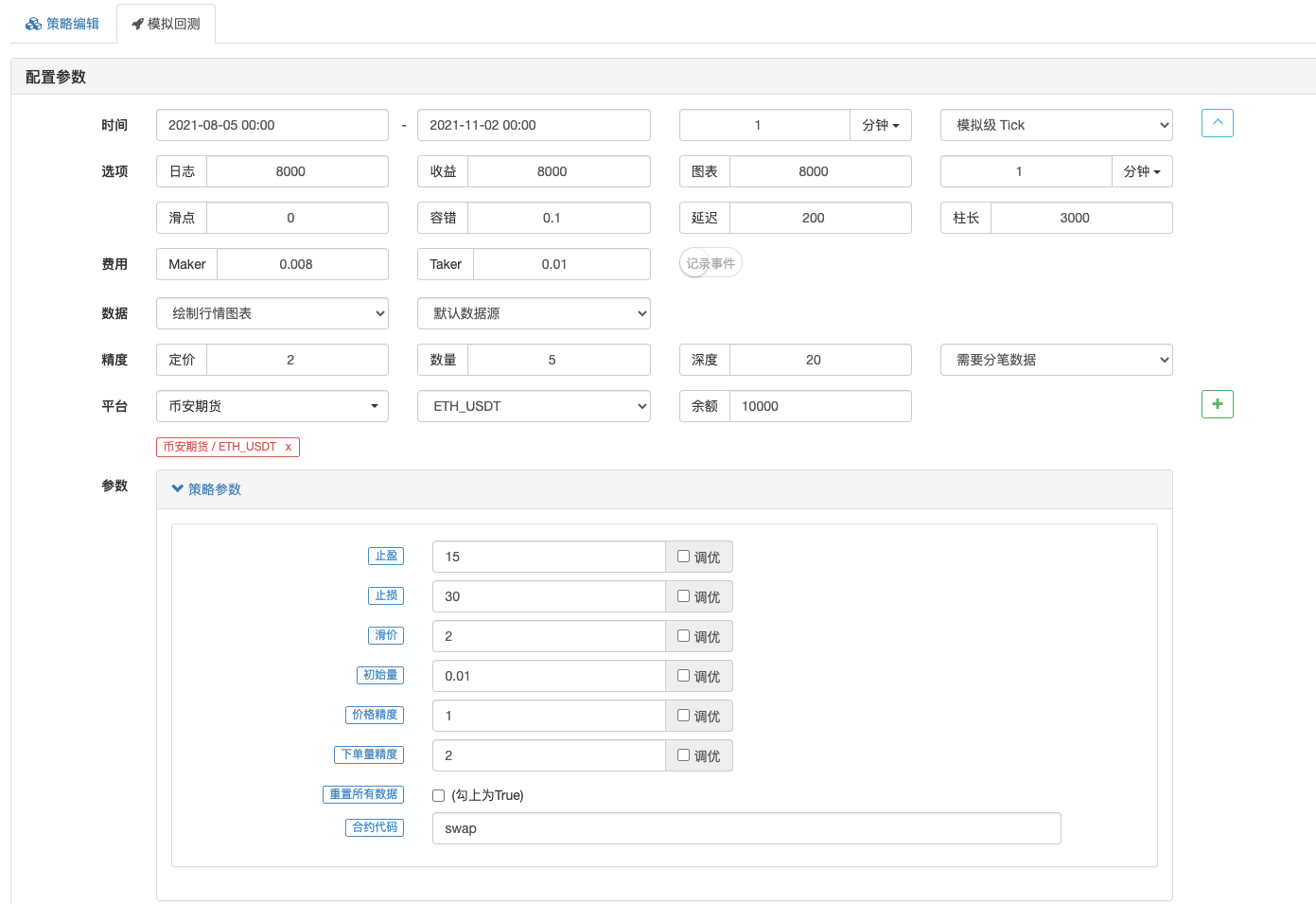

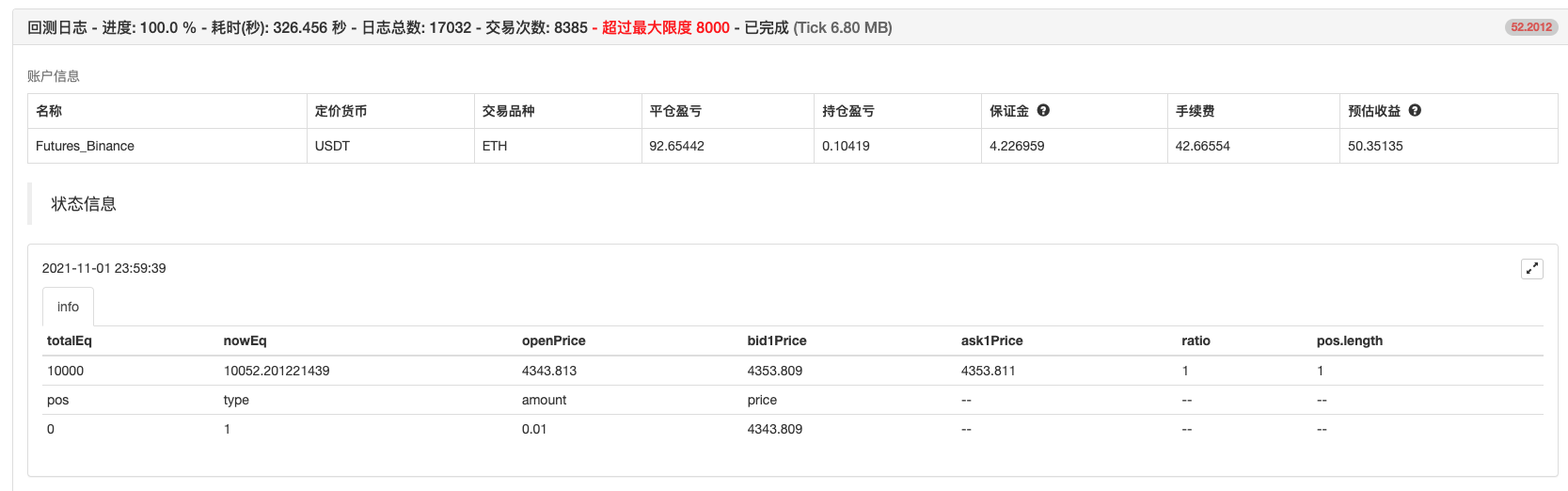

Reassessment

The review is for reference only, >_

I've done the retesting, no bugs. But I feel like I'm in the right system for the retesting...T_T, the real disk is running and playing.

Running for real

This policy is for educational, reference, and educational purposes only.How many?~How many?Don't use the hard drive!

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Inventors quantify new functionality: Easily create HTTP services using the _Serve function

- FMZ Quant Trading Platform Custom Protocol Access Guide

- FMZ Funding Rate Acquisition and Monitoring Strategy

- FMZ funding rate acquisition and monitoring strategies

- A Strategy Template Allows You to Use WebSocket Market Seamlessly

- A policy template that allows you to use WebSocket seamlessly

- Inventors Quantified Exchange Platforms General Protocol Access Guide

- How to Build a Universal Multi-Currency Trading Strategy Quickly after FMZ Upgrade

- How to quickly build a universal multi-currency trading strategy after FMZ upgrade

- DCA Trading: A Widely Used Quantitative Strategy

- FMZ platform Python replicator app for the first time - crawling Binance announcements

- Inventors quantify trading platforms with quick access app

xionglonghuiDo you have a Dydx decentralized exchange that now supports spot trading? Or is it just a perpetual contract? I have never used a decentralized exchange, and if Dydx supports spot trading, you can consider doing a spot grid trading strategy. There is also a decentralized exchange that requires time to confirm whether a buy or sell is successful, unlike a centralized exchange that requires a long confirmation process.

hyc1743Little white one, please ask why you can't run up.

Inventors quantify - small dreamsI have a real, permanent contract with dYdX.

Inventors quantify - small dreamsThe policy source code is just policy code, and parameters are configured. Parameters have screenshots in the article.