【HFT Market-Making Grid New】(Miner Edition)

One of your personal USDT mining machines.

Hello~Welcome come to my channel!

Welcome all traders to my channel. I am a Quant Developer, and I develop full-stack CTA & HFT & Arbitrage and other trading strategies. Thanks to the FMZ platform, I will share more content related to quantitative development in my quantitative channel, and work with all traders to maintain the prosperity of the quantitative community.

For more information, please move to my channel~ I’m waiting for you here to tease 【TradeMan Home】

Hello traders, after months of debugging, optimization, and iteration, I am pleased to announce that this high-frequency Maker strategy has reached a stable level and is ready to be shared with everyone. This is a grid-based, optimized, and iterated high-frequency order book strategy that aims to profit from fluctuations by continuously placing Ask (sell) and Bid (buy) orders around the current mid-price, providing corresponding liquidity. This strategy is not a super high-frequency liquidity-making strategy based on the order book, but a second high-frequency order placement strategy based on seconds. Therefore, the threshold is lower, the universality is stronger, the sensitivity to transaction fees is lower, and there is no need for an arms race, making it more suitable for ordinary transaction fee accounts. Below is a detailed explanation of this strategy.

I. Basic Concepts of Market Making and Crypto Market Characteristics

High-frequency market making (Market Making) strategy is a common quantitative trading strategy, which refers to a strategy that establishes limit buy (Bid) and sell (Ask) orders respectively, uses the fluctuation of the underlying price to trigger limit orders, and obtains trading profits through the price difference between buy (Bid) and sell (Ask) orders. In market-making strategies, the focus is on the number of limit orders and the setting of buy and sell order quotes and the distance from the mid-price. Therefore, in various classic market-making strategies, the estimation of the mid-price is mainly studied, and then buy and sell orders are placed at appropriate positions on both sides of the mid-price.

In some trading activities of underlying assets with good liquidity, ordinary investors can participate in market transactions by submitting market orders or directly buying and selling underlying assets or related derivatives. In such a market, there are many investors, and the asset liquidity is good. As long as investors bid at a reasonable price, they can quickly find trading counterparts. However, in assets with poor liquidity, due to various reasons, there are fewer traders participating in investment activities of these assets, and investors who want to carry out buying and selling activities on these assets find it difficult to correctly understand the true value of the assets and find suitable counterparts for transactions. At this time, market makers are needed to provide liquidity to the market.

Market makers rely on the price difference between high and low prices of assets to obtain profits from price fluctuations. So, how is this buying and selling price difference formed? Harold Demsetz, in 1968, studied the trading costs of the New York Stock Exchange and first explained the process of forming the buying and selling price difference of market makers: the imbalance of supply and demand will lead to the price difference, and the buying and selling price difference is an addition paid by the organized market for the immediacy of the transaction. Market-making strategies usually quote on both sides, and profit from the narrow price difference between the transaction price and the price difference, which is generally only 1-2 price levels, rather than a directional change. According to the efficient market theory, stock prices are in a state of “random walk” in an efficient market, and the direction of price movement is unpredictable. However, long-term tracking studies have found that the long-term trend of prices has the characteristics of “mean reversion”. Mean reversion is theoretically inevitable, and price trends cannot only rise or fall, or maintain a positive or negative yield, which is called mean aversion. In the mean reversion theory, the phenomenon of mean aversion is temporary, and mean reversion is inevitable. The degree to which asset prices deviate from their intrinsic value affects the length of the mean reversion cycle.

In traditional markets, ordinary traders usually do not have on-exchange seats, and their orders are sent to centralized exchanges through brokers. Only a few brokers and contracting institutions have the opportunity to become exchange market makers. However, in the Crypto digital currency market, every trader can directly connect to the exchange, and the threshold is very low. Moreover, the difference in fees and API interface usage between a retail investor and a top institution is not as great as in traditional markets. Therefore, in the Crypto digital currency market, market making is not a mysterious concept. Every trader can become a market maker, and the market gives every trader this opportunity. As long as you use Maker limit orders, you are a liquidity provider, and you are a market maker.

II. Classification of Market Making Strategies and Why Retail Investors Cannot Participate in Super High-Frequency Order Book Market Making?

Traditional market-making strategies are mainly divided into order book market making and grid market making. Order book market making mainly analyzes the supply and demand situation and price level in the market through Level2 data (including information such as the price, quantity, and direction of each order and tick-by-tick transaction information), and provides buy and sell quotes. It mainly includes two classic high-frequency market-making models: the AS model (Avellaneda, M., and S. Stoikov, 2008) and the GP model (Fabien Guilbaud and Huyen Pham, 2011). The AS model focuses on inventory risk management and studies the optimal decision in a single underlying asset quote considering inventory risk, that is, creating optimal buy and sell orders on both sides of the “true price” of the asset. The GP model assumes that the market maker’s goal is to maximize profits in a short-term interval by controlling inventory quantity through market orders and limit orders. By simulating the change of the mid-price through the Markov process, using the Cox process to simulate the market maker’s limit order transaction situation given the given price difference and limit price, and combining the Calibration program to estimate the transition matrix and density parameters of the price difference, etc., a dynamic operating system based on inventory and price difference variables is finally formed.

Order book market making requires a high level of mathematical and market microstructure knowledge, and the hardware equipment is too exclusive. It has gradually developed into an arms race of high computer/network performance and hardware optimization under the background of high mathematical statistics, usually for optimizing the architecture for several milliseconds or even nanoseconds, and all are pursuing top funding rates to offset the losses of the strategy itself. It is a field that retail investors and the general public cannot participate in. However, as I mentioned before, as long as it is a Maker order placement strategy, it provides liquidity to the market, and everyone in the crypto market is a market maker. Ordinary retail investors and the general public can avoid the competitive red ocean and find a profitable place in the second high-frequency field through this high-frequency hedging grid strategy.

