Overview

This strategy combines the 123 reversal pattern and Stochastic oscillator to generate buy signals when the price shows bottom reversal and the Stochastic oscillator also reversed from the bottom. It can effectively identify bottom reversals and the double confirmation filters can reduce trading frequency and improve signal accuracy.

Strategy Logic

123 Reversal Strategy

Buy signal is generated if the closing price is higher than previous 2 days’ closing price, and 9-day Stochastic fast line is below slow line and below 50.

Sell signal is generated if the closing price is lower than previous 2 days’ closing price, and 9-day Stochastic fast line is above slow line and above 50.

Stochastic Oscillator Strategy

Buy signal is generated if Stochastic %K line crossed above upper band (default 20).

Sell signal is generated if Stochastic %K line crossed below lower band (default 80).

Dual Confirmation

Buy signal is only generated when both 123 reversal and Stochastic strategies give buy signal. Sell signal is similar. This dual confirmation can filter out false signals and improve accuracy.

Advantages

Dual confirmation filters out noise and improves signal accuracy.

123 reversal catches bottom and top reversals. Stochastic avoids false breakouts.

Stochastic identifies overbought and oversold effectively, great match with 123 reversal.

High optimization flexibility with parameters tuning.

Simple logic, easy to understand, good for beginners.

Risks

Dual confirmation may miss some chances and reduce trading frequency.

Stochastic may generate false signals, needs careful examination.

Proper parameter tuning is needed, improper settings affect performance.

Only works for markets with reversal pattern, not for persistent trends.

Strictly follow strategy signals, avoid biases from own judgement.

Risk Solutions: Optimize parameters, strictly follow signals, adjust applicable market condition.

Optimization Directions

Optimize Stochastic parameters for more stability.

Add stop loss strategy.

Add filters like volume confirmation to improve signal quality.

Test combinations of different reversal strategies and Stochastic.

Utilize machine learning to train and optimize parameters.

Apply strategy on different markets to test robustness.

Explore combinations with other indicators.

Conclusion

This strategy combines Stochastic oscillator and 123 reversal pattern, which effectively catches bottom reversal opportunities. Compared to single indicator, the multi-indicator combination significantly improves signal quality and win rate. Although there is still room for improvement, the overall logic is simple and easy to grasp, making it ideal for beginner’s live trading practice. With repeated testing and optimization, the parameters can become more robust for consistent positive results.

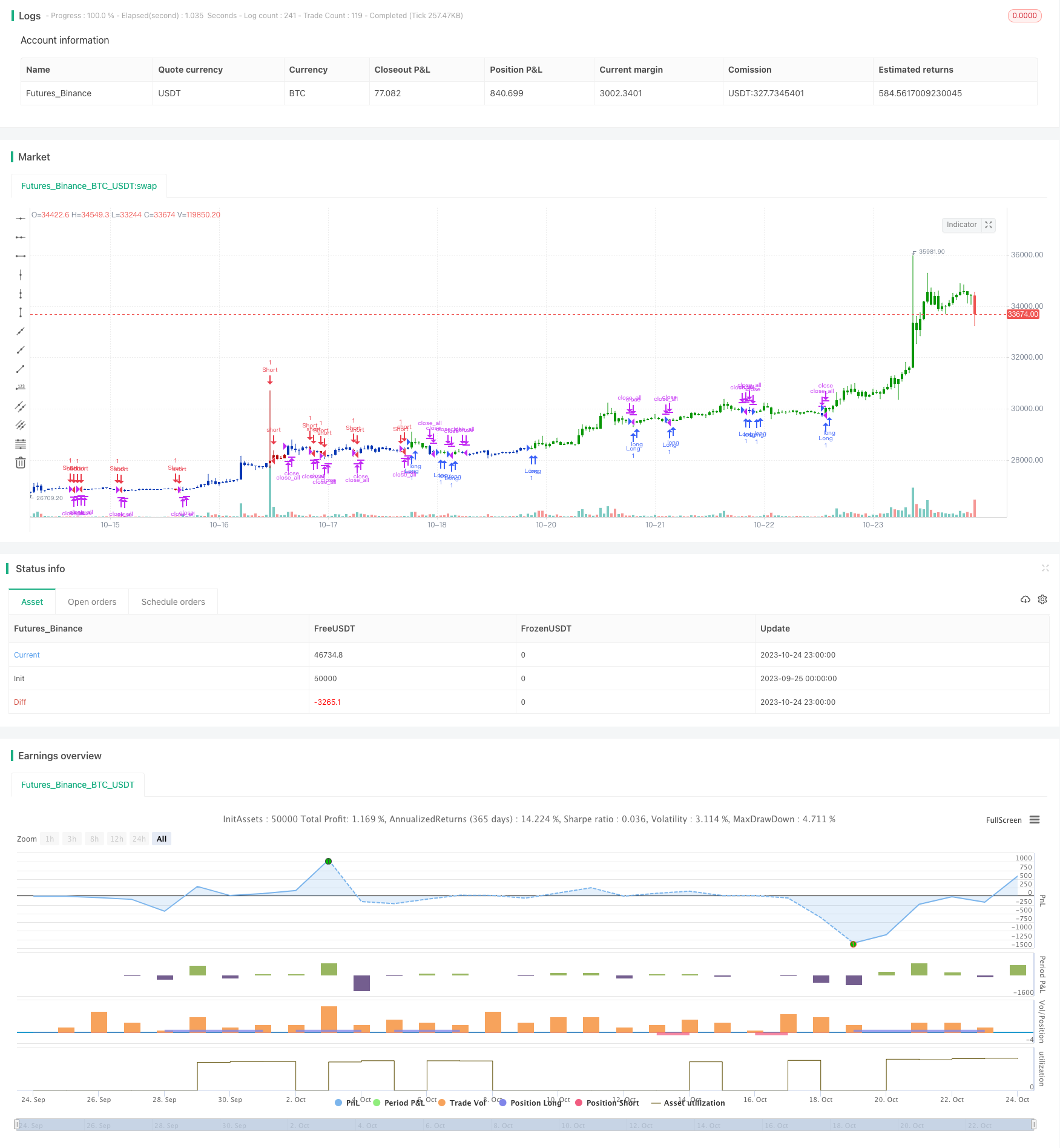

/*backtest

start: 2023-09-25 00:00:00

end: 2023-10-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/07/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This back testing strategy generates a long trade at the Open of the following

// bar when the %K line crosses up UpBand line.

// It generates a short trade at the Open of the following bar when the %K line

// crosses down DownBand line.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Stochastic(Length,DLength,UpBand,DownBand) =>

pos = 0.0

vFast = stoch(close, high, low, Length)

vSlow = sma(vFast, DLength)

pos := iff(vFast > UpBand, 1,

iff(vFast < DownBand, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Stochastic", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Stochastic ----")

LengthS = input(7, minval=1)

DLengthS = input(3, minval=1)

UpBand = input(20, minval=1)

DownBand = input(80, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posStochastic = Stochastic(LengthS,DLengthS,UpBand,DownBand)

pos = iff(posReversal123 == 1 and posStochastic == 1 , 1,

iff(posReversal123 == -1 and posStochastic == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )