Overview

The Sizeblock strategy is a trading strategy based on the percentage or tick deviation of price changes displayed in diagonal rows. It can clearly show local trends and reversal points on the chart. This is a very useful tool for tracking price direction.

Principles

The calculation is based on the percentage or tick deviation of the price movement (indicated in the “Deviation” parameter), which is displayed on the chart in the form of rows.

The row consists of the base middle line, upper and lower limits:

The base middle line is equal to the upper or lower limits of the previous row (if the price changes rapidly in one time interval, then the base middle line of the current row is greater than the upper limit of the previous row or less than the lower limit of the previous row by an equal number of deviations depending on the direction of price movement). At the beginning of the calculation, the base middle line is equal to the initial value of the first row.

The “Quantity” parameter determines the deviation for the upper or lower limits depending on the direction of the price movement, and the “U-turn” parameter determines the deviation for changing the direction of the price movement.

The rule for constructing a new row:

If the close ≥ the upper limit and close > open, the upper limit will gradually move up, and the lower limit will also move up but less.

If the low ≤ the lower limit and close < open, the lower limit will gradually move down, and the upper limit will also move down but less.

By adjusting certain deviations, you can clearly see the local trend and reversal points on the chart. This is a very useful tool for tracking price direction.

Advantages

Visualize price change trends and clearly identify support and resistance.

Diagonal lines clearly show the strength of breakouts and the range of pullbacks.

The slope of diagonal lines can be adjusted as needed to identify trends of different strength.

Can find relatively large support and resistance for breakouts.

Easy to see changes in price rhythm and adjust position size accordingly.

Risks

Diagonal lines cannot completely accurately predict subsequent price moves.

Need to watch for divergences in trends where diagonal lines may diverge from actual prices.

Cannot be used as an isolated strategy, needs to incorporate other indicators to determine the major trend.

Improper parameter adjustments may lead to overly frequent trading.

Need to beware of potential reversals during pullbacks instead of blindly chasing trends mechanically.

Can moderately reduce position sizing and refer to other indicators as auxiliary judgment within major trends.

Optimization

Can add position management modules to dynamically adjust positions in different trend stages.

Can incorporate volatility indicators to reduce positions when volatility increases.

Can set stop loss based on drawdown percentage to control single loss.

Can add filters to pause trading when price divergences occur.

Can divide diagonal slopes into multiple levels to identify trend changes of different strength.

By dynamically adjusting positions, setting stops and filters, can more steadily track price trends.

Summary

The Sizeblock strategy utilizes diagonal lines to intuitively display price trend changes and clearly identify support, resistance and breakout levels. But cannot solely rely on diagonal lines for judgment, need to incorporate analysis from other indicators and manage risks. This is a very valuable auxiliary tool to help traders better grasp market rhythm. Optimization can make the strategy more robust and efficient with great application potential.