III. High-frequency market-making strategy based on grid trading iteration development

The origin of grid trading can be traced back to Shannon, the father of information theory in the 1940s. Shannon, the famous author of “Information Theory”, is known as a giant who opened the information age on his own. The core assumption and idea of the strategy is that the market is efficient, random-walking, and has mean-reverting characteristics. The simplest grid trading strategy is difficult to obtain long-term stable profits and requires subjective judgment of the market for operation. If the simplest grid strategy is developed into a high-frequency market-making strategy, it is necessary to analyze its trading costs and profit and loss characteristics, optimize and iterate one by one, in order to adapt to the unpredictable market under the commission fee.The following focuses on the optimization and iteration direction of this high-frequency market-making grid strategy. First, we analyze the trading cost aspect. Knowing what costs exist will provide direction for optimization. There are mainly the following aspects:

Instruction processing cost. Refers to the transaction fee of the trade. If it is a high-frequency trade, it will generate a huge amount of transaction fees, which will greatly affect the profitability of the strategy. Therefore, it needs to be changed to a limit order maker transaction to have lower sensitivity to transaction fees. In order to save limit order usage, this strategy uses a virtual limit order method. Only a small amount of buy and sell orders will be placed on the order book each time, and large-scale limit orders will not be placed in order to reduce the error rate. About 90% of the orders in this high-frequency grid market-making strategy are maker orders, and 10% are taker orders. Under normal fees, the transaction fee expenditure is about 1⁄4 to 1⁄2 of the profit, and the monthly trading volume is about 100-500 times the principal. For example, with a principal of 10,000 yuan, the monthly trading volume may be between 100,000 yuan and 500,000 yuan, and the transaction fee is about 200-1,000 yuan. If there is no transaction fee, this expenditure will become extra profit. Therefore, if there are accounts with low fees or even negative fees, the profit effect will be more significant.

No inventory cost. Refers to the loss cost of market fluctuations without inventory in hand. The reason why market makers can make profits is that their long inventory will be sold in continuous rises, and their short inventory will be sold in continuous declines. The accumulation of inventory requires limit orders to be eaten. If the limit order keeps moving in one direction without being eaten, there will be no inventory in hand to sell, and no profit can be earned. In response to this pain point, this strategy will continuously buy and sell limit orders at the order book to obtain one inventory immediately when there is no inventory in hand, and then place a take-profit limit order at the corresponding position to obtain one profit.

Inventory accumulation cost. Compared with the no inventory cost, market makers are more afraid of the inventory accumulation cost, which specifically refers to the loss caused by the market continuously moving in one direction and the one-sided inventory in hand cannot be sold. There are usually the following solutions:

■ Gradually increase the position when replenishing the position, so as to quickly reduce the cost and throw it out at the small rebound. However, this type of method also comes with greater risks. If there is no rebound in the short term, more positions will be accumulated. You must not double endlessly like Martin. It is important to consider how to grasp the balance and scale between the number of positions added and the account risk.

■ Manage one-way inventory and adjust pending orders according to inventory level and risk preference. This method avoids extreme losses and controls inventory holdings. The disadvantage is that it is not as easy to throw out inventory as it is to lower costs, and the time cost is higher.

■ Dynamically adjust the spacing and upper and lower positions of pending orders. Adjust the width of pending orders based on volatility and trends, and place and place orders at an unbalanced interval.

■ Extreme case limitations. In extreme unilateral situations, perform operations such as waiting for time and only closing pending orders to minimize accumulation.

■ Hedging. Hedging is a business as well as an art. The hedging that market makers can use includes: hedging of the same type, cross-species hedging, unilateral hedging based on trends, accumulation-to-threshold hedging, unified hedging of all varieties from an asset allocation perspective, etc. This strategy currently uses the same variety of hedging and multi-species hedging to further increase stability and reduce the impact of a single market and currency.

