Implementation of Dual Thrust trading algorithm by using Mylanguage on FMZ Quant platform

Author: FMZ~Lydia, Created: 2022-12-16 13:54:12, Updated: 2024-12-23 16:56:59

Implementation of Dual Thrust trading algorithm by using Mylanguage on FMZ Quant platform

1. Introduction to Dual Trust trading strategy

The dual trust trading algorithm is a famous strategy developed by Michael Chalek. It is usually used in futures, foreign exchange and stock markets. The concept of Dual Thrust is similar to a typical breakthrough system, which adopts dual thrust historical prices to construct an updated backtracking period - making it more stable in any given period theoretically.

2. Implementation of Dual Trust trading strategy

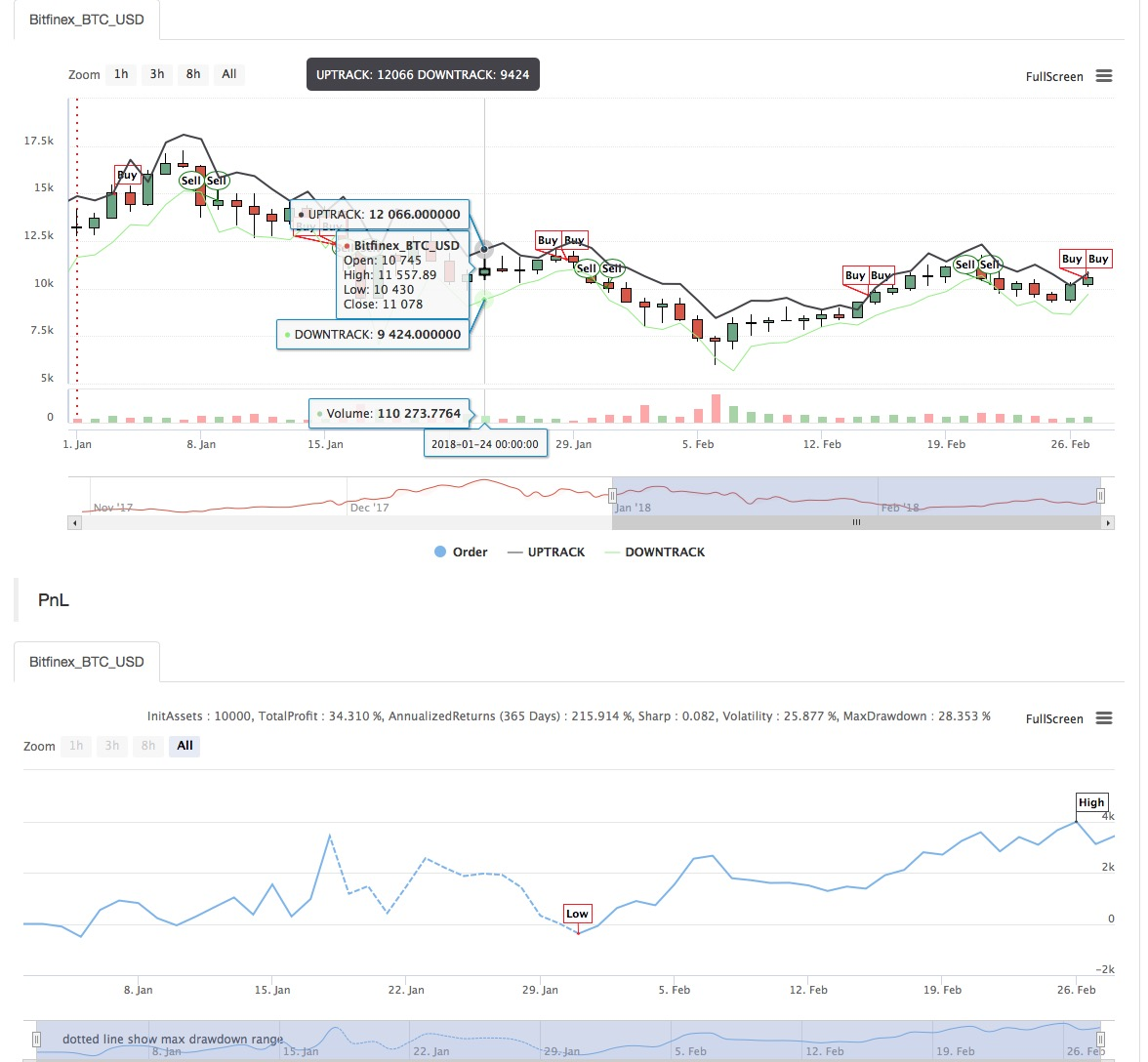

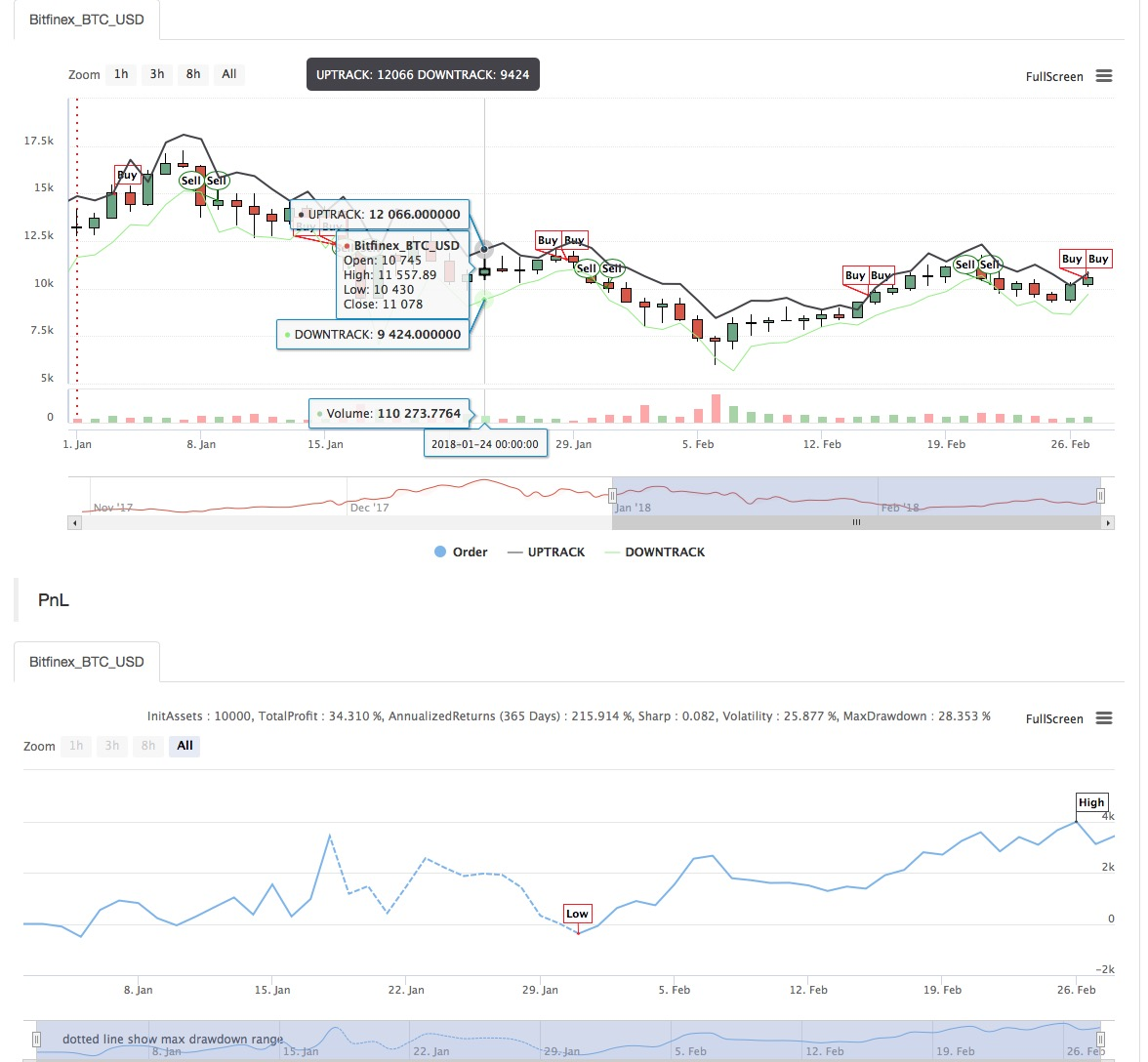

In this article, we will introduce the strategy briefly and show how to implement this algorithm by using Mylanguage on the FMZ Quant platform. After extracting the historical price of the selected transaction object, this range is calculated based on the closing price, the highest price and the lowest price in the last N days. When the market moves a certain range from the opening price, the opening operation is performed. We tested the strategy in two market states: trend market and range shock market. The results show that this momentum trading system works better in the trend market, but it will trigger some false buying and selling signals in the volatile market. In the interval market, we can adjust the parameters to obtain better returns.

- Basic formula: At the close of the day, two values are calculated: the highest price - the closing price, and the closing price - the lowest price. Then take the larger value and multiply by the value of k. The result is called the trigger value.

At the opening of the next day, record the opening price, and then buy immediately when the price exceeds (opening price+trigger value), or sell short when the price is lower than (opening price - trigger value).

