Overview

This strategy combines the support & resistance analysis of price action and the trend analysis of the MACD indicator. It aims to make low-risk long trades at key support & resistance levels when the trend direction is determined, in order to gain profits exceeding the stop loss.

Strategy Logic

Identify key support and resistance levels using the “Price Action - Support & Resistance by DGT” indicator. This indicator determines support and resistance based on price action. These levels are often potential areas where price may reverse or consolidate.

After the indicator identifies support and resistance levels, confirm the strength of these levels by analyzing historical price behavior around them. Multiple touches or bounces from the same level indicates stronger support or resistance.

Add the MACD indicator, consisting of the MACD line, signal line and histogram representing the difference between the two lines. MACD helps identify momentum and potential trend reversals. When the MACD line crosses above the signal line and the histogram turns positive, it suggests bullish momentum is likely to form.

Combine the support identified by the “Price Action - Support & Resistance by DGT” indicator and the trend direction by the MACD indicator to spot trading opportunities:

- Bullish Trade: When price approaches a strong support level, if the MACD line crosses above the signal line and the histogram turns positive, it indicates potential bullish trend. Go long near the support with a stop loss below the support level.

After entering a trade, set the profit target based on the distance between entry price and the nearest significant support/resistance. Also use trailing stop loss or other risk management techniques to lock in profit and limit loss.

Advantage Analysis

- Trade at key reversal areas identified by support & resistance, which carries lower risk

- Only trade when the trend is determined by MACD, avoiding trading against the trend

- Long near support with stop loss, risk is controlled

- Profit target is large, with potential to gain profit exceeding the stop loss

- Support & resistance and MACD can validate each other’s signals, increasing success rate

Risk Analysis

- Support & resistance levels may be broken, need to watch price action after breakout

- MACD has lagging effect, may generate false signals

- Stop loss being triggered is probable, need to control loss per trade

- Need to ensure reasonable profit target, overly aggressive target may not be achieved

- Need to verify all signals to avoid false signals

Solutions to the risks:

- Breakout of support & resistance needs timely stop loss or reverse trade

- Be cautious when MACD signals, use price action to verify

- Keep single stop loss at 1-2% to avoid large loss

- Don’t set profit target too aggressively, can lower it appropriately

- Only enter trade after all signals are confirmed, avoid blindly following

Optimization Directions

- Test support & resistance indicator with different parameters

- Optimize MACD parameters for more accurate signals

- Add other indicators like RSI for signal verification

- Study bands like Bollinger Bands for stop loss and take profit

- Add trailing stop loss to better lock in profits

- Optimize parameters for different products

- Backtest to find optimal stop loss and take profit levels

Summary

This strategy integrates trend determination and key zone trading. It makes low-risk trades at key support levels when the trend is determined, in order to gain profits exceeding the stop loss. With this long-term trading mode, stable profits can be achieved with relatively few trades. Of course, no strategy can completely avoid losses. Strict risk management is needed to control the downside. Through continuous optimization of parameters and signal verification methods, this strategy can achieve higher win rate. In conclusion, it provides a robust framework for long-term trading.

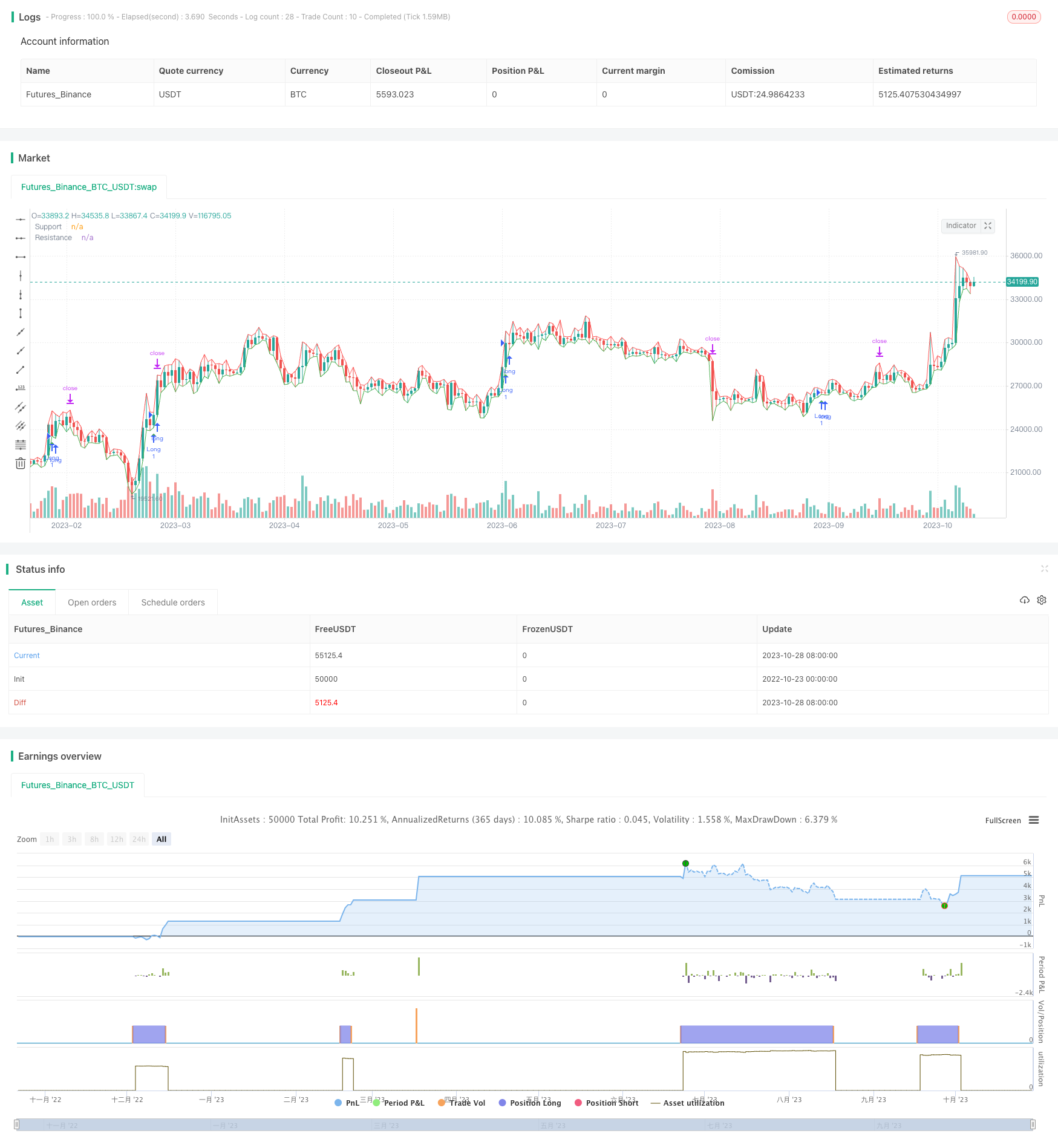

/*backtest

start: 2022-10-23 00:00:00

end: 2023-10-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Price Action - Support & Resistance + MACD Strategy", overlay=true)

// Price Action - Support & Resistance

supportLevel = input(100, title="Support Level Strength", minval=1)

resistanceLevel = input(100, title="Resistance Level Strength", minval=1)

var supportPrice = 0.0

var resistancePrice = 0.0

if low <= supportPrice or barstate.islast

supportPrice := low

if high >= resistancePrice or barstate.islast

resistancePrice := high

plot(supportPrice, color=color.green, linewidth=1, title="Support")

plot(resistancePrice, color=color.red, linewidth=1, title="Resistance")

// MACD Indicator

[macdLine, signalLine, _] = macd(close, 26, 100, 9)

macdHistogram = macdLine - signalLine

// Bullish Trade Setup

bullishSetup = crossover(macdLine, signalLine) and macdHistogram > 0 and close > supportPrice

plotshape(bullishSetup, color=color.green, title="Bullish Setup", style=shape.triangleup, location=location.belowbar)

// Stop Loss and Take Profit Levels

stopLossLevel = input(5, title="Stop Loss Level (%)", minval=0.1, step=0.1)

takeProfitLevel = input(7.5, title="Take Profit Level (%)", minval=0.1, step=0.1)

// Execute Long Trades

if bullishSetup

stopLossPrice = close * (1 - stopLossLevel / 100)

takeProfitPrice = close * (1 + takeProfitLevel / 100)

strategy.entry("Long", strategy.long)

strategy.exit("Exit", "Long", stop=stopLossPrice, limit=takeProfitPrice)