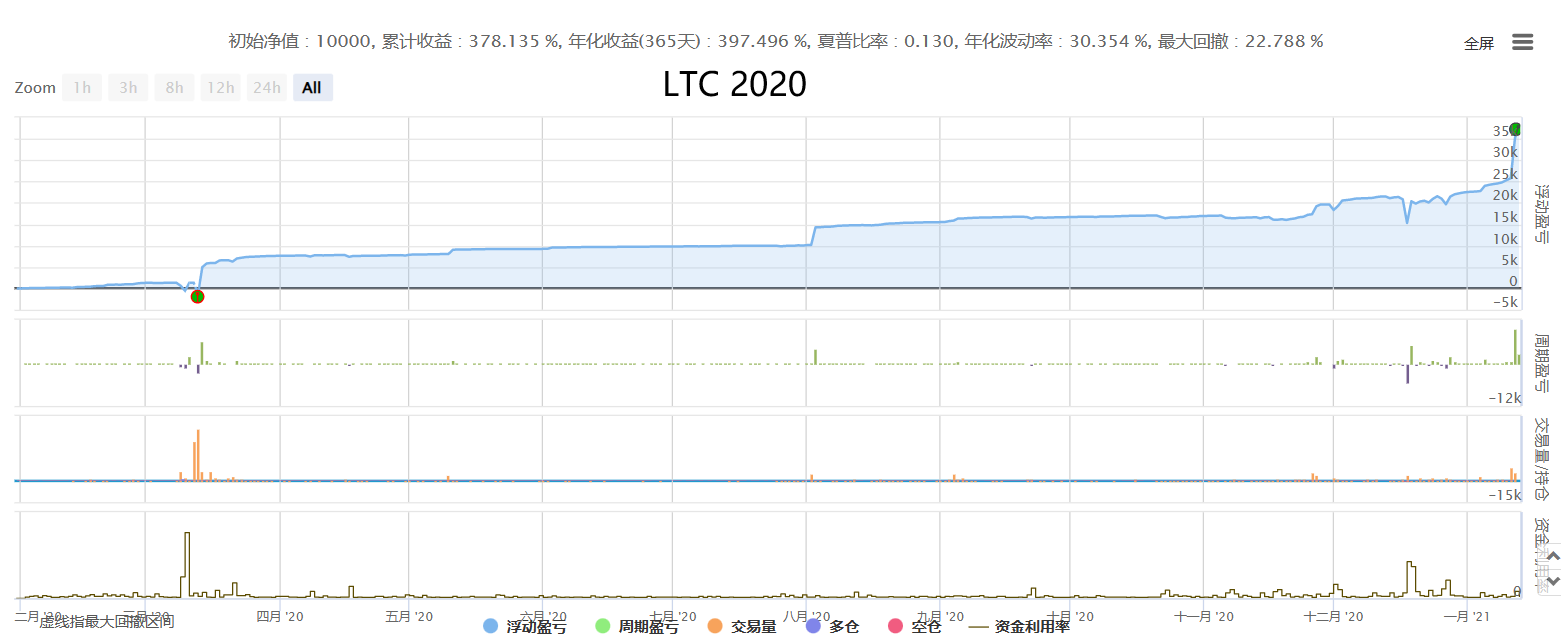

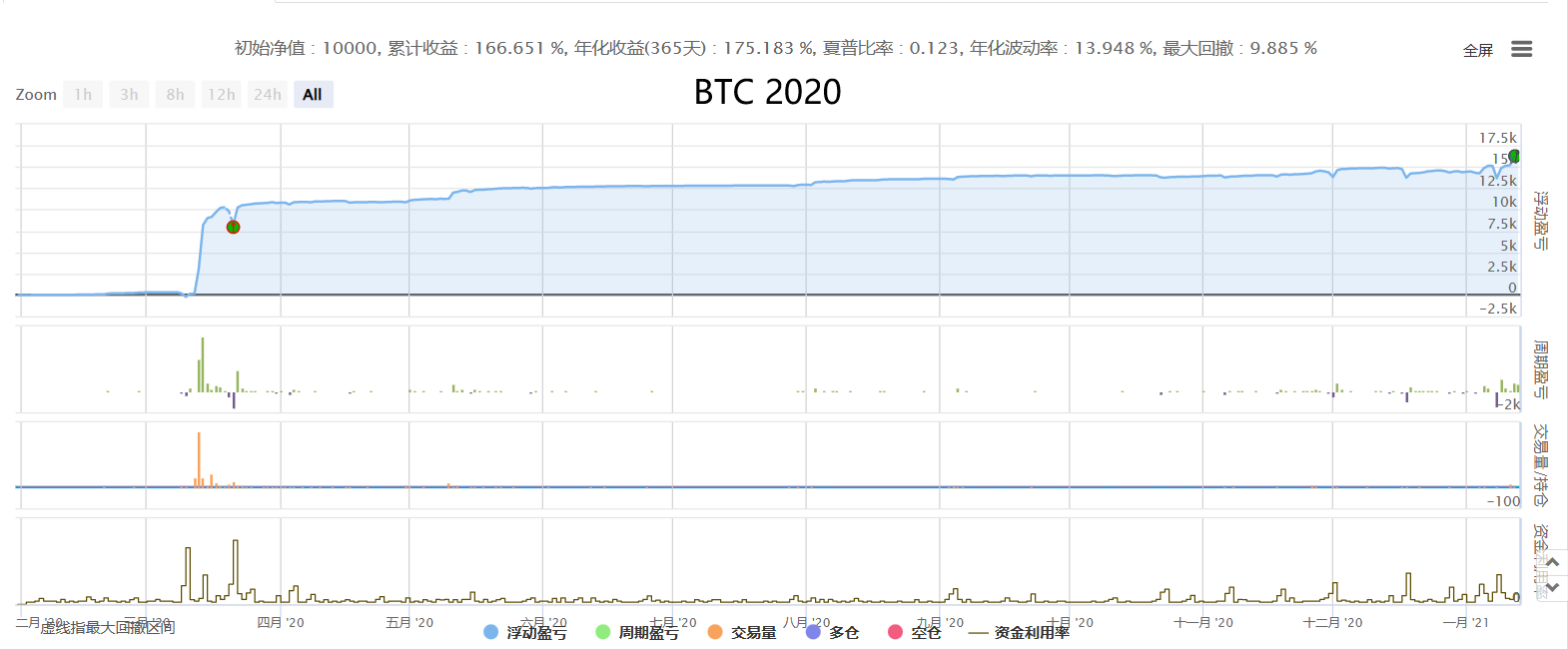

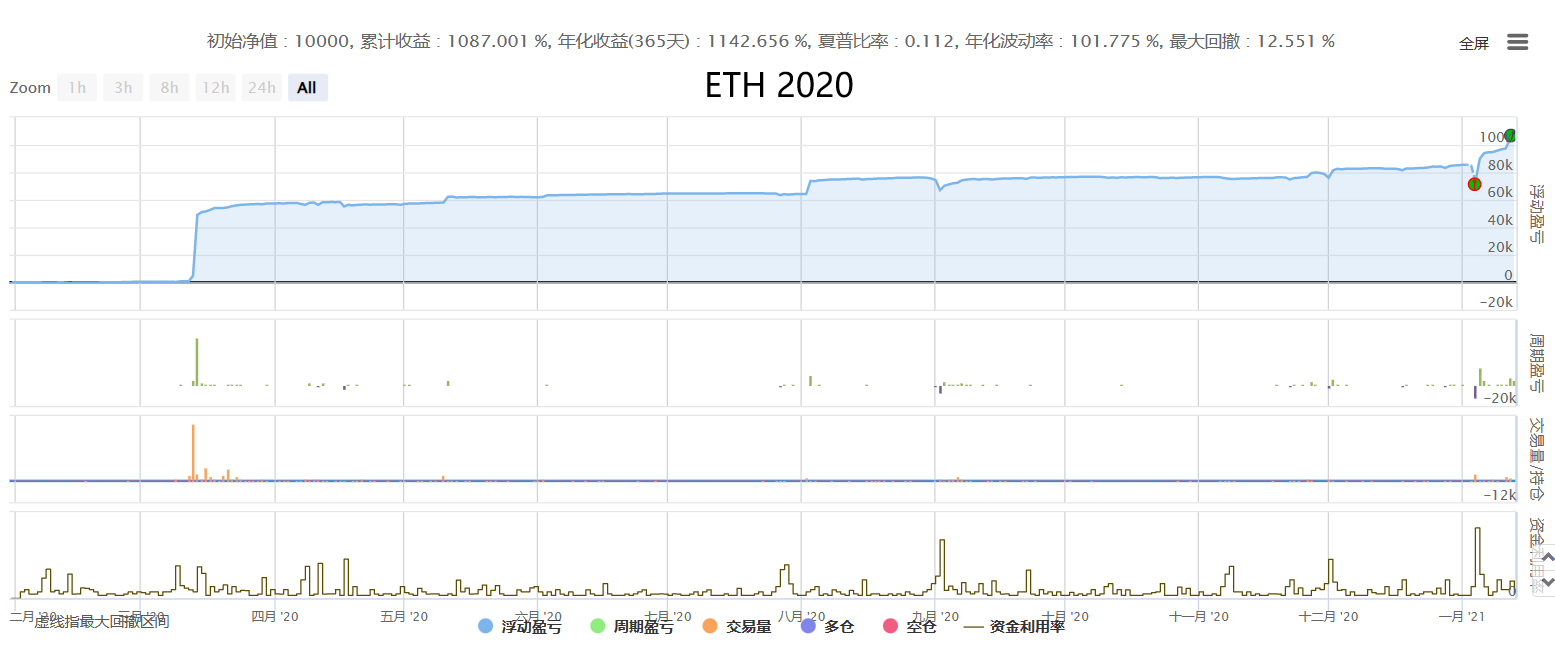

■ Variety selection. Market makers prefer markets with more retail participants and better liquidity. Market makers like shocks the most, and dislike unilateralism the most. On 3.12⁄5.19, too many contract market makers exploded. This strategy has been iterated to the extreme and will not liquidate the position. All market conditions from 2020 to 2023 can be safely passed. Detailed display will be given in the subsequent data section. This strategy will also have a suitable currency for matching, and users can also choose the appropriate currency independently according to market principles.

Information cost. Ordinary limit order grid trading does not incorporate additional market information and is easily selected in reverse by informed traders. An additional α factor can be input to predict the market, and the prediction can be directional or whether to make the market. Directional prediction can be judged based on additional factor information, and unbalanced limit orders can be placed in the direction of the trend or stop reverse limit orders. Whether to make the market can be judged based on additional information, but the direction of the market making is not judged. This strategy has tried to add prediction factors during development and iteration, but the results show that trying to make smarter predictions seems to be counterproductive, and doing nothing is better than making predictions (the current high-frequency level prediction level is insufficient). At the same time, the input of prediction and additional factor signals will produce path dependence. If the prediction is excellent, it will be greatly enhanced, and the same prediction will reduce its robustness and anti-fragility if it is not satisfactory. Therefore, no more additional predictions have been made at present, and continuous iteration and optimization will be carried out in the future if there is an opportunity.

IV. Strategy Performance and Profit/Loss Characteristics under Various Market Conditions

Third-party real offer performance

(Note: In order to avoid self-drawing curves and simultaneously display the performance of third-party real-time trading platforms, the displayed account is a Binance ordinary rate account. If it is a market merchant account, the performance will be more than doubled.)