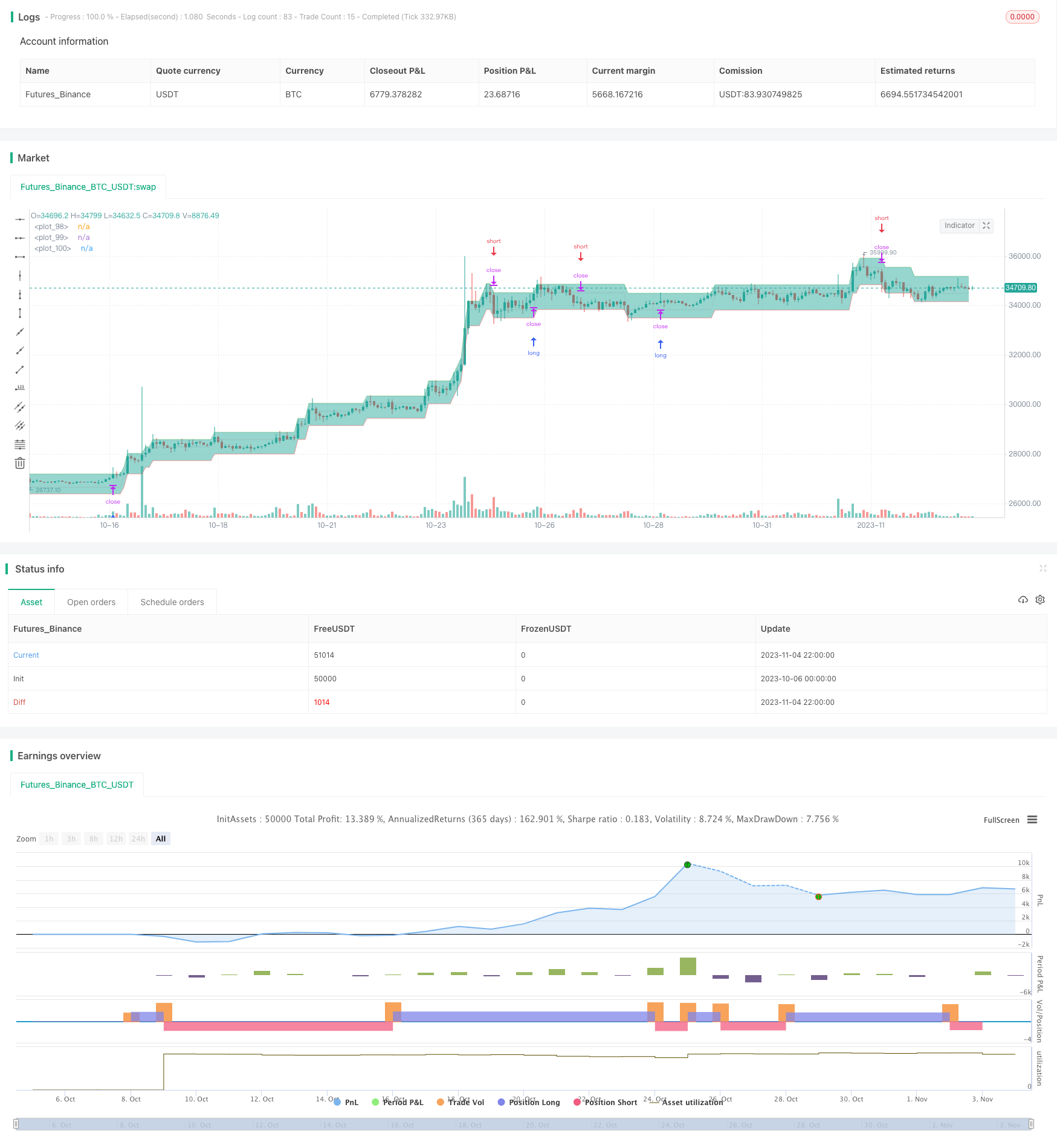

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// **********************************************************************************

// This code is invented and written by @StCogitans.

// The idea presented in this code and the rights to this code belong to @StCogitans.

// © https://www.tradingview.com/u/StCogitans

//

// Description.

// Sizeblock - a price change strategy in the form of diagonal rows.

// **********************************************************************************

// STRATEGY

string NAME = 'Sizeblock'

string ACRONYM = 'SB'

bool OVERLAY = true

int PYRAMIDING = 0

string QTY_TYPE = strategy.percent_of_equity

float QTY_VALUE = 100

float CAPITAL = 100

string COM_TYPE = strategy.commission.percent

float COM_VALUE = 0.1

bool ON_CLOSE = false

bool BAR_MAGNIFIER = false

bool OHLC = true

strategy(NAME, ACRONYM, OVERLAY, pyramiding=PYRAMIDING, default_qty_type=QTY_TYPE, default_qty_value=QTY_VALUE, initial_capital=CAPITAL, commission_type=COM_TYPE, commission_value=COM_VALUE, process_orders_on_close=ON_CLOSE, use_bar_magnifier=BAR_MAGNIFIER, fill_orders_on_standard_ohlc=OHLC)

// ARGUMENTS

// Datetime

DTstart = input(timestamp("01 Jan 2000 00:00 +0000"), 'Start time', group='Datetime')

