Overview

The Ichimoku Equilibrium strategy is based on the Ichimoku indicator and combines moving average systems to generate trading signals. It utilizes the Tenkan, Kijun and Senkou lines to determine price direction and trends, generating buy and sell signals.

Strategy Logic

The strategy uses the middleDonchian function to calculate the Tenkan and Kijun lines. The Tenkan line calculates the average of the highest and lowest prices over the past 9 bars, representing the short-term equilibrium price. The Kijun line calculates the average of the highest and lowest prices over the past 26 bars, representing the medium-term equilibrium price.

The Senkou A line calculates the average of the highest and lowest prices over the past 52 bars, then shifts forwards 26 bars, representing long-term future leading. The Senkou B line calculates the average of the Tenkan and Kijun lines, representing the current value midpoint.

The strategy judges the relative strength of prices by the relationship between the close price and the Senkou A and Senkou B lines. A close price breakout above the Senkou A line is a buy signal, while a breakout below the Senkou B line is a sell signal.

The pos variable tracks the current position direction. The possig variable adjusts the signal direction based on the reverse input parameter. Finally, entry and exit are determined according to the values of pos and possig.

Advantage Analysis

Uses two sets of moving averages with different parameter lengths to capture trend changes across different timeframes.

Senkou A line reflects long-term trend changes in advance. Senkou B line captures current midpoint shifts, forming a leading system.

Identifies significant trend reversal points by price breakouts of the cloud boundaries.

Applicable to trending and ranging markets. The reverse parameter allows quick adaptation to long/short switching.

Cloud twist visuals filter out false breakouts.

Risk Analysis

Potential false signals when long and short moving averages cross over.

Frequent opening of positions when prices oscillate around cloud boundaries during consolidations.

Failed breakout risk due to cloud twists.

Chasing high purchases and low sales in trending markets.

Reversals require caution and consideration of major trends.

Optimization via adjusting moving average combinations, adding filters etc can reduce unnecessary trading frequency and avoid being trapped.

Optimization Directions

Optimize moving average combinations to find the best equilibrium point.

Add volume filter to avoid low volume false breakouts.

Incorporate other indicators for additional confirmation, e.g. MACD, KDJ etc.

Optimize entry timing, e.g. requiring close to also breakout after cloud breakout.

Optimize stop loss methods, e.g. trailing stop, staggered stop etc.

Optimize reverse trading rules based on major trends.

Conclusion

The Ichimoku Equilibrium strategy combines the strengths of moving average trading and cloud analysis for unique trend reversal identification. Simple and practical for trending and ranging markets, it can be adapted via optimization for different instruments and trading styles. But false breakout risks remain, so major trend analysis is key for determining direction. With continuous optimization, it can generate stable returns as a systematic strategy.

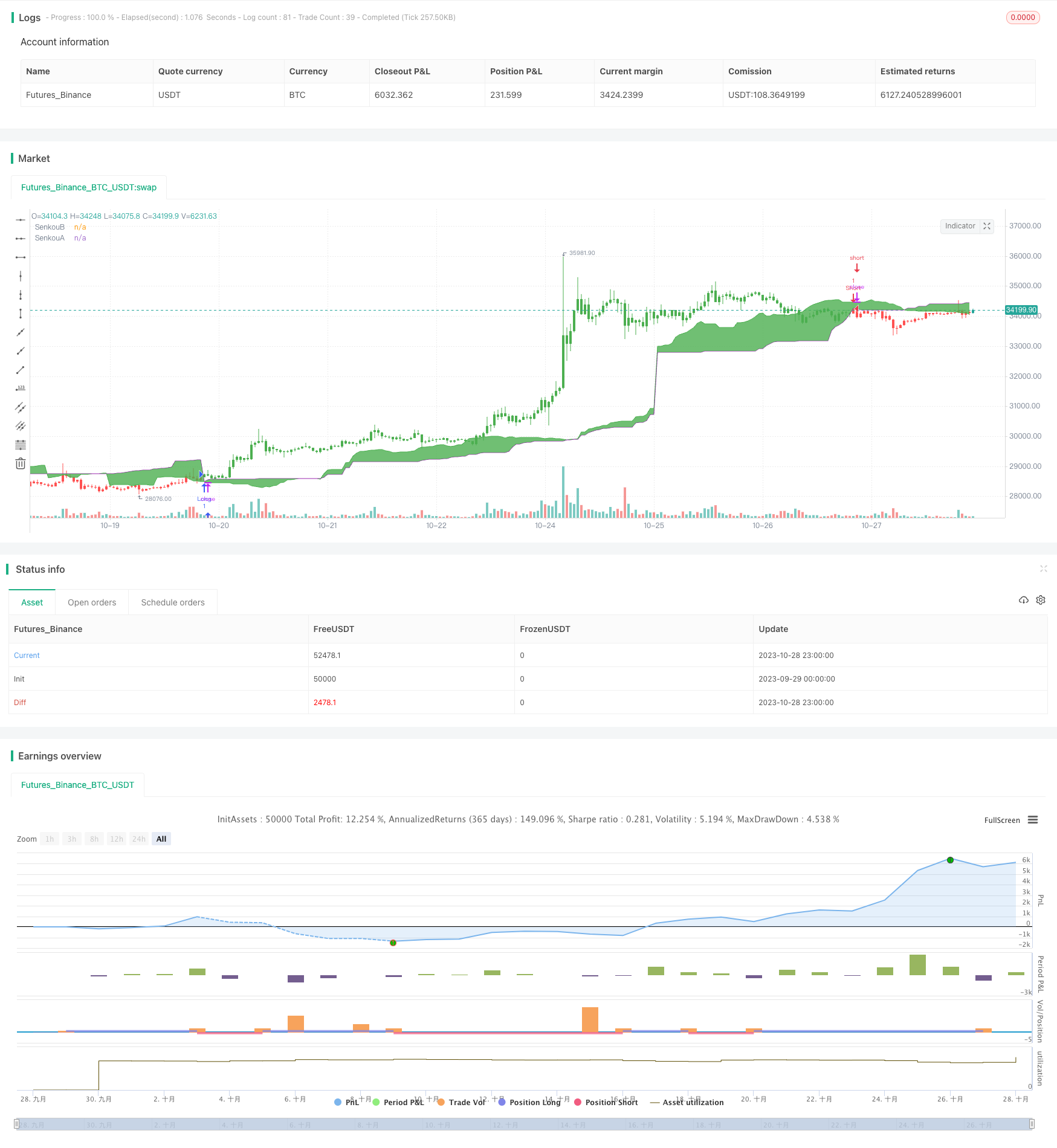

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 26/09/2018

// Ichimoku Strategy

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

middleDonchian(Length) =>

lower = lowest(Length)

upper = highest(Length)

avg(upper, lower)

strategy(title="Ichimoku2c Backtest", shorttitle="Ichimoku2c", overlay = true)

conversionPeriods = input(9, minval=1),

basePeriods = input(26, minval=1)

laggingSpan2Periods = input(52, minval=1),

displacement = input(26, minval=1)

reverse = input(false, title="Trade reverse")

Tenkan = middleDonchian(conversionPeriods)

Kijun = middleDonchian(basePeriods)

xChikou = close

SenkouA = middleDonchian(laggingSpan2Periods)

SenkouB = (Tenkan[basePeriods] + Kijun[basePeriods]) / 2

A = plot(SenkouA[displacement], color=purple, title="SenkouA")

B = plot(SenkouB, color=green, title="SenkouB")

pos = iff(close < SenkouA[displacement], -1,

iff(close > SenkouB, 1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

fill(A, B, color=green)