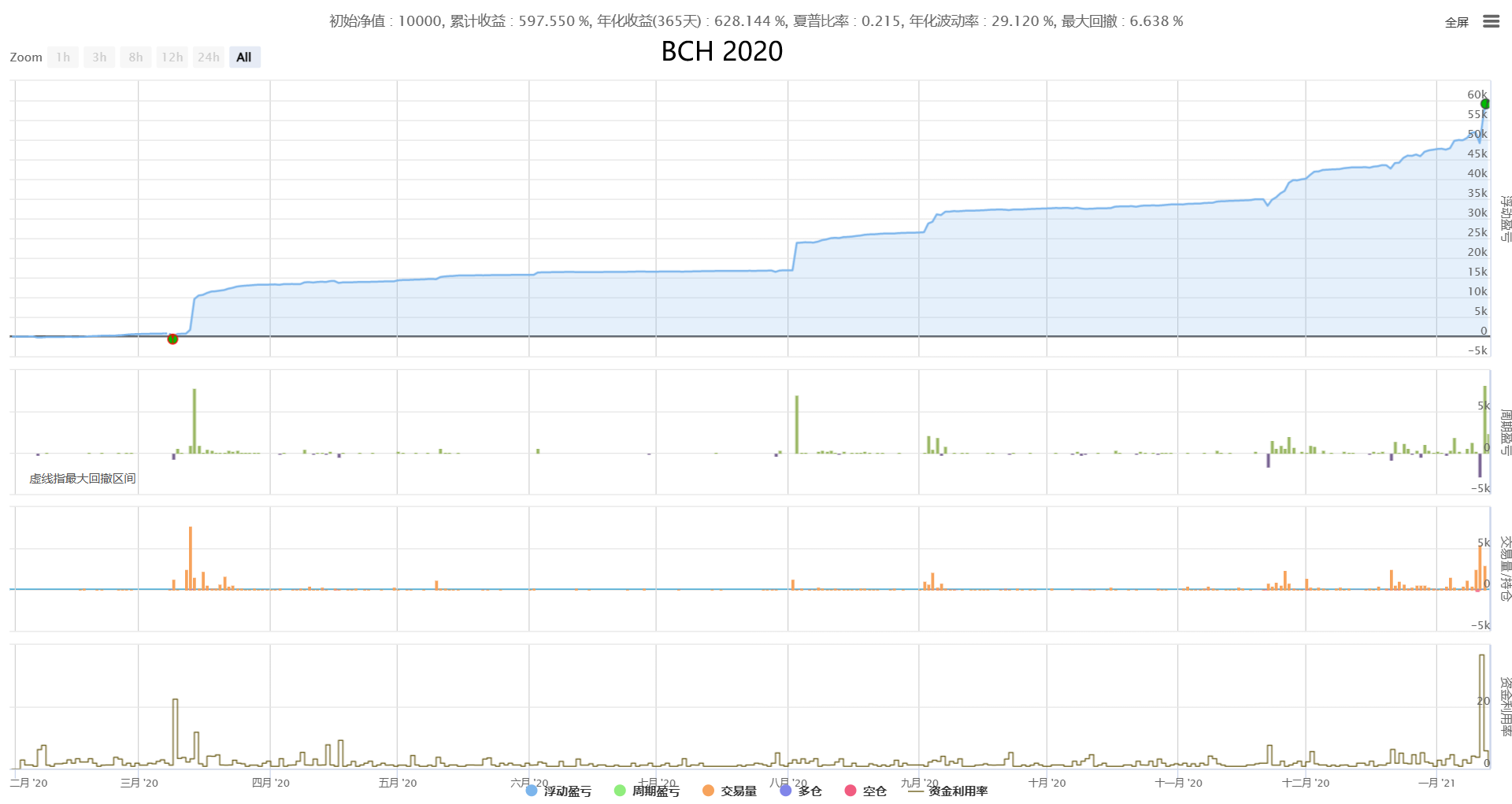

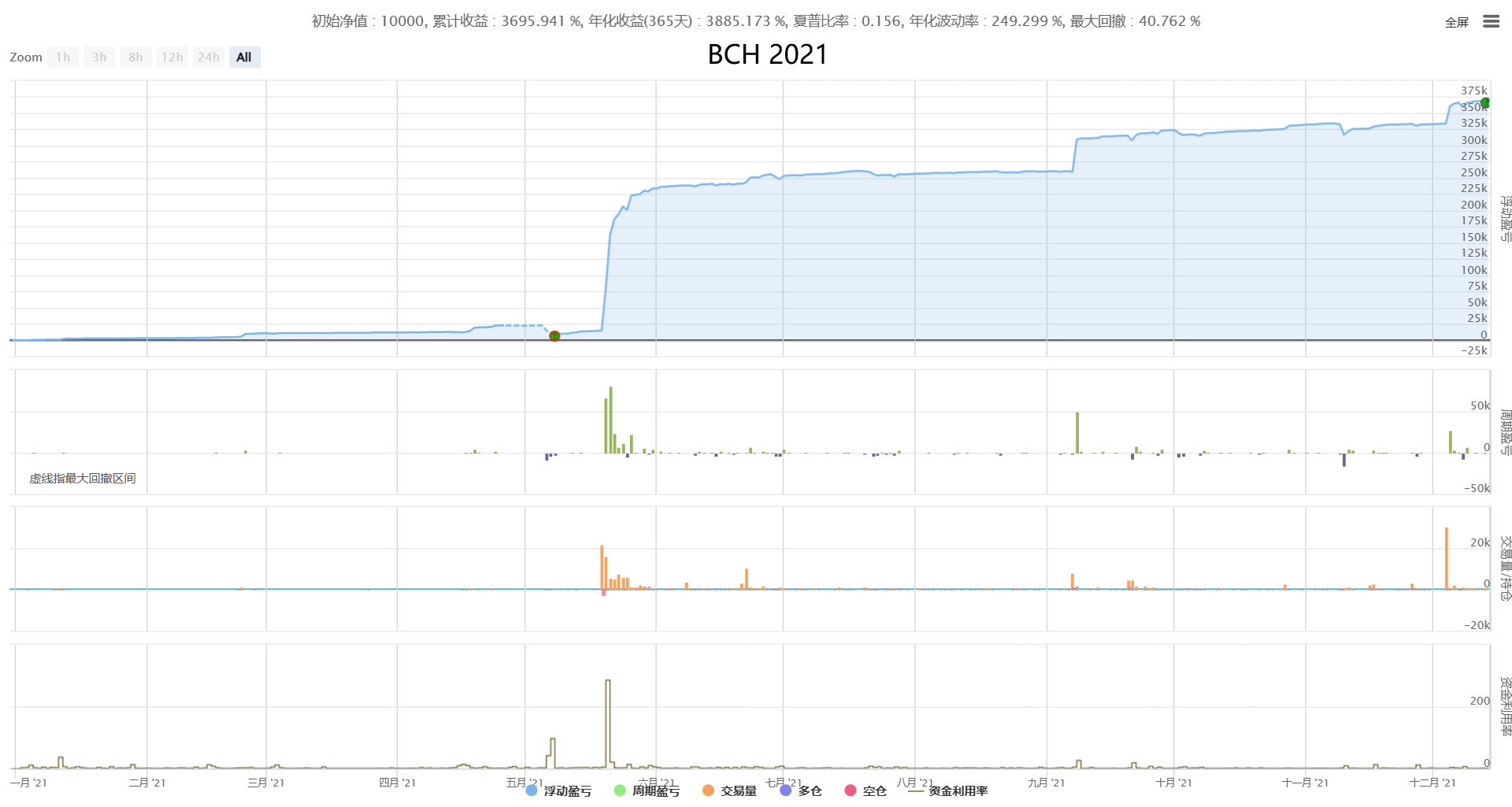

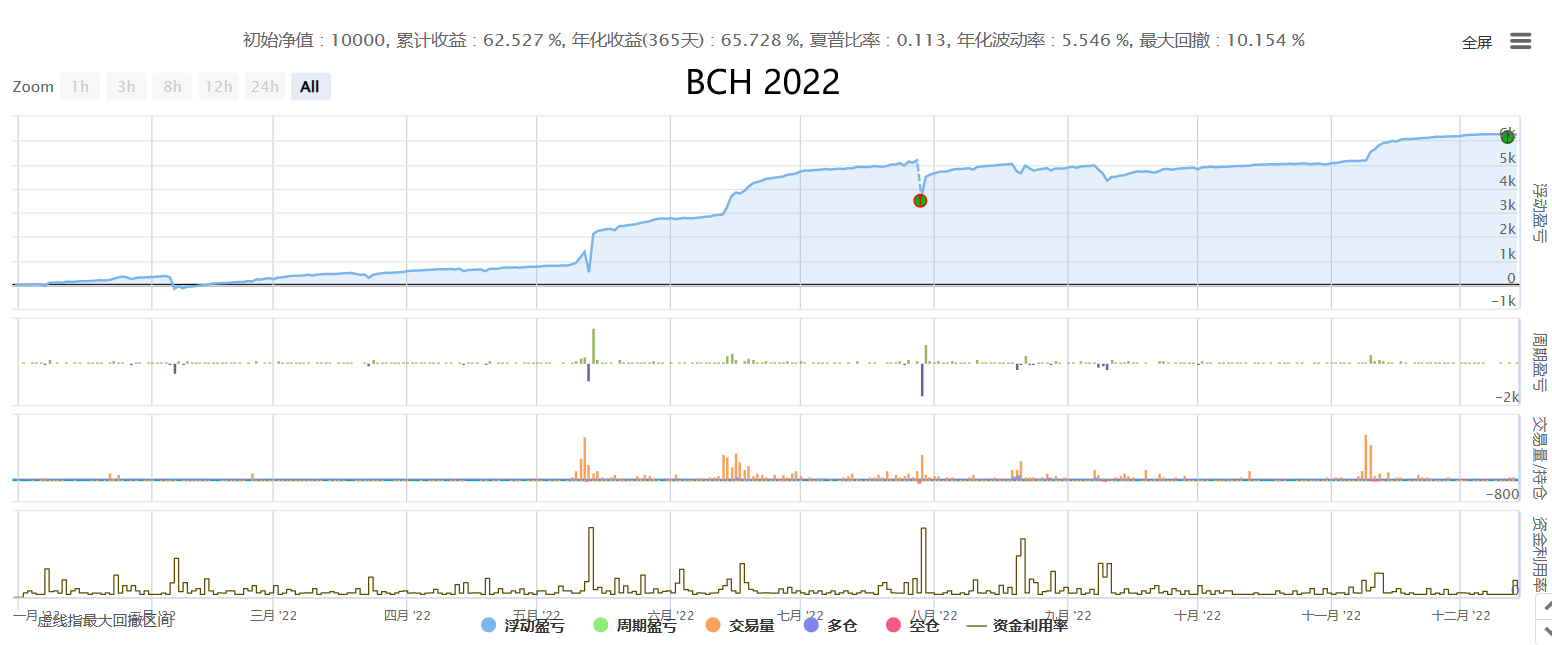

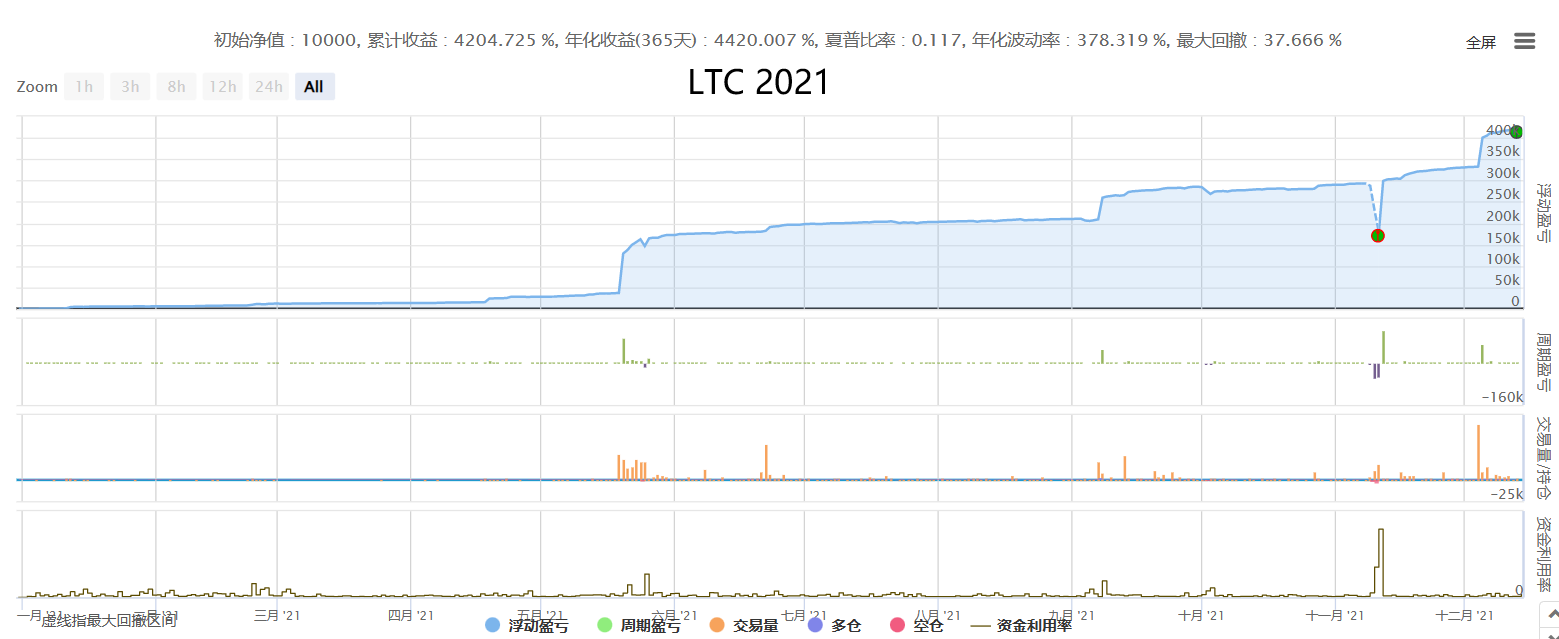

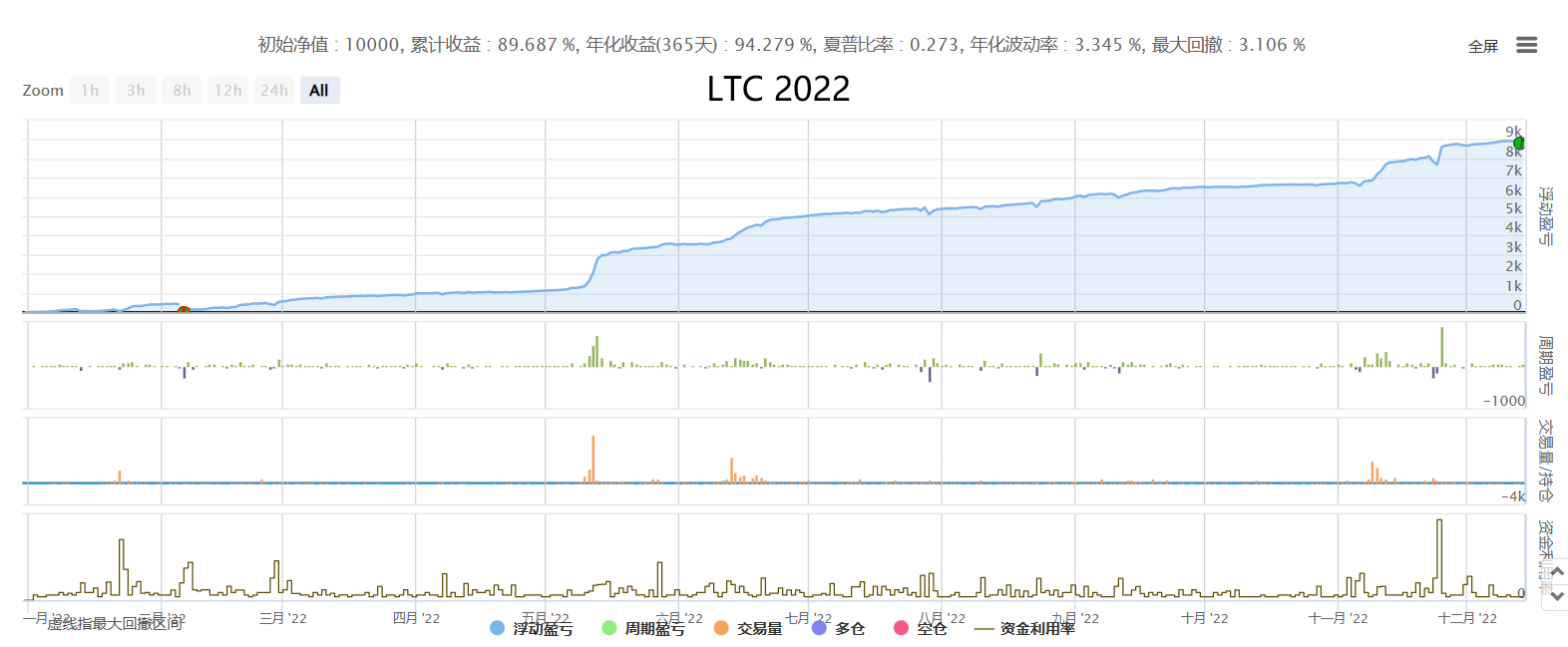

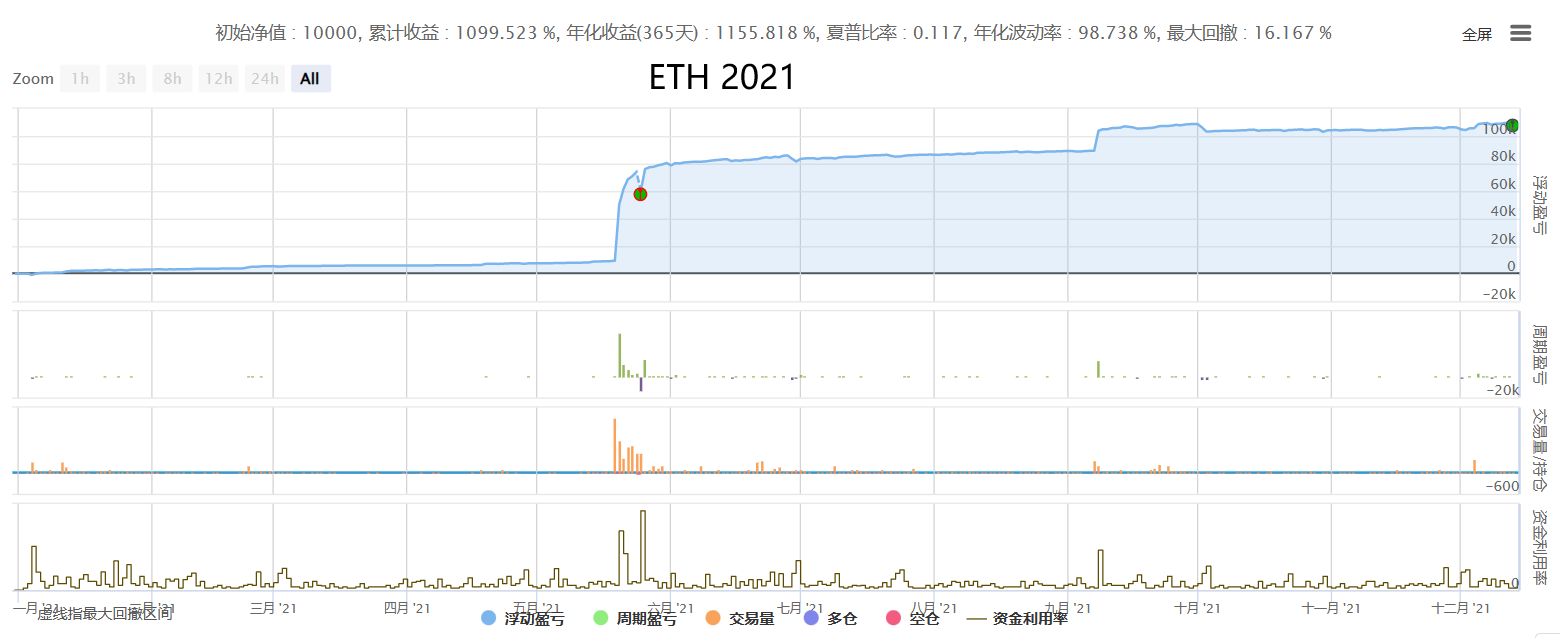

Historical backtest performance (Note: The sandbox backtest uses tick data, and the handling fee is Maker: 0.2%/Taker: 0.5%)

**Part of the single product display (the actual offer is mainly multi-product hedging): **

V. Looking forward to cooperation and exchange, learning and progress together

Every strategy has its own methodology and suitability for different market conditions. For example, high-frequency market-making is based on the theory of mean reversion in the random walk of the market, while trend tracking is based on