DTfinish = input(timestamp("01 Jan 2080 23:59 +0000"), 'Finish time', group='Datetime')

DTperiod = true

// Main

dev_source = input.string('Close', title='Source', options=["Close", "HighLow"], tooltip='Price data for settlement.', group='Main')

dev_type = input.string('Percentage', title='Deviation', options=['Percentage', 'Ticks'], tooltip='The type of deviation to calculate.', group='Main')

dev_value = input.float(1, title='Quantity', minval=0.001, step=0.01, tooltip='Quantity to be calculated.', group='Main')

dev_back = input.float(2, title='U-turn', minval=0.001, step=0.01, tooltip='Quantity for reversal.', group='Main')

mode = input.string('Limit', title='Positions', options=['Limit', 'Market'], tooltip='Limit or market orders.', group='Main')

direct = input.string('All', title='Direction', options=['All', 'Buy', 'Sell'], tooltip='The type of positions to be opened.', group='Main')

swapping = input.bool(false, title='Swapping', tooltip='Swap points to open a new position.', group='Main')

// CALCULATION SYSTEM

Assembling(s, t, v, vb) =>

float a = open

float b = close

float c = s == "HighLow" ? math.round_to_mintick(high) : math.round_to_mintick(b)

float d = s == "HighLow" ? math.round_to_mintick(low) : math.round_to_mintick(b)

float x = math.round_to_mintick(a)

x := nz(x[1], x)

float _v = t == "Ticks" ? syminfo.mintick * v : v

float _vb = t == "Ticks" ? syminfo.mintick * vb : vb

float h = t == "Ticks" ? math.round_to_mintick(x + _v) : math.round_to_mintick(x * (1 + _v / 100))

float l = t == "Ticks" ? math.round_to_mintick(x - _v) : math.round_to_mintick(x * (1 - _v / 100))

h := nz(h[1], h)

l := nz(l[1], l)

if t == "Ticks"

if c >= h and b > a

while c >= h

x := h

h := math.round_to_mintick(h + _v)

l := math.round_to_mintick(x - _vb)

if d <= l and b < a

while d <= l

x := l

l := math.round_to_mintick(l - _v)

h := math.round_to_mintick(x + _vb)

else if t == "Percentage"

if c >= h and b > a

while c >= h

x := h

h := math.round_to_mintick(h * (1 + _v / 100))

l := math.round_to_mintick(x * (1 - _vb / 100))

if d <= l and b < a

while d <= l

x := l

l := math.round_to_mintick(l * (1 - _v / 100))

h := math.round_to_mintick(x * (1 + _vb / 100))

[x, h, l]

[lx, lh, ll] = Assembling(dev_source, dev_type, dev_value, dev_back)

// PLOT

// Lines

plot_up = plot(lh, color=color.new(color.green, 50), style=plot.style_line, linewidth=1)

plot_main = plot(lx, color=color.new(color.silver, 50), style=plot.style_line, linewidth=1)

plot_down = plot(ll, color=color.new(color.red, 50), style=plot.style_line, linewidth=1)

// Areas

fill(plot_up, plot_main, lh, lx, color.new(color.teal, 80), color.new(color.teal, 80))

fill(plot_main, plot_down, lx, ll, color.new(color.maroon, 80), color.new(color.maroon, 80))

// TRADING

// Alert variables

int Action = -1

int PosType = -1

int OrderType = -1

float Price = -1.0

// Direction variables

bool ifBuy = direct == "All" or direct == "Buy" ? true : false

bool ifSell = direct == "All" or direct == "Sell" ? true : false

// Market entries

if (strategy.closedtrades + strategy.opentrades == 0 or mode == "Market") and DTperiod

if ((swapping and lx < nz(lx[1], lx)) or (not swapping and lx > nz(lx[1], lx))) and ifBuy

Action := 1

PosType := 1

OrderType := 1

Price := math.round_to_mintick(close)

strategy.entry('Long', strategy.long)

if ((swapping and lx > nz(lx[1], lx)) or (not swapping and lx < nz(lx[1], lx))) and ifSell