The system is a reverse system without a separate stop loss. In other words, the reverse signal is also a closing position signal.

- Main chart:

Upper track: formula: UPTRACK^^O + KSRG;

Lower track: formula: DOWNTRACK^^O-KXRG;

- Secondary chart: null

Mylanguage code:

HH:=HV(H,N);

HC:=HV(C,N);

LL:=LV(L,N);

LC:=LV(C,N);

RG:=MAX(HH-LC,HC-LL);

UPTRACK^^O+KS*RG;

DOWNTRACK^^O-KX*RG;

C>UPTRACK,BPK;

C<DOWNTRACK,SPK;

For strategy source code, please refer to: https://www.fmz.com/strategy/128884

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- FMZ Journey -- with Transition Strategy

- Teach you to transform a Python single-species strategy into a multi-species strategy

- Implement a quantitative trading robot timed start or stop gadget by using Python

- Oak teaches you to use JS to interface with FMZ extended API

- Call Dingding interface to realize robot push message

- Balanced Pending Order Strategy (Teaching Strategy)

- Thoughts on asset movement through contract hedging strategy

- Many years later, you will find this article is the most valuable one in your investment career - find out where the returns and risks come from

- Recent FMZ official charging strategy introduction

- Preliminary Exploration of Python Crawler Application on FMZ Platform -- Crawling the Content of Binance Announcement

- Introduction FAQ to Quantitative Trading of Digital Currency

- Another TradingView Signal Execution Strategy Scheme

- Use the extended API on FMZ Quant Trading Platform to realize TradingView alert signal trading

- Visualization Module to Build Trading Strategy - Simple Explanation

- Visualization Module to Build Trading Strategy - Advanced Understanding

- Visualization Module to Build Trading Strategy - First Acquaintance

- The Journey of Detours from an Experienced Programmer

- Single Platform Balance Strategy of Python Version

- Cross-period Arbitrage Strategy of Digital Currency Based on Bollinger Band

- Example of Python MACD drawing