the existence of fat-tailed fluctuations in the market under large cycles, and so on. It is important to understand the principles, adapt to their characteristics, and adjust to their fluctuations. At the same time, strategy users must pay attention to the correlation between profit and loss. Higher returns always come with higher risks. Mature strategies have their advantages and disadvantages. It is important to use them reasonably, play to their strengths, avoid their weaknesses, and understand their complete performance in suitable market conditions, so as to be confident and calm in the face of success or failure.

*Live trading address of this strategy: * 【High-frequency hedging market-making grid New】(HFT Market-Making mining machine version)-Money Maker

Cooperation method:

Quantitative trading is not a perpetual motion machine, nor is it omnipotent, but it is definitely the direction of future trading and worth learning and using for every trader! We welcome traders to point out shortcomings, discuss together, learn and progress together, and ride the waves in the magnificent market, forging ahead.

● More cooperation plans: We maintain an open and win-win attitude towards cooperation with any individuals and institutions in need. We look forward to your discussions and customized cooperation based on your needs, risk preferences, etc.

**Another long-term stable statistical arbitrage strategy of neutral hedging with zero long-term exposure risk, and a stable strategy of making more money than Alpha without exposing the beta risk in the market: ** 【Neutral-Hedge Statistical Arbitrage New】(Pure-Alpha dream version)

If you have a large amount of capital, you can also observe another large-capacity, low-frequency composite CTA trading system that has been live for 800 days, rain or shine. It is currently the longest published, most stable, and most universal CTA strategy combination system, aiming to achieve stable long-term growth: Composite Proprietary CTA Trading System (Trend + Oscillation + Band + Alternative Public Version)

✱ Contact information (welcome to communicate and discuss, learn and progress together) WECHAT: haiyanyydss Telegram: https://t.me/JadeRabbitcm More useful information ➔ TradeMan Home https://www.fmz.com/market-offer/512 ✱Fully automatic CTA & HFT & Arbitrage trading system @2018 - 2024