Action := 2

PosType := 2

OrderType := 1

Price := math.round_to_mintick(close)

strategy.entry('Short', strategy.short)

// Closing positions by market

if DTperiod and mode == "Market"

if direct == "Buy" and strategy.position_size > 0

if swapping and lx > nz(lx[1], lx)

Action := 2

PosType := 3

OrderType := 1

Price := math.round_to_mintick(close)

strategy.close('Long', comment='Close')

if not swapping and lx < nz(lx[1], lx)

Action := 2

PosType := 3

OrderType := 1

Price := math.round_to_mintick(close)

strategy.close('Long', comment='Close')

if direct == "Sell" and strategy.position_size < 0

if swapping and lx < nz(lx[1], lx)

Action := 1

PosType := 3

OrderType := 1

Price := math.round_to_mintick(close)

strategy.close('Short', comment='Close')

if not swapping and lx > nz(lx[1], lx)

Action := 1

PosType := 3

OrderType := 1

Price := math.round_to_mintick(close)

strategy.close('Short', comment='Close')

// Limit entries and exits

if swapping and DTperiod and mode == "Limit"

if strategy.position_size < 0

Action := 1

PosType := 1

OrderType := 2

Price := ll

if ifBuy

strategy.entry('Long', strategy.long, limit=ll)

else

PosType := 3

strategy.exit('Exit', limit=ll)

if strategy.position_size > 0

Action := 2

PosType := 2

OrderType := 2

Price := lh

if ifSell

strategy.entry('Short', strategy.short, limit=lh)

else

PosType := 3

strategy.exit('Exit', limit=lh)

if strategy.closedtrades + strategy.opentrades > 0 and strategy.position_size == 0

if ifBuy

Action := 1

PosType := 1

OrderType := 2

Price := ll

strategy.entry('Long', strategy.long, limit=ll)

if ifSell

Action := 2

PosType := 2

OrderType := 2

Price := lh

strategy.entry('Short', strategy.short, limit=lh)

if not swapping and DTperiod and mode == "Limit"

if strategy.position_size < 0

Action := 1

PosType := 1

OrderType := 2

Price := lh

if ifBuy

strategy.entry('Long', strategy.long, stop=lh)

else

PosType := 3

strategy.exit('Exit', stop=lh)

if strategy.position_size > 0

Action := 2

PosType := 2

OrderType := 2

Price := ll

if ifSell

strategy.entry('Short', strategy.short, stop=ll)

else

PosType := 3

strategy.exit('Exit', stop=ll)

if strategy.closedtrades + strategy.opentrades > 0 and strategy.position_size == 0

if ifBuy

Action := 1

PosType := 1

OrderType := 2

Price := lh

strategy.entry('Long', strategy.long, stop=lh)

if ifSell

Action := 2

PosType := 2

OrderType := 2

Price := ll

strategy.entry('Short', strategy.short, stop=ll)

// Everything is closed and canceled

if not DTperiod

strategy.cancel_all()

strategy.close_all(comment='Close')

// Alerts

// Convert to string variables

string Action_Txt = Action == 1 ? "Buy" : Action == 2 ? "Sell" : na

string PosType_Txt = PosType == 1 ? "Long" : PosType == 2 ? "Short" : PosType == 3 ? "Flat" : na

string OrderType_Txt = OrderType == 1 ? "Market" : OrderType == 2 ? "Limit" : na

string Price_Txt = Price > 0 ? str.tostring(Price) : na

// Output

if not (Action == nz(Action[1], Action) and Price == nz(Price[1], Price) and OrderType == nz(OrderType[1], OrderType)) and DTperiod

alert('{"pair": "' + syminfo.ticker + '", "direction": "' + Action_Txt + '", "entertype": "' + OrderType_Txt + '", "position": "' + PosType_Txt + '", "price": "' + Price_Txt + '"}')

// *********************

// Good job, Soldier! ;>